JHVEPhoto

McKesson (NYSE:MCK) provides healthcare services in the United States and internationally. It operates through four segments: U.S. Pharmaceutical, International, Medical-Surgical Solutions, and Prescription Technology Solutions (RxTS).

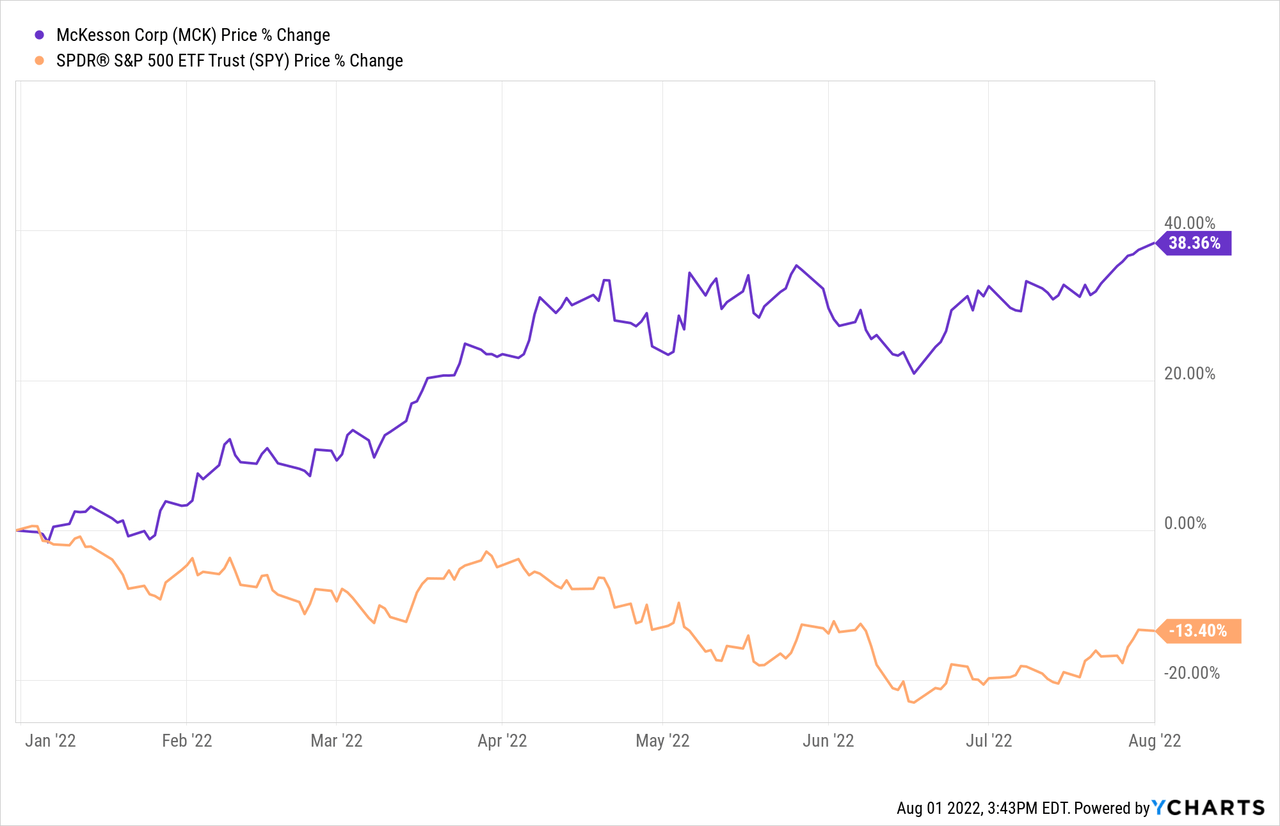

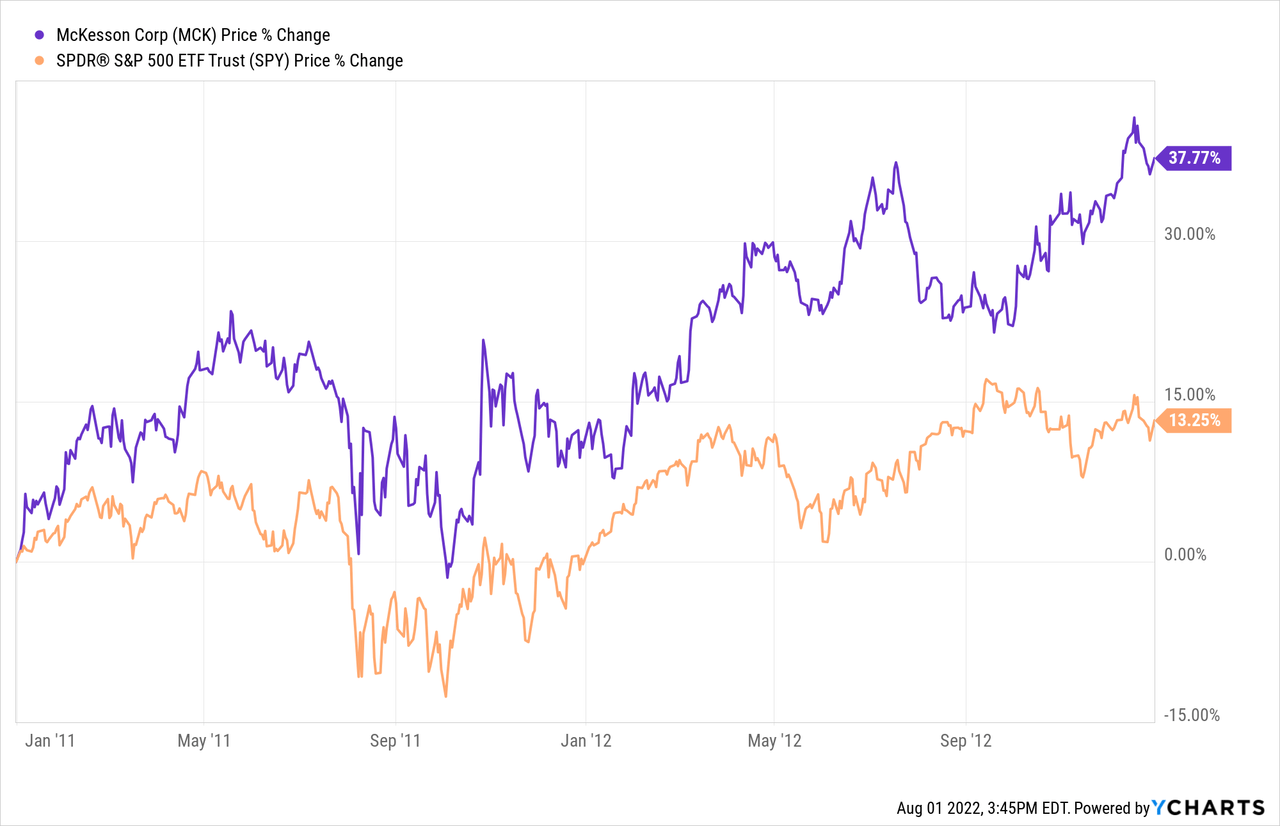

MCK’s stock has performed exceptionally well and has gotten the attention of many investors in the first half of 2022. Despite the difficult macroeconomic environment, MCK’s stock price has increased by as much as 38% year-to-date, outperforming the broader market by more than 50%.

In our opinion, this outperformance is likely to last in the near term, and in this article we will explore three reasons why this stock could be an attractive choice in the current market environment.

We will be primarily focusing on the stock’s performance during times of low consumer confidence in the past 20 years, to form expectations about the current market environment. We will also look at the dividend and the firm’s commitment to return value to its shareholders through share buyback programs.

Let us get started with the macroeconomic aspects.

Macroeconomic environment

Performance during times of low consumer confidence

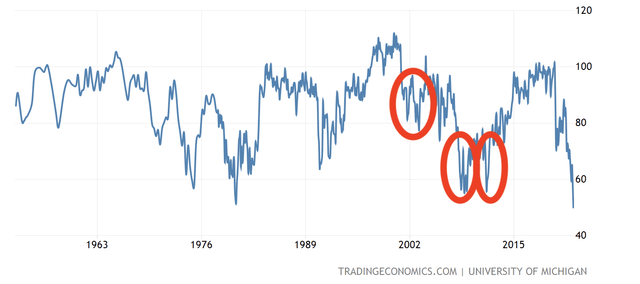

Consumer confidence is a leading economic indicator, often used to predict potential changes in the consumer spending behaviour in the near future. During times of declining or low consumer confidence, people are becoming more reluctant to spend their financial resources on durable, discretionary, non-essential goods. Spending on services are also likely to be cut, if possible, by switching to lower cost alternatives.

While consumer spending has remained strong in the first half of 2022 in the United States, confidence has been gradually declining. In our opinion, such a trend could potentially lead to a significant decline in demand for the above-mentioned goods.

U.S. Consumer confidence (Tradingeconomics.com)

There are, however, sectors and industries, which are less impacted by the consumer confidence. These are sectors, in which firms provide essential goods and services, like consumer staples or health care.

As McKesson is a company operating in the health care sector, we expect their financial performance to be relatively unaffected by the consumer sentiment. But let us actually take a look how MCK’s stock performed during times of low consumer confidence in the last 20 years.

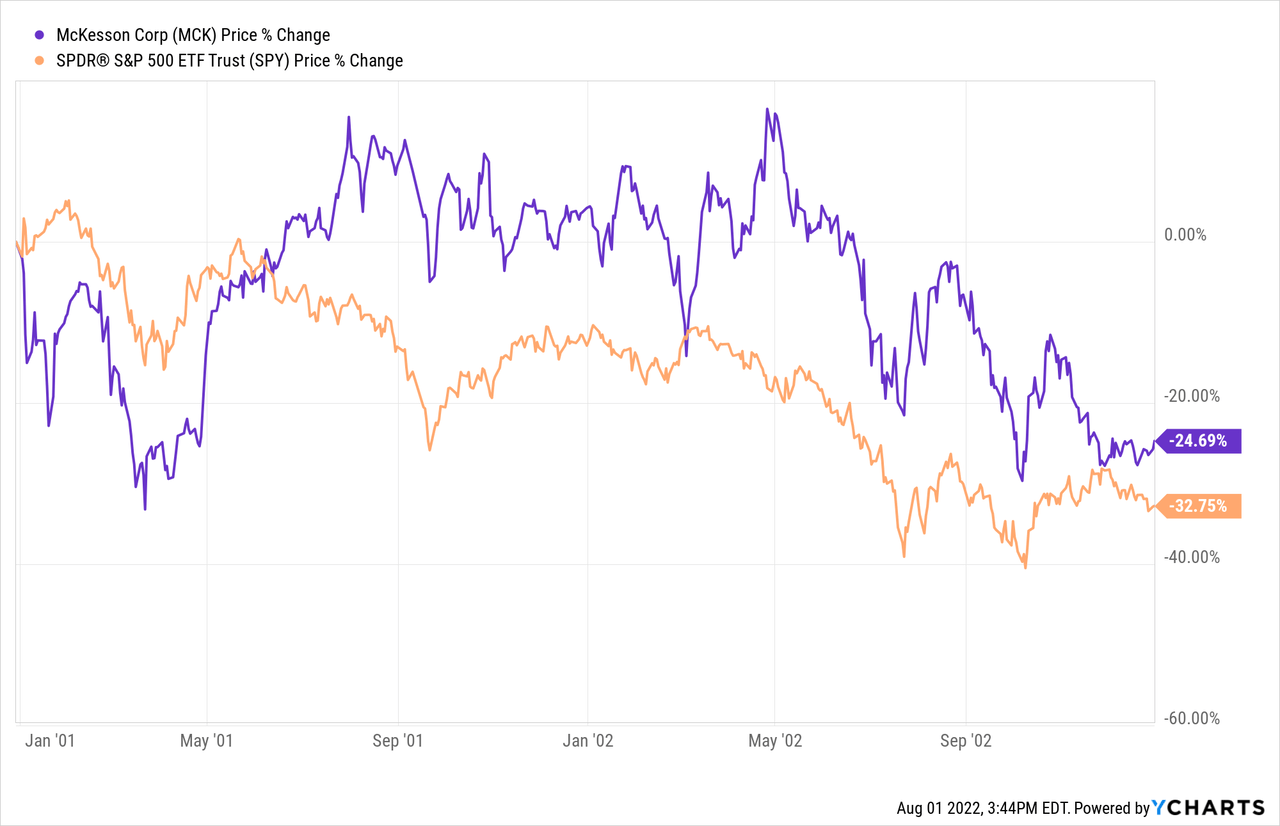

2001-2003

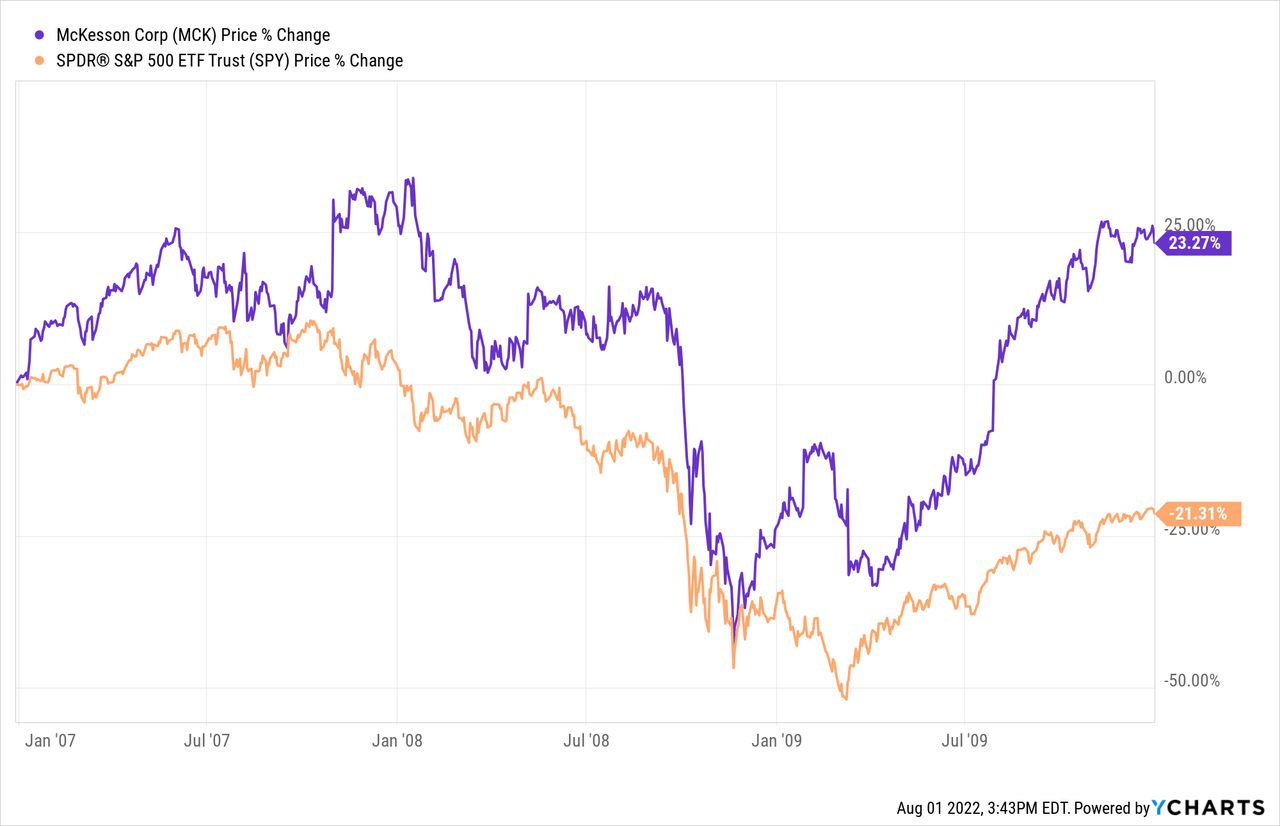

2007-2010

2011-2013

In three out of three period MCK’s stock has outperformed the broader market by far. Although past performance is not always helpful to predict future performance, we believe that the past trends in such environments allow us to form expectations about the near future.

Strong U.S. Dollar

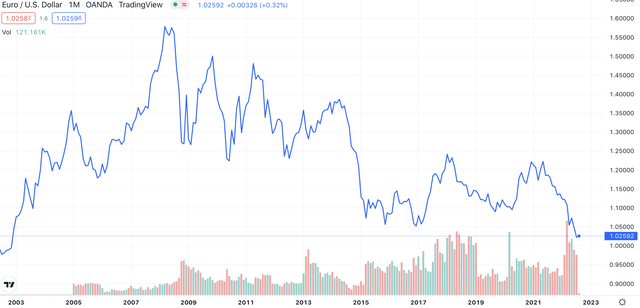

In the second quarter of 2022, many firms have been hurt by the strong U.S. Dollar, as the EUR-USD exchange rate has even reached parity in July.

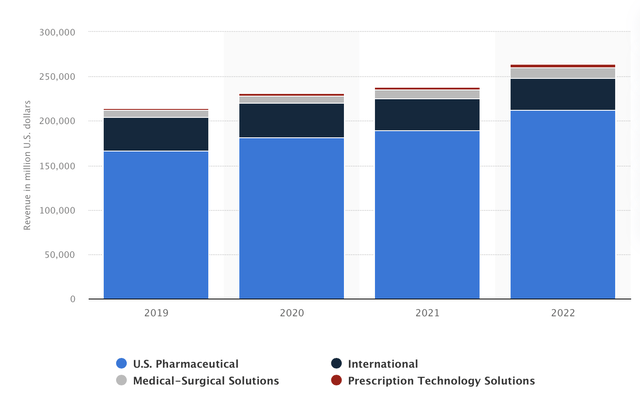

While McKesson is operating internationally, most of its revenue is generated by the U.S. pharmaceutical segment, making it less impacted by the foreign exchange rates.

Revenue by segment (statista.com)

We believe that McKesson could be an attractive candidate for investors who are trying to minimize their foreign exchange risk, while still maintaining positions in firms that are active internationally.

Inventory management

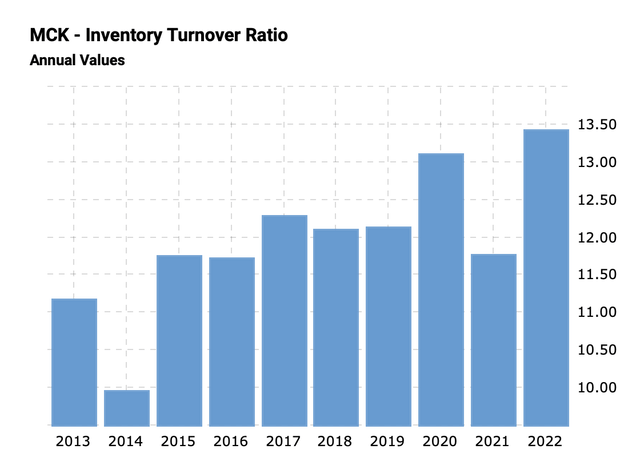

Although inventory and inventory management is not necessarily related to the macroeconomic environment, we decided to mention it in this section. The reason being is that inventory management issues were a common phenomenon among many firms in the first half of 2022, including large retailers like Walmart (WMT) and Target (TGT).

Increasing inventory and poor management can lead to selling goods at significant discounts in order to quickly reduce inventory. Such actions could lead to decreasing margins and therefore lower profits.

McKesson, however, has been managing their inventory well, so far, resulting in a record inventory turnover level.

MCK Inventory turnover (macrotrends.net)

In the current market environment, we believe that firms in the health care segment are much more attractive and could turn out to be safer investments than firms in the consumer discretionary sector.

Let us look at some company specific information now.

Dividends

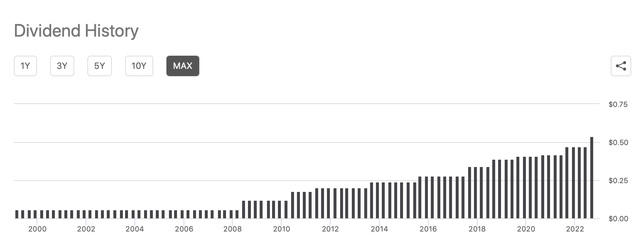

MCK has a strong track record of paying dividends. In fact they have been paying dividends for their shareholders in each of the last 23 years.

Dividend history (seekingalpha.com)

They have also managed to increase these dividends in the last years.

Important to mention that dividend payments are only attractive, if they are safe and sustainable – meaning that these payments can be afforded by the company.

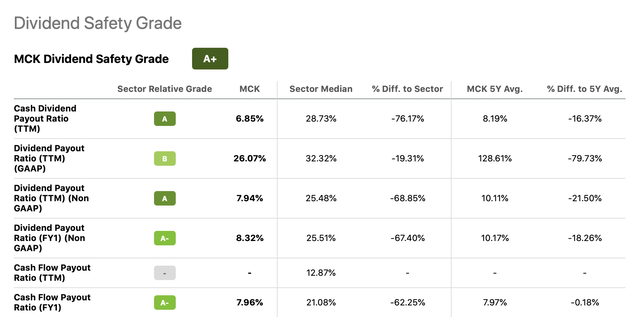

Dividend safety (seekingalpha.com)

The firm has a dividend safety grade of A+, which is well justified as the payout ratios as substantially below the sectors medians. We believe that a payout ratio of about 8%, is very likely to be safe and sustainable in the near future.

While the yield is only 0.6%, we believe that the firm could be an excellent addition to a dividend or dividend growth portfolio, especially when considering that fact that in July the firm has raised its dividends by as much as 15%.

Share buybacks

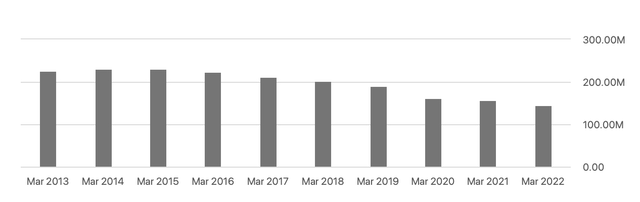

In the last decade, MCK has reduced its number of shares outstanding by more than 35%.

Share outstanding (seekingalpha.com)

Such a substantial reduction in number of shares outstanding has generated significant value for the shareholders.

At the end of 2021, the firm has announced that they are aiming to continue with the share buyback programs increasing it by $4 billion. As both revenue and earnings are expected to remain strong in the upcoming years, we believe that the share repurchase program can be safely implemented.

Before we conclude our article, let us also take a look at the highlights of the recently released quarterly earnings report.

Q1 2023 Earnings

Some the key highlights of the earnings report were:

- Revenues of $67.2 billion, representing an increase of 7% year over year

- Adjusted Earnings per Diluted Share of $5.83 representing a growth of increase 5% year over year

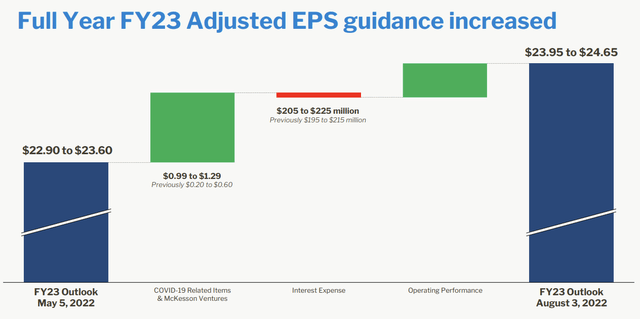

- Raised Fiscal 2023 Adjusted Earnings per Diluted Share outlook to $23.95 to $24.65 from $22.90 to $23.60.

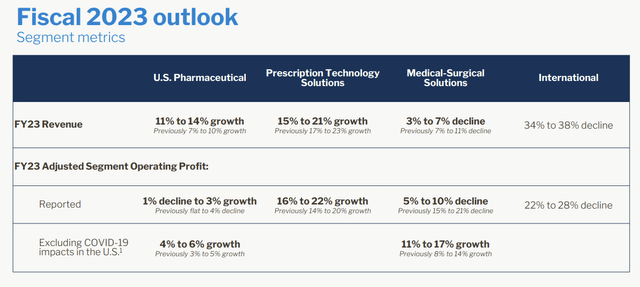

The strong revenue growth was driven by the U.S. Pharmaceutical and Prescription technology solutions segments, which both saw double digit growth, primarily driven by specialty product volumes, and by biopharma services programs, respectively. Medical-surgical solutions revenues grew in the low single-digits, driven by growth in the primary care business, partially offset by lower contribution from COVID-19 tests. On the other hand, the decline in international revenue has somewhat offset this growth, as the international segment revenues declined by as much as 29% year over year, driven by the divestitures of McKesson’s UK and Austrian businesses.

Looking forward, the company appears to have an optimistic view on the rest of 2022, as they have substantially adjusted their guidance upwards.

Guidance (McKesson) Outlook by segment (McKesson)

The strong financial results of the firm and the upbeat outlook also support our initial thesis that the firm could perform well in the near term, despite the highly uncertain macroeconomic environment.

Key takeaways

MCK’s stock has performed exceptionally well during times of low consumer confidence in the last 20 years. We believe that the firm is well positioned to outperform the broader market in the current macroeconomic environment as well, because the demand for its products are relatively independent of consumer sentiment.

While McKesson operates internationally, most of its revenue is generated by the U.S. pharmaceutical segment. This means that the strong U.S. Dollar and foreign exchange rate headwinds are not likely to have a substantial impact on the earnings figures.

The firm has a strong track record of paying a safe and sustainable dividend, while buying back its share.

For these reasons we rate MCK’s stock as “buy”.

Be the first to comment