vitranc

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three homebuilding stocks. With mortgage rates rising rapidly, should you consider these three homebuilding stocks of Meritage Homes Corp., Taylor Morrison Home Corp. and Toll Brothers, Inc.?

Homebuilding Stocks Recent News

Prior to 2022 operators in the homebuilding industry benefited from rising per capita disposable income, accommodative interest rates set by the Federal Reserve and improving macroeconomic conditions prior to the coronavirus pandemic. Rapidly rising home prices over the past two years have been able to offset increased labor and material costs. So far this year, rising mortgage rates and declining demand for single-family homes has hurt the industry this year.

However, demand is of concern for the end of 2022 and into 2023. As of August, National Association of Home Builders (NAHB) sentiment has dropped for eight consecutive months. In August, the reading dropped to 49, which is considered negative. The value of residential construction spending and the number housing starts are both expected to decline during the next few years. Additionally, once the economy recovers, interest rates are expected to rebound to more normal levels, hindering industry revenue. However, this decline will be slightly offset by improving macroeconomic conditions, as both consumer spending and per capita disposable income are expected to increase.

Within the industry there are some notable trends. With rising energy prices, many homebuilders are pushing toward solar panel installations. Not only does this save homeowners from high energy costs, but it also requires little to no upkeep. Additionally, homeowners are beginning to look at environmentally friendly building materials and practices as crucial factors in choosing a homebuilder. Adapting to changing consumer preferences and a challenging macroeconomic environment will be essential to the success of homebuilders in the coming years.

Grading Homebuilding Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

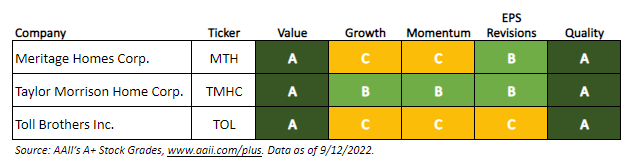

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three homebuilding stocks—Meritage Homes, Taylor Morrison, and Toll Brothers—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Homebuilding Stocks

American Association of Individual Investors

What the A+ Stock Grades Reveal

Meritage Homes Corp. (MTH) is a designer and builder of single-family homes. Its segments include homebuilding and financial services. The homebuilding segment is engaged in acquiring and developing land, constructing homes, marketing and selling those homes and providing warranty and customer services. In addition, homebuilding operations consist of three regions, West, Central and East, which include nine states: Arizona, California, Colorado, Texas, Florida, Georgia, North Carolina, South Carolina, and Tennessee. The financial services reporting segment offers title and escrow, mortgage, and insurance services. Its financial services operation provides mortgage services to its homebuyers through an unconsolidated joint venture. The company also operates Carefree Title Agency Inc. Carefree Title’s core business includes title insurance and closing/settlement services to its homebuyers.

The company has a Value Grade of A, based on its Value Score of 98, which is considered deep value. Higher scores indicate a more attractive stock for value investors and, thus, a better grade.

Meritage Homes’ Value Score ranking is based on several traditional valuation metrics. The company has a rank of 22 for shareholder yield, 18 for the price-to-book-value (P/B) ratio and 5 for the price-earnings (P/E) ratio, with the lower the rank the better for value. The company has a shareholder yield of 3.1%, a price-to-book-value ratio of 0.86 and a price-earnings ratio of 3.3. The ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA) is 2.9, which translates to a score of 10.

The Value Grade is based on the percentile rank of the average of the percentile ranks of the valuation metrics mentioned above, along with the price-to-free-cash-flow ratio (P/FCF) and the price-to-sales (P/S) ratio. The rank is scaled to assign higher scores to stocks with the most attractive valuations and lower scores to stocks with the least attractive valuations.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades over the period from 1998 through 2019.

Meritage Homes has a Quality Grade of A with a score of 82. The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The F-Score is a number between zero and nine that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity, and operating efficiency of a company. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

The company ranks strongly in terms of its return on assets and buyback yield. Meritage Homes has a return on assets of 18.4% and a buyback yield of 3.1%. The sector median return on assets and buyback yield are 2.9% and negative 0.3%, respectively. The company also ranks highly with a Z-Score of 8.55 which ranks in the 84th percentile. However, Meritage Homes ranks poorly in terms of its accruals to assets, in the third percentile.

Meritage Homes reported an earnings surprise for second-quarter 2022 of 15.3%, and in the prior quarter reported a positive earnings surprise of 23.4%. Over the last month, the consensus earnings estimate for the third quarter of 2022 has remained the same at $6.675 per share despite one upward and nine downward revisions. In addition, Meritage Homes has a Growth Grade of C based on a poor quarterly year-over-year operating cash flow growth of negative 69.1% offset by a strong five-year earnings per share growth rate of 40.3%.

Taylor Morrison Home Corp. (TMHC) is a public homebuilder in the U.S. The company is also a land developer, with a portfolio of lifestyle and master-planned communities. It provides an assortment of homes across a range of price points to appeal to an array of consumer groups. The company designs, builds and sells single- and multi-family detached and attached homes in traditional markets for entry level, move-up and 55-plus active lifestyle buyers. The company operates under various brand names, including Taylor Morrison, Darling Homes Collection by Taylor Morrison, and Esplanade. Through Christopher Todd Communities it operates a build-to-rent homebuilding business. It serves as a land acquirer, developer, and homebuilder while Christopher Todd Communities provides community designs and property management consultation. In addition, it develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand.

Taylor Morrison has a Momentum Grade of B, based on its Momentum Score of 62. This means that it ranks strongly in terms of its weighted relative strength over the last four quarters. This score is derived from an average relative price strength of negative 5.6% in the most recent quarter and above-average relative price strength of negative 5.6% in the second-most-recent quarter, negative 8.4% in the third-most-recent quarter and 25.3% in the fourth-most-recent quarter. The scores are 53, 44, 42 and 95 sequentially from the most recent quarter. The weighted four-quarter relative price strength is 0.0%, which translates to a score of 62. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weighting of 20%.

Earnings estimate revisions offer an indication of how analysts view the short-term prospects of a firm. For example, Taylor Morrison has an Earnings Estimate Revisions Grade of B, which is positive. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Taylor Morrison reported a positive earnings surprise for second-quarter 2022 of 32.8%, and in the prior quarter reported a positive earnings surprise of 14.4%. Over the last month, the consensus earnings estimate for the third quarter of 2022 has increased from $2.510 to $2.535 per share due to four upward and five downward revisions. Over the last three months, the consensus earnings estimate for full-year 2022 has remained the same at $9.560 per share despite nine upward revisions.

The company has a Value Grade of A, based on its Value Score of 99, which is in the deep value range. This is derived from a very low price-earnings ratio of 3.4 and a high shareholder yield of 8.2%, which rank in the sixth and eighth percentile, respectively. Taylor Morrison has a Growth Grade of B based on a score of 71. The company has strong quarterly year-over-year operating cash flow growth of 195.5% and strong quarterly year-over-year earnings per share growth of 156.7%.

Toll Brothers, Inc. (TOL) is a builder of luxury homes. The company is engaged in designing, building, marketing, selling, and arranging to finance for an array of luxury residential single-family detached homes, attached homes, master-planned resort-style golf and urban communities. Its segments include traditional homebuilding and urban infill (city living). The traditional homebuilding segment builds and sells homes for detached and attached homes in luxury residential communities located in affluent suburban markets that cater to move-up, empty-nester, active-adult, affordable luxury, age-qualified and second-home buyers in the U.S. The traditional homebuilding segment operates in five geographic areas, including the North region, Mid-Atlantic region, South region, Mountain region and Pacific region. The urban infill segment builds and sells homes through Toll Brothers City Living. It operates in over 24 states and in the District of Columbia.

Toll Brothers has a Quality Grade of A with a score of 82. The company ranks strongly in terms of its return on assets, buyback yield and F-Score. Toll Brothers has a return on assets of 8.9%, a buyback yield of 6.9% and an F-Score of 7. The industry average buyback yield is significantly worse than Toll Brothers’ at negative 0.3%. The company ranks below the industry median for accruals to assets and return on invested capital.

Toll Brothers has a Momentum Grade of C, based on its Momentum Score of 45. This means that it is average in terms of its weighted relative strength over the last four quarters. This score is derived from a relative price strength of negative 5.7% in the most recent quarter, 1.7% in the second-most-recent quarter, negative 28.1% in the third-most-recent quarter and 16.7% in the fourth-most-recent quarter. The scores are 53, 58, 23 and 92 sequentially from the most recent quarter. The weighted four-quarter relative price strength is negative 4.2%, which translates to a score of 45.

Toll Brothers reported an earnings surprise for third-quarter 2022 of 2.3%, and in the prior quarter reported a positive earnings surprise of 20.2%. Over the last month, the consensus earnings estimate for the fourth quarter of 2022 has decreased from $4.939 to $3.981 per share due to 14 downward revisions. Over the last month, the consensus earnings estimate for full-year 2022 has decreased 8.8% from $10.225 to $9.33 per share, based on one upward and 15 downward revisions.

The company has a Value Grade of A, based on its Value Score of 93, which is in the deep value range. This is derived from a very low price-earnings ratio of 5.4 and a high shareholder yield of 8.6%, which rank in the 12th and seventh percentile, respectively. Toll Brothers has a Growth Grade of C based on a score of 59. The company has a strong five-year operating cash flow growth rate of 53.9%. However, this is offset by a low quarterly year-over-year operating cash flow growth rate of negative 109.9%.

____

The stocks meeting the criteria of the approach do not represent a “recommended” or “buy” list. It is important to perform due diligence.

If you want an edge throughout this market volatility, become an AAII member.

Be the first to comment