Allan Akins/iStock via Getty Images

The market, despite some recent positive movements, remains in turmoil. Some might say that rate increases are already priced in. To that I say, we haven’t even had even one rate increase at this point – and many analysts are forecasting no less than seven individual rate increases.

Because of this, and many other factors, I believe we are in for a tumultuous year with plenty of ups and downs even in sectors and companies we would otherwise consider “safe”. We will likely see movement in companies in the tech sector similar to that we’ve seen in Facebook/Meta (FB).

This isn’t just a US trend. Scandinavia has already seen increased costs and mortgage rate increases, despite that we haven’t seen rate increases yet either. Bank costs for mortgages are increasing, and as a result, they’re increasing their rates. The signals for more problematic trends are all over the stock market, for those who know where to look.

I can point at one clear difference from last year. The risk appetite is nearly gone. Out of 163 IPOs of 2021 in Stockholm alone, over 74% of these companies are in retreat, with an average drop of nearly 16%. If we look at the smaller-cap IPOs found in Spotlight, First North, And NGM, that percentage moves up to 92%, with average drops of 10-30%. The signals here are clear – investors are moving away from risk, and this is repeated in the rest of the EU and US as well. To sell an IPO in a red-hot stock market with no cost for cash is one thing.

To offer your business or idea in a market environment such as this is something else entirely.

To me, this is a good thing. It means the demands on companies and their profitability is increasing. Businesses need to show higher numbers to “impress” the market, and as interests rates rise and interest costs increase, it’s likely these dynamics will be even more on point.

So. Conservative approaches and companies.

The appeal of non-profitable tech or growth companies will likely decline further – that is my view, at least.

Over the past 4 months, I have been tirelessly rotating and considering my allocations for what I see as a more demanding market. Positions have been sold and bought.

My very general stance is the following:

I am willing to wait years for the upside in undervalued businesses to be realized, potentially suffering poor 2022 RoR for the safety in their conservative dividends and relatively low beta. What I have exchanged for these undervalued businesses, are positions I have held for years and that have appreciated in many cases over 100%.

So, my expectation is in fact for 2022 to deliver relatively poor returns. I believe the upsides in many of my investments will take a longer time to come to fruition – as the upsides in many of the sold investments took years as well.

I accept this – and the reason is I see a favorable risk/reward in doing so.

What I do not do, as some others do is:

- Invest in “growth tech” stocks, such as Meta or PayPal (PYPL) because they’ve dropped X%. Even with drops, they pay no dividends, and I view them as comparatively less safe investments than companies I rotate into because of the new market environment we’re moving into.

- Invest in really anything that’s substantially valued above 15-25X P/E (depending on the sector). I use very fundamental multiples to look at every company I buy, and unless I think I’m getting a deal, I won’t buy it. I want bargains, and I’m willing to take on the risk of “time” to get them.

- Panic and move outside my areas of expertise and start investing in things like crypto or NFT’s. Not for me – enough said.

If you follow my work, you know what I look for.

If you don’t yet follow me, this may be enlightening to you.

I’m going to mix it up here and present you with 2 EU and 1 NA companies that I consider to be very buyable in this market situation.

What’s good about them isn’t just that they’re cheap. There are a lot of cheap companies out there.

It’s not just that they’re safe. Again, lot of safe companies out there.

It’s not just that they have safe yield – plenty of cheap yields out there.

Dear readers – they combine the best of all worlds.

You get Yield. You get fundamentals. You get valuation.

That’s the differentiator.

I don’t care if the market takes 1-2 years to realize this. In my work and in my analysis, I find that this is the case – and that is why I invest in them.

Let’s look at these companies I consider “so great”.

1. BASF (OTCQX:BASFY)

BASF is 3% of my portfolio.

The biggest chemical company in the entire world is going to be a staple on a list such as this, until it goes “cheap” again, which it hasn’t.

We haven’t seen the company’s 4Q21/FY21 results yet. Those are bound to come in on the 25th of February. At that point, we’ll know more what sort of rewards shareholders might enjoy, but I view it extremely likely that we’ll see a small dividend bump, putting the yield at around 5% – or one of the highest in the entire sector. It’s certainly one of the best when you consider the comparative safety of BASF seen in its valuation and performance.

I’ve written multiple articles on BASF, and I’m heavily invested in the company at more than 2% of my total portfolio value – TPV. My returns on the investment are more than 20% including FX so far – but I still don’t see €68/share for the native as being close to the fair target price here.

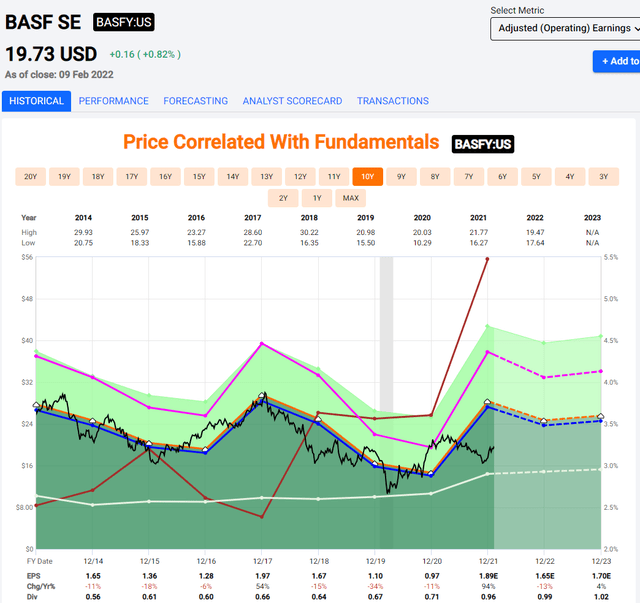

If we assume that the average of 2021E earnings materialize, we’re looking at a P/E valuation for BASF of less than 12.5X – for the largest chemical company in the entire world.

There is no hiding that this is a cyclical business. But a cyclical business isn’t “dangerous” or “problematic” as long as we know and understand the cycles.

F.A.S.T graphs BASF Valuation (F.A.S.T graphs)

The upsides of a fundamental chemical company are clear. BASF strategic core – the “Verbund” concept, of which you can read more in my articles, is a key contribution to the company’s impressive profitability. BASF offers the entire chemicals value chain, from oil-based raw materials to products for consumer goods production.

In a world where inflation and costs and input increases are driving trends, BASF only has to adjust pricing for its contracts in order to match these trends. This doesn’t take away from the volatility – and I wouldn’t buy BASF over 16X P/E. But at these multiples, there is very little downside.

The only risk/issue to BASF is Co2-compliance. BASF is set to IPO Wintershall DEA, but this is currently unclear as to when exactly it will happen. It has already been postponed once. It will happen, of course, but the “when” is the question here. The IPO will structurally improve the company’s wallet, which will be good for some of the Co2 challenges as well as the removal of some of the physical natgas hedges that the IPO will entail. There is, as of now, no substitute for the legacy business of Oil/Gas, and it will likely take time to find one.

As another risk worth pointing out, certain parts of BASF seem poorly managed even to a cursory review, such as mine. What I mean by this is that the chemical value chain profitability in latter parts of that chain is surprising – because this is not a segment-specific trend. it’s BASF-specific, and it’s an unnecessary volatility addition. BASF management should address this.

Beyond that, the fundamentals speak for themselves. A 5%+ well-covered dividend yield with a massive, incoming share buyback in the billions of euros, a necessary commodity chemical producer, and the largest company in the world.

The upside is no less than 22% annualized until 2023, as I see it, and based on a 15-16X P/E normalization. It is my belief that with its fundamentals, including a debt of less than 2.3X ND/EBITDA and an A grade S&P Global credit, BASF belongs in a conservative dividend investors portfolio.

That’s number one.

2. Deutsche Telekom (OTCQX:DTEGY)

Deutsche Telekom is 2.8% of my portfolio.

This is perhaps one of the companies I get most questions about – to which my usual answer is – “Read my articles”.

If you have not yet read or followed my article on the company, it’s likely that you missed out on a quick 10% bounce, or more than 40% annualized since I seriously started drumming for DTEGY back in January.

The upside to this telco incumbent is significant. With US operations now properly set up, the plan until 2025 is to enjoy the TMUS, market-leading 5G network to further leverage growth. DTEGY has market-leading legacy EBITDA margins of 40%+ in Germany and has a strong foothold in Eastern and southern Europe.

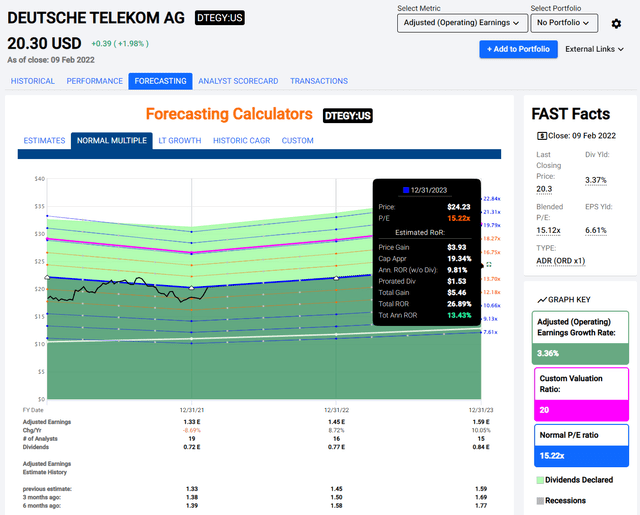

Its updated €0.64 dividend implies a yield of 3.7% (almost 4% YoC for me). While this is on the lower end for overall Telco’s, if you read my articles you know my considerations behind this. The next 4-5 years have a decent likelihood of a massive dividend increase, and I consider a 5-7% yield likely on a YoC basis in 2024. We also have decent visibility for this, as the company’s debt is above its target corridor. DT won’t increase the dividend until debt is back under 2.75X – it’s currently around 2.9X on an EBITDA basis.

Risks? Yeah – some. But fewer than BASF.

As a telco, there’s a lot of CapEx, and the next few years will be good margins but very little growth (or none) in legacy markets like Germany. DT also has to battle off against Vodafone (VOD) in certain key markets and segments.

However, risks can’t even come close to what I see as the fundamental upsides in the company. With the US on track and the company’s growth from this, given that it with its options owns over 50% of TMUS, there’s a massive global upside to Deutsche Telekom/T-Mobile.

DT isn’t as cheap as some peers, say Orange (NYSE:ORAN) or Telefonica (NYSE:TEF). But it’s cheaper than Scandinavian Telco’s, and for what it offers, it’s certainly cheaper than most.

I see DT on a target of no less than €22/share for the long term. This implies an upside of 24.5% even at a price of €17.7.

US investors have two ways of digging into DT. They either buy the native stock DTE through brokers that allow such trading, such as Interactive Brokers (NASDAQ:IBKR). They can also buy the official ADR DTEGY, which is a 1:1 ADR with a current price of ~$20. The ADR doesn’t take the full implications of the dividend or earnings increases from the company’s ownership structure of TMUS into consideration – but it’s still an impressive upside, even if you lost out on that 10% recent growth.

F.A.S.T Graphs – Deutsche Telekom Upside (F.A.S.T graphs)

So, what else do we have?

What’s number 3?

3. Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is 4.75% of my portfolio.

You can disagree or you can ignore it. But the fact is if someone told me they’re a conservative dividend investor and don’t have BMY in their portfolio, that to be would be baffling.

BMY is now my largest pharma holding. It’s also one of the most undervalued pharma companies in existence. With AbbVie (ABBV) reaching valuations where the yield is below 4%, and with Amgen (AMGN) recovering, and Merck (MRK) no longer as appealingly valued, much of it now comes down to Bristol-Myers Squibb.

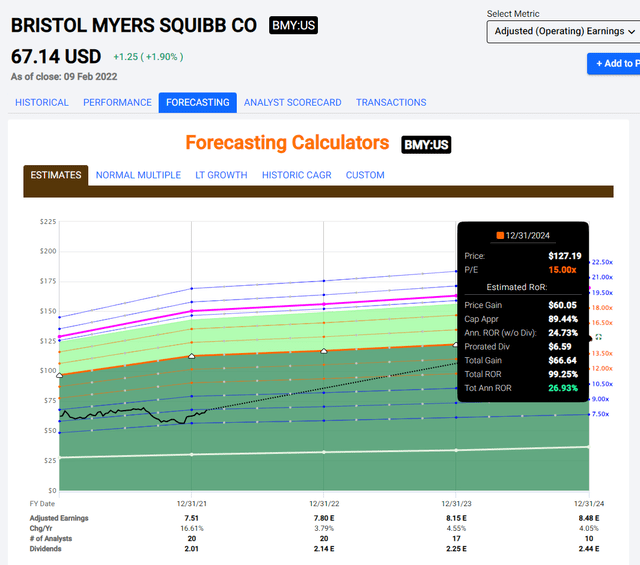

BMY, despite recent recovery, trades at less than 9X P/E. For the past 3 years, the company has been disconnected from fundamental valuation trends that previously were extremely decisive in the company’s multiples. In 2016, BMY traded at more than 30X P/E. The corresponding share price for that today would be more than $225/share.

I’m not saying they’re going up there. But every single fair-value indicator on the planet tells us BMY is undervalued. You’re investing at an EPS yield of almost 11.5%, and a dividend yield of 3.22%.

Many investors who are not yet “in” BMY fear that the market “knows” something investors do not. That there are risks to the company’s portfolio or pipeline that somehow the market is discounting for, and that make this valuation “acceptable” or “normal” in the long-term.

While I of course cannot with 100% certainty say that this is false, I would welcome input here with that in mind. Because after spending hours and hours – days when I consider all the work done on BMY that’s justified when having near-on $70,000 invested in a business, I still cannot find anything that justifies this. Not on any level.

What we see, is in fact the opposite.

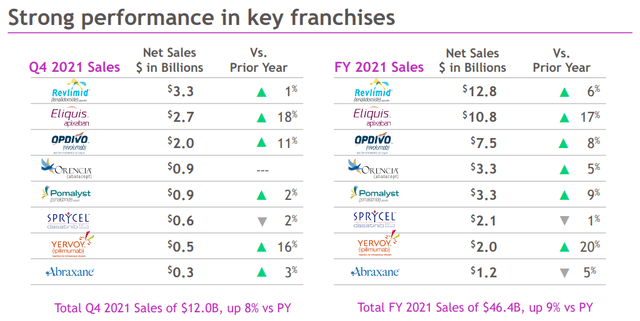

We see earnings beats, with 2 full-year sales declines in key franchises, both of them close to 1-3%.

Bristol-Myers-Squibb 4Q21 Presentation (Bristol Myers Squibb ir)

We see earnings beats and early 2022E guidance sets. We see medication prices increase close to double digits. We see accelerated buybacks. It’s almost as if the company wants to take advantage of a collective loss of the minds in the market, don’t you think?

BMY potentially has some of the best-selling non-COVID medications on the market. With AbbVie’s Humira losing protection as early as next year, it’s likely that they will climb higher with both Eliquis and Revlimid – and Opdivo is on the top-10 as well. That gives BMY literally 3 out of the 10 most best-selling medications in the entire world – and I don’t think the COVID-19 vaccine should necessarily be viewed as long-term here.

In fact, I expect massive sales declines not only for COVID-19 vaccine giants such as Johnson & Johnson (NYSE:JNJ), Pfizer (NYSE:PFE), but crippling sales declines for companies like Moderna (MRNA).

When it comes to BMY, all you need to decide is how much of a normalization you expect from the company. For me, I expect my stake to double in less than 3-4 years.

Why?

F.A.S:T graphs BMY Upside (F.A.S.T graphs)

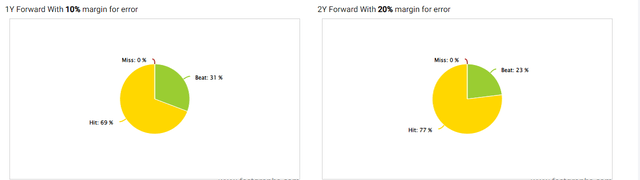

Even on only a 15X P/E normalization – and keep in mind, most trade higher than this -, this company will under current forecasts, come in with a 100% error-adjusted accuracy (when discounting for earnings beats), return almost 100% in less than 3 years.

F.A.S.T graphs BMY Forecast Accuracy (F.A.S:T graphs)

I believe that my biggest problem with my BMY stake will be deciding what to do with that almost 10% portfolio stake, or $140,000 in a few years – because I cannot have such a large single position.

BMY is my, by far, highest-conviction “BUY” in the entire healthcare sector, and I firmly believe that any conservative investor’s portfolio is less for leaving it out.

Concluding

So – these are 3 stocks I consider to be solid “BUY”, with upsides that range from 20-100% in the medium/long term.

They all come in around that sweet spot, between 3.3-5%. That’s where I believe that the twin variables of “risk” and “reward” converge in a usually most-appealing fashion.

Anything less than 3%, and I’ll want significant DGR potential.

Anything more than 5-6%, and I need to look very closely at specific long-term risks that would pressure capital appreciation over time.

But there are plenty of very attractive companies in that 3-5% range that offer combined upsides, including dividends, of well over 20% even in this market environment.

That, to me, is a win-win situation – regardless of how it goes.

It drops lower? Who cares – I’ll buy more.

It goes higher? While happy, I usually refrain from buying more, and just enjoy the ride.

ABBV is one such example. I’ve enjoyed the ride with AbbVie for years, ever since purchasing it well below $80/share when people were seriously making a case for why the company would “go bankrupt”.

That’s why my YOC is well over 6%. Not because it’s risky – but because I came, saw fundamentals, invested, and was patient.

You can do the same – and these are 3 companies that offer such upsides.

These three businesses together are almost 10% of my current portfolio. They weren’t 10% a year ago. I’ve rotated significant capital into each of them. I’ve sold overvalued shares in other companies. I’ve pushed fresh cash to work.

I expect that the cash I’ve put to work here will no less than double in 3-6 years, if including dividends.

It could, if you share my views, do the same for you.

Questions?

Let me know!

Be the first to comment