AlpamayoPhoto

Amid the stock market’s volatility this year, dividend stocks have been a relative safe haven for investors. I say “relative” because many dividend stocks have fallen in price as well, only less than the broader market and especially the high-growth, high-tech, non-dividend paying stocks.

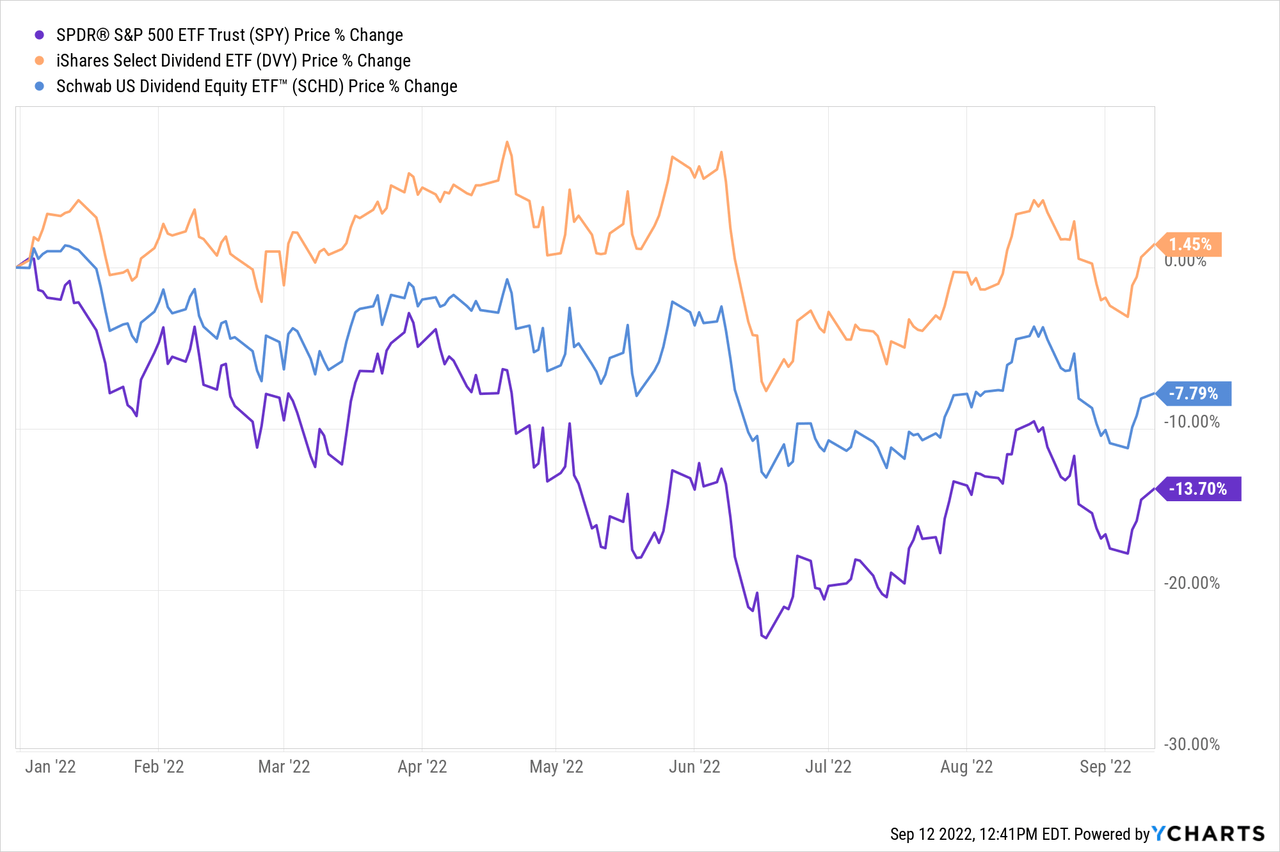

Compare, for instance, the performances of the iShares Select Dividend ETF (DVY) and Schwab U.S. Dividend Equity ETF (SCHD), two of the most popular and widely owned dividend ETFs, to that of the SPDR S&P 500 (SPY):

Most of the difference in performance between these three ETFs comes down to the kinds of companies they own, not just dividend payers versus nonpayers, but rather the particular sector allocations of each.

For instance, take Utilities, one of the most recession-resistant sectors (most people still pay their electric and gas bills even when the budget is tight).

For DVY, Utilities are the largest sector allocation at over 28%, whereas for SCHD Utilities are the smallest sector allocation at about 0.3% of the portfolio. Compare this to the SPY’s 3.2% exposure to Utilities.

The two ETFs have roughly the same exposure to Financials, which generally perform well during rising interest rate environments: DVY has 20.8% exposure while SCHD has 19.6%. Meanwhile, 11% of SPY’s portfolio is in Financials.

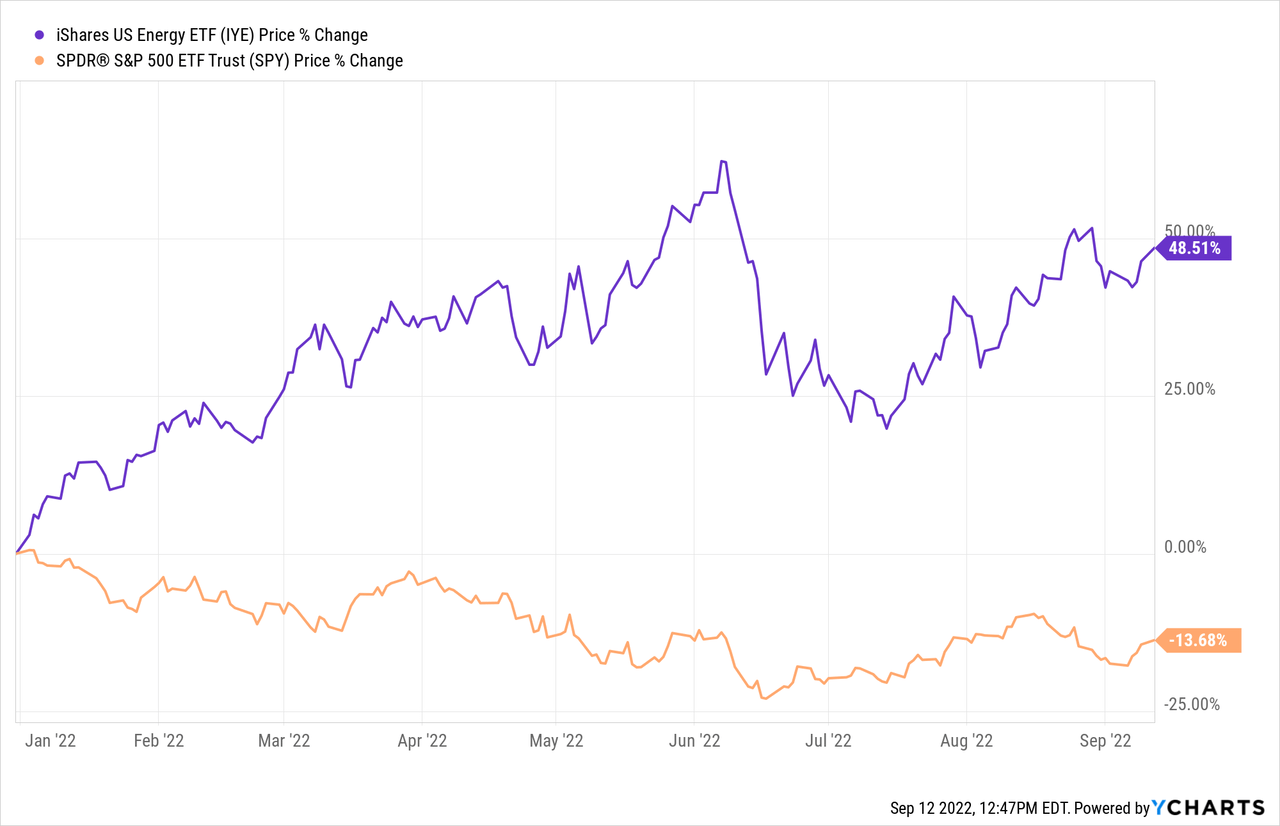

The other big difference between the two ETFs’ sectoral exposures is Energy. DVY’s ~8.6% exposure to Energy companies is almost double SCHD’s 4.7% exposure, which has benefited DVY greatly this year as Energy is the best performing sector of the equity market this year, up nearly 50% against the broader market’s ~14% decline.

The SPY has a rather paltry 4.5% exposure to Energy, which explains why Energy’s charge upward this year has done relatively little to buoy the index.

Today, however, there are not many companies in the Utilities or Energy sectors that are cheap. As most investors know, long-term investing does not generally work that well when one buys stocks that have already risen considerably.

There are exceptions, of course. If you’d bought Amazon (AMZN) at any price ten years ago, you’d be sitting on a massive gain today. But unless you’re buying a company like Amazon with an exponential growth trajectory ahead of it, it usually isn’t a good idea to buy at just any price.

As perhaps the most famous investor of our time, Warren Buffett, once opined, “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

So, in that spirit, let’s take a look at three cheap dividend stocks that fall outside of the Utilities and Energy categories of the market. They may be out of favor today, but I believe they are strong, long-term performers that should continue to compound shareholders’ invested dollars in the long run.

1. Matthews International (MATW)

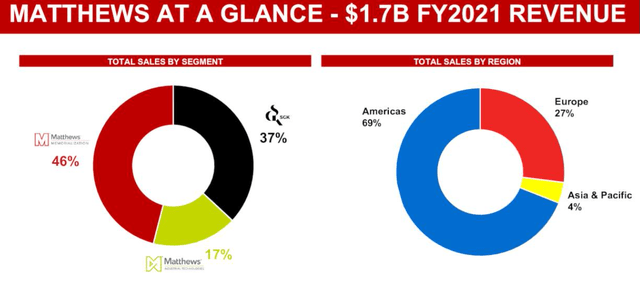

MATW is an industrial conglomerate with three distinct and diverse business segments:

- Memorialization (funeral and death care products)

- Industrial Technologies (battery storage and warehouse automation)

- SGK Branding Solutions (branding/packaging for retail and pharmaceutical products)

As you can see below, the legacy memorialization segment, which makes gravestones, caskets, cremation machinery, and other death care products, retains the largest share of total sales and also has the highest margins.

MATW Q2 Presentation

Though memorialization is expected to grow slower, it does reliably generate cash flows with which to invest in MATW’s fast-growing industrial and energy solutions businesses.

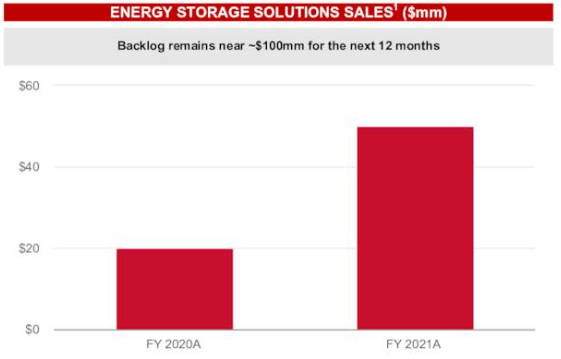

Energy solutions, in particular, is an exciting business line that holds a commanding market position in manufacturing machinery engaged in the dry electrode process of lithium battery production. Orders for these machines are coming in from around the world faster than MATW is able to churn them out.

MATW Q2 Presentation

Sales in this segment rose by 2.5x from 2020 to 2021, and in the next 12 months, they are expected to double again.

MATW is trading at a normalized free cash flow yield (based on my estimate of normalized FCF) of about 13%, and the company is currently paying out less than half of its actual FCF, which is depressed due to inflation and currency issues. What’s more, the company has an impressive record of dividend growth, spanning 28 consecutive years.

MATW’s enterprise value to EBITDA sits at about 7.5x, based on 2022’s estimated EBITDA range of $200 million to $210 million. That is far below its historical average EV to EBITDA multiple of ~14x.

You can read my full investment thesis on MATW here.

2. Medtronic (MDT)

MDT’s stock price is down about 11% year-to-date, but over the last twelve months that decline is more like 30%. This is for one of the world’s leading medical device makers, whose product portfolio includes pacemakers, blood sugar monitoring devices, and countless surgical tools. What gives?

The company has four different product categories:

- Cardiovascular

- Medical Surgical

- Neuroscience

- Diabetes

All four of these categories have suffered revenue declines in the last year, which is unusual for the company. But some context would be helpful. In 2020 and into 2021, MDT enjoyed a nice boost from sales of ventilators when COVID-19 hospitalizations were high. And in 2021, MDT enjoyed a little boost from elective surgeries that had been postponed in 2020.

Inflation and supply chain difficulties didn’t help the situation and instead pressured margins.

But the long-term picture for MDT remains attractive. Heart disease remains the largest cause of death in the US, and the standard diets of developed countries around the world will likely continue to increase cases of heart disease, even as the death rate of heart disease declines because of companies like MDT.

The same long-term trends hold true for diabetes, arrhythmia, and other health conditions that will likely increase in occurrence because of aging demographics, unhealthy diets, and other factors. And in just the last year, MDT has gained approvals for over 200 new products in the US, China, Japan, and elsewhere.

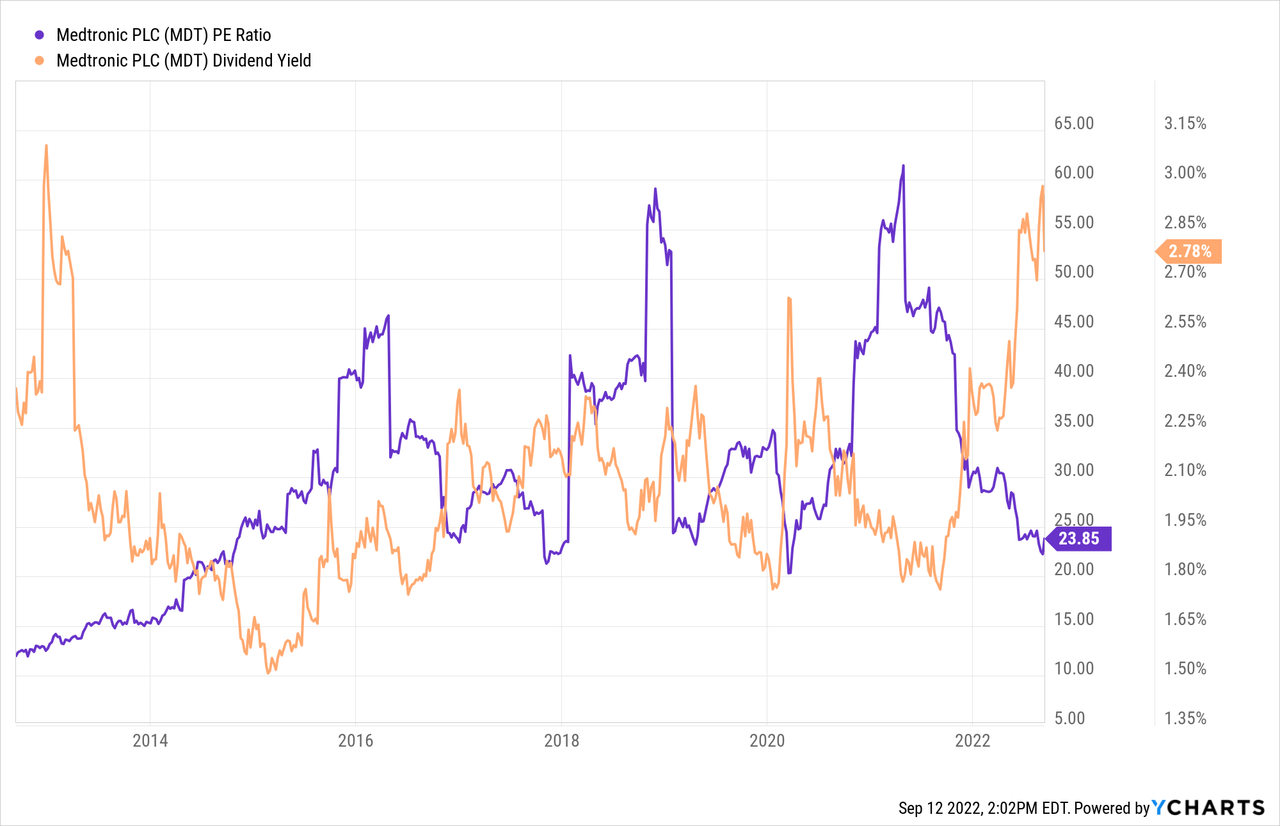

And yet, MDT is cheaper than it has been in a long time. Its dividend yield is near its highest point in 10 years, and its P/E ratio is near its lowest point in the last 7 years. On a forward basis, MDT’s P/E ratio of ~16.5x looks very cheap indeed.

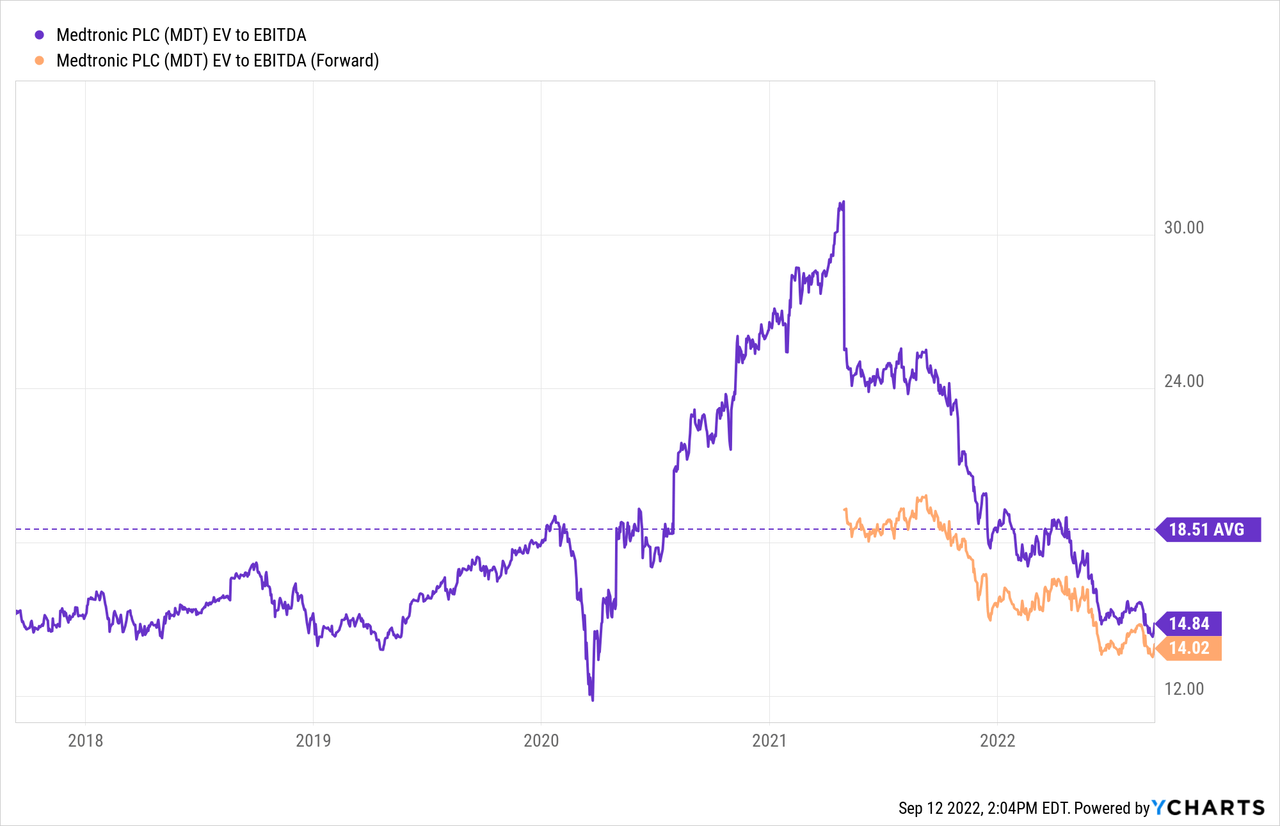

Moreover, MDT’s enterprise value to EBITDA is around its cheapest level from any time in the last five years, especially looking at forward EBITDA.

What’s more, MDT is a very shareholder-friendly company. Management plans to return 50% of free cash flow to shareholders this year, split between dividends and share buybacks. MDT allocated some $2.5 billion to share buybacks last year and repurchased over $300 million just in the last reported quarter.

On top of buybacks, MDT is a perennial dividend grower, having achieved 45 consecutive years of dividend growth so far.

3. M.D.C. Holdings (MDC)

MDC is a midsized homebuilder that builds homes through its wholly owned subsidiary, Richmond American Homes. Over 80% of its homebuilding is concentrated in five states: California, Colorado, Arizona, Florida, and Nevada.

The homebuilder has increasingly shifted its building to Sunbelt states where migration inflow is strongest, and it has also shifted its product offerings from more expensive homes to more affordable ones in order to appeal to Millennial first-time homebuyers.

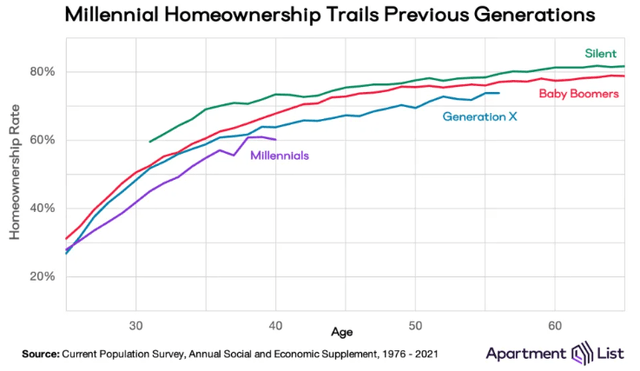

I think this latter shift is a great idea, as I do not believe the Millennial demand for homeownership is anywhere close to being fully tapped. All the way up to the oldest Millennials at age 40, this generation owns homes at lower rates than any of the three preceding generations did at the same age.

Apartment List

This does not signify that Millennials do not want to own homes, as some commentators suggest. Rather, it’s overwhelmingly an affordability issue, which currently comes primarily from a high mortgage rate relative to home prices.

Of course, we are probably only at the beginning of the oncoming housing market weakness, as mortgage rates rise and home sales volume is collapsing, driving inventory of homes on the market (especially newly built homes) higher at a rapid rate.

That’s what makes MDC particularly interesting. The company has no senior debt maturing until January 2030, which means management has done a great job of minimizing damage from rising interest rates. Moreover, MDC has a massive cash position equal to 27% of its market cap, which should act as a buffer in the case of a nasty housing correction or extended period of low sales volume.

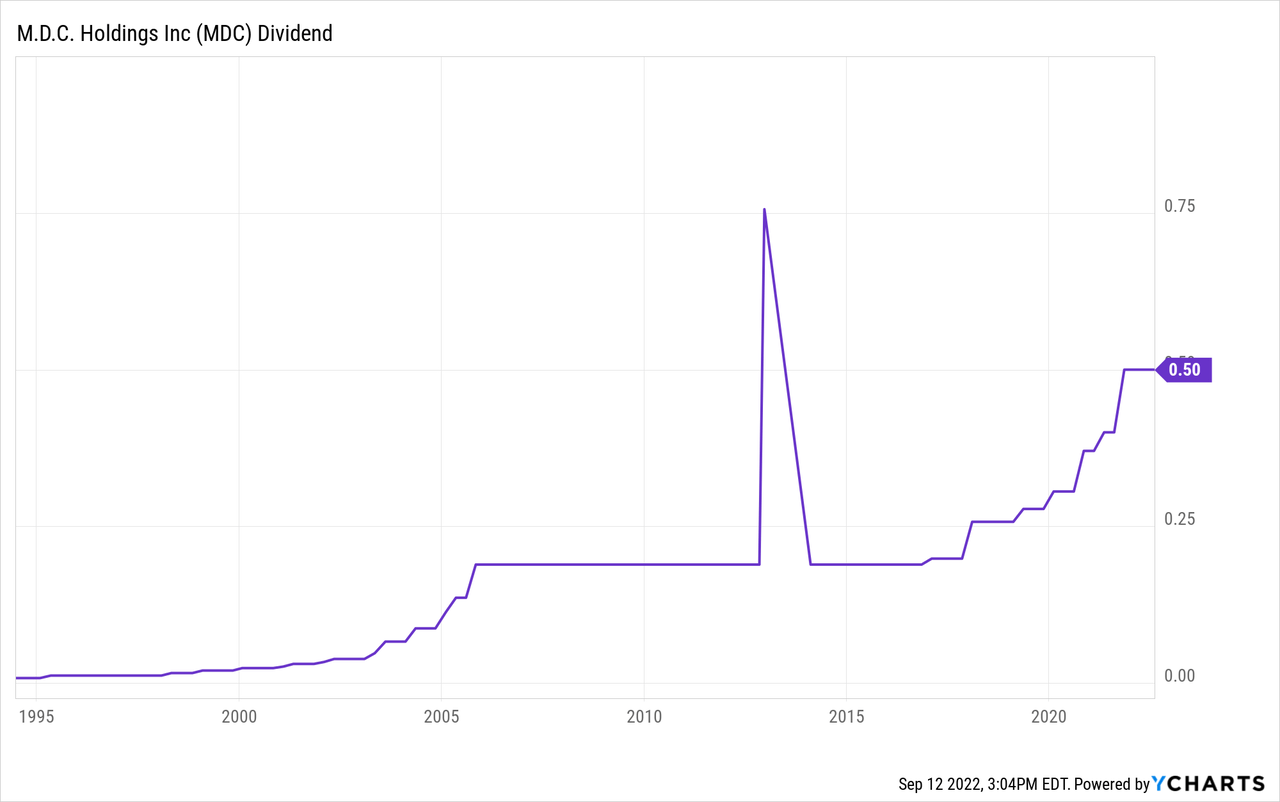

The dividend, currently yielding 6.3%, eats up only about 20% of earnings, although earnings could take a dip in the second half of the year as the housing market slows down. I believe the dividend is safe, as MDC has either raised or held flat its dividend for 28 consecutive years without a single cut, even through the housing crash and financial crisis of 2008-2009.

You can read my full investment thesis for MDC here.

Bottom Line

Whether it’s socks or stocks, buying quality merchandise at a discount is almost always a good idea. In my opinion, the three dividend-paying companies above are all quality “merchandise” being offered by the market at very nice discounts. Unlike Utilities and Energy, these companies are currently out of favor, which is often the best time to buy for long-term investors.

But, of course, for every stock pick, there is a multitude of investor opinions about that stock, and many of them are quite reasonable and compelling. I would love to hear about others’ opinions, whether in agreement or disagreement or somewhere in between!

Be the first to comment