Kwarkot/iStock via Getty Images

Investing In Real Estate Stocks to Fight Inflation

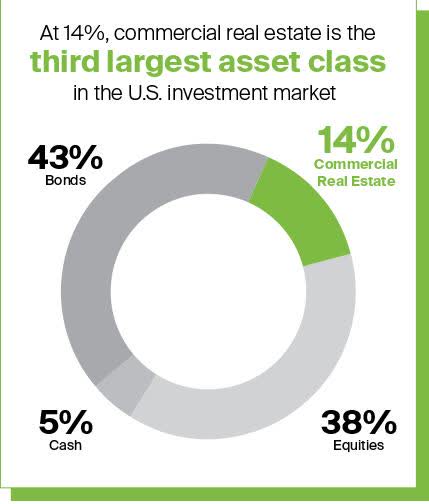

One of last year’s top-performing sectors, real estate investment trusts (REITs), are popular among investors given the bustling real estate market, dividend benefits, and portfolio diversification. The third-largest asset class in the United States, commercial real estate, REITs can offer a diversified blend of real estate assets and long-term total returns similar to stocks. Rising inflation is also one of the primary drivers of REITs and driving inflows as investors seek options to generate income and help boost their risk-return profiles. Along with the benefits of investing in REITs, I would be remiss not to mention potential risks.

Largest U.S. Asset Classes

Largest U.S. Asset Classes (REIT.com)

If the Fed moves forward with aggressive rate hikes (which they’ve indicated), we could see a slowdown in real estate. The two most significant variables impacting real estate affordability are the underlying property’s price and the cost to finance the property. Rising interest increases the cost of debt capital, which increases overall costs. Because asset values have already appreciated significantly, an increase in the price of debt capital or leverage will decrease the affordability of property values, hence potentially causing a slowdown in demand. Another immediate risk involves rising bond yields.

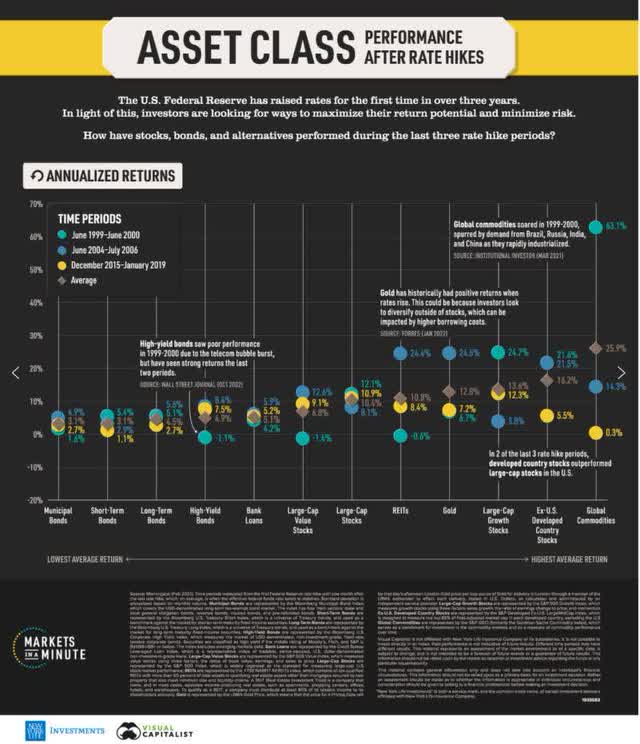

REITs’ returns tend to perform better than bond returns. The select asset classes in the visual below over the last three rate hikes make clear that REITs do well and bonds experienced poor performance during that period. In a low or falling interest rate environment, investors tend to gravitate to high-income or dividend-paying stocks to meet their income needs.

Asset Class Performance Post Rate Hikes (New York Life Investments)

When rates rise, investors tend to abandon high dividend-paying stocks for bonds that now have a similar yield and less perceived risk and volatility. As we look at the image below, REITs had one of the lowest average risks, showcasing the performance of varying asset classes over three periods following rate hikes. And while past performance is not a guarantee of future results, “Rising rates generally means the economy is growing, which translates into greater demand for real estate and the ability to charge higher rent. Interestingly, a 40-year analysis by Nareit found that REITs performed well during both high inflation and low inflation periods. This means they are less subject to prediction risk, or the risk that investors correctly predict high-inflation periods,” writes Jenna Ross of Visual Capitalist.

Asset Class Performance Over the Last Three Interest Rate Hikes

Asset Class Performance Over the Last Three Interest Rate Hikes (Visual Capitalist)

With the 10-year U.S. Treasury yield rising to its highest level in three years (2.79%), the bond market decline accelerated as rates increased. Our goal is to pinpoint investments with characteristics that can beat inflation, and REITs can do that. Alternative investments that include tangible assets can help protect against inflation. Historically, REITs have benefited from unexpected inflation, offering investors a total return investment and tax advantages. These benefits, among others, are why we are recommending three top REITs to consider for your portfolio.

3 Top REIT Stocks to Invest In

As a portfolio diversifier aiding to reduce the portfolio risks inherent in real estate or real estate stocks in general, REITs historically provide competitive returns driven by regular dividend income and moderate to long-term capital appreciation, similar to value stocks. Because REITs are liquid with attractive return potential in low and high-inflation environments and trade on major stock exchanges, here are three of my top-ranked REITs to help fight inflation.

1. Essential Properties Realty Trust, Inc. (NYSE:EPRT)

-

Market Capitalization: $3.22B

-

Dividend Yield: 4.08%

-

P/AFFO (FWD): 16.83

-

Quant Rating: Strong Buy

Rents and property values tend to increase when inflation is present. When rental rates increase, REITs can serve as a solid hedge as property values also rise and support their dividend growth for a stable income stream.

Essential Properties Realty Trust (EPRT) is a real estate company that engages in the ownership, acquisition, and management of single-tenant properties. EPRT specializes in long-term net leases to middle-market companies in the service- and experience-based sectors. In addition to rental payments, net leases require tenants to pay some, or all taxes, fees, and maintenance associated with the property; EPRT receives rent post expenses. Some of the notable names in EPRT’s portfolio include restaurant chains like Taco Bell, McDonald’s, and Arby’s and companies like Marriott, Circle K, and Cinemark.

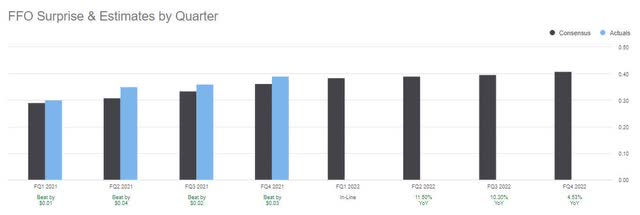

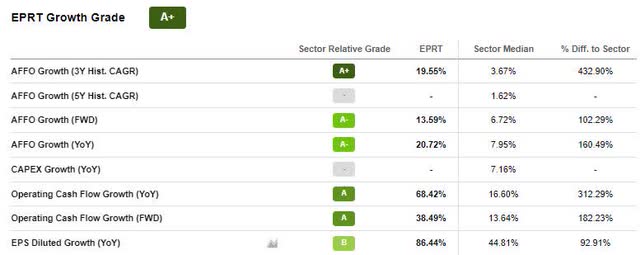

EPRT Valuation and Growth

Maintaining a strong balance sheet and closing out 2021 with a record $322M of investments for Q4 and $974M for the full year, Essential Properties Realty Trust ranks #2 out of 20 in its industry according to our quant rankings. It continues to outperform after three consecutive top- and bottom-line earnings beats, so the most recent Q4 2021 earnings should come as no surprise. With an EPS of $0.24 beat by $0.04 and revenue of $65.02M outperformed by +58% ($3.83M), EPRT boasts “the highest AFFO per share growth in its peer group, and its guidance calls for the highest growth among its peers,” writes Austin Rogers, Seeking Alpha Marketplace Author.

EPRT FFO 2021 Quarterly Surprise & Estimates

EPRT FFO 2021 Quarterly Surprise & Estimates (Seeking Alpha Premium)

With a forward AFFO multiple of 16.83x, more than 10% below the sector with expectations of 2022 leading growth within its industry, EPRT comes at an attractive B- overall valuation, substantiating our strong buy.

EPRT Growth Grade (Seeking Alpha Premium)

Paying an above-average dividend yield of 4.13% after tremendous earnings results, EPRT raised its dividend by 4% to $0.26. Although growth may moderate in 2022 amid the economic backdrop and geopolitical concerns, EPRT’s “differentiated focus on capital deployment strategies has insulated us from the increased competition, which is evidenced by our initial cash yields averaging 7.1% in 2020 and 7% in 2021,” said EPRT President and CEO Peter Mavoides during the Q4 Earnings Call.

EPRT Profitability

EPRT ended Q4 with 1,451 leased properties and more than 311 tenants, with early childhood education as their largest industry at 14.6% of ABR, followed by restaurants (12.4%), medical facilities (11.9%), and car washes at 11%. Income-producing gross assets increased by $3.54B to end 2021, and net debt to annualized adjusted EBITDA for the same period was 4.7x. “Our balance sheet and liquidity position remains highly supportive of our investment pipeline… our portfolio outlook and our strong performance in 2021, particularly during the fourth quarter and now continuing into the first quarter of 2022, provided us with the basis to increase our 2022 AFFO per share guidance to a range of $1.47 to $1.51, which, as Pete noted, implies a 14% year-over-year growth at the midpoint,” said Mark Patten, EPRT CFO.

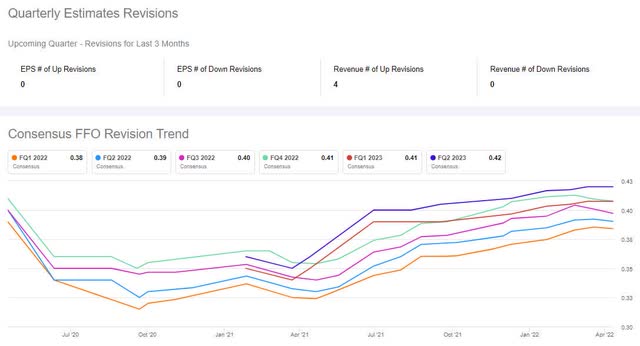

EPRT Quarterly Estimates Revisions (Seeking Alpha Premium)

Housing shortages throughout the U.S. and record selling pricing are driving demand and boosting cash flow for real estate companies. Wall Street analysts and the EPRT executive team are optimistic that it will continue to grow revenue and cash flow. Given the company’s A Revisions grade and real estate stocks’ potential as reliable sources of income, we believe EPRT is a strong buy, along with our next pick, WPC.

2. W. P. Carey Inc. (NYSE:WPC)

-

Market Capitalization: $15.84B

-

Dividend Yield: 5.17%

-

P/AFFO (FWD): 15.68

-

Quant Rating: Strong Buy

W. P. Carey Inc. (WPC) is very bullish and ranks among the biggest net lease REITs with nearly a $16B market capitalization and approximately $18B in diversified commercial real estate portfolio. Invested in premier single-tenant warehouses, office, retail, and self-storage units, rising inflation and fears of an economic downturn make WPC an excellent real estate stock pick.

WPC Valuation and Growth

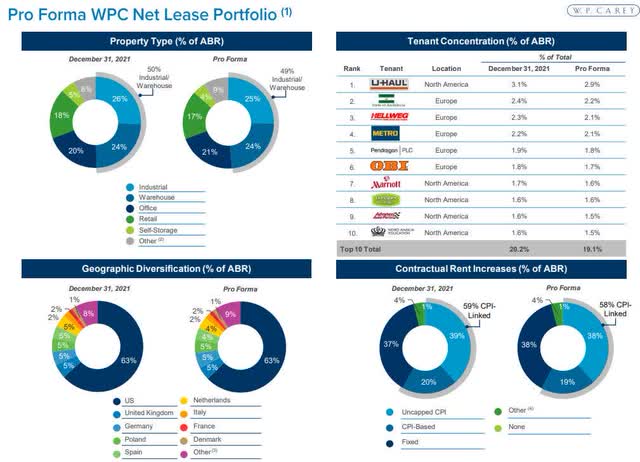

Like our previous stock pick, as the Fed raises rates, REITs like WPC can shift those costs onto their tenants so that the price of maintenance services and tools associated with maintaining properties and taxes do not affect their bottom line. WPC’s properties include 1,215 net leases that generate approximately $1.2B in annualized rental income, 352 tenants, a 98.5% occupancy rate, and 99% of leases with rent escalations. With nearly half of its rental revenue generated from industrial real estate and mission-critical logistics, WPC benefits from the supply chain headwinds that other industries are experiencing. Therefore, we believe it is a lower-risk investment relative to other sectors.

WPC Diversification Pro Forma (WPC Financials (data from 12/31/21))

As we look at its diverse tenant holdings and geographic locations, WPC should benefit from the rising rate environment, especially as “~37% of its rental revenue comes from Europe and a few other non-U.S. geographies. This gives it exposure to lower interest rates that it can arbitrage against the high inflation/rising rate environment in the U.S,” writes Samuel Smith, Seeking Alpha Marketplace author. “Higher inflation emphasized the benefits of diversification in our rent escalations—something our founder etched in our lease structure nearly 50 years ago,” CEO Jason Fox emphasized. Along with its geographic diversification and the strong demand for industrial and logistics assets, WPC has showcased a robust growth pipeline with nearly $2B in new property acquisitions, rent increases for 2022, and it’s building on its strong AFFO per share growth (6.1%) from 2021. With a forward P/AFFO grade of B, at 15.68x, which is more than a 17% difference to the sector, we believe WPC is trading at a discount with ample room for continued growth. Over the last five years, WPC’s share price has been on an upward trend. Although only up 1% YTD, over one year, WPC’s share price is +15%, and over five years, +30%. As evidenced by its momentum grade below, the stock performs well with gradual increases and outperforms its sector peers.

WPC Momentum (Seeking Alpha Premium)

In addition to 59% of their REIT rents coming from leases tied to CPI which surged to heights not seen in 40 years, WPC is well positioned to capitalize in the current and future environment. In addition to ranking as one of our top-rated diversified REITs, WPC raised its quarterly dividend to $1.057/share last month, indicating its current strength and future commitment to shareholders. We believe WPC will continue to be a strong buy into the future and before we wrap up this REITs article, we have to include self-storage facilities.

3. Life Storage, Inc. (NYSE:LSI)

-

Market Capitalization: $12.42B

-

Dividend Yield: 2.77%

-

P/AFFO (FWD): 25.41

-

Quant Rating: Strong Buy

Adjusted income storage REITs are another good solution. Many follow a monthly re-pricing model, whereby they can adjust rates upwards quickly, helping offset the rising cost of inflation. They also tend to be more recession resilient than many other sectors, which is why Life Storage, Inc. (LSI) is my final REIT pick.

Self-storage is a niche market that offers advantages like low capital and operational expenses, increasing cash flows, and wide operating margins. With more than 1,000 locations in the United States and Canada, warehouse rents are great investments, mainly as e-commerce drives warehouse demand and the need for storage of products and the tech industry houses its serves. Supply chain and labor shortages have kept occupancy and rental rates high, and why we believe Life Storage has a growth advantage over many other REITs.

LSI Valuation and Growth

Although Seeking Alpha’s Factor Grades give LSI a less than ideal D+ valuation grade, we still believe this real estate stock is a strong buy given the collective characteristics that include growth, profitability, momentum, and earnings. Year-to-date the stock is trending up, with a one-year price performance +61%, its five-year up an astounding 155%, and as the A+ momentum grade below depicts, the gradual price performance is outperforming its sector peers.

LSI Momentum (Seeking Alpha Premium)

Over the last few years, LSI has beat both top-and bottom-line earnings with the most recent leading to an A- revision grade and 6 FY1 Up revisions within the last 90 days. Q4 2021 EPS of $0.90 beat by $0.05 and revenue of $221.16M beat by $10.10M (+32% YoY). With an average occupancy of 94.2%, record acquisition volume plus the addition of 144 properties to end the year, LSI continues to grow via acquisitions and plans to add more stores throughout the Sun Belt region in the U.S. which is characterized by high economic growth.

Life Storage Growth Strategy and Acquisitions

LSI Growth Strategy and Acquisitions (Life Storage)

Over the last five years, LSI has seen tremendous growth in its store count, by 99%. “We are off to a strong start in 2022, with January month-end occupancy of 93.6%, which is 80 basis points higher than January 2021. Asking rates for January are up 26% year-over-year. And similar to last year, we are also starting off the year with a very strong acquisition pipeline with $483 million already closed or under contract. With regards to guidance for 2022, we estimate our adjusted funds from operations per share to be at the midpoint of $5.98 for the year, which would be 18% growth over 2021,” said Life Storage CEO Joseph Saffire during the Q4 Earnings Call.

Although Life Storage has not cut its dividend in the last decade, it froze it in 2018, reinstated it, and recently declared a $1.00/share quarterly dividend, which is in line with previous quarters. With a current forward 2.77% dividend yield and healthy balance sheet, we foresee the company taking advantage of the high inflationary environment by continuing to showcase solid earnings growth, prompting this REIT to gain in popularity.

The popularity of REITs is increasing as investors seek investments that are an inflation hedge while offering higher dividend yields and growth with potential valuation appreciation. Because real estate stocks typically benefit from inflation, REITs are valuable assets to consider in a portfolio, given rent hikes linked to the consumer price index. “REIT M&A volume has broken a 15-year record that was set back in 2006… all major sectors have contributed to the record, which implies a very favorable deal-making environment for our sector. Confidence has returned, more REITs have strong currencies to use in strategic mergers, debt is historically cheap, and debt markets are liquid,” said Steve Hentschel, Head of M&A and Corporate Advisory Group at JLL Capital Markets. We believe our top three picks outlined in this article are ripe for the picking and excellent options to fight inflation.

REITs Are Great Inflation Hedges That Possess Terrific Yields

REITs can offer solid returns over long periods, amid rising interest rates, especially in the current environment. Many REITs have proven resilient as inflationary hedges and income-producing as prices continue to rise, and the three picks outlined come at reasonable price points. With strong dividend yields and growth and profitability prospects, investors and these REITs will likely thrive.

We have many Top REITs for you to choose or check out our Top-Rated Dividend Stocks to help inflation-proof your portfolio. Our investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.

Be the first to comment