JasonDoiy/iStock Unreleased via Getty Images

Competition and Lack of Direction

23andMe (NASDAQ:ME) is a company that provides genetic testing services for consumers, providing information on both ancestry and health data. While the services are rising in population and have allowed ME to gain over 12 million users, the financial grounds of the investment are not the best. Most importantly, most consumer sales occur during the holidays when the test kits are on steep discounts. This can be seen when looking at the lumpy quarterly revenue chart. This also drives down the revenues and profits and may be a sign of waning demand. Does Apple (AAPL) ever directly discount their iPhones? This is also a sign that there is steep competition, especially by larger peer Ancestry, owned by Blackstone (BX).

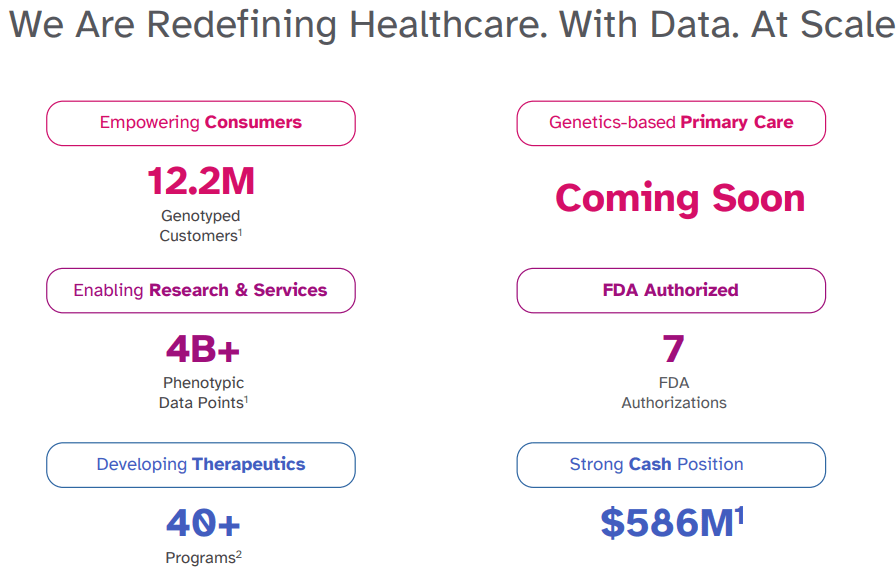

To combat these issues, 23andMe is doubling down on their advantages in the health segment and each year of new users allows for their accuracy to improve. The company is also attempting to seek partnerships for genetic analysis, and their current partnership with GSK (GSK) is now extended to five years. This will include a $50 million payment and a chance to earn royalties in the future. The company also has other plans in the works, such as integration with physicians in order to grow support for genetics-based primary care. Whether these alternative programs allow for stable revenues in the future is up in the air, along with being up to a decade from being significant.

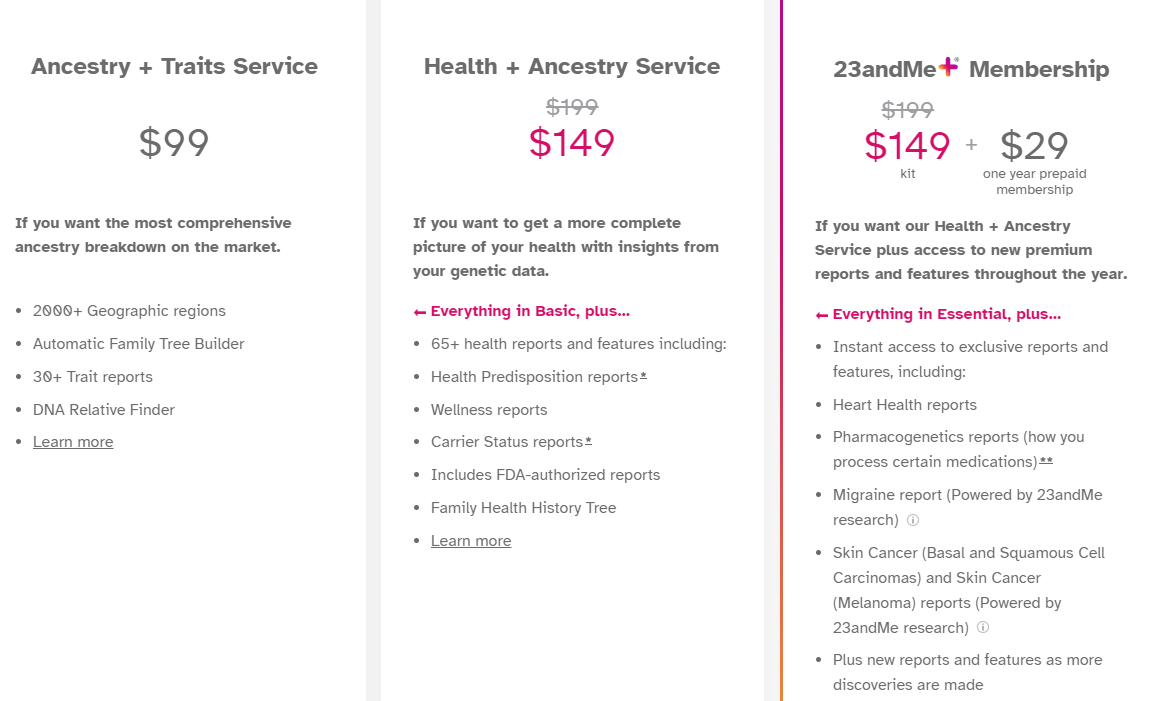

23andMe

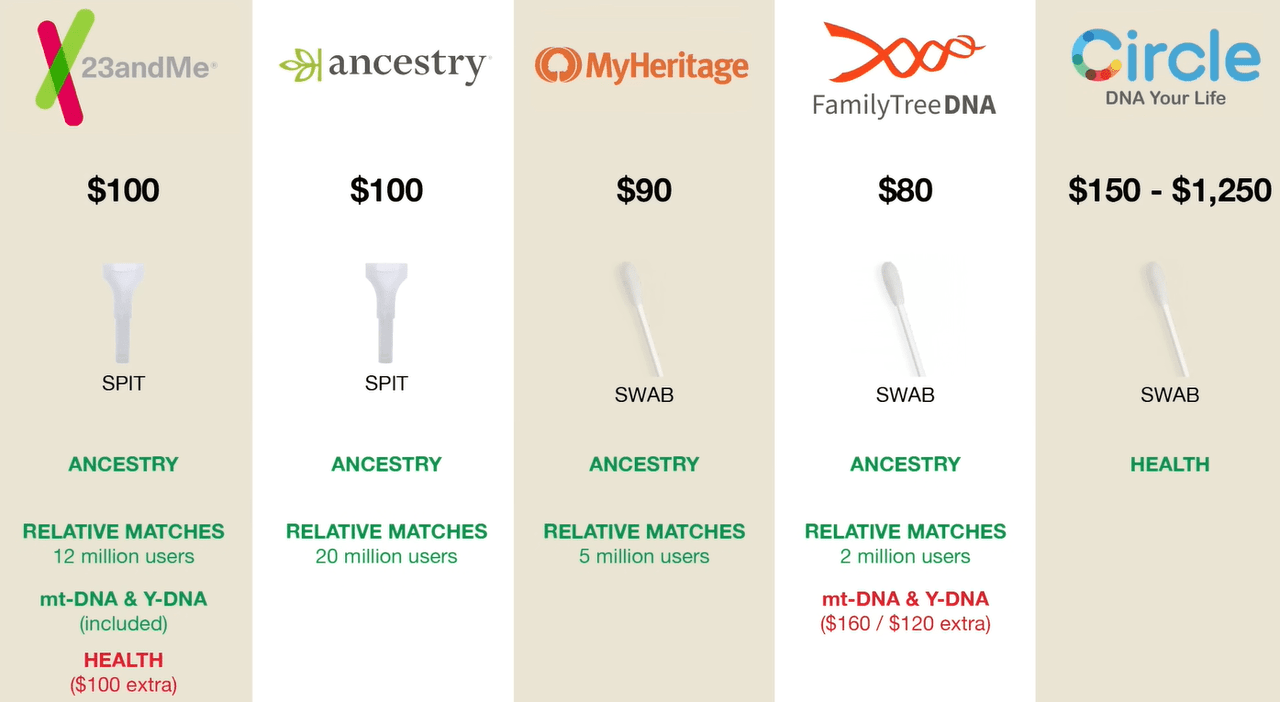

23andMe’s test kits start at a price of $99 for basic ancestry and traits, with add-ons for health services being an extra $100. I find that there is an issue with this basic price, as competitors are either the same price or slightly less. Since 23andMe has one of the largest databases, there should be a premium paid for the service. However, the minor differences seem to not be a competitive advantage and competitors are able to offer similar pricing. Perhaps with increased physician engagement and research, the advantages in health and mt/Y-DNA may allow for better performance than peers.

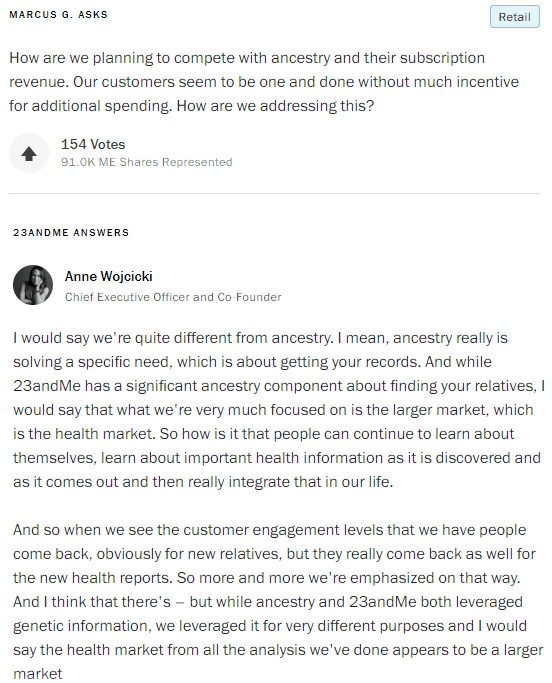

As the only pure-play public company in the space, does it even matter? If the financials were sound, such as revenue growth and stable earnings, the competition is something to expect. What I mean is this: as Target (TGT) and Walmart (WMT), or Exxon (XOM) and Chevron (CVX), exist in equilibrium, 23andMe should exist in equilibrium with peers with growth matching the trend of genetic testing. However, 23andMe is stuck spending hundreds of million USD per year to try and differentiate their platform from peers. Even when management claims they are different than a peer like Ancestry (see the picture from Q&A below). I believe the fundamentals do not reflect the overall genetics test kit market, and the company should be avoided. Let’s take a look as the financials make this point clear.

UsefulCharts (Youtube) 23andMe Q&A

Financials

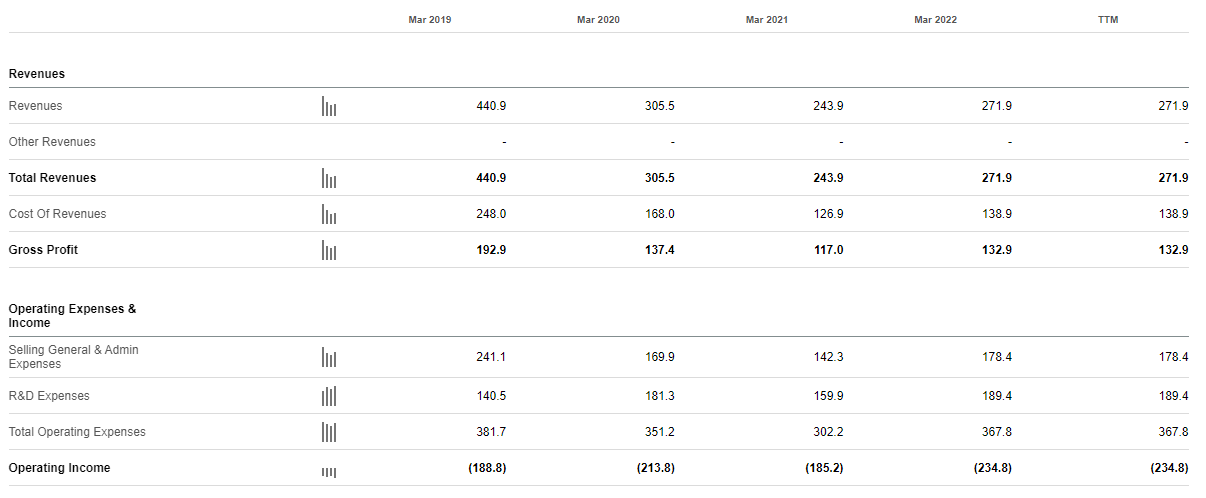

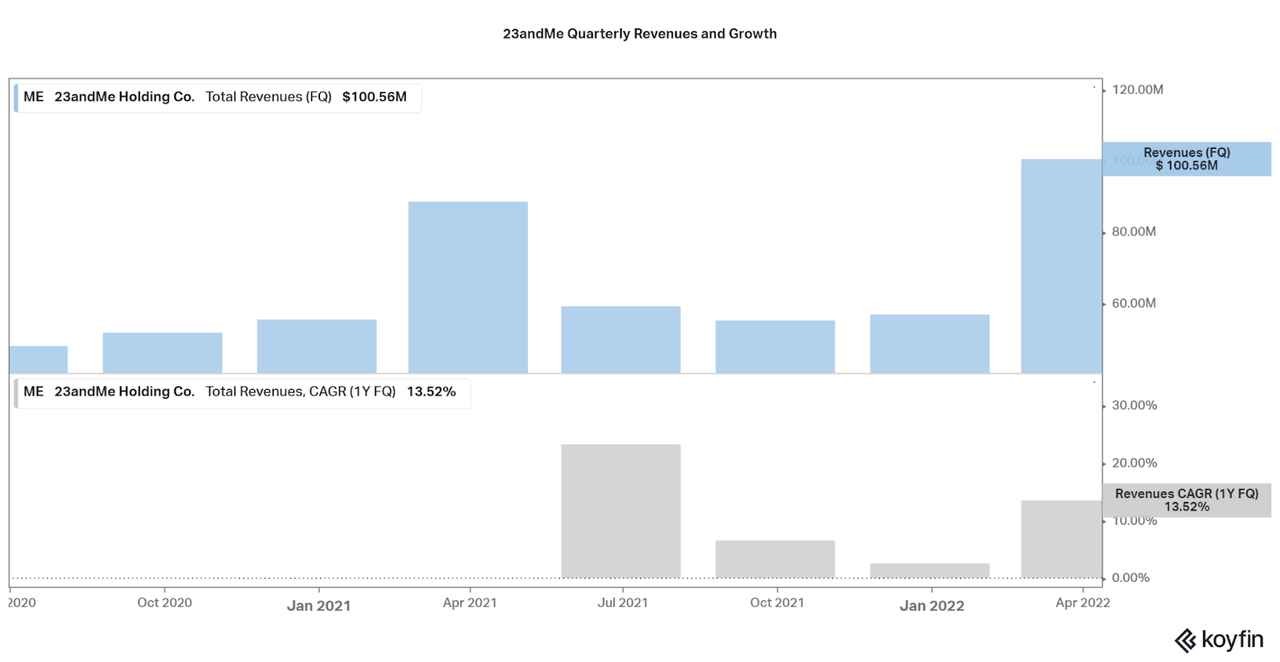

23andMe has limited data history due to being a private company until its IPO in 2020. Below, I show both the annual data for the past four years, and the quarterly revenue data since the IPO. Based on the longer-term data shown below, revenues are in a downtrend since 2019 and the revenues are heavily skewed towards the holiday season. This means that the purchase of genetic test kits may no longer be a high growth segment. This may be because consumers have either moved to competitor products or no longer care for this information in general.

When looking just at the holiday quarter, in the second chart, we can see that growth may be in a new upward trend, but at 13% growth, 23andMe would need quite a low valuation and strong profitability to support the investment thesis. Unfortunately, this is not the case as losses continue to be in the hundreds of millions per year. However, I will discuss ways ME expect to earn more revenues in the coming years later in the article.

SeekingAlpha Koyfin

Expenses

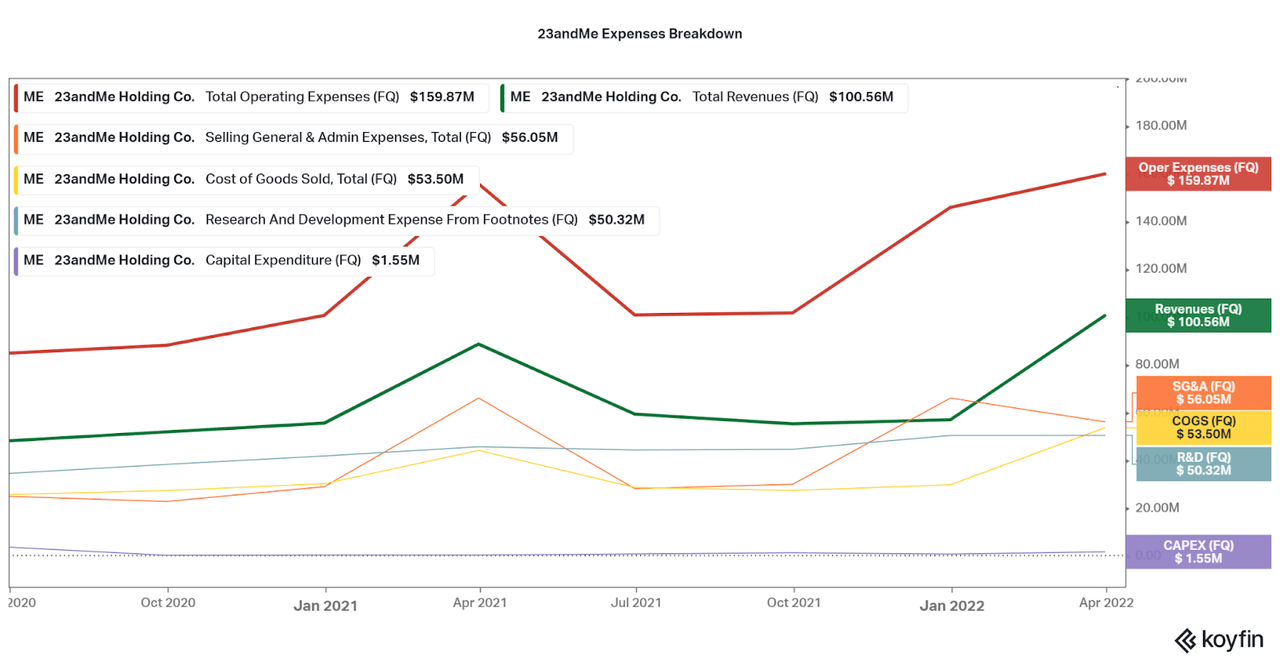

23andMe currently spends most of their money on SG&A, likely most to do with advertising. There also is a significant amount of expenses for R&D, usually $50 million per quarter, as the company works to increase the capabilities of their platform. Also, stock-based compensation ranges from $40 to $90 million per year, even as the company only recently IPOed. These are unfortunate facts as the company has fairly solid margins when comparing revenues to costs of goods sold, and profitability could be reached if other expenses were lowered.

As is typical of “early-stage” companies (23andMe is hardly a new company), it is likely management believes the losses now are for improvements that will drive growth in the future. I recommend reading the online Q&A as a way to gauge company expectations. Although, I believe most investors believe this is becoming less clear of a result as revenue growth stalls and losses continue. So far it is not a good look, in my opinion, but I will discuss aspects of the outlook at the end of the article. There are some surprises.

Koyfin

Balance Sheet

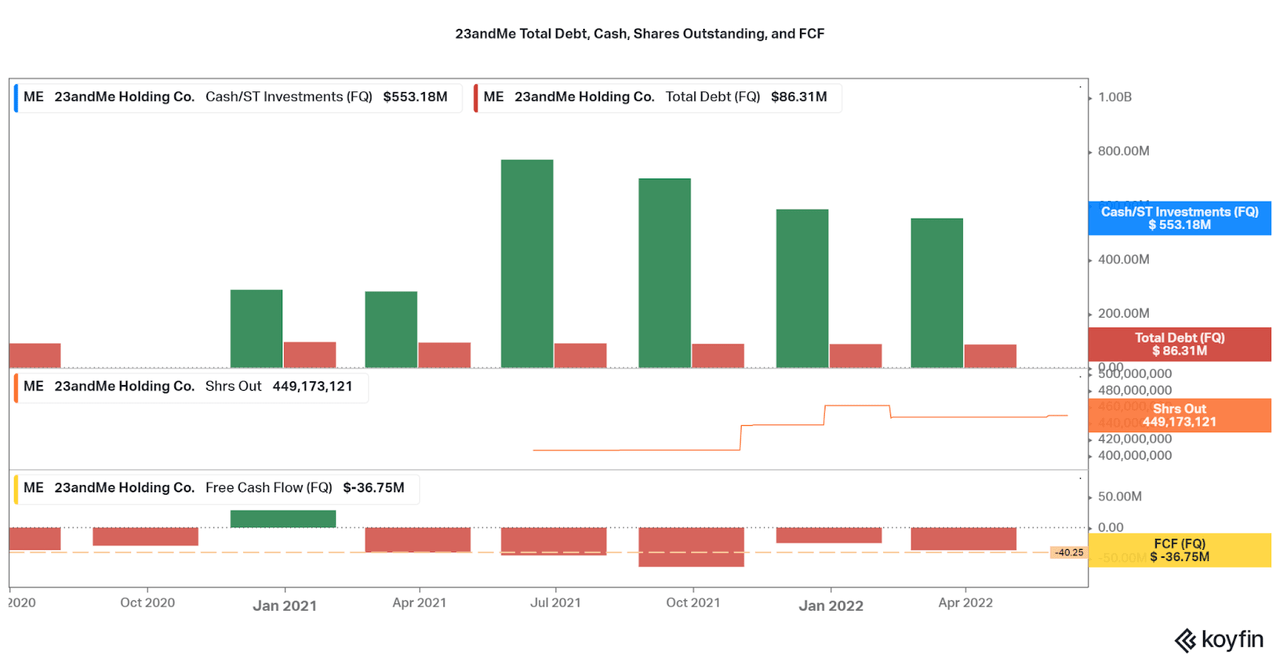

While growth stalls and losses continue, the company has begun to eat away at the cash gained during the IPO process. The current average negative cash flow is $40 million, so the company has about three years of runway, but that includes when the company dilutes or adds debt. However, the fairly mature and regular test kit sales do help reduce free cash flow overall. The question remains whether the company will find operational profitability before this current pile of cash runs out. If going by just test kit sales, I do not believe this to be possible with current spending.

Koyfin

Valuation

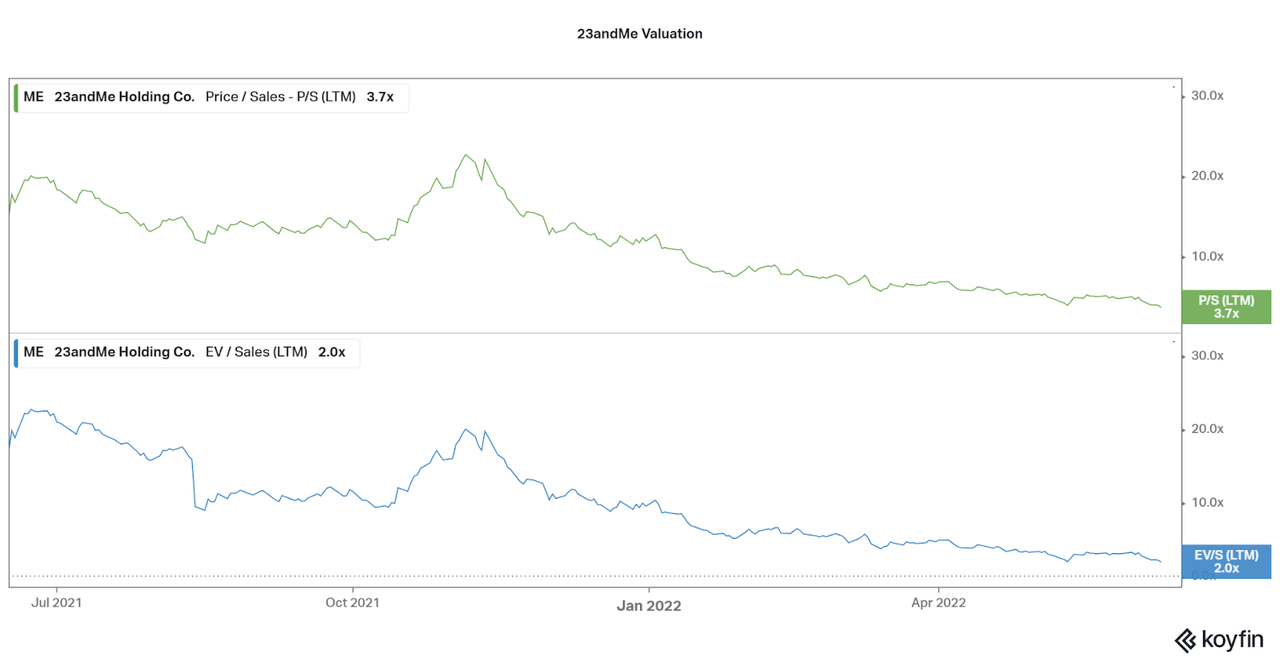

As a result of this weak historical and current financial performance, but flashy sales pitch back during the IPO (SPAC), the share price of the company has fallen over 80% from highs. The company now trades at a more reasonable 3.7x Price to Sales, 2.0x Sales when considering the enterprise value. However, with 10% growth and no profits coming in, there is plenty of room for the price to continue falling. Considering the future catalysts being developed (which I will be discussing next) are many years from fruition, I believe the share price has room to continue falling in the current market.

Koyfin

The Future

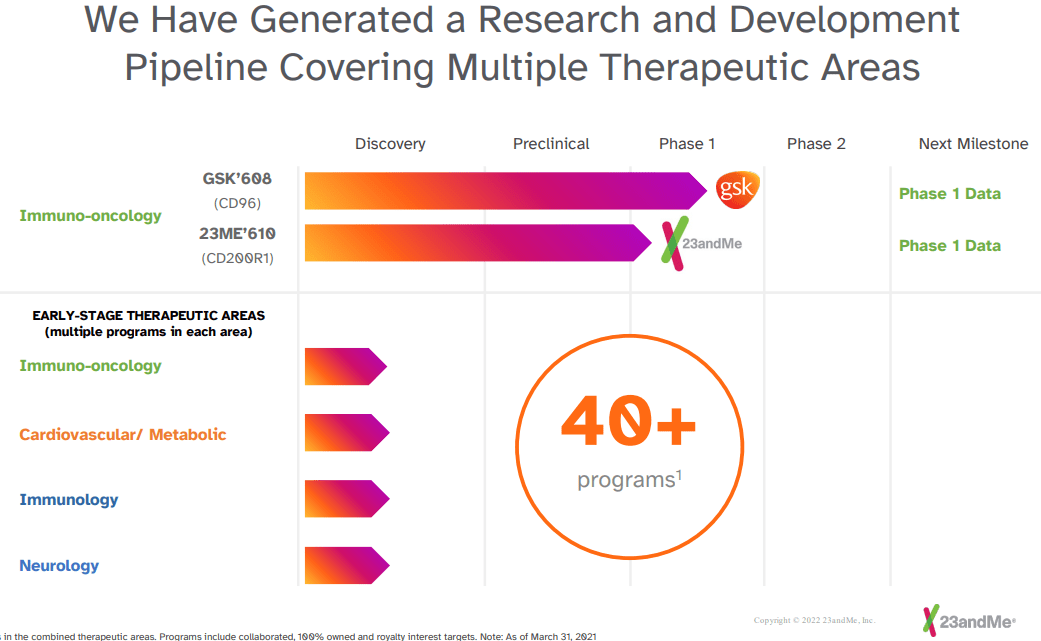

Many readers may be wondering what allows 23andMe to maintain a relatively high valuation for stagnant test kit growth. The answer is two-fold: biotechnology and innovative health. These two commonly used buzzwords are the main fall-backs for the company moving forward. First, the company spends millions per year attempting to find therapies that target genetic issues that are found with the test result database. In fact, two therapies, one of which is in partnership with GSK, are enrolling patients for phase 1 trials. Yes, this is where most R&D spending is going, drug research. It is an interesting concept considering the large genetic database on hand. However, I find that perhaps it would be a more viable business strategy to just lease out the information for a profit. Why take the risk in developing therapies that may not be approved if you can make other companies do it for you? Investors will have to be very patient from this point to see any value be derived from this segment.

23andMe

The other buzzword of innovative healthcare, or telehealth, is interesting as well. First, 23andMe has one of the more comprehensive health coverage for a DNA test-kit, and this proves insightful to consumers. However, the company is now looking to provide targeted primary care to DNA test recipients with a telehealth platform. While noble considering the company is working on developing therapies for genetic diseases and wants to assist in providing genetic-based health services, issues with adoption are likely to be very strong. First, the battle with health insurance companies may prevent coverage or increase costs to consumers, even if it is illegal.

In general, long-term-care insurers can indeed use genetic test results when they decide whether to offer you coverage. The federal Genetic Information Nondiscrimination Act does prohibit insurers from asking for or using your genetic information to make decisions about whether to sell you health insurance or how much to charge you. But those privacy protections don’t apply to long-term-care policies, life insurance or disability insurance.

Further, providing telehealth services requires significant spending and are quite competitive (as seen with names such as Teladoc (TDOC)), which takes away from the company’s ability to find a niche. As genetic data and information is disseminated across the healthcare industry, 23andMe will hold less and less advantage. While this segment may drive some revenue growth upon initial release, I worry about the ability to become profitable in the long-run. Therefore, the company is in a weak state as the could-be profitable test kit segment becomes phased out for the riskier and expensive biotech and primary care segments. Again, both of these issues could be addressed if the company just leased out their data to those already within the industry, like they do with GSK.

23andMe

Conclusion

While I believe leveraging the DNA test data research and database through profitable licensing agreements would be the better choice of path, the potential upside is limited if these growth paths are successful. This is what current and future investors will have to bank on as the test kit sales have limited growth. Considering the steep marketing and R&D costs required to be successful on both sides of the company, I believe there will be plenty of dilution over the next 5 years or so. With all this uncertainty, and the ability for investors to choose from thousands of pure-play biotech or telehealth companies, I find little reason to invest in 23andMe at the moment. Especially with the pessimism for growth names that may lead to a better buying opportunity. I will take a look back in a few years as progress becomes more clean. Until then, I will expect the share price to be quite flat or in-line with the test kit sales.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment