akinbostanci

Co-produced with Treading Softly

When I was young, I thought that a dollar was incredibly valuable.

Having $10 was an incredible feat.

$100 meant you had achieved “rich” status and could buy whatever you wanted.

Growing up also meant re-aligning my understanding of the value of a dollar. A dollar’s value was brought into a more realistic place. $100 went from an amount I couldn’t imagine to an amount that doesn’t always cover my run to the grocery store for “just a few items” that somehow turns into a full cart.

I also learned the value of intangibles. My rock collection was worthless to others, but each and every rock carried value from the memories I had discovering and unearthing them. The trip, the digging, and the joy of discovery were all valuable to me, but to others meant little to nothing.

So when it comes to investing, you may value a company or opportunities differently based on your experience, your goals, and your opinion. We all have some shared experiences. We are all investing in order to have more money. Yet there are different paths to get there.

I am a buy-and-hold-style income investor. Momentum and swing traders think I’m crazy! My picks are horrible for their investing or trading style. Meanwhile, their style doesn’t come close to meeting my goals at all.

You see, I prioritize income. A dollar today is worth more than a dollar tomorrow. I want that income stream pouring into my account, always ensuring that I can tap into it whenever I want. It has both a monetary value and an intangible value. Show me two investments that have the exact same “total return”, and the one that provides more income is more valuable to me. There is intangible value in knowing that income is there and that it will keep coming in through a bear market, recession, pandemics, wars, and the good times too.

Today, I want to look at two ultra-cheap income investments begging to be bought due to their excellent yield, strong outlook, and discount to the value we see in them.

Let’s dive in.

Pick #1: ATAX – Yield 7.6%

America First Multifamily Investors, L.P. (ATAX) is a unique company that is structured as a partnership and issues a K-1.

ATAX’s main investments are in MRBs (mortgage revenue bonds) issued by state housing agencies to encourage the construction of affordable government-subsidized housing and the development of new-build apartments that are not affordable housing.

The MRB segment is a niche investment that doesn’t get a lot of attention from large institutions. ATAX profits from the interest payments, which are the revenues that are Federal Tax-exempt, a benefit passed along to investors through the partnership structure.

MRBs are a great niche investment that has served ATAX well over the years, including through the Great Financial Crisis. Yet, for 2022, the exciting part of ATAX is their “Vantage” properties. This side business is generating immense returns for the year and is leading to significant excess dividends.

The Vantage properties are part of a joint venture. ATAX provides capital, and their partner builds new apartment buildings in growing areas. After construction, the properties are leased up and then sold to investors, and ATAX gets a cut of the profits. In 2020, this segment was responsible for ATAX needing to cut the distribution. The JV decided to hold off on selling any properties in the turmoil created by COVID. In hindsight, this was an excellent decision.

Prices for multi-family properties have spiked, and the JV has made several sales. ATAX hiked its regular dividend in June to $0.37/quarter and announced a supplemental dividend of $0.20.

ATAX attempts to distribute 100% of CAD (Cash Available For Distribution), and it has the “problem” of not being able to distribute fast enough!

ATAX had CAD of $1.74 in the first half, compared to “only” $0.90 in distributions. That doesn’t count another sale that closed in July, generating $19.4 million in proceeds and another $0.48 in CAD per unit. In the earnings call, management telegraphed that the supplemental distributions were expected to continue for the remainder of the year. They did not specify the size of those supplements. By our math, ATAX currently has $1.32 in undistributed CAD, and the “regular” distribution is only scheduled to distribute another $0.74.

The bottom line is that we can expect ATAX to continue supplements as large or larger than the $0.20 it paid out in Q2, plus there is a very good chance of a special distribution like last year.

There are still another 5 months in the year, providing plenty of time for more sales of more Vantage properties. The best time to buy a company that pays a special distribution is to buy it before it is announced. The writing is on the wall. For 2022 CAD is going to be materially higher than the regular dividend can keep pace with. We’ll see more supplements and/or a special distribution at year-end. The “regular” distribution at a 7.6% yield isn’t exactly anything to sneeze at. If you buy today, you will realize a yield a lot higher than that for at least the first year.

Pick #2: PFFA – Yield 8.6%

I am often asked about ETFs (Exchange Traded Funds), and my response is usually the same – I’m not a fan. Why do I dislike ETFs?

Well, typically, ETFs are not managed. Imagine you are on a plane, and the pilot takes off, kicks on autopilot, and then parachutes out the door. Is that a plane you want to be riding? Not me. Yet this is what millions do to their retirement dollars. They load them up on planes flying without a pilot, send them off and hope for the best.

Most ETFs create some formula for determining what stocks they buy, that formula is then blindly followed. It isn’t that the manager is sitting there agreeing with what the formula is doing. The manager doesn’t have the power to change direction if they wanted to, not that the manager usually cares. They don’t make money from performance, they make money from convincing you to buy their formula.

ETFs generally hold publicly traded stocks and always trade very close to NAV. Since they are following a formula, you could recreate the same formula yourself. You could buy the same stocks and the same weighting and save yourself the fees. The only real benefit most ETFs provide is instant diversification to a particular sector and liquidity. Those benefits aren’t enough to overcome the drawbacks in most situations, and that’s why I’m not a fan of ETFs.

Now let me tell you about an ETF I am a fan of. Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is technically an ETF, and it will always trade very close to NAV and provides the benefits of diversification and liquidity that only an ETF can provide. This is a big bonus in the preferred stock space where liquidity for specific picks can be limited.

PFFA also provides an additional benefit: Leverage.

PFFA uses a modest amount of leverage, typically 20-30%. Leverage has the effect of amplifying the performance of a fund. If the fund does well, it results in greater returns. If the fund goes down, it results in lower returns. I like a little leverage because the market has positive returns over the long haul. Returns are positive more often than negative, so leverage is good more often than bad. I don’t want leverage on my personal brokerage account, but I have no problem with it being carried on PFFA’s balance sheet! Also, PFFA gets a better price on borrowing than I can.

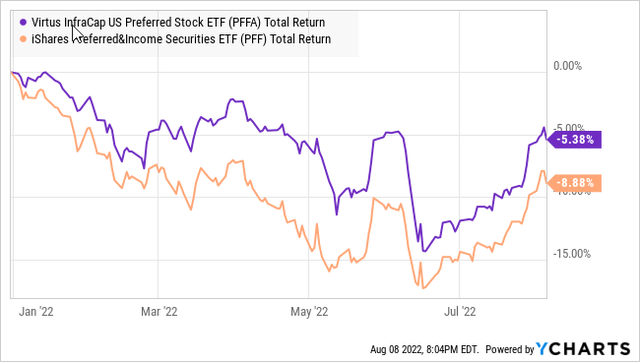

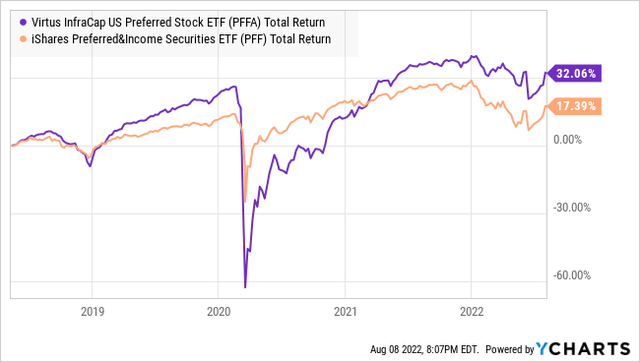

The real strength of PFFA is what sets it apart from peers – it is actively managed. There is a pilot at the helm, watching the skies and making decisions, this makes a huge difference. How much? Well, let’s look at PFFA compared to peer ETF, iShares Preferred and Income Securities ETF (PFF):

PFFA has managed to outperform in a down year, despite being leveraged, and it did so while paying a dividend yield over 80% higher!

PFFA’s ability to mitigate losses in a down market is the strength of active management and is why PFFA has soundly outperformed PFF since its inception.

Management matters and PFFA has demonstrated an ability to pay a high yield, manage leverage responsibly, and provide higher returns than its direct peers.

If you are looking for a way to gain more exposure to preferred shares while the sector is beaten up and selling at a discount, PFFA is hands down the best ETF for preferred shares.

Shutterstock

Conclusion

PFFA and ATAX are both undervalued. PFFA holds many preferreds which are trading below their par value. ATAX is actively selling Vantage properties that unlock millions in dollars which they actively reward their unitholders with.

Both provide excellent and outstanding levels of current income. For your wallet now, not a promise of some cash later after selling shares to someone who thinks they’re more valuable than you do. Instead of hoping to profit from a greater fool, why not collect income for being the smartest person in the room today?

I don’t strive to benefit from the foolhardiness of others or their failures. Investing is not a competition where I seek to “win” against others. My goal isn’t to buy from someone who doesn’t realize the value of their investment or to sell to a “bag holder” at an elevated price. I’m buying income, and there is plenty of room for others to join and buy income too.

As an owner of preferred shares, I want the company that issued them to succeed and provide valuable goods and services to others. As an owner of ATAX, I want multifamily dwellings to pay their debts on time, meaning they have the financial means to do so.

I want everyone to succeed. I don’t need to see others fail or hurt to achieve my goals in the market. That’s a guilt-free income stream. That’s what your retirement can and probably should be. We can all benefit from the great economic engine of the economy.

That’s income investing. I want to see you succeed, and I seek to succeed in a way that doesn’t stop you or anyone else from succeeding!

Be the first to comment