SERSOL/iStock via Getty Images

Co-produced by Austin Rogers

The stagflationary environment currently at play in the U.S. economy makes it difficult for investors to know where best to allocate capital.

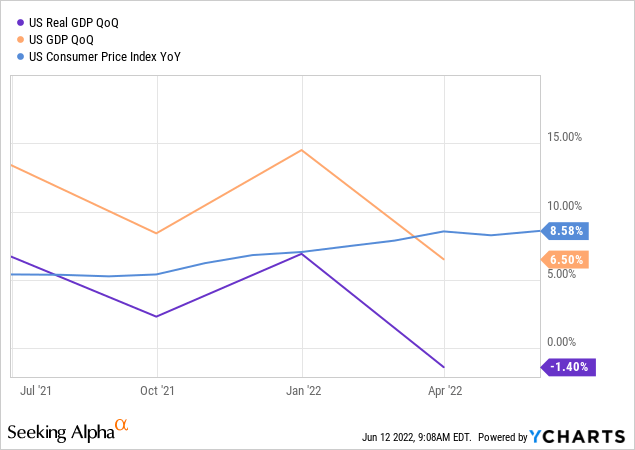

On the one hand, inflation is running hot with the Q1 2022 consumer price index averaging 7.8%.

On the other hand, in Q1 2022, real GDP declined at a 1.4% annualized rate, a sharp drop from Q4 2021’s 6.9% real GDP growth. That is significantly below economic analysts’ forecast for 1% growth and demonstrates surprising weakness.

Does this mean that the economy is already in recession? Yes and no. The economy might already be in recession, but we do not know that yet. The traditional definition of “recession” is two consecutive quarters of negative GDP, although that definition has been loosened recently. After all, the economy suffered a very sharp decline in activity in the Spring of 2020, but it did not translate into two consecutive quarters of falling GDP.

However, it is extremely important to note the difference between nominal GDP (in today’s US dollar value) and real GDP (nominal value minus inflation). If you take the average rate of inflation as measured by the CPI for Q1, you will notice that the only reason nominal GDP is still positive is inflation – in other words, price hikes.

A big part of the reason that Q4 2021’s GDP number was so strong was inventory buildup surrounding the Holiday shopping season. In fact, inventory buildup accounted for almost all GDP growth in the second half of 2021, after rebounding consumer expenditures buoyed GDP in the first half of the year.

Retailers and businesses entered 2022 with elevated inventory, effectively pulling forward what otherwise would have been part of Q1 2022’s inventory growth. Unsurprisingly, this stockpiling led to a drop in inventory purchases during the first quarter, which dragged GDP down with it.

Other factors in the GDP decline include:

- Weakening economies overseas, triggered by the Russian invasion of Ukraine, which led to decreased US exports.

- Falling government spending on intermediate products.

- Chinese lockdowns slowing down supply chains and preventing timely goods deliveries.

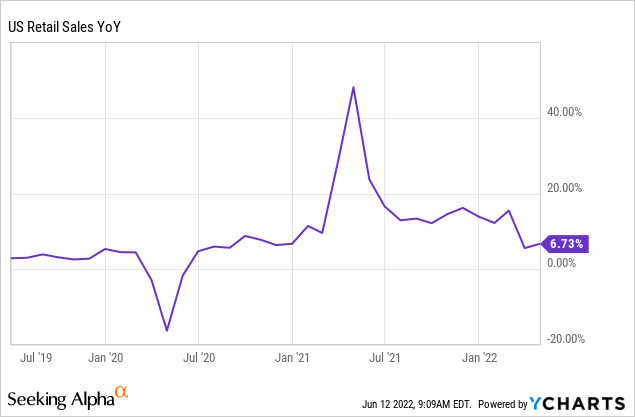

The good news for American retail, such as it is, is that even after a sharp drop in retail sales growth, the latest reading of ~5.5% YoY is still higher than the average range of 2-4% retail sales growth experienced from 2015 through 2019.

Even so, investors need to be prepared for a slowdown in retail into the second quarter of 2022.

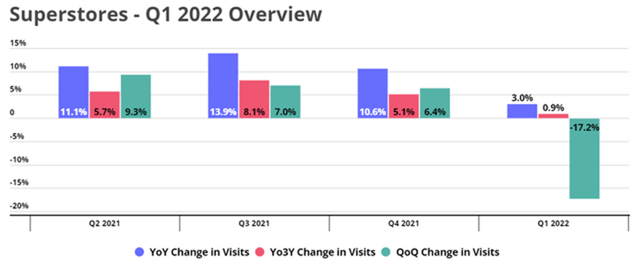

If we look at foot traffic data provided by Placer.ai, we find a sharp drop in quarter-over-quarter visits to superstores like Walmart (WMT), Target (TGT), Costco (COST), Big Lots (BIG), and Dollar General (DG).

Superstores experience a sharp drop in visits (Placer.ai)

As you can see, visits to superstores did rise 3% YoY but only 0.9% over 2019 levels. That is still improvement, but it shows that the post-pandemic rebound is dramatically softening.

Why does this matter to retail overall?

Because superstores often anchor shopping centers and act as the major driver of traffic to shopping centers. Shoppers may come to the center primarily to buy items at Walmart, for instance, but then end up getting a drink at Starbucks (SBUX) or lunch at Chipotle (CMG) or dog food at Petco (WOOF).

Lower foot traffic at superstores often indicates lower traffic at all types of physical retail locations.

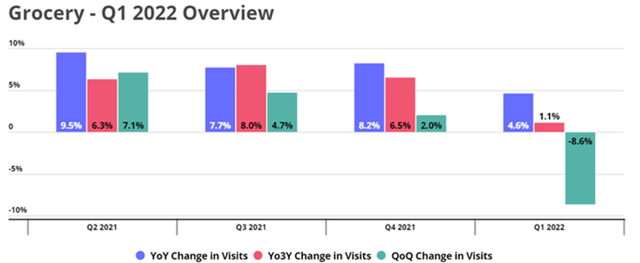

The same could be said of traffic to grocery stores, which saw similar patterns as superstores in the first quarter.

Grocery stores experience a sharp drop in visits (Placer.ai)

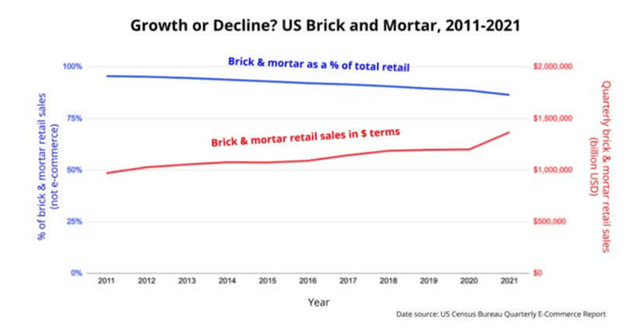

Regardless of the short-term dips or spikes, it is important to note that physical/brick & mortar retail does continue to see growth in absolute levels of sales. This is contrary to the longstanding “retail apocalypse” narrative that mistakenly sees retail real estate dying.

On the contrary, though Amazon-like (AMZN) companies are taking up a larger and larger share of total retail sales over time, both are growing on an absolute dollar basis. Brick & mortar retail sales surged ~15% in 2021 after remaining roughly flat in 2020.

Brick & mortar sales continue to rise (Placer.ai)

Moreover, consider that for the first time in years, there were more retail store openings than closings in 2021.

And not just a few more. There were roughly double the amount of store openings as closings last year, indicating retailers’ desire to reach customers as many ways as possible, including through physical stores.

Nevertheless, if you are concerned that e-commerce will gradually do to most retail what Netflix (NFLX) did to Blockbuster, consider grocery stores and grocery-anchored shopping centers. In 2020-2021, online sales accounted for only 8-10% of grocery stores’ sales, and the vast majority of that was in-store or curbside pickup.

A recent Mercatus/Incisiv study projects that e-commerce will account for 20% of grocery sales by 2026, but also that 75% of those e-commerce sales will be fulfilled by customer pickup at physical stores.

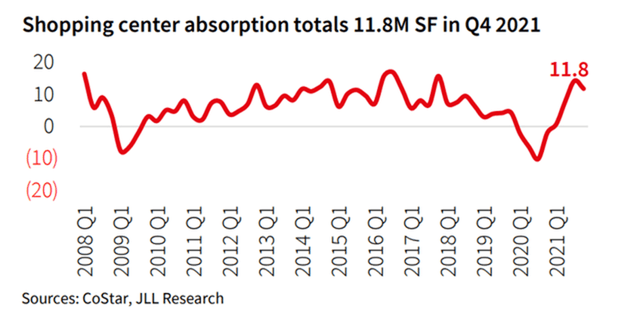

This bodes well for the continued strong performance of grocery-anchored retail centers for the foreseeable future. Leasing activity was particularly strong in the second half of 2021, with some of the highest absorption of space at any time in the last decade.

Shopping centers experience strong leasing (JLL)

As a result, rent rates at these retail centers have surged, often by double-digits, more than keeping pace with inflation.

Unlike net lease properties with long lease terms (10+ years) and contractually fixed rent escalations typically around 1-2%, multi-tenant retail centers tend to have much shorter lease terms lasting 3-7 years. This allows rents to adjust to the market rate more frequently, thereby keeping pace with inflation more easily.

Moreover, grocery stores are remarkably defensive, as everyone needs to eat, even during recessions. To some degree, they are even counter-cyclical, since consumers typically rein in their spending at restaurants and eat more at home when the budget gets tight.

This combination of inflation-hedging and recession-resistant qualities makes grocery-anchored real estate one of the best kinds of assets to own during a stagflationary environment.

Let’s take a look at two of our top picks.

1. Brixmor Property Group (BRX)

BRX is a predominantly grocery-anchored shopping center REIT with properties spread across the country but with an above-average presence in the Sunbelt region.

Publix-anchor shopping center (Brixmor)

The REIT utilizes a value-add approach to retail real estate investment, buying Class B or C properties, upgrading or redeveloping them, then hiking the rents substantially. This offers higher returns on invested capital (10-11%) than what BRX could get simply buying stabilized properties with no upgrades needed.

It also acts as a great way to hedge inflation, as market rents keep going up alongside both real estate replacement value (or construction costs) and tenant demand for space.

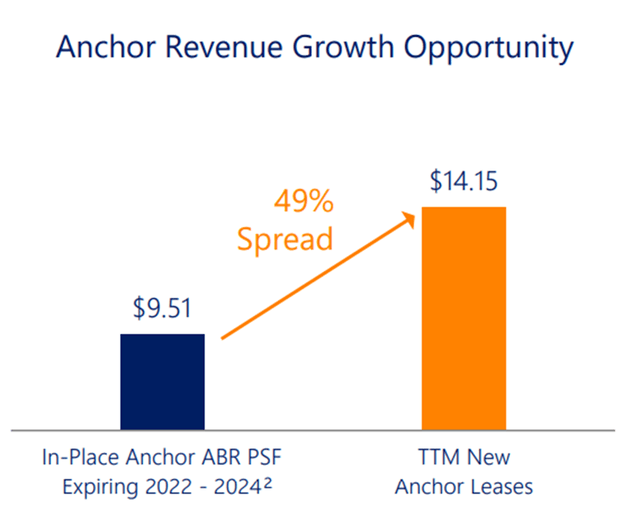

Take, for instance, the rents per square foot on anchor space leases signed in 2021, which are an astounding 49% higher than in-place anchor leases expiring over the next few years.

Brixmor releasing opportunity (Brixmor)

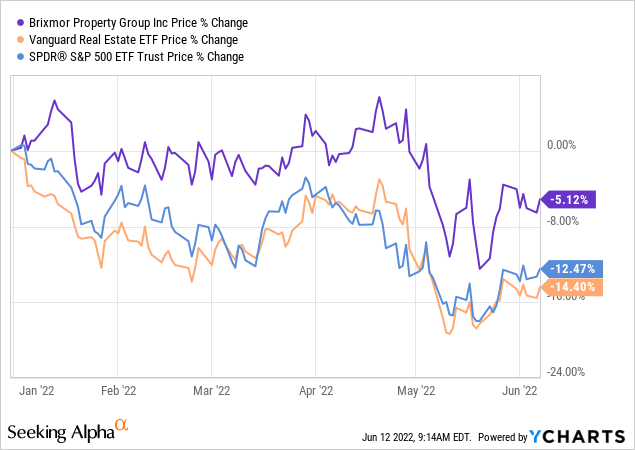

This has been BRX’s key to outperformance over the broader real estate index (VNQ) and the S&P 500 (SPY) this year.

With stagflation in mind, consider some more metrics from the Q1 2022 earnings results:

- Same-space rent growth for renewing leases of 18%.

- Same-space rent growth for new leases of 36%.

- SPNOI growth of 8.4%.

- NOI yield on stabilized reinvestment projects of 10%.

The value-add approach to grocery-anchored shopping center investing is working quite well for BRX, and FFO per share growth is expected to rise nearly 10% this year with the dividend likely to follow.

Despite that, the company is today priced at just 11x FFO and offers a ~4.7% dividend yield that’s expected to grow in the coming years. With a near 5% yield and ~10% growth, the shares can offer double-digit total returns even without any multiple expansion. That’s very attractive coming from a recession- and inflation-resistant investment.

2. Whitestone REIT (WSR)

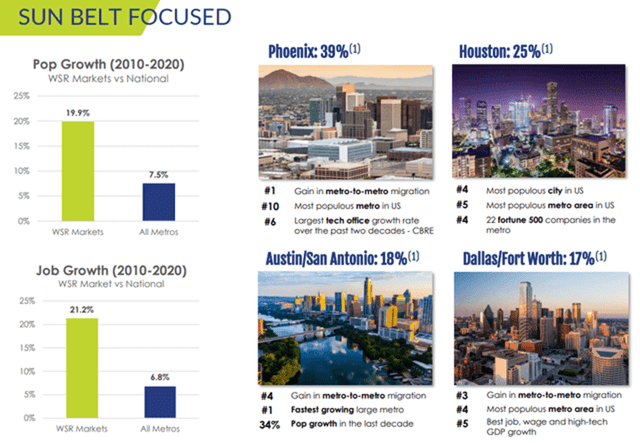

WSR owns and manages 60 high-quality shopping centers in affluent areas of four fast-growing Sunbelt cities.

Whitestone REIT sunbelt portfolio (Whitestone REIT)

Though the REIT used to be poorly managed by the CEO, the underlying assets held by the REIT were high-quality and well-located in some of the fastest-growing markets. Recently, the board fired the previous CEO with cause, and the refreshed management team has expressed its commitment to act strictly in shareholders’ best interest.

David Holeman, the new CEO, stressed on the Q4 2021 conference call:

“We are laser-focused on maximizing value for shareholders with a renewed commitment to listen to shareholders and to execute.”

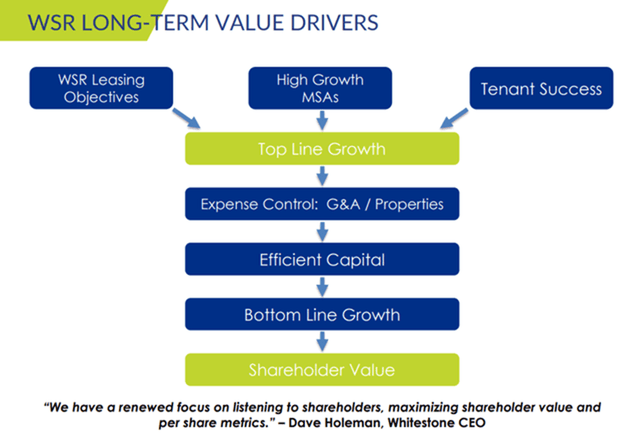

There are two primary ways in which management plans to maximize shareholder value:

- Focus on lease-up of existing properties, continuing the 300 basis point increase in occupancy in 2021. At the end of the first quarter, WSR’s occupancy sat at 91%, which is still below average for a portfolio of its quality.

- Lower general & administrative expenses, which were too high due to the previous CEO who was overpaid.

Whitestone long-term value drivers (Whitestone )

Also keeping buyers away from the stock was the REIT’s highly leveraged balance sheet. But one of the primary ways in which the new CEO plans to act more in shareholders’ best interest is through deleveraging. This will primarily come through increasing EBITDA, but it may also include a strategic disposition if necessary.

On the back of these strong fundamentals, management hiked the dividend by 11.6% early this year. Even after that dividend hike, WSR is still paying out less than half of core FFO, leaving lots of room for further raises.

As financial management improves and leverage comes down, we would expect WSR to gradually earn a higher FFO multiple and see its stock price rise. Currently, WSR is valued at a 11x multiple, but we think it could easily reprice at a 15x multiple a year from now. That implies around 25% upside on top of WSR’s 4.6% dividend yield.

Bottom Line

With inflation still running hot and real GDP dipping into negative territory in the first quarter of this year, it appears we have entered into a stagflationary period. We may even have just begun a stagflationary recession, though it is too early to say for sure.

This will likely prove a difficult environment for investors to make money, but we think well-located retail real estate, especially grocery-anchored shopping centers, will be one of the few asset types capable of retaining and even gaining value during this period.

Be the first to comment