z1b/iStock via Getty Images

Co-produced by Austin Rogers for High Yield Investor.

You Are Probably Underweight Energy

During the pandemic, investors and consumers alike became well acquainted with the idea of “essential” products, as the businesses in industries deemed “non-essential” were forced to close for some period of time.

At High Yield Investor, we would argue that there is perhaps no type of product more essential than energy. In today’s economy, energy powers everything.

Now, it is true that consumers spend relatively little directly on energy, although that share has risen in the last few years as energy inputs have become more expensive.

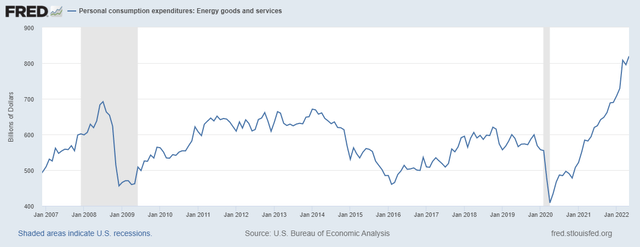

In January 2020, consumers allocated 3.8% of their total spending on energy goods and services. By May 2022, that number had jumped to 4.8%. In fact, Americans are spending more on energy on a nominal dollar basis today than at any time in history.

People spend more on energy (FRED)

But this severely understates the importance of energy in the economy, because everything that is produced, transported, and consumed requires energy.

- Electricity requires fuels, nuclear power, and/or renewable energy.

- Using the Internet requires electricity. So does running the air conditioner and watching a TV show.

- Transporting everything that lines the shelves of the grocery store requires energy.

- Driving to work, the gym, a shopping center, or a restaurant requires energy.

- Even a battery-powered EV car like a Tesla (TSLA) needs to be charged, which requires energy.

Energy is arguably the most essential part of the economy. It is the bedrock on which everything else is built.

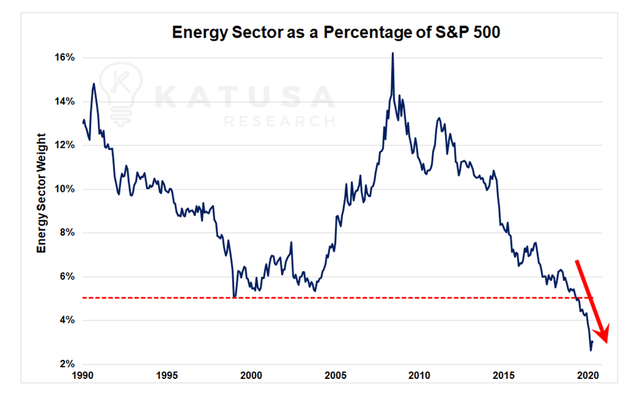

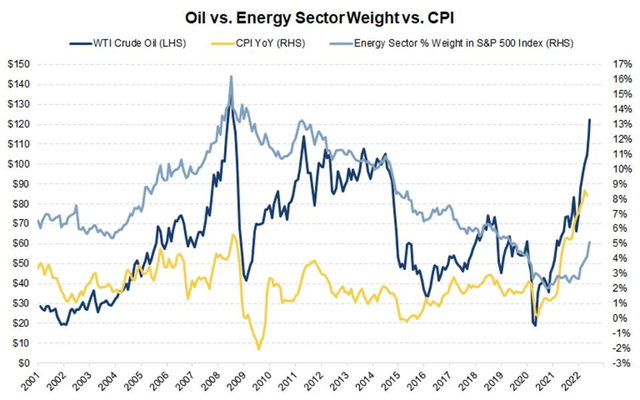

And yet, the average investor portfolio is strikingly underweight energy stocks. At the worst point of the pandemic, for instance, energy stocks made up less than 3% of the S&P 500 (SPY).

Energy as a percentage of S&P500 is declining (Katusa Research)

Actually, after this chart was created, energy as a share of the S&P 500 sank even lower to slightly below 2%.

And now, after a massive surge in energy prices with the price of oil at its highest level in history and natural gas near its all-time-high as well, what share of the S&P 500 are energy stocks?

The surprising answer is 5%.

That’s right. After peaking at 15% of the index in 2008, energy’s share of the S&P 500 remains near its lowest level outside of the pandemic of any time in the last two decades. That is in spite of the strongest macroeconomic backdrop for energy at any time during that period.

In short, then, your investment portfolio is probably underweight energy stocks, at least if it looks like or consists largely of the S&P 500.

The good news is that this is a fixable problem.

But what kind of energy stocks should one buy? The world is in the midst of a massive energy transition toward green/renewable energy sources and away from carbon-emitting fossil fuels. At the same time, it is highly unlikely that fossil fuels are going away anytime soon. Short of some massive government legislative action, oil & gas are sure to retain a meaningful share of the total energy mix over the next few decades.

At High Yield Investor, we believe there are great investment opportunities in both “carbon” and “zero-carbon” energy.

Below we highlight one attractive investment opportunity in each.

Hannon Armstrong Sustainable Infrastructure

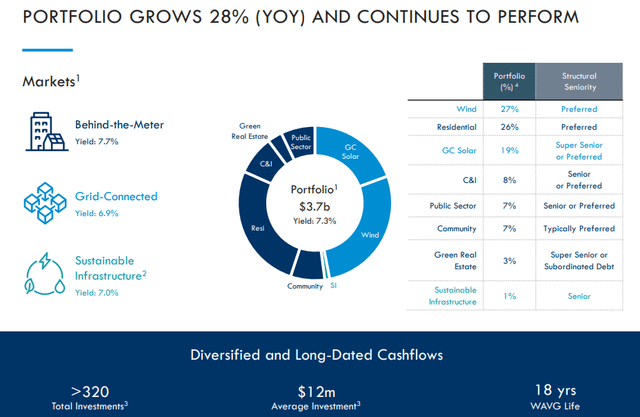

As the name implies, Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) invests in green energy infrastructure projects. Organized as a real estate investment trust (“REIT”), HASI mainly invests in green energy via senior loans and preferred equity.

In other words, HASI provides long-term financing for corporations, utility companies, and government entities that are investing in green energy and sustainable infrastructure on the equity side. And by “long-term financing,” we really do mean “long-term.” HASI’s weighted average remaining contract life as of Q1 2022 sat at 18 years.

Hannon Armstrong Sustainable Infrastructure portfolio (Hannon Armstrong Sustainable Infrastructure)

As you can see above, HASI’s portfolio can be split roughly into two segments: grid-connected (“GC”) and behind-the-meter (“BTM”).

For GC assets, the counterparties to HASI are typically investment grade corporations or utilities. For public sector and sustainable infrastructure investments, obligors are predominantly investment grade government entities. For green real estate investments, assets are secured by a lien on the real estate. And, finally, for BTM residential and community solar assets, customers are overwhelmingly of high credit quality.

As of the end of March 2022, around 99% of HASI’s portfolio is performing as expected, while 1% is slightly underperforming and virtually 0% is non-performing. This snapshot of HASI’s credit quality coincides with its historical track record, as the REIT has suffered less than 20 basis points of cumulative credit losses since 2012.

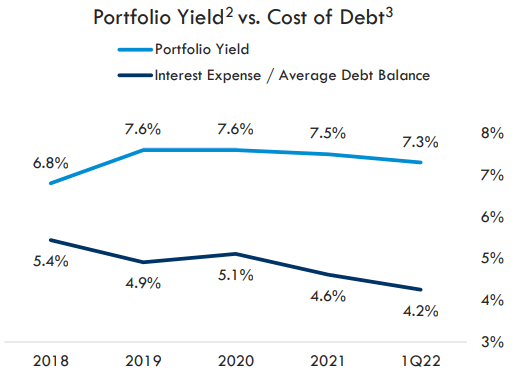

Though the portfolio is mixed between fixed and floating rate yields, nearly all (96%) of HASI’s own debt is fixed rate, locked in for many years at low rates. HASI has a BB+ rated balance sheet and an average interest rate on debt of 4.2%.

Hannon Armstrong Sustainable Infrastructure portfolio yield vs. cost of debt (Hannon Armstrong Sustainable Infrastructure)

This has expanded the investment spread between HASI’s portfolio yield and cost of capital significantly.

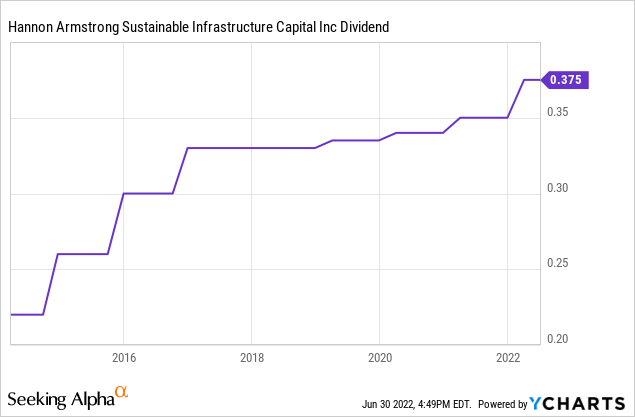

HASI’s formula of using a prudent mix of debt and equity to fund portfolio expansion has worked well for the REIT since going public in 2013 and facilitated steady dividend growth.

Hannon Armstrong Sustainable Infrastructure dividend (Hannon Armstrong Sustainable Infrastructure)

Going forward, management expects to achieve annual dividend growth of 5-8%. This year may see a dividend bump on the high end of that range since distributable EPS surged 21% in the first quarter.

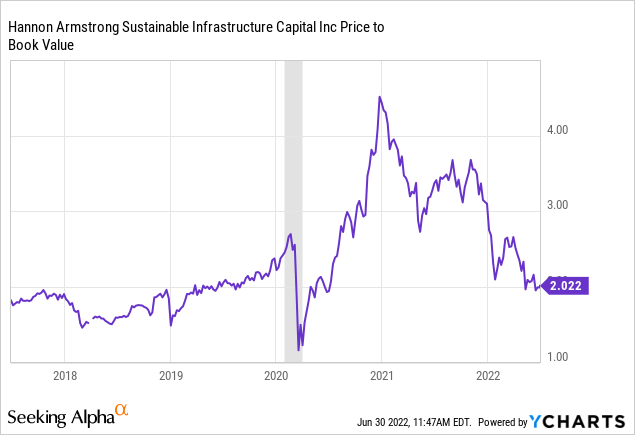

HASI always trades at a premium to book value, but right now at around a 2x price to book, HASI is cheaper than it has been in years.

Hannon Armstrong Sustainable Infrastructure valuation (Hannon Armstrong Sustainable Infrastructure)

Though not as cheap relative to book value as it was in 2018, one must also keep in mind that investment opportunities are only growing for the likes of HASI as governments, corporations, and utilities alike invest heavily in decarbonization, energy efficiency, and sustainable infrastructure.

Between a 4% dividend yield and high single-digit growth alone, HASI offers total returns of around 10-12%. But adding in valuation upside of 20-30% makes this specialty REIT an even more compelling investment opportunity.

Enterprise Products Partners

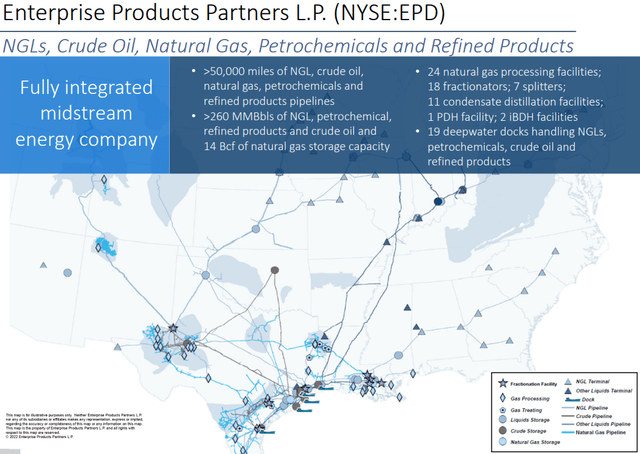

Enterprise Products Partners L.P. (EPD) is one of the largest, most diversified, most lightly leveraged, and best run midstream oil & gas companies in the United States. For investors who are okay with the K-1 form from ownership of EPD’s limited partnership units, this is one of the most conservative ways to generate high income from the stock market.

EPD’s portfolio includes over 50,000 miles of pipelines, 14 billion cubic feet of natural gas storage capacity, dozens of natural gas processing facilities, multiple petrochemical plants, and 19 deepwater (including export) facilities.

Enterprise Products Partners portfolio (Enterprise Products Partners)

In addition, EPD continues to prudently and judiciously allocate capital to growth projects, such as a natural gas export facility expected to come online in 2025.

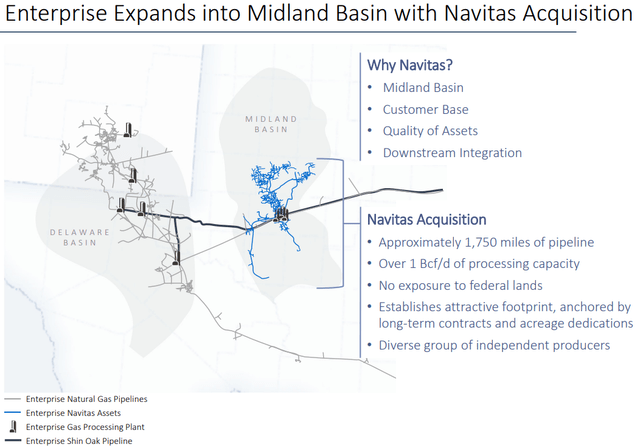

Moreover, EPD recently acquired fellow midstream company Navitas Midstream in a $3.25 billion transaction that significantly expands EPD’s footprint in the productive Midland Basin of Texas.

Enterprise Products Partners latest acquisition (Enterprise Products Partners)

This deal is a highly attractive bolt-on acquisition for EPD and demonstrates management’s ability to source high-return uses of capital in order to continue per-share (or rather, per-unit) growth.

Over the past ten years, EPD’s return on invested capital has averaged 12%.

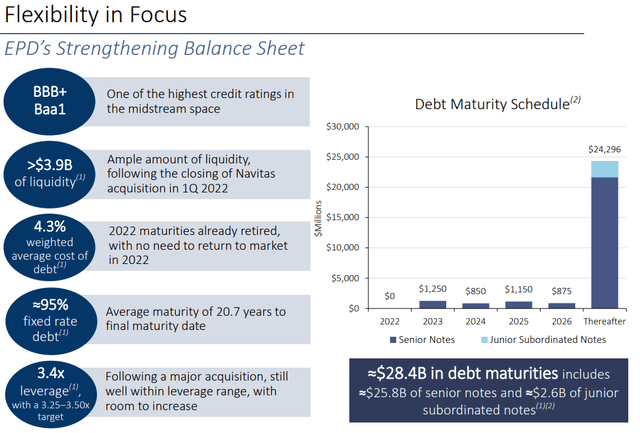

Perhaps the strongest aspect of EPD is the midstream company’s balance sheet with its BBB+ credit rating, 4.3% weighted average interest rate, and average maturity over 20 years. As interest rates rise, management look extremely far-sighted to have locked in low rates for so long.

Enterprise Products Partners fortress balance sheet (Enterprise Products Partners)

One explanation for this highly prudent balance sheet management is the fact that the management team and board of directors are heavy shareholders themselves. Insiders own nearly one-third (32%) of EPD, which helps to explain the company’s extraordinarily long-term focus on value creation.

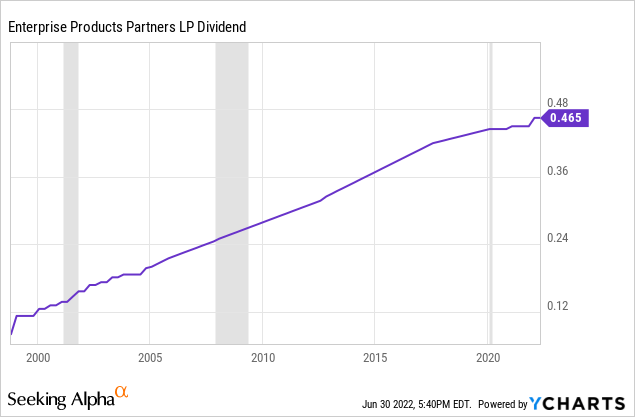

Another benefit of this long-term focus is EPD’s impressive track record of distribution growth, spanning 23 years through three recessions and high volatility in commodity prices.

Enterprise Products Partners dividends (Enterprise Products Partners)

With a payout ratio of only 80% of free cash flow, EPD has given itself plenty of room for further distribution hikes in the years to come.

EPD’s 7.6% yield combined with mid-single-digit earnings growth should result in at least 12-13% total returns assuming no valuation upside. EPD currently has an enterprise value to EBITDA of about 9.4x, but we believe the company is worth at least a 12x multiple, giving it about 25% upside to fair value.

Bottom Line

The world cannot live without energy. Everything in the economy relies on it.

While oil & gas stocks have traditionally been highly cyclical in nature, the situation appears to be different now. Management teams have become laser-focused on allocating cash toward shareholder returns rather than production growth. As such, even in a recessionary scenario, oil and gas prices are unlikely to collapse to very low levels as they have in the past.

That makes the returns provided by oil & gas companies like EPD more stable than they used to be.

Meanwhile, green energy investors like HASI should remain stable through a recession as well, since contracts are very long and made with financially strong counterparties.

At High Yield Investor, we do not want to make the same mistake as the crowd in being underweight this essential industry, because we believe various kinds of energy stocks offer some of the most attractive prospective returns going forward.

Be the first to comment