VTT Studio/iStock via Getty Images

Co-produced with Treading Softly.

When it comes to investing in high-yield dividend stocks, the market of 2022 has been generous to income investors, to say the least.

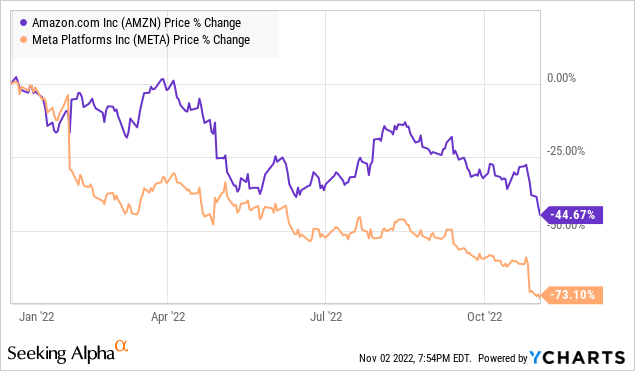

While total return gurus and growth advocates have been grappling with losses from Meta Platforms (META) or Amazon.com (AMZN) during this earning season, with no tangible returns to enjoy, dividends have continued to pour into the account of income investors without abatement. They just keep on coming.

So, when the market continues to put on sale outstanding income-generating investments, I will be scooping up these dirt-cheap opportunities. If you have to ask, “How does Rida keep buying more and more?” then you truly haven’t embraced the biggest benefits of dividend investing. I don’t need to keep cash in my account, cash keeps arriving there from my holdings. I keep putting it back to work to get more cash later!

Today, I want to highlight two exceptionally strong income generators from the energy sector. We’ve all seen the headlines as oil, and natural gas demand remains strong and continues to grow. These midstream operators will keep on minting new dividends for you and me to enjoy.

Let’s dive in.

Pick #1: AM – Yield 8.4%

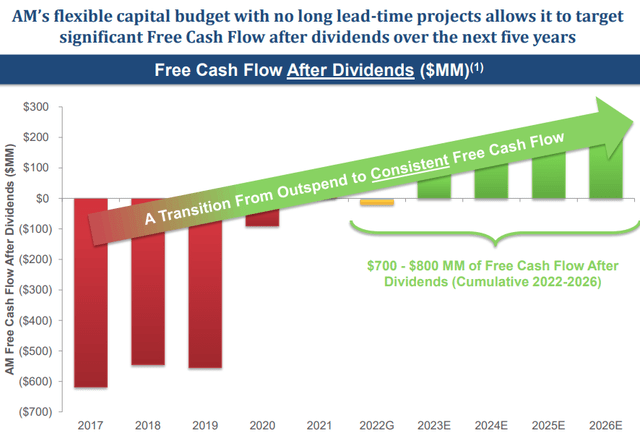

Antero Midstream Corporation (AM) is doing exactly what it said it would do. It guided in the first half that FCF (Free Cash Flow) after dividends would be negative, but it would cover dividends in the second half. Q3 ended with $30 million in FCF after dividends.

AM had an ambitious goal: To fully fund all capital expenditures from FCF and still have positive FCF after dividends. Q3 2022 is when it reached that point. AM has made meaningful progress over the past several years, and now instead of being “less red,” AM can focus on adding more green. (Source: AM Q3 2022 Presentation.)

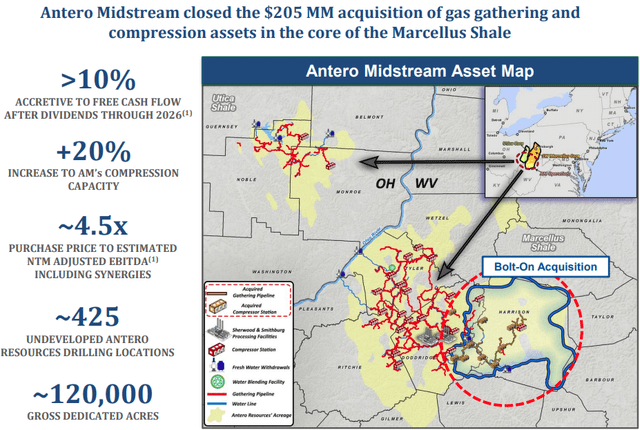

AM has already started its growth with an acquisition from Crestwood Equity Partners LP (CEQP), adding on to assets AM already operates.

AM has dramatically improved its balance sheet and positioned itself to be able to grow without the necessity of adding debt or tapping into the equity markets. Given how fickle the capital markets can be and the rising cost of debt with higher interest rates, AM couldn’t have implemented this plan at a better time.

When we think of the “blue chips” in the midstream sector, like Enterprise Products Partners (EPD), the one thing they all have in common is that they do not rely on issuing equity or debt for growth. They have conservative payout ratios and aim to fund all cap-ex from cash flow. While this might mean growing a little bit slower, in the long run, it is a practice that has been very beneficial for shareholders. Providing consistency in dividends and earnings in a sector that is known for some wild swings.

AM has positioned itself to become a high-quality midstream company, and it is structured as a corporation so investors will receive a 1099 instead of a K-1 at tax time.

Pick #2: MMP – Yield 7.9%

Speaking of high-quality midstream, Magellan Midstream Partners, L.P. (MMP) sits right alongside Enterprise Product Partners (EPD) as what can only be called the “old faithful” of the midstream space.

This quarter was no different. MMP saw year-over-year improvement from both of its major reporting segments, which lead to higher overall revenues for the partnership. This also translated to stronger bottom-line numbers, with net income rising as well.

The big question for MLPs is distributable cash flow and free cash flow. These numbers can be reported in different ways by different firms. Antero Midstream typically only reports free cash flow before and after dividends. MMP reports distributable cash flow, this is the cash flow available after all other expenses are paid, including maintenance CAPEX. They report free cash flow, this is the cash available after growth CAPEX has been deducted but any profits from asset sales have been added back in. They finally report free cash flow after distributions. AM’s and MMP’s after-distribution cash flow is comparable in nature here.

MMP saw a large jump in after-distribution cash flow mainly due to two factors:

- They conducted terminal sales to Buckeye Partners, which closed in June

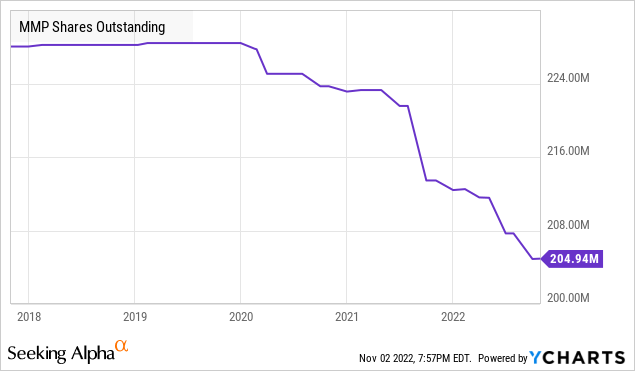

- They have been actively reducing their unit count via buybacks.

MMP’s year-to-date after-distribution cash flow is over $100 million higher than in 2021 largely due to the higher amount of asset dispositions. So what is management doing with all that excess money?

MMP has been using it to buy back units at a rapid clip. This past quarter alone they continued this trend: “During third quarter 2022, Magellan repurchased 2.75 million of our common units for nearly $138 million” – Source.

For every unit they repurchase, $4 annually makes it to MMP’s bottom line. This means this quarter alone, MMP will see an annual boost to their after-distribution cash flow of $11 million.

MMP continues to show why we consider it one of the top midstream companies around. Their focus on organically funded growth, rewarding unitholders via raising their distribution. Buying back units when the price is attractive has resulted in a strong and more profitable partnership.

If you don’t have a full allocation to MMP yet, there is no better time than the present.

Note: MMP issues a K-1 at tax time.

Dreamstime

Conclusion

With AM and MMP, we can enjoy strong dividend payouts from two established and well-managed firms. AM has hit an inflection point where it is now covering all of its CAPEX spending and dividends, with extra cash left over to reduce its leverage. MMP has a strong history of distribution coverage and is actively growing its distribution by reducing its unit count. This means, as an income investor, both companies are taking steps to continue to reward me richly for my ownership.

That’s the kind of reward I demand from every investment in my portfolio. That’s how my retirement is paid for! I use my money to do what money does best – earn more.

This way, I can kick back in my favorite chair and enjoy another sunset. I can take my car for a spin and not have to worry about gas prices! I can invite the whole family over for Thanksgiving and not have to fret about how I’ll afford it.

AM and MMP are taking care of that for me while I can take time to invest in my loved ones.

That’s the beauty of income investing!

Be the first to comment