kupicoo

On July 5, I wrote this in an email:

“It’s understandable – maybe even preferable – to see headlines and news stories with varying opinions across different platforms. It’s usually healthy to see more than one perspective about an issue, economic or otherwise.

“But when you start to see the same sources posting completely contradictory information? Well, you know the situation is pretty complicated.

“Either that or the source is pretty incompetent.

“While that latter possibility could be it, I’m going to give this purposely unnamed site the benefit of the doubt and say it’s much more the former issue. After all, the Dow is down 670 points, or 2.16%, as I write this…

“Yet I can’t confidently comment on that because there is an actual chance that, by the time you read this, it will actually be in the green!”

I’m going to stop right there for a moment, since the Dow ended down less than 130 points that day. The S&P came in a bit above breakeven. And the Nasdaq, which had also been solidly in the red before 12, was actually up 150 points.

Recognizing the possibility of such an intense turnaround – which should have been almost impossible under normal circumstances – I further wrote:

“We live in interesting times, to be sure. And interesting times call for solid analysis.

“Which makes today just like any other time that ever was and ever will be. I hope that makes life look a lot less disconcerting…”

Because it should.

Understanding the Stock Market Times

This next part doesn’t discount that last statement one bit. It only expounds on the one that goes: “And interesting times call for solid analysis.”

So let’s recount how “interesting” things are, first by citing half a headline Nasdaq published on July 2: “Stocks Just Had Their Worst First Half-Year Run in 52 Years.”

It begins with:

“The last half-year hasn’t exactly been stellar for the stock market. During the first six months of 2022, the S&P 500 dropped 20.6%, marking its worst first-half performance since 1970. Meanwhile, during that same timeframe, the Dow had its largest first-half drop since 1962. And let’s not even talk about the Nasdaq, which had its largest percentage drop in its history.”

What else is going on? How about:

- Employers continue to struggle to find and retain employees.

- Inflation is still through the roof.

- Gas prices remain overwhelmingly high.

- Food shortages are increasing.

Put together, that makes for uncomfortable costs of living – at best. And while some of those factors have gotten a bit better or could be about to get better, we’re still looking at a lot of market volatility.

Fortunately, though, that Nasdaq article (of which the second half of its title is “Here’s Why You Shouldn’t Worry”), continues with:

“All told, the events of the past six months have a lot of investors worried, and understandably so. But… the reality is that investors really shouldn’t panic.”

As it goes on to note, “It’s still only a loss on screen” until you sell. There are ways to “protect your portfolio” even now. And its final piece of advice…

“Stay the course… In fact, if you have extra money on hand, now’s actually a good time to buy stocks.”

That’s what I’m writing about today.

Cigar-Butt Shares Can Be Worth Stocking Up On

As this writeup’s title already told you, I’m more specifically writing about cigar-butt stocks today. As I explained back in January in “3 Deeply Discounted Cigar Butts We’re Buying”:

“‘Cigar butt’ investing can be traced back over 90 years to Benjamin Graham. While he might not have used the exact term, he wrote about the concept in a series of articles during the Great Depression.

“Here’s one snippet [of his book, The Intelligent Investor]:

“‘It is clear that these issues were selling at a price well below the value of the enterprise as a private business. No proprietor or majority holder would think of selling what he owned at so ridiculously low a figure… In various ways, practically all these bargain issues turned out to be profitable. And the average annual result proved much more remunerative than most other investments.’”

Today, cigar-butt investing is oftentimes associated with profiting off companies that are dying altogether. That’s thanks to Graham’s protégé, Warren Buffett, who I also quoted in the article:

“A cigar butt found on the street that has only one puff left in it may not offer much of a smoke. But the ‘bargain purchase’ will make that puff all profit.”

Well, I don’t like to recommend dying companies. I don’t even like recommending companies that are at risk of “merely” cutting their dividends.

But I do like to invest in stocks that the markets have given up on despite facts and figures that indicate otherwise. That’s a great way to follow the age-old investing ideal of “buying low and selling high.”

It’s something that few people are actually brave enough to do. But if you want to be one of that elite, keep reading onward.

Cigar Butt #1: Clipper Realty

A few years ago, we added a small-cap pick to our coverage spectrum, Clipper Realty Inc. (CLPR). It’s an interesting real estate investment trust (“REIT”) that owns apartments and offices.

More recently, iREIT on Alpha decided to put it and other smaller names into their own special bucket, since they deserve a lot more TLC.

As I wrote in an apartment article earlier this month, “the irrational weakness in the multi-family space has created some attractive opportunities.”

Now, Clipper is the only pure-play New York City-centric multifamily/office REIT out there. Headquartered in Brooklyn, it owns buildings there and in Manhattan – 66 in all, amounting to 3.3 million leasable square feet.

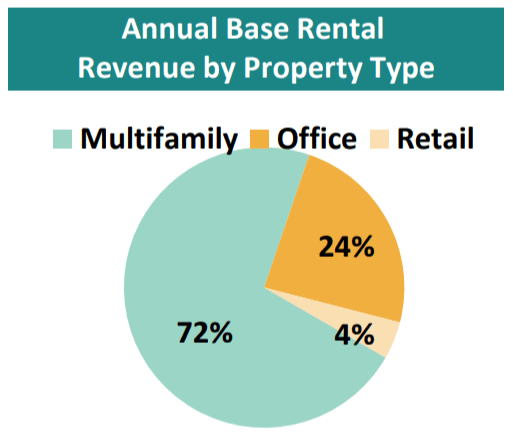

(CLPR Investor Deck)

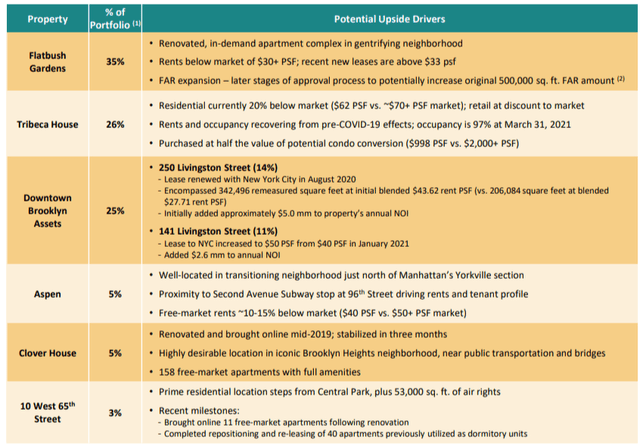

And don’t worry about the office properties. Clipper owns just two buildings in Brooklyn: 141 and 250 Livingston Street. They feature approximately 549,000 square feet of office space and 27,000 of residential.

“So what?” you might be saying. “How does that data make me not worry?”

Well…

- 141 Livingston is 100% leased to New York City at $50 per square foot. And it added $2.6 million to net operating income (NOI) after a rent bump in January 2021.

- 250 Livingston office is 100% leased to the city at $43.62 psf. And it added $5 million in NOI after a lease renewal in August 2020.

- 250 Livingston residential takes up the top four floors and involves 36 rental apartments at $51 psf.

Together, they generate 25% of Clipper’s NOI. That’s why you shouldn’t worry.

Clipper’s Communities Continued

Now, let’s break down Clipper’s residential properties, starting with Flatbush Gardens. It’s a low-cost option in Brooklyn that delivers steady growth and substantial renovation.

Recent new free market leases were, on average, $33 per square foot versus $25. As of Q1-22, the community was 93.7% leased and generating $40.9 million in revenue.

It represents 35% of portfolio NOI.

Tribeca House, meanwhile, is a below-market complex in downtown Manhattan. Recent new leases moved from an average of $62 psf toward $70. It was 96.5% leased in Q1-22 and generates $27.8 million in annual base rent.

The two buildings generate 26% of portfolio revenue.

Next up, Aspen is located in a transitioning uptown Manhattan neighborhood near the Second Avenue subway. A block-front building, it’s approximately 187,000 square feet across 232 apartments with ground-floor retail and indoor parking

Aspen was purchased in June 2016 for $103 million. Today, apartments are 96% leased at an average $35 psf.

As for retail, that goes for an average $40 psf. And the whole kit and caboodle generates 5% of portfolio revenue.

Another piece of the Clipper portfolio – Clover House – was brought online mid-2019 after being purchased in a vacant state in May 2017 for $87.5 million. Three years later, the 102,000 square-foot space with its indoor parking garage is experiencing exceptional demand in Brooklyn Heights.

It’s now 98.1% leased at an average $63 psf and generates 5% of portfolio revenue.

Then there’s 10 West 65th Street. It’s in a prime residential location near Central Park and Lincoln Center on Manhattan’s Upper West Side.

Purchased October 2017 for $79 million, it used to involve dorm units but has since been turned into 40 “grown-up” apartments. Those units are 96% leased at an average $44 psf that generate 3% of portfolio revenue.

(CLPR Investor Deck)

A New Development Deal

1010 Pacific Street is a residential redevelopment in Brooklyn’s Prospect Heights neighborhood. It’s in close proximity to Barclays Center/Atlantic Terminal, which adds to its appeal.

CLPR purchased the land in November 2019 for $31 million. Though not completed yet, the 119,000 square foot building with indoor parking should have 175 total units. Seventy percent will be free-market and 30% affordable.

The property is eligible for a 35-year 421-a tax abatement due to affordable component. And on the latest (Q1-22) earnings call, Clipper management said:

“We are moving well on construction at 1010 Pacific Street and on target for substantial completion by the fourth quarter. We have completed the site work… and window installation is nearing completion. And we expect to be in finished in the third quarter of this year.“

CLPR has finalized approximately 95% of the construction contracts, thereby mitigating the recent inflation concerns.

The Balance Sheet

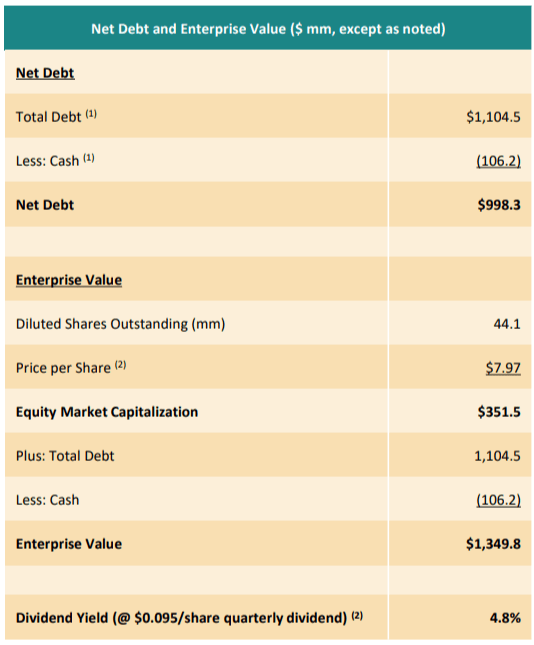

As shown below, CLPR has a simple balance sheet. It involves $1.1 billion in debt and a market cap of $351 million.

And no, that’s not a typo.

(CLPR Investor Deck)

CLPR has significant debt, which is one of the reasons we exclude it from our broader coverage universe. It’s a risk that must be analyzed, so let’s peel open the REIT’s latest 10-K:

(CLPR 10-K)

All Clipper’s debt is property-level senior secured, and maturities are well-laddered. And while debt is nearly 2x its peer average, the company has relatively no short-term debt maturities.

Most importantly, it’s locked in some attractive interest rates at 3.125%-4.5%.

Also, there’s strong expected NOI growth embedded rent growth as existing below-market rents reach current market and the effects of Covid-19 continue to diminish.

Also keep in mind that founders own 67% of the company. What investor doesn’t like to see that kind of skin in the game?

Still, I wanted to determine the secured lenders. So I pulled them from the 10-K:

- New York Community Bank (Flatbush Gardens)

- Citi Real Estate Funding Inc (250 Livingston Street)

- Citi Real Estate Funding Inc. (141 Livingston Street)

- Deutsche Bank AG (Tribeca House)

- CapitalOne Multifamily Finance LLC (Aspen)

- MetLife Investment Management (Clover House)

- New York Community Bank (10 West 65th Street)

- AIG Asset Management (1010 Pacific Street)

- Bank Leumi, N.A (Dean Street).

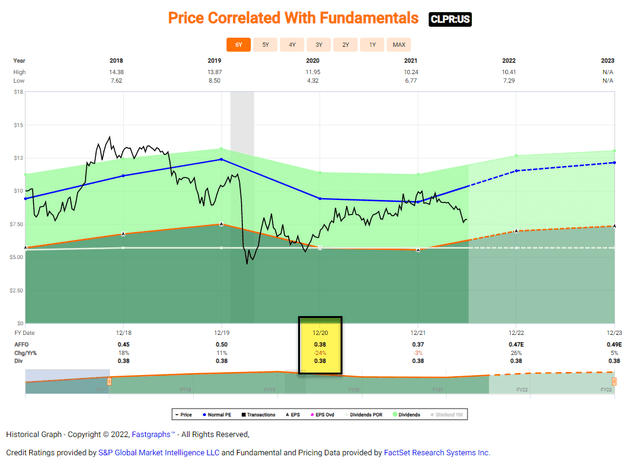

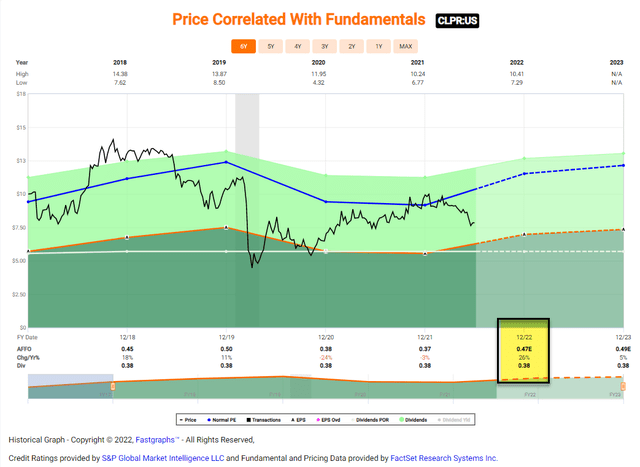

Although Clipper doesn’t have much history as a publicly traded REIT… there is some useful information we can gather, such as the effects related to Covid-19:

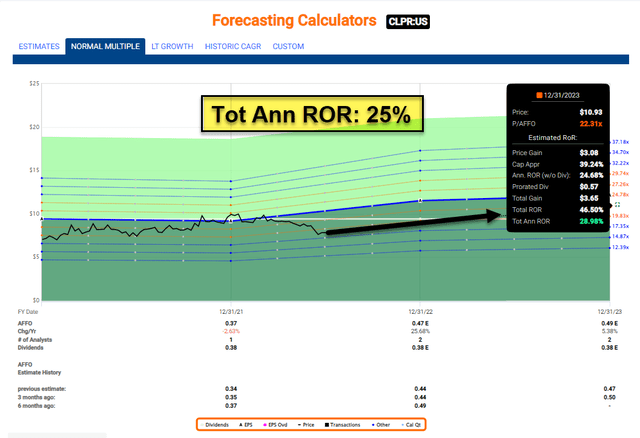

(FAST Graphs)

As shown above, CLPR was able to dodge a dividend cut in 2020, which is a positive sign. On the negative side, there’s been no dividend growth since 2017.

Needless to say, a highly leveraged REIT that doesn’t grow its dividend isn’t going to get a high-quality score from iREIT.

However, we’re intrigued by Clipper’s forward-looking indicators, such as its 2022 adjusted funds from operations (AFFO) forecast of $0.47 per share. Plus, in Q1, it generated revenue of $32.1 million… NOI of $16.5 million… and AFFO of $4.4 million, up from $3.1 million in Q1-21.

(FAST Graphs)

Now keep in mind, there are just two analysts providing the 2022 forecast. And we simply can’t base our investment decisions off two analysts.

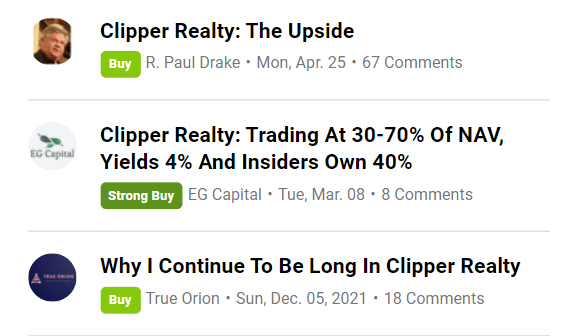

Though I will add that three Seeking Alpha analysts are also bullish:

(Source: Seeking Alpha)

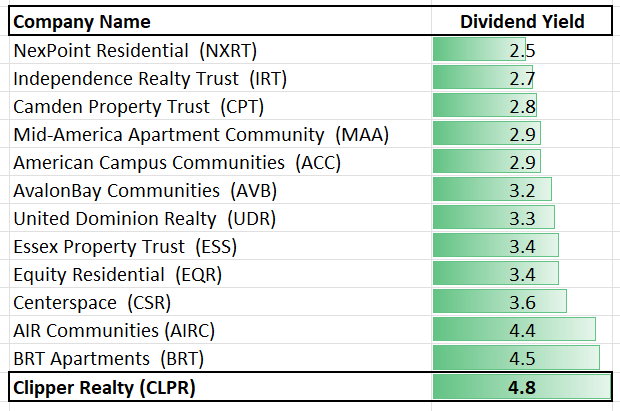

As you can see below, CLPR is attractive based on the 4.8% dividend yield – the highest in the apartment sector.

(iREIT)

However, investors should be cautious given the fragile payout ratio:

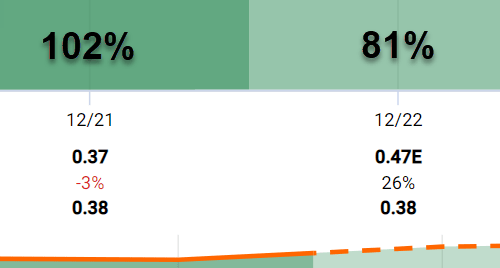

(FAST Graphs)

Assuming CLPR does hit $0.47 per share in AFFO by the end of 2022… it will be paying out just around the average payout ratio of the apartment peers. As of Q1-22, the average payout ratio (based on AFFO) was 78.5% (as per REIT BASE).

Meanwhile, CLPR now trades at 18.8x P/AFFO and using the forecasted year-end model, shares trade at 16.7x. The average for CLPR is around 25x, whereas:

- Mid-America’s (MAA) is 25.5x.

- Equity Residential’s (EQR) is 25.9x.

- Camden Property’s (CPT) is 25.8x.

- Essex’s (ESS) is 22.5x.

Once again, CLPR is much higher risk between its leverage, being a small-cap, and such. And I don’t see it trading like the pure-play REITs above.

(FAST Graphs)

As I’ve modeled above, CLPR has potential. Our 25% annual return forecast suggests above-average returns. However, again, investors are taking on elevated risk to generate these returns including:

- Geographic concentration risk

- Property concentration risk

- Key man (succession) risk

- Leverage risk

- Small-cap (volatility) risk

- Conflict risk (see 10-K)

- Development risk.

In summary, we’re maintaining a Speculative Buy rating. But it’s important to recognize that there are safer opportunities out there that offer equal or better risk-return prospects.

We advise that you limit this cigar-butt pick and avoid placing it in a retirement account.

Risks are elevated. Ask yourself, “Is the thrill of victory worth the agony of defeat.”

Cigar Butt #2: CorEnergy

CorEnergy Infrastructure Trust, Inc. (CORR) is a pioneer: the first publicly traded REIT focused on traditional energy infrastructure.

One of its core premises is to provide investors a substitute to the master limited partnership model (‘MLP’) – and the K-1 that comes with it. Under its management, investors enjoy:

- The simplicity of the REIT structure

- 1099 taxation

- Opportunity to hold CORR in any type of investment account without worrying about UBTI.

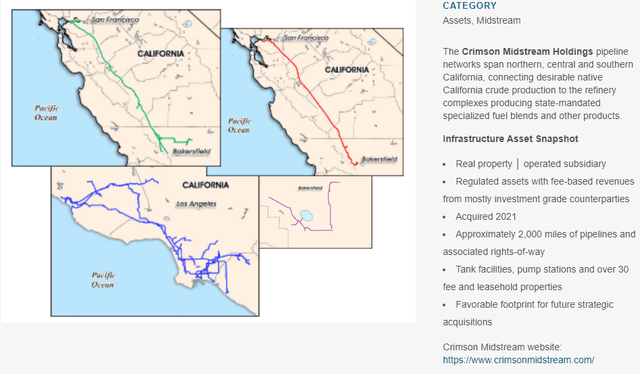

(Source: CorEnergy)

Like an MLP, CORR has historically maintained exposure upstream, midstream, and/or downstream energy assets. And since its portfolio consists of just three assets, we can analyze each one.

(Source: CorEnergy)

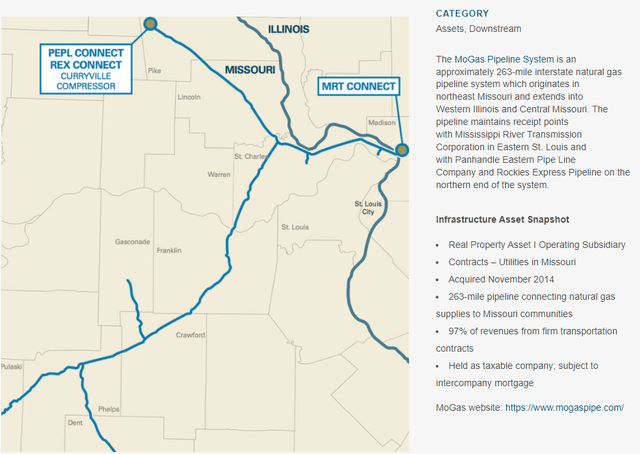

Its MoGas Pipeline System is an interstate natural gas pipeline based out of Missouri, Illinois. Covering 263 miles, it’s contracted to utilities in Missouri with 97% of revenue coming from transportation contracts.

This makes it insensitive to commodity prices. Usually that’s a plus… but not necessarily today.

Either way, these attributes are in line with that you’d expect from a similar asset owned by an Enterprise Products Partners (EPD) or Magellan Midstream Partners (MMP), two high-quality primarily midstream MLPs we’ve recommended and WER currently owns.

(Source: CorEnergy)

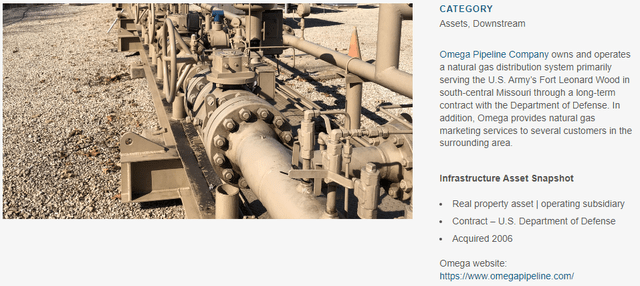

Next up is an asset in the downstream sector that serves the U.S. Army’s Fort Leonard Wood – also located in Missouri. It provides natural gas to other clients as well, but its primary contract is with the U.S. Department of Defense.

This has been in the portfolio for over 15 years.

(Source: CorEnergy)

As for CORR’s final asset, it’s another pipeline that’s in California. Acquired last year, it includes approximately 2,000 miles of pipeline and rights-of-way.

It appears to have growth opportunity, but the fact that it’s located in California gives us pause.

Obtaining new drilling permits and the like is no easy task there. The geographic footprint is attractive in terms of population centers – however, with exposure to Los Angeles, San Francisco, and Bakersfield.

Regardless, the Crimson asset is now the driving force of CORR’s financial profile and makes comparisons to previous reporting periods muddy at best.

These seems like reasonably good assets that shouldn’t have too much variability in cash flows. So why is CORR’s stock signaling it may not be around for too much longer?

Well, evaluating cash flow and the balance sheet tends to answer these questions. So let’s keep moving.

CORR’s Cash Flow and Dividend

We’re starting this section off differently than usual by taking a step back to understand CORR’s capital stack. This is particularly useful when a company’s stock price suggests insolvency risk.

(At least that’s what a -93.4% five-year stock price performance tells us. But you be the judge.)

CORR ended Q1 with 15.6 million common shares outstanding. Multiplied by the current stock price of $2.33, that gives us a $37 million market capitalization – which, incidentally, includes 683,761 Class B common stock.

The firm also has $129.5 million in Series A 7.375% preferred stock outstanding. Those 5.2 million shares equate to a $2.4 million quarterly liability. Which is nearly $10 million annually… a lot of money for a company worth less than $40 million in aggregate.

But we aren’t done yet.

CORR’s 5.875% convertible notes carry an interest expense of $1.73 million each quarter. And that’s before discount amortization and deferred debt issuance amortization that increase it to about $150,000 from an accounting perspective.

Total interest expense, which includes other types of debt financing, is $3.15 million per quarter. That’s up from $2.9 million in Q1-21.

Therefore, every quarter, CORR must overcome at least $5.6 million in preferred distributions and interest expense. You’ll see why we said “at least” momentarily. But for now, we’re ready to put the typical revenue and profit metrics into the proper context…

Q1-22 revenue was $32.9 million for net income of $4.4 million and adjusted EBITDA of $12 million. These numbers reconcile given what we’ve learned this far.

Management stated there was $2.2 million in cash available for distribution (‘CAD’) for the quarter… which looks reasonably good relative to where the stock trades today.

That said, the company is obligated to pay principal loan repayments as well. We don’t know the exact number, but it looks to be around $8 million a year.

CAD is significantly dependent on the amount and timing of maintenance capital expenditures. Management expects adjusted EBITDA of $42-$44 million, which we know will be reduced by at least $22.4 million in interest/preferred expenses.

That equates to no more than $21.6 million in net income.

If historical trends are accurate, that’s CAD of $7 million to $8 million. With the common distribution now at $0.05 per share, that $780,000 annual liability isn’t much to overcome (assuming Class B shares receive dividends, which may not be the case).

There doesn’t look to be a major risk for the common stock dividend in 2022. But declining metrics (and daily crude oil volumes) suggest an increase isn’t likely, either.

CORR’s Balance Sheet and Risk

The book value per share of common stock (including Class B) is a mere $0.67 as of Q1-22’s 10-Q. Common stock outstanding was $13.7 million as of the end of Q1-21, which means there was approximately 14% dilution over the period.

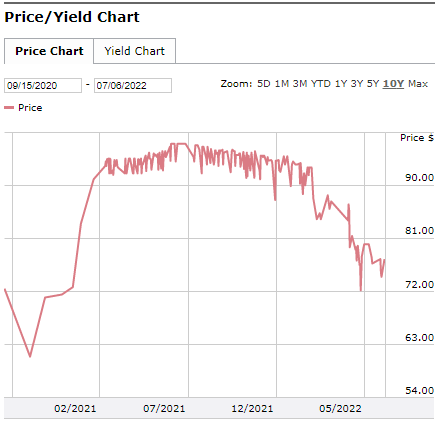

That certainly doesn’t help the stock price, but that alone wouldn’t cause a nearly 60% one-year decline.

(Source: FINRA)

Starting in late 2021, credit markets started losing confidence in CORR’s senior notes. This issuance last traded for $77.50 for a yield to maturity of 15.236%.

On the plus side, these bonds don’t fully mature until 2025. However, there’s no way for CORR to economically refinance this issue or issue new bonds.

There’s another element at work here that’s not necessarily obvious at first glance. As shown above, the senior notes have a yield on cost of 7.8% with a yield to maturity over 15%.

(Source: Seeking Alpha)

The preferred stock doesn’t have a maturity date like the bonds, but their yield on cost is currently 9.3%. From that perspective, the preferred shares do carry a modest 1.5% premium to the senior notes. As they should.

Here’s a very quick history lesson: preferred equity goes down with the ship 99% of the time that the common equity becomes worthless.

But the yield to maturity is a real number. And the fact that it’s over 50% greater than the preferred shares current yield is worrisome.

Even if we perform a yield-to-maturity calculation with the preferred shares reaching par value at $25 when the bonds do, we’d obtain a 17.9% yield. Once again, then, we have a modest but not spectacular premium over the bonds.

The bonds trading at a lower percentage of par than the preferred stock is a signal of substantial financial uncertainty and distress – even if the preferred carrying a greater yield on cost explains some of the discrepancy.

Total liabilities assumed with the acquisition of Crimson ended Q1-22 at $20.1 million. That compares to $96.9 million and $115.8 million in secured credit facilities and senior notes, respectively, for total liabilities of $237.5 million as of the end of the last reporting period.

In short, this is a seriously leveraged company.

Roughly $20 million of that total isn’t “debt,” admittedly. But the remainder is still massive for a sub-$40 million market capitalization.

Valuation and Conclusion

As is usually the case, CORR isn’t on life support. The firm is highly likely to be able to pay its interest and preferred distribution expense for the remainder of 2022 and perhaps most of 2023 at the current run rate.

2023 and beyond are dependent on a few factors, including if the downward trajectory of its transportation volumes continues and the extent to which interest rate hikes increase interest expense on its sizeable floating rate credit facilities outstanding.

For context, a 1% rise in rates equates to $969,000 in incremental interest expense based on the amount drawn at the end of the last reporting period.

The federal funds rate has already increased about 75 basis points since the last financials came out. And WER has personally seen 150-200 basis point increases throughout different parts of the economy (e.g., real estate).

Although the benchmarks in the loan agreements will behave slightly differently, we know that interest expense is going up, not down.

Compared to high-quality midstream MLPs like EPD and MMP, as mentioned previously – which we think have many attractive characteristics – CORR trades at significantly (20%+) higher enterprise value multiple…

Has way lower quality financials…

A much less diversified portfolio…

And is experiencing a decline in certain coverage ratios and revenues.

We won’t delve into comparing the dividend track records and credit ratings, since we think we all know the story there.

Despite the very large decline in the stock price, we don’t see an ultra-high risk, ultra-high reward situation with CORR.

Instead, we see high risk and moderate upside at best, which is an equation we don’t find too compelling. That’s especially the case today when there are many great companies trading at attractive valuations.

In other words, stay away from this cigar butt… you may get burned!

Thanks for Reading…

As always, thank you for reading my article and, as always, I look forward to your comments below. I want to remind you that both of these “cigar butt” stocks are small caps and as a result are much more volatile. As Frank J. Williams wrote in “If You Must Speculate, Learn the Rules”:

The creed of the new speculator is: I want to make a lot of money on little capital in a short time without working for it. This is just as impossible in Wall Street as it is in any other place.

Williams summed up my harbinger with these wise words:

The speculator is he who buys today with the hope of selling tomorrow or next month at a higher price…Men and women certainly should not speculate until they have paid the landlord, the butcher, and the tailor. They should have no doctor’s bills or insurance premiums due.

Be the first to comment