Toltek

Co-produced with Treading Softly.

July is an exciting time in my home. We have two national holidays – Canada Day and Independence Day – along with two birthdays.

We love a good celebration – between firework shows, cookouts in the backyard, and opening presents, we can enjoy an exciting month!

For many, there is a doldrum of celebrations from July through September when Labor Day arrives. I don’t know anyone who holds celebrations on that day, so we look forward to Halloween. Canadians have Civic holiday on August 1st and Thanksgiving in October before Halloween. What can I say, living in a dual-nationality household we get to celebrate often!

For my portfolio, however, every month is an exciting time. I receive regular large cash infusions from my various holdings. Love letters of thanks for my ownership.

This July, I have two excellent picks worth buying, or adding to in your portfolio. They will reward you with monthly income – to afford all those celebrations! – and we can enjoy a recent dividend increase.

Let’s dive in.

Pick #1: OXLC – Yield 14.4%

Oxford Lane Capital (OXLC) operates in a niche market that is unknown to many investors. OXLC is a fund that invests in “CLOs” or collateralized loan obligations.

What is a CLO?

Well, say you go to the bank and take out a loan to buy a car. The bank will underwrite your loan and provide you the money, but it has little interest in waiting for the next 5-7 years waiting to see if you pay off the loan as agreed. Instead, the bank will sell your loan to investors who are happy to sit and collect your interest payments. This way, the bank immediately frees up capital so that it has the cash to provide the next person who qualifies for a loan, this is how almost all debt works. The originator collects a fee and then sells off a significant portion of the loans to other investors who are not in the business of originating loans and are content to sit and wait for the interest payments.

Now, how do you ensure that loans are easily sold in enough volume? You need to appeal to a wide range of potential investors. From those looking for very low-risk investments to those looking for higher returns. One practice to appeal to the widest range of possible investors that has become common is “securitization”. Instead of selling an entire loan, the owner of loans can sell off small parts of the loans to various investors. Selling a $300 million loan is hard, selling $3 million chunks of a loan to 100 buyers is much easier, especially when many of those buyers are funds that are in turn sold to thousands of investors.

A CLO buys up pieces of senior secured first-lien loans. Specifically, these are loans that are publicly rated with credit ratings averaging in the B/B+ range. Through owning those pieces of loans, the CLO collects the interest and principal payments that it passes along to investors based on their priority.

CLOs will typically have several “tranches” that they sell, which include “debt” tranches in which they have a specific obligation to repay $X in principal with interest. The tranches are further split into “senior” and “subordinated” tranches, just like you see with many companies. They are essentially a debt obligation for the CLO, complete with various covenants that will trigger prepayment in the event that the CLO assets decline in value or cash flow declines.

Then you have the equity tranche. You know what equity is, it is what 99% of the articles on Seeking Alpha are about, equity positions. In other words, you are not contractually guaranteed a return, your return will be dependent on the actual performance of the company or fund. In this case, a CLO is a bond fund, and the equity holders get to collect whatever profits exist after the debt expense for the fund is paid, this is the equity that OXLC buys.

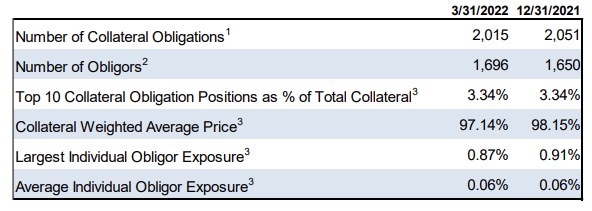

OXLC holds positions in over 190 CLOs. This provides substantial diversity with exposure to over 2,000 loans and nearly 1,700 individual borrowers. OXLC has an average exposure to a specific borrower of only 0.06%, and 0.87% to any single borrower. (Source: Investor Presentation Quarter Ended March 31, 2022).

Investor Presentation Quarter Ended March 31, 2022

The “collateral” that is discussed here are the loans that the CLOs own. As borrowers pay their debt, the CLO pays the debt and the equity owners of the CLO (which includes the CLO manager and OXLC) get the profits.

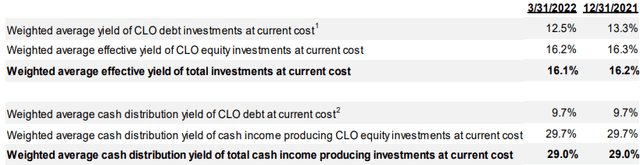

Those profits have been exceptionally high, with OXLC receiving a cash yield on their cost of 29%!

Investor Presentation Quarter Ended March 31, 2022

Note that the “effective yield” includes estimates of future defaults rising to historical averages. OXLC is able to support an exceptionally high dividend because it is collecting an exceptionally high yield. As it is, OXLC’s dividend coverage was 197% over the past 4 quarters.

Looking forward, it is probably inevitable that defaults will rise and OXLC’s cash yield will decline. After all, defaults can’t really get lower than zero, the only place they can go is higher.

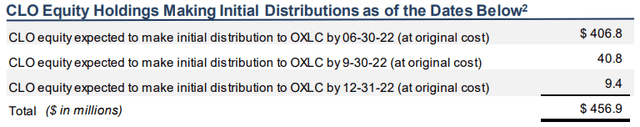

This is more than offset by the substantial investments that have just started paying OXLC. By June 30th, OXLC had $406.8 million worth of investments scheduled to make their first distribution.

Investor Presentation Quarter Ended March 31, 2022

This represents 28% of OXLC’s gross assets! This is a massive tailwind for OXLC’s earnings. Additionally, these loans are all floating-rate, while the leverage that OXLC uses is primarily fixed-rate preferred and bonds. Owning floating-rate debt and borrowing fixed is an excellent strategy in a rising rate environment.

Pick #2: PDO – Yield 10.7%

“If it sounds too good to be true, it probably is.” That’s great advice much of the time – sometimes it is terrible advice. When I was young, one of my first jobs was for a newspaper. My boss assigned me the task of giving the paper away for free. Easy, right? Actually, it was quite difficult. You see, everyone was immediately suspicious of getting something for free. They were sure that there had to be some catch they just weren’t seeing.

Of course, the newspaper company wasn’t giving out free papers as charity. The hope was that once the customers had a sample they would be willing to pay for a subscription. Yet, they were getting papers for free. The only “risk” to the customer was that they would like it so much that they would pay for more in the future.

Investors can be equally as suspicious. If a stock has a high yield it “must” be super risky. If share prices are down, it must be “bad”. Often, I see investors conflate whether a company or fund is “good” or “bad” with its share price movements.

They will pass on buying something saying that it is “too expensive”. Then when the price comes down, they won’t buy it because it is “bad” and use the price coming down as evidence of that belief.

One great example is PIMCO Dynamic Income Opportunities Fund (PDO). I frequently saw that PIMCO is the best CEF manager for bond funds. By “best,” I don’t mean that PIMCO funds outperform every other investment over every time frame. Like any fund, they will have their days in the sun, and their days of difficulty.

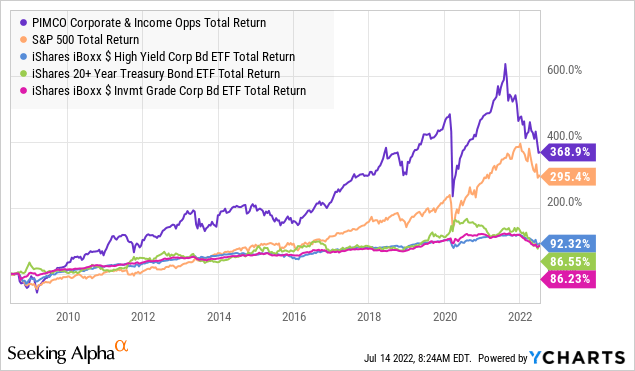

I say that PIMCO is the best because, over the long term, they have soundly outperformed on a consistent basis. Consider PDO’s very similar sister fund, PIMCO Corporate & Income Opportunity (PTY):

PTY has outperformed the S&P 500. See all those ETFs at the bottom? Those are bond ETFs. PTY is a bond fund, and those are the ETFs it should be compared to, yet there is no comparison. This is why PTY chronically trades at a double-digit premium to NAV. Over the decades, it has proven to consistently outperform.

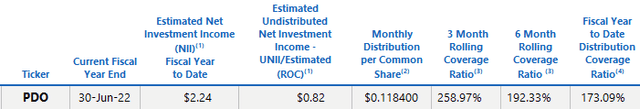

PDO is a newer offering from PIMCO and uses similar strategies and management. It is trading at a 10% discount to NAV. This has put PDO’s regular dividend into the double digits. While some might worry about dividend coverage just because the price is low, we can easily check PDO’s dividend coverage with their UNII report (undistributed net investment income) (xlsx download).

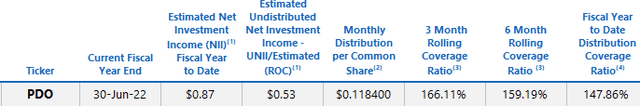

PDO has $0.82 in UNII, which is income that will be distributed. Last year, PDO paid out a $0.49 special dividend to reduce its UNII. We expect the same will happen again this year. It is also worth noting that PDO’s dividend coverage has been improving as rates rise. Here is PDO’s UNII report from November 2021:

In the first 5 months of their fiscal year, PDO’s dividend coverage was 147%. Since November, it has been 192% and strengthened to 258% over the past 3 months. In other words, as interest rates rise, PDO’s dividend has become safer. This is why PDO hiked its monthly dividend by 8% this month!

It might be difficult to believe that the price is lower and at the same time the dividend is safer, being raised, and the probability of getting a special dividend is higher. Yet that is the reality. The reason this happens is that PDO’s primary reason for existing is to buy bonds. When you are a buyer, lower prices are good for you. Buying at lower prices leads to higher yields, which leads to higher income.

We noted last year how PDO was well-positioned for rising rates, with a significant portion of its portfolio scheduled to mature within 3 years. We can see these benefits with PDO’s strengthening UNII as it is dramatically out-earning its dividend. For income investors, this is a huge win, and we can buy at a discount!

Getty

Conclusion

OXLC and PDO will provide you with a monthly income to enjoy again and again. Monthly celebrations rain into your account. Who cares if the market is up, down, or sideways? You’re getting paid to wait. You’re getting paid to hold shares. You’re getting paid, when others are only counting their lashings as their bloated portfolio of non-dividend-paying securities fall from their lofty heights.

In retirement, you will want to enjoy every celebration you can. Loved ones will not always be with us, and you will want to have the funds to afford to see them, spend time with them, and cover those necessary expenses – like your power bill. Having a portfolio that generates large sums of income from your hard-earned money is an essential tool that so many overlook.

Pick up the tool of income investing, and build something beautiful with it. Let its beauty pour into your accounts month after month. If you have time to reinvest dividends, do it. You’ll be amazed to see how quickly what was a trickle of income turns into a roaring flow pouring in.

Be the first to comment