Co-produced with “Hidden Opportunities”

Andrii Dodonov/iStock via Getty Images

Legendary investor Warren Buffett bought his first stock right in the middle of WWII when the economic conditions were not looking good. His perspective was that investors would be significantly better off owning productive assets over the next 50 years than pieces of paper.

You have all heard that it is always darkest before dawn. A phrase used to motivate individuals during difficult times is very relevant in the financial markets. Throughout history, we have seen the stock market turn up, often explosively, when the situation appears to be at its worst. December 1941, the attack on Pearl Harbor brought the U.S. into WWII. Within months, the markets bottomed, giving birth to a new bull run from Spring 1942. Was the economy perfect? Not at all. In many ways, it wasn’t even good.

It is normal to be afraid when alarmists prepare their thesis that we are headed into a recession. There is seldom a perfect environment for the stock market where risks and concerns are near zero. So if you are fearing the market today and accumulating pieces of paper, don’t; this is the best opportunity for you to build a position in quality dividend-paying stocks.

The Income Method, as we like to call it, enables you to create a passive income stream from various securities. The income persists through good and bad times, and the higher your passive income, the lower your dependence on your primary job, setting you up for early retirement. Prices will rise, and prices will fall. When I buy a stock, I am prepared to hold it for many years, generating the majority of my returns through income.

Today, you can get started down this path, buying when the prices are low, and yields are high. We have two picks to get you started.

Pick #1: CCD, Yield 9%

Calamos Dynamic Convertible & Income Fund (CCD)

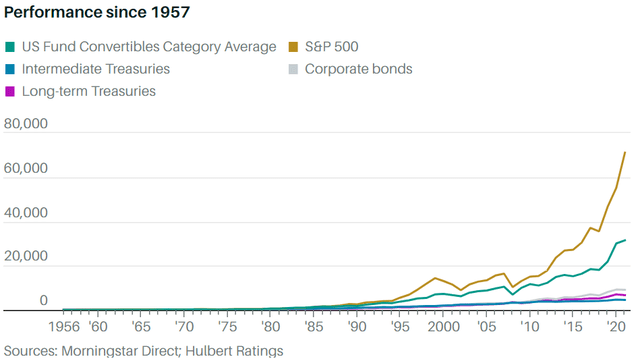

Convertible bonds have an established history of being durable against rising rates. The past performance of this asset class also shows us that it can do well both in high and low inflation environments. Their blended equity- and bond-like traits make them an excellent inflation hedge.

When the economy is firing on all cylinders or when we experience higher inflation, convertibles behave more like equities. However, during a recession, they act more like debt instruments. Since 1957, these securities have been closer to equities than bonds in their performance.

How Convertibles Perform (barrons.com)

We are in an economy where the Treasury yields fail to provide coverage against projected long-term inflation rates. As such, convertible bonds are a suitable addition to an income portfolio.

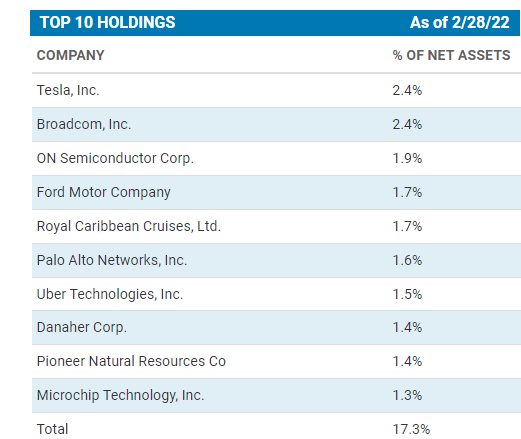

Calamos Dynamic Convertible & Income Fund is a CEF (closed-end fund) managed by Calamos Investments, an award-winning global convertible bond fund manager. CCD’s portfolio includes convertible notes of some high-growth tech names (like Tesla (TSLA), Airbnb (ABNB), Workday (WDAY), Okta (OKTA), and highly defensive names (like Metlife (MET), Iron Mountain (IRM), DaVita (DVA)) and 73% of the fund is composed of convertible securities.

Calamos

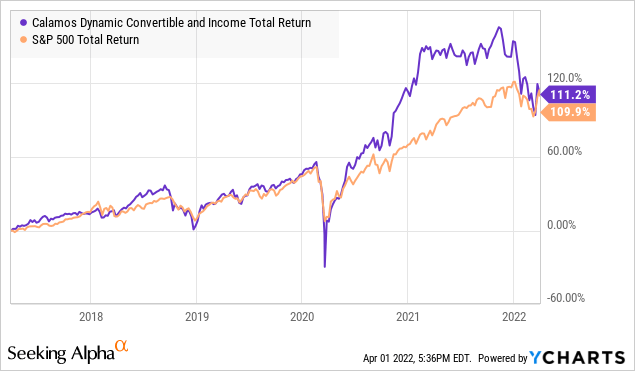

Before the value investor in you sees TSLA convertible notes on the list and runs in the opposite direction, please allow me to elaborate further. CCD is well-diversified across 612 holdings, with exposure to a single company not exceeding 2.4%. Moreover, in the past five years, CCD has handsomely outperformed the S&P 500 while paying healthy monthly distributions. We expect the outperformance to continue as the equity markets recover from this panic-induced correction.

Today, you can lock in high yields while this fund trades at a 4.6% discount to its NAV. CCD has traded at healthy premiums to NAV during past bull runs.

It is noteworthy that CCD has a Dividend Reinvestment Plan whereby dividends can be used to purchase additional shares at up to a 5% discount when the fund is trading at a premium. The CEF pays shareholders monthly, and its current $0.195 payment calculates to an attractive 9% annualized yield.

CCD has maintained a steady distribution since its inception in mid-2016, with a 17% increase last year. 15.4% of the CEF’s distribution represents qualified dividends, adding some tax-related advantages (where applicable).

CCD’s composition makes it a security that moves with the market while preserving its ability to generate income for shareholders. This should provide significant capital upside during the market’s bull run while rewarding you for being patient with handsome monthly distributions.

Pick #2: Realty Income, Yield 4.1%

Real estate is an excellent investment for passive income. However, buying real estate involves significant cash upfront and often takes a lot of debt. Average investors can only own a small number of properties. This creates a relatively concentrated portfolio with even one tenant default jeopardizing your monthly income and creating stress on your mortgage payments and other obligations. I’ve seen more than one millionaire lose their millions investing directly in real estate. This is why I prefer REITs for passive income. REITs can provide great diversification, allow you to invest with small amounts of capital, do the hard work for you, and are very liquid – you can sell in seconds from your cell phone. The Monthly Dividend Company – Realty Income (O) – is a Dividend Aristocrat and one of the highest quality REITs money can buy.

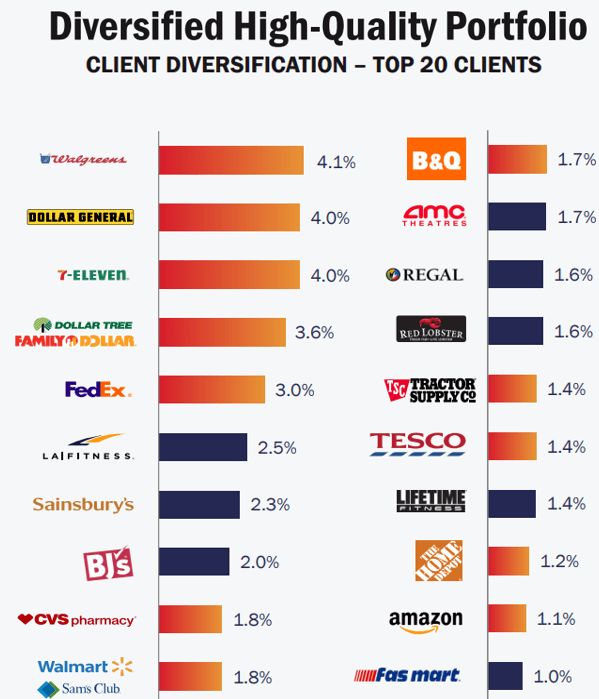

O owns over 11,100 properties in multiple U.S., U.K., and Spain regions. The company has over 1,000 clients representing 60+ industries. 60% of O’s rental income comes from its top 50 tenants, and 60% of them have investment-grade rated balance sheets. In short, O is a highly diversified commercial REIT whose rent comes from several recession-resistant tenants, making it a very defensive stock during turbulent economic conditions.

Investor Presentation

O’s balance sheet carries an A3 credit rating by Moody’s. This solid investment-grade rating is one of the best credit ratings in the REIT industry. This allows the company to experience much less impact from rising rates.

The monthly dividend company is, in fact, a Dividend Aristocrat with an impressive 4.4% CAGR dividend growth rate since its IPO in 1994. O reported 2021 AFFO as $3.59, covering its $3 annual dividend by 120%. The company collected 99.5% of the contractual rent due for Q4 across its total portfolio.

In addition, O also invested $2.6 billion in 401 properties and properties under development. The company guides 2022 AFFO to be between $3.84 to $3.97, representing ~9% YoY AFFO growth. This will provide plenty of room for more dividend raises this year, consistent with the company’s solid track record.

The opportunity couldn’t be more evident – O stock continues to trade ~15% lower than pre-pandemic levels despite demonstrating 8% higher AFFO. Additionally, the company pays a 13.6% higher monthly dividend today. Realty Income is a company that considers its dividend as sacrosanct to its mission and is, therefore, an income investor’s best friend. When we are surrounded by a lot of irrationality, fear, and uncertainty that causes O to trade at a discount, buy it. O is a great example of the power of compounding being applied to dividend growth.

Getty

Conclusion

Currently, investors are fearing inflation and a potential Fed policy-induced recession. Keep in mind that the economy faces multiple threats every year, and there is no shortage of alarmists to scare you into selling your stocks. A bearish article on the U.S. equities market is likely to garner more interest and subsequent panic-driven action than one that explains the overall resilience and the benefits of holding quality companies.

Fortunately, these companies hold the fort during harsh economic conditions and tend to be great for passive income production. In these companies, we tend to find ones having tremendous pricing power, inelastic demand, predictable cash flows, and a clean history of prioritizing dividend payments. These are investments you can hold through a recession without fear, knowing that your income will keep coming.

If you are looking to build passive income, the opportunity is best during market corrections, when there is looming fear and share prices are down. Investors like Mr. Buffett have amassed large fortunes through disciplined investing and by taking advantage of situations caused by the average investor’s fears.

Mr. Market won’t be tweeting an alert when the market bottoms and a new bull rally begins. Passive income needs to be built slowly and steadily by taking advantage of market corrections.

As the Oracle of Omaha says, you will be much better off owning productive assets over the long term. Today, the opportunity is ripe for the picking, and we present two sizeable dividends with yields up to 9% to get you started on your quest for early retirement.

Be the first to comment