gawrav

I know someone who has seen meaningful growth in his total compensation over the years at a large company, and he thought that buying rental properties is a surefire way to building wealth.

However, the problem with buying physical real estate is that it’s almost always fairly valued, and while he saw decent capital appreciation for a time, the fair value of those properties now at break even or worse, below what he paid for them.

Worse yet, it seems that the more money he makes the less cash flow he has, as a good part of his monthly income is now tied up in subsidizing the negative cash flow even after rental income.

That’s why a better strategy may be to buy income stocks that generate income right off the bat, with an experienced management team that takes care of the headaches for you. In this article, I highlight 2 attractively valued dividend stocks that generate a high dividend right off the bat.

Pick #1: Main Street Capital

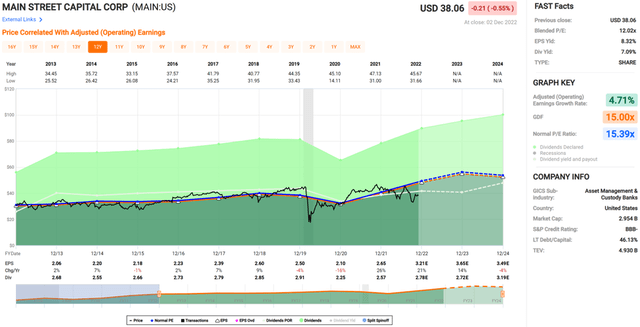

Main Street Capital (MAIN) is one of just a handful of internally managed BDCs, with $6 billion in capital under management at present. It’s been public since 2007, having survived 2 recessions and countless market corrections in between. It mainly focuses on investments in the lower middle market, as defined by those companies with $10 to $150 million in annual revenue.

MAIN benefits from its business model of finding deals in the lower middle market space, which is highly fragmented with plenty of opportunities. Moreover, MAIN’s shareholders benefit from its internal management structure and operating leverage, with the lowest operating expense ratio in the BDC sector, at just 1.4% over the trailing 12 months. This means that MAIN is able to return more capital to shareholders, and is better at withstanding economic adversity, as it has never cut its dividend over two recessions in the past 15 years.

Speaking of the dividend, MAIN has grown its dividend by 105% since initiating one in 2007, and recently raised its monthly dividend by 2.3% to $0.225 while also declaring a supplemental dividend of $0.10. The distribution is also well covered by a safe payout ratio of 77%.

Most of MAIN’s debt investments (76%) are floating rate while most of its borrowings (73%) are fixed rate debt, enabling it to take advantage of the investment spread from rising rates. It also maintains a strong balance sheet, with a debt-to-equity ratio of 0.86x, sitting well below the 2.0x limit.

I see value in MAIN at the current price of $38.06 with a forward PE of 11.9, sitting well below its normal PE of 15.4, all while paying an attractive 7.1% yield not including supplement dividends. As such, find MAIN to be a sound buy at present for high income and capital appreciation potential.

Pick #2: V.F. Corporation

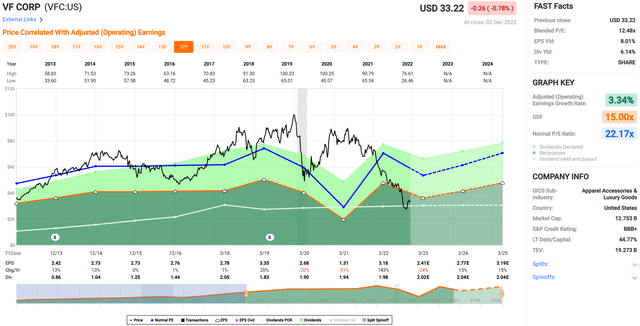

V.F. Corporation (VFC) is a global leader in branded lifestyle apparel, footwear and accessories with 40,000 employees worldwide and annual sales of nearly $12 billion. VFC’s product offerings span multiple channels including retail, wholesale and e-commerce. The company’s portfolio of iconic lifestyle brands includes Vans, The North Face and Timberland, which combine to make 80% of its sales.

VFC is currently seeing some headwinds from supply chain disruptions and lackluster results from one of its key brands, Vans. However, robust demand for its highly coveted The North Face brand more than made up for Vans’ weakness, contributing to total revenue growth of 2% in constant currency dollars in the third quarter.

Meanwhile, VFC enjoys pricing power due to its premium brands, as reflected by its A- score for gross margin, which sits at 53%, well above the 36% sector median. Management is also deploying talent to reignite growth at Vans with a promising lineup, and continues to demonstrate that it’s an innovation leader with Outdoor magazine awarding The North Face with eight must have product designations, and its FUTURELIGHT Boot received the Editor’s Choice Award.

Plus, VFC maintains a strong BBB+ rated balance sheet and pays an attractive 6.2% yield. While the payout ratio is currently elevated at 83% due to near term headwinds, this is expected to improve as management plans on more than doubling EPS to $5 per share by 2027.

Lastly, I find VFC to be attractive at the current price of $33.22 with a blended PE of 12.5, sitting well below its normal PE of 22.2 over the past decade. I see potential for VFC to trade at a 15x PE at a minimum. This is considering VFC’s strong brands, dividend aristocrat status, and analyst expectations for 13 to 15% annual EPS growth over the next 2 years.

Investor Takeaway

Buying cashflow siphoning rental properties is no fun, and forces one to adopt a frugal lifestyle in order to adapt. That simply doesn’t sound fun to me. It’s far better to wake up and smell the cashflow, and buy a basket of income generating investments that pay you right off the bat. MAIN and VFC are high yielding stocks that provide immediate diversification from one another. I hope you found these 2 well thought out income-generating picks to be useful as you continue on your income growth journey.

Be the first to comment