designer491

Investment Thesis

In a previous article, I wrote about my top 5 dividend growth stocks for a retirement-portfolio. Today, I’m writing about two attractive high dividend yield stocks that you could buy and I will explain why I think they are attractive choices to be added to a retirement-portfolio. The two companies should fulfil the following characteristics in order to be able to continuously increase their dividend:

- High market capitalization

- Strong brand image

- Strong competitive advantages over its competitors, which contribute to building an economic moat

- High financial strength and high profitability

- High dividend yield

- A dividend payout ratio with enough scope for future dividend enhancements

These are the two high dividend yield stocks that I have selected:

- Allianz (OTCPK:ALIZF)

- Verizon (VZ)

Allianz

Allianz is one of the largest insurance companies in the world in terms of revenue and market capitalization. In 2021, the company generated a revenue of $130,292.5M. In the same year, Interbrand named Allianz the No.1 global insurance brand for the third year in a row. According to Brand Finance, Allianz is also ranked as the top globally operating insurance brand and at the same time ranked as the 30th most valuable brand in the world. Allianz’s strong brand image contributes to the company’s competitive advantages over its opponents. In comparison to smaller insurance companies, Allianz stands out particularly well because of its global presence. The company has a strong AA rating from Standard & Poor’s and a Moody’s credit rating of Aa3, providing extra proof of its enormous financial strength. In 2021, the combined ratio of Allianz was 93.8 %, confirming the profitability of the German insurance company. The combined ratio is a measure of profitability and is used by insurance companies to measure how well they are performing in their operations (a combined ratio below 100% shows that the company is making an underwriting profit). In 2021, Allianz’s combined ratio improved by 2.5 percent as compared to the previous year, which underlines the company’s robust and stable business model.

Allianz currently has a dividend yield (FWD) of 6.24%. Furthermore, the company has a 5 Year Average Dividend Growth Rate of 6.37% and a dividend payout ratio of 67.67%, indicating that there is still scope for future dividend increases. This relatively high dividend yield (FWD) in combination with a dividend payout ratio that has enough scope for future dividend increases, make Allianz an attractive investment for long-term investors seeking dividend-income stocks and investors aiming to invest for their retirement.

Allianz’s financial strength (which is underlined by the company’s strong credit ratings), its profitability (demonstrated by a combined ratio of 93.8%), as well as the company’s competitive advantages (such as its brand image and global presence) in combination with a high dividend yield, strengthen my belief that Allianz is an excellent choice to be added to an investment portfolio for retirement.

Valuation

Relative Valuation Models

P/E (FWD) Ratio

Currently, Allianz has a P/E (FWD) Ratio of 9.31, which is 6.9% below the Sector Median of 10.00. This shows that Allianz is currently slightly undervalued.

Price/Book (TTM) Ratio

The company has a current Price / Book Ratio of 0.97, which is 13.63% below the Sector Median (1.12). This is yet another indicator that Allianz is currently undervalued.

This undervaluation as according to the relative valuation models, reassures me that the company is a good choice for a retirement-portfolio.

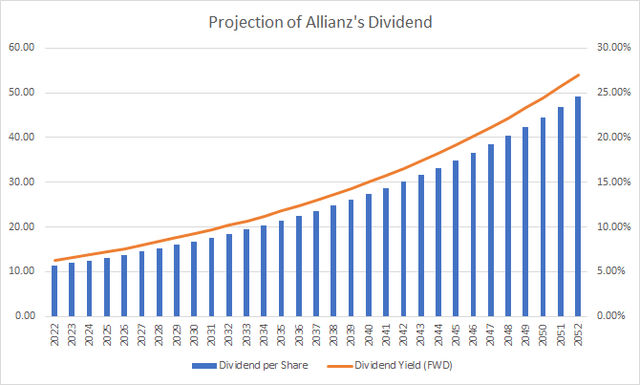

Projection of Allianz’s Dividend

Currently, Allianz pays an annual dividend of $11.35. At the company’s current stock price of $181.86, this is a dividend yield (FWD) of 6.24%. In the last 5 years, Allianz was able to increase its dividend by 6.24% on average. I will make more conservative assumptions and I assume a dividend growth for the company’s dividend of about 5% in the next 30 years. Due to its strong competitive advantages, its relatively low dividend payout ratio and the company having been able to raise its dividend in the last decades, I assume that Allianz will be able to make future increases of the same magnitude. In the graphic below you can see the results of Allianz’s dividend for the next 30 years when assuming that the company raises it by 5% on average per year:

Projection of Allianz’s Dividend and Dividend Yield Assuming a Dividend Growth Rate of 5% per Year on Average

Source: The Author

If you invested today in Allianz at the current stock price of $181.86 and the company was able to raise its dividend by 5% per year on average, you would get back 88.67% of your initial investment in form of dividends after 10 years (no withholding tax has been taken into account in this calculation). By 2042, you would get back 222.93% of your initial investment in the form of dividends (again, no withholding tax is taken into account in this calculation).

Projection of Allianz’s Accumulated Dividend Assuming a Dividend Growth Rate of 5% per Year on Average

|

Year |

Dividend per Share |

Dividend Yield (FWD) |

Accumulated Dividend |

|

2022 |

11.35 |

6.24% |

6.24% |

|

2032 |

18.49 |

10.17% |

88.67% |

|

2042 |

30.11 |

16.56% |

222.93% |

|

2052 |

49.05 |

26.97% |

441.62% |

Source: The Author

These numbers show that Allianz can be considered as an attractive investment when investing on a long-term basis. In my opinion, the company is appealing in terms of risk and reward and for this reason I believe that the company is an excellent choice to be added to an investment portfolio for retirement.

Verizon

Verizon is a leading provider of communication, technology, information and entertainment products and services. According to the Brand Finance ranking, Verizon is currently the 10th most valuable brand in the world, with a value of $69,639M. Verizon’s network leadership is the hallmark of its brand.

The company has a relatively high dividend yield (FWD) of 5.08%. At the same time, Verizon’s payout ratio of 46.83% is relatively low. This makes the company very attractive for dividend income investors planning to invest for their retirement, as it shows there is still a lot of potential to raise the company’s dividend in the future. Verizon’s high EBIT margin of 21.45% and high Return on Equity of 27.81% show the enormous profitability of the company and are indicators of the strong competitive position it has within its industry. Furthermore, the company has a higher EBIT margin than its competitors AT&T (NYSE:T) (with a EBIT margin of 20.21%) and T-Mobile (NASDAQ:TMUS) (with a EBIT margin of 13.12%), which underlines its position within the sector. The strong competitive position of the company in combination with its high dividend yield and relatively low dividend payout ratio supports my decision to choose Verizon as one of the company’s I would currently buy for a retirement-portfolio.

Valuation

Discounted Cash Flow Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Verizon. The method calculates a fair value of $53.45 for the company. At the current stock price, this results in an upside of 6.1%.

Verizon’s EBIT Growth Rate (FWD) of the last 5 years has been 5.24% on average. Here I will make more conservative assumptions for Verizon and therefore, I assume a Revenue Growth Rate of 3% and an EBIT Growth Rate of 4% for the next 5 years. The GDP Growth Rate of the United States is about 3% per year on average. Therefore, I assume a Perpetual Growth Rate of 3% for the company.

I have used Verizon’s current discount rate (WACC) of 7.75%. Furthermore, I calculate with an EV/EBITDA Multiple of 8.7x, which is the company’s latest twelve months EV/EBITDA.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Company Ticker |

VZ |

|

Revenue Growth Rate for the next 5 years |

3% |

|

EBIT Growth Rate for the next 5 years |

4% |

|

Tax Rate |

23.1% |

|

Discount Rate (WACC) |

7.75% |

|

Perpetual Growth Rate |

3% |

|

EV/EBITDA Multiple |

8.7x |

|

Current Price / Share |

$50.36 |

|

Shares Outstanding |

4199 |

|

Debt |

$182,317 |

|

Cash |

$1661 |

|

Capex |

$21,613 |

Source: The Author

Based on the above assumptions, I calculated the following results (in $ millions except per share items):

Market Value vs. Intrinsic Value

|

Market Value |

$50.36 |

|

Upside |

6.1% |

|

Intrinsic Value |

$53.45 |

Source: The Author

Relative Valuation Models

P/E Ratio (FWD)

Verizon’s P/E Ratio is 9.99. This is 44.07% lower than the P/E Ratio of the Sector Median, which is 17.87. This is a strong indicator for an undervaluation of Verizon.

At the same time, the company’s current P/E Ratio of 9.99 is 15.38% lower than its Average P/E Ratio of the last 5 years (which is 11.81). This is another indicator that Verizon is currently undervalued and strengthens my belief that the company is an excellent pick as a long-term investment for a retirement-portfolio.

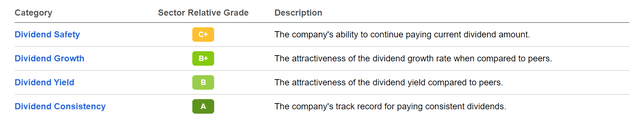

Verizon According to the Seeking Alpha Dividend Grades

According to the Seeking Alpha Dividend Grades, Verizon gets an A for Dividend Consistency, a B+ for Dividend Growth and a B for its Dividend Yield. In terms of Dividend Safety, Verizon is rated with a C+. Verizon’s rating as according to the Seeking Alpha Dividend Grades, reinforces my belief that the company is an attractive stock for a dividend income portfolio for retirement. Below you can find the Seeking Alpha Dividend Grades for Verizon:

Source: Seeking Alpha

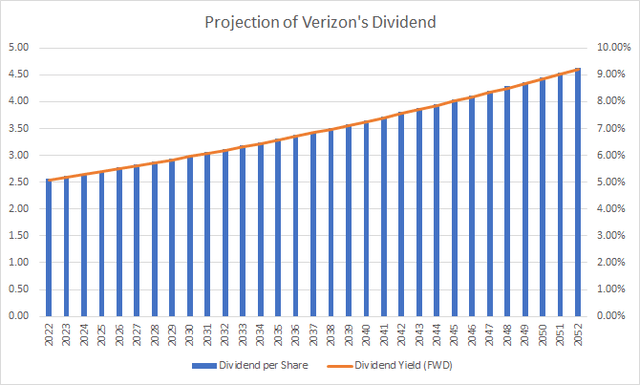

Projection of Verizon’s Dividend

At this moment in time, Verizon has an annual dividend payout (FWD) of $2.56. At the company’s current stock price of $50.36, this results in a dividend yield of 5.08%. Verizon’s Average Dividend Growth Rate in the last 5 years has been 2.08%. Assuming that the company is able to continue raising its dividend by about 2% on average per year, we would get the following results for the next 30 years as shown in the graphic below. Verizon’s relatively low dividend payout ratio of 46.83% as well as the company’s Average 5 Year Dividend Growth Rate of 2% and the fact that it has increased its dividend continuously in the last 18 years, are all indicators that Verizon should be able to raise its dividend by about 2% per year in the future.

Projection of Verizon’s Dividend and Dividend Yield Assuming a Dividend Growth Rate of 2% per Year on Average

Source: The Author

Below you can see the accumulated dividend when investing in Verizon with the assumption that the company was able to increase its dividend by around 2% per year on average for the next 30 years (such as the average of the past five years).

In 10 years, you would receive 61.86% of your initial investment in the form of dividends (no withholding tax is taken into account in this calculation). In 20 years, you would receive 131.07% of your initial investment in the form of dividends and 215.43% in 30 years (again, no withholding tax has been taken into account for this calculation).

Projection of Verizon’s Accumulated Dividend Assuming a Dividend Growth Rate of 2% per Year on Average

|

Year |

Dividend per Share |

Dividend Yield (FWD) |

Accumulated Dividend |

|

2022 |

2.56 |

5.08% |

5.08% |

|

2032 |

3.12 |

6.20% |

61.86% |

|

2042 |

3.80 |

7.55% |

131.07% |

|

2052 |

4.64 |

9.21% |

215.43% |

Source: The Author

This example shows us how investors can benefit by investing on a long-term basis in relatively stable and robust businesses. At the same time, it reinforces my belief that the company is an attractive choice for a retirement-portfolio.

The table below provides an overview of the two high dividend yield companies: Allianz and Verizon.

|

Allianz |

Verizon |

|

|

Sector |

Financials |

Communication Services |

|

Industry |

Multi-line Insurance |

Integrated Telecommunication Services |

|

Market Cap. |

74.20B |

212.04B |

|

Dividend Payout Ratio |

67.67% |

46.83% |

|

5 Year Average Dividend Growth Rate |

6.37% |

2.08% |

|

Dividend Yield (FWD) |

6.24% |

5.08% |

|

Dividend Frequency |

Annual |

Quarterly |

|

Moody’s credit rating |

Aa3 |

Baa1 |

|

EBIT Margin |

6.09% |

21.45% |

|

Return on Equity |

6.52% |

27.81% |

Sources: Seeking Alpha, Moody’s

The Bottom Line

Both Allianz and Verizon have several characteristics in common which makes them attractive investments in terms of risk and reward: they have strong brand images that generate competitive advantages over their opponents, and they have a relatively high dividend yield in combination with a dividend payout ratio that has enough scope for future enhancements. Furthermore, both companies have been able to continuously raise their dividends in recent years; a fact that strengthens my belief that they will continue to do so in the years to come. Additionally, both companies have a high market capitalization, a robust business model, strong financials and are profitable. For all these reasons, both are excellent choices for a long-term investment portfolio for retirement in my opinion.

Which companies that are particularly attractive in terms of risk and reward, are currently your favorite high dividend yield stocks for a retirement-portfolio?

Author’s Note:

Thank you very much for reading! If you have any questions regarding this analysis, you can leave a comment below!

Be the first to comment