Introduction

This article series is designed to keep investors informed of upcoming dividend increases. For dividend growth investors, this can be an opportunity to start or add to positions prior to a new increased payout. This can be especially important for retirees who live on dividend checks. Please perform due diligence before making any investing move, especially now during COVID.

The lists I’ve compiled provide various stats for the stocks that are increasing their dividends next week.

This list is a trimmed-down version only covering dividend increases. A full upcoming dividend calendar is always available here. If you know how this was built and the caveats, feel free to jump down to the lists themselves.

How It’s Assembled

The information presented below was created by combining the “U.S. Dividend Champions” spreadsheet hosted here with upcoming dividend information from Nasdaq. This meshes metrics about companies with dividend growth history with upcoming dividend payments (and whether those payments are increasing). These companies all have a minimum five-year dividend growth history.

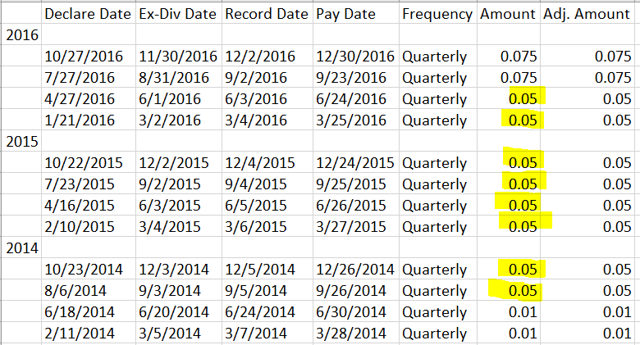

As a point of clarification, companies are included that may not raise their dividend every calendar year, but the total annual dividend received will still be higher each year. One such example is Bank of America (BAC).

In the table here on SA, the annual dividend payout received by a shareholder increased for each year in this time frame. Thus, it is eligible for inclusion in the “CCC” list.

That said, it did pay out the same amount for eight quarters in a row, but again, the total annual amount increased each year.

What Is The Ex-Dividend Date?

The “ex-dividend” date is the date you are no longer entitled to the dividend or distribution. You need to have made your purchase by the preceding business day. If the date is a Tuesday, you need to have purchased (or already owned) shares by market close on Monday. Be aware that for any stock going ex-dividend on a Monday (or Tuesday, if Monday is a holiday), you must own it by the prior Friday.

Dividend Streak Categories

Here are the definitions of the streak categories, as I’ll be using them throughout the piece.

- King: 50+ years

- Champion/Aristocrat: 25+ years

- Contender: 10-24 years

- Challenger: 5+ years

Fun Facts

| Category | Count |

| King | 0 |

| Champion | 0 |

| Contender | 7 |

| Challenger | 3 |

The Main List

The data is sorted by the ex-dividend day (ascending) and then the streak (descending):

| Name | Ticker | Streak | Forward Yield | Ex-Div Date | Increase Percent | Streak Category |

| American Water Works Company, Inc. | (AWK) | 13 | 1.7 | 11-May-20 | 10.00% | Contender |

| Xilinx, Inc. | (XLNX) | 18 | 1.73 | 12-May-20 | 2.70% | Contender |

| Tetra Tech, Inc. | (TTEK) | 6 | 0.86 | 12-May-20 | 13.33% | Challenger |

| Lindsay Corporation | (LNN) | 18 | 1.43 | 14-May-20 | 3.23% | Contender |

| Southwest Gas Holdings, Inc. Common Stock (DE) | (SWX) | 14 | 3.23 | 14-May-20 | 4.59% | Contender |

| PetMed Express, Inc. | (PETS) | 11 | 2.85 | 14-May-20 | 3.70% | Contender |

| Pool Corporation | (POOL) | 10 | 0.99 | 14-May-20 | 5.45% | Contender |

| Enviva Partners, LP Common units representing limited partner interests | (EVA) | 6 | 7.86 | 14-May-20 | 0.74% | Challenger |

| Community Healthcare Trust Incorporated | (CHCT) | 6 | 4.26 | 14-May-20 | 0.72% | Challenger |

| Southern Company (The) | (SO) | 20 | 4.62 | 15-May-20 | 3.23% | Contender |

Field Definitions

Streak: This is years of dividend growth history sourced from the U.S. Dividend Champions spreadsheet.

Forward Yield: This is the new payout rate divided by the current share price.

Ex-Dividend Date: This is the date before which you need to own the stock.

Increase Percent: This is the amount by which the dividend is being increased.

Streak Category: This is the overall dividend history classification of the company.

Show Me The Money

Here’s a table mapping the new rates versus the old rates. It also reiterates the increase in percentage. This table is sorted the same way as the first table (ex-dividend day ascending, dividend streak descending).

| Ticker | Old Rate | New Rate | Increase Percent |

| AWK | 0.5 | 0.55 | 10.00% |

| XLNX | 0.37 | 0.38 | 2.70% |

| TTEK | 0.15 | 0.17 | 13.33% |

| LNN | 0.31 | 0.32 | 3.23% |

| SWX | 0.545 | 0.57 | 4.59% |

| PETS | 0.27 | 0.28 | 3.70% |

| POOL | 0.55 | 0.58 | 5.45% |

| EVA | 0.67 | 0.68 | 0.74% |

| CHCT | 0.415 | 0.42 | 0.72% |

| SO | 0.62 | 0.64 | 3.23% |

Additional Metrics

Here are some additional metrics related to these companies, including yearly pricing action and the P/E ratio. This table is sorted the same way as the table above. The value investor may find stock ideas with those companies near their 52-week lows. They may provide a larger margin of safety and inflated yield.

| Ticker | Current Price | 52 Week Low | 52 Week High | PE Ratio | % Off Low | % Off High |

| AWK | 117.9 | 92 | 141.7 | 35.4 | 28% Off Low | 13% Off High |

| XLNX | 85.31 | 67.68 | 133 | 26.77 | 25% Off Low | 34% Off High |

| TTEK | 70.09 | 63.61 | 99.34 | 27.23 | 10% Off Low | 28% Off High |

| LNN | 86.51 | 71.86 | 111.76 | 50.86 | 19% Off Low | 21% Off High |

| SWX | 70.69 | 45.68 | 92.94 | 18.52 | 55% Off Low | 21% Off High |

| PETS | 37.95 | 15 | 41.59 | 29.08 | 152% Off Low | 2% Off High |

| POOL | 222.83 | 160.35 | 238.23 | 33.79 | 39% Off Low | 5% Off High |

| EVA | 34.34 | 20.63 | 39.3 | 736.81 | 65% Off Low | 12% Off High |

| CHCT | 39.19 | 20.12 | 52.33 | 98.1 | 86% Off Low | 23% Off High |

| SO | 53.69 | 41.96 | 71.1 | 16.54 | 28% Off Low | 21% Off High |

Tickers By Yield And Growth Rates

Some investors are more interested in the current yield, so this table is sorted descending by yield. This also includes some of the historical dividend growth rates as a bonus. Additionally, the “Chowder Rule” has been included, which is the current yield + five-year dividend growth rate.

| Ticker | Yield | 1 Yr DG | 3 Yr DG | 5 Yr DG | 10 Yr DG | Chowder Rule |

| EVA | 7.86 | 4.2 | 8.9 | |||

| SO | 4.62 | 3.4 | 3.4 | 3.4 | 3.6 | 7.9 |

| CHCT | 4.26 | 2.5 | 2.6 | |||

| SWX | 3.23 | 4.9 | 7.1 | 8.6 | 8.7 | 11.7 |

| PETS | 2.85 | 3.8 | 12.9 | 9.7 | 18.4 | 12.4 |

| XLNX | 1.73 | 2.8 | 4.2 | 6.4 | 9.7 | 8.2 |

| AWK | 1.7 | 9.8 | 10.1 | 10.1 | 9.1 | 11.7 |

| LNN | 1.43 | 1.6 | 2.8 | 3.2 | 14.9 | 4.6 |

| POOL | 0.99 | 22.1 | 20.8 | 19.8 | 15 | 20.8 |

| TTEK | 0.86 | 23.9 | 17.7 | 22.1 | 22.9 |

Comments

Another week, another few million unemployed, another new stock market rally. I’ve been beating the table for a while now, but dividend safety continues to be the most important metric to follow right now. This particular set of stocks doesn’t have any immediate red flags in terms of ultra high yield so that is a good initial sign. Please be careful before investing and do your own due diligence.

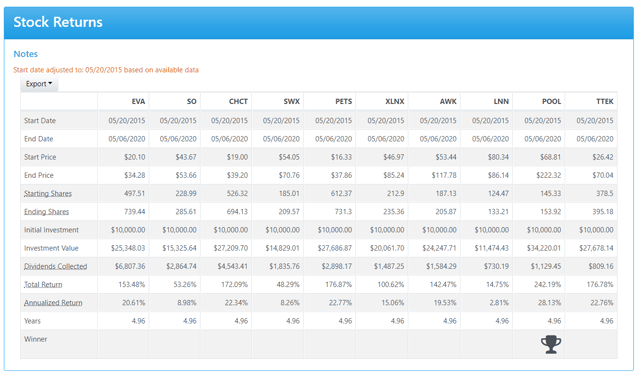

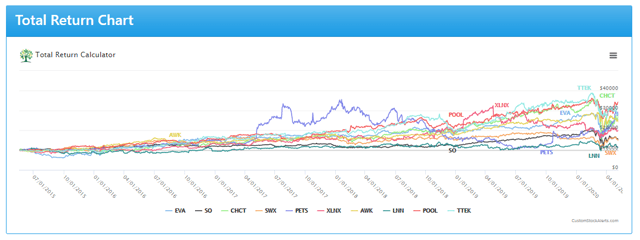

I took all of the companies on the list and threw them into my stock return calculator to see what would come out the other side. I also included the S&P 500 as a comparison point. The data went back to May of 2015 based on available data. POOL was the best performer with a 242% return followed by a few performers in the 170% range (TTEK, PETS and CHCT). EVA rocked the competition with the most dividends delivered with $6,800 in just five years on a hypothetical $10,000 investment.

POOL was the best performer with a 242% return followed by a few performers in the 170% range (TTEK, PETS and CHCT). EVA rocked the competition with the most dividends delivered with $6,800 in just five years on a hypothetical $10,000 investment. PETS is the purplish line that was a quick outperformer for a few years before diving back down underneath the rest. It’s a little hard to see but POOL is the red line that finished at the top at the end there though there were some interesting places traveled by many of these companies.

PETS is the purplish line that was a quick outperformer for a few years before diving back down underneath the rest. It’s a little hard to see but POOL is the red line that finished at the top at the end there though there were some interesting places traveled by many of these companies.

Conclusion

I hope you find this information valuable. Let me know if you want to see additional data points or what may help make this more useful. Again, be careful especially now with adding more money to a dividend play. We’ve seen some companies halting dividends fairly quickly into this crisis.

As always, do your due diligence on any stock before buying or selling. Happy investing!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment