Sundry Photography

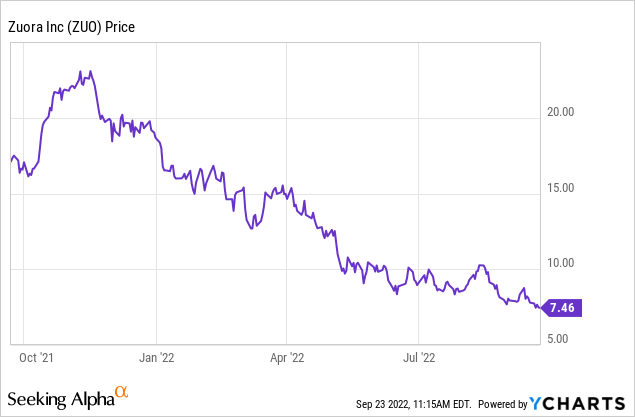

Right now, investors aren’t taking any chances, and that means growth stocks – especially small caps – are continuing to slink deeper into the penalty box. Few companies have suffered as much stock market pain as Zuora (NYSE:ZUO), a revenue-management company specifically designed for subscription-based businesses.

Zuora has long been a niche software vendor, but in my view, that niche element is one of Zuora’s strengths. The company is growing at a respectable clip (even if it can’t be considered a hyper-growth stock) and is gradually gaining economies of scale and closing its operating margin gaps.

Year to date, Zuora has shed about 60% of its value, which has pushed the stock into deep-value territory. By the mad logic of this year’s markets, losers keep on losing, and so few investors are willing to take a chance on Zuora right now. I think that’s a huge mistake, and that this is a very buyable dip.

Considering Zuora’s continued slide in the absence of major fundamental red flags, I am updating my viewpoint on Zuora to be very bullish. This stock will take quite a bit of patience and resistance to volatility, but the chance to get in on the ground floor is incredibly enticing.

For investors who are newer to this stock, here are the key highlights of the bullish thesis for Zuora:

- Subscription-based business models are becoming dominant – Given the fact that more and more businesses are adopting this type of model, Zuora’s base of potential customers has widened significantly. Zuora’s uniqueness in this regard is also important to point out: companies can choose a regular ERP, but Zuora’s subscription-focused solutions help to address common pain points.

- Innovation track record is strong; the product portfolio is expanding – There’s virtually no other company that markets itself as a purpose-built platform for subscription companies. Zuora has also done a good job at fleshing out its portfolio of solutions, ranging from revenue management to billing tools to CPQ (configure, price and quote) applications.

- Zuora grows along with its customers – As Zuora’s clients grow their subscriber bases, so does Zuora’s opportunity to monetize and grow alongside its customers. The company has noted that upsells have hit a “record pace”, and highlighted several key milestones like GoPro’s (GPRO) subscription-based storage and insurance program (a key feature of the company’s planned turnaround) hitting one million subscribers.

- Offloading services work to partners – As Zuora has scaled, it has also been able to ramp up its third-party vendors and resellers to take on more of the unprofitable services/onboarding work that typically acts as a drag on software-company margins. Zuora’s mix of subscription versus services revenue has grown over the past several quarters, helping boost gross margins and illustrating where Zuora would prefer to be at scale.

- Acquisition possibility – While I never like to base any investment decision based on high hopes that the stock will get acquired, Zuora checks off a lot of boxes for being acquired: it’s small with just a ~$1 billion market cap; it offers a very unique product that many larger software companies may want to get their hands on, especially during times when organic growth is fading; and it’s FCF positive.

Zuora’s relentless slide has left its valuation incredibly low. At current share prices near $7, Zuora trades at a market cap of $980 million. After we net off the $449 million of cash and $206 million of debt on Zuora’s latest balance sheet, the company’s resulting enterprise value is $738 million.

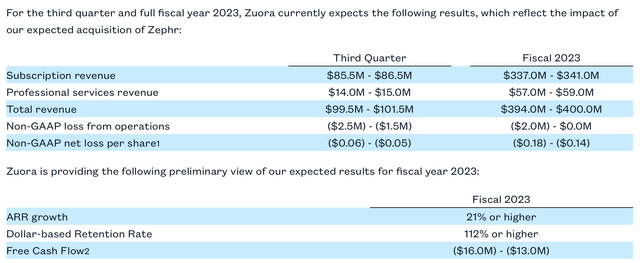

Yes, it’s true that Zuora dropped its revenue guidance alongside its latest earnings. It is now calling for FY22 revenue of $394-$400 million of revenue, representing 14-15% y/y growth (from a prior outlook of $402-$406 million, or 16-17% y/y growth). This drop, however, was driven primarily by intensifying FX pressures, which is a macro issue affecting all companies and not just Zuora in particular.

Zuora outlook update (Zuora Q2 earnings release)

Against this updated revenue view, Zuora trades at just 1.8x EV/FY22 revenue. For a mid-teens grower that has also notched a breakeven pro forma operating margin, I think this is quite a bargain multiple.

Stay long here and take advantage of Zuora’s slide to buy more.

Q2 download

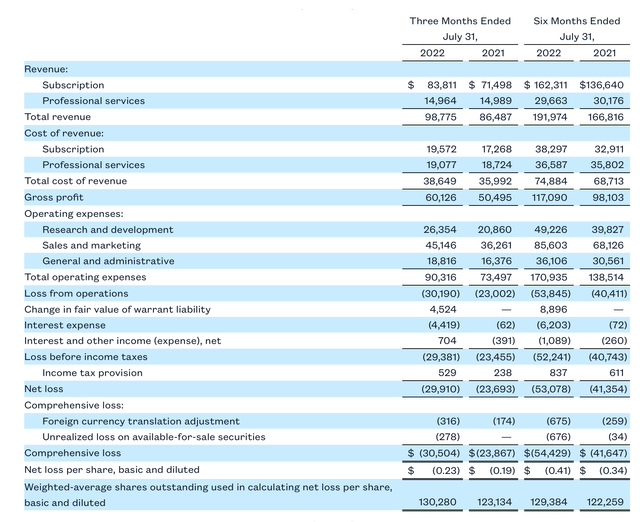

Let’s now discuss Zuora’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Zuora Q2 results (Zuora Q2 earnings release)

Zuora’s revenue grew 14% y/y to $98.8 million for the quarter, beating Wall Street’s expectations of $97.6 million (+13% y/y) by a thin one-point margin. Revenue growth also decelerated from 16% y/y growth in Q1, but that’s largely driven by worsening FX impacts from the strengthening dollar.

ARR, meanwhile, continued to see 20% y/y growth to $337.6 million. This represents a roughly ~$11 million net-new ARR add for the quarter. This is why it’s relatively short-sighted to punish Zuora for near-term revenue contraction due to FX headwinds, when the company is still making huge strides toward building a lasting recurring subscription base.

We note as well that net revenue retention rates hit 111% in the quarter (indicating 11% average upsell), one point stronger than 110% in Q1.

The company noted that churn was low within the install base, and that reseller partners were also a big driver for landing new wins in the quarter. Per CEO Tien Tzuo’s prepared remarks on the Q2 earnings call:

In Q2, we saw our lowest churn rate as a percentage of entering ARR since going public in 2018. In Q2, we saw our customers doing even more with us, adding more products and driving more volume through our system. In fact, if you look at our cohort of customers a year ago with annual contract value above $500,000, this cohort has grown by over 40% in ARR year-over-year. And so you see our biggest customers are going all in with us. And today, we have over 60 large enterprise names with annual contracts of $1 million or more […]

And in Q2, our partners continued to deliver. We saw our SI partners participate in over 70% of new business transactions, and the size of these deals have been trending higher each quarter. In fact, in Q2, deals that were sourced by our SI partners were more than twice as big as they were just one year ago. These partners are also helping drive go-lives where SIs involved — were involved with over 60% of go-lives in Q2.”

Margins also made meaningful strides in Q2. Pro forma gross margins notched 67% in the quarter, up three points from 64% in the year-ago Q2. This is largely driven by Zuora moving more of its professional services work (for which its target is zero-margin) to reseller partners. Subscription revenue mix in the quarter improved to 85%, up from 87% in the year-ago Q2.

Pro forma operating margins also hit breakeven, a five-point improvement from -5% in last year’s Q2.

Key takeaways

Cheap valuation, sturdy (even if not incredibly exciting) growth, margin progress, and a fantastic sticky product that caters to other subscription services – there’s a lot to like here in Zuora, especially after its sharp fall. Stay long here and buy on dips.

Be the first to comment