Sundry Photography/iStock Editorial via Getty Images

Rebounds are all about positioning. As the stock market looks to put the sharp losses of the past few months in the rearview mirror, how can investors position their portfolios to best take advantage of a coming upswing?

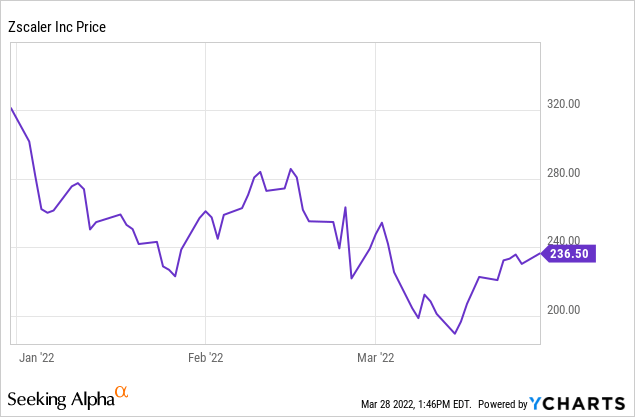

On Zscaler (NASDAQ:ZS), my thinking has recently changed. Though I originally recommended Zscaler as a strong “buy the dip” play, with investors having the opportunity to buy a long-time Wall Street darling at ~35% off highs, the landscape since then has shifted in two ways. First, many of Zscaler’s peers have lost substantially more than Zscaler, and I think there are far better rebound/upward correction opportunities in some of the more beaten-down names in the enterprise SaaS sector. Second, though Zscaler remains one of the most attractive “growth at scale” category leaders in the software sector, there may be hints of upcoming deceleration, which would put pressure on Zscaler’s already-rich valuation.

Year to date, Zscaler has shed ~20% of its value. Though I do see a minor rebound in store for Zscaler, I just don’t think Zscaler will materially outperform the broader market indices / it will almost certainly underperform some of its SaaS peers that have suffered deeper losses since November.

My rating on Zscaler goes to neutral. I don’t see any particular harm in holding Zscaler in your portfolio, as I do think we will see near-term lifts. However, I think selling Zscaler and rotating the position with some other SaaS names isn’t a bad idea, especially because I view Zscaler’s long-term appreciation potential as more limited due to its valuation.

There are, certainly, fundamental merits to Zscaler. The shortlist of Zscaler’s best qualities is below:

- Growth at scale. Zscaler is one of the few software companies reaching a ~$1 billion revenue scale that is able to grow revenue/billings at north of 60% y/y. Though Zscaler will not be able to sustain this pace of growth forever, the fact that has managed such rapid growth so far is a testament to the largesse of its market (Zscaler estimates its TAM is more than $70 billion) as well as the greenfield nature of its industry, where many IT buyers don’t have a ready solution in place for what Zscaler is offering.

- Increasing amount of apps are moving to the cloud. In the workplace a decade ago, most of our work apps were hosted locally, requiring the legacy cybersecurity companies to put network firewalls in place. Nowadays, however, we log into CRMs online; we view our HR portals online, and we run finance and accounting online. As this trend continues, Zscaler Internet Access will only become more relevant. Zscaler is a direct beneficiary of the business community’s cloud conversion.

- Forget the rule of 40; Zscaler’s growth/profitability balance is unparalleled in the industry. Most software companies aspire to the rule of 40 and don’t get there. Zscaler has already achieved its own strata of success by hitting a “Rule of 70”, with 60%+ revenue growth combined with a ~10% pro forma operating margin.

That being said – I do think at this point that Zscaler’s strengths are already baked into its valuation. At current share prices near $234, Zscaler trades at a market cap of $33.00 billion. After netting off the $1.62 billion of cash and $940.7 million of debt on the company’s most recent balance sheet, the company’s resulting enterprise value is $32.32 billion.

Meanwhile, for the fiscal year FY23 (the year for Zscaler ending in June 2023), Wall Street analysts have a consensus revenue growth target of $1.42 billion for the company, representing 36% y/y growth (data from Yahoo Finance). Against this revenue target, Zscaler already trades at a rich 22.8x EV/FY23 revenue multiple.

Now, I was more sanguine about the richness of this multiple when there were other high-fliers trading in the market in this neighborhood. However, since the November tech crunch, fewer high-fliers have been spared from the recent pain. Names like Palantir (PLTR), Asana (ASAN), and Coupa (COUP) have been humbled and seen a lot of their premium valuations reset.

Given that the relative valuation between Zscaler and some of these peers has shifted, I’m recommending moving out of Zscaler and buying into some of the more beaten-down names. Several SaaS stocks I particularly like at the moment include Palantir and Coupa as mentioned above, as well as DocuSign (DOCU), Zoom (ZM), and Twilio (TWLO) – all former Wall Street darlings now trading at a literal fraction of what they used to.

Q2 download

Let’s now discuss Zscaler’s most recent quarterly results (Q2, the period ending in January for Zscaler) and also illuminate why there may be fundamental risks at play here.

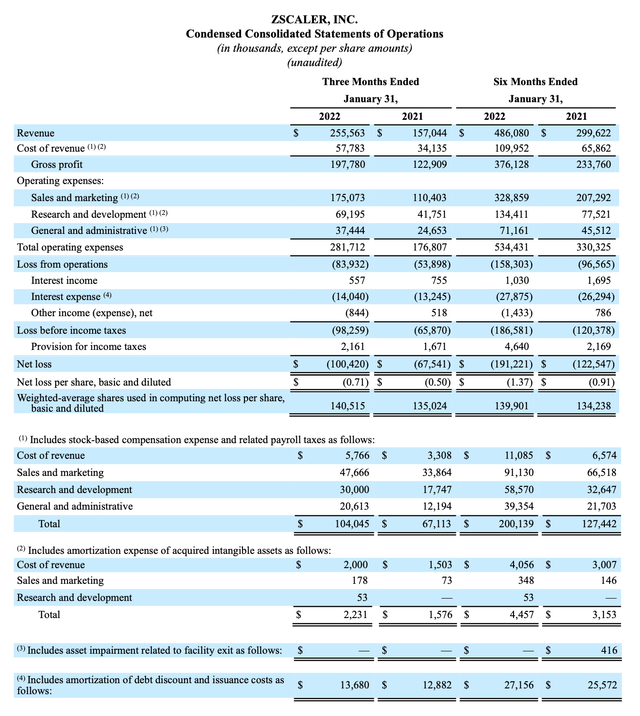

The Q2 earnings summary is shown below:

Zscaler Q2 results (Zscaler Q2 earnings release)

Zscaler’s revenue in Q2 grew at a 63% y/y pace to $255.6 million, beating Wall Street’s expectations of $241.9 million (+54% y/y) by a substantial nine-point margin – though we will say, a beat of this magnitude is more or less par for the course for Zscaler, which has routinely issued relatively conservative guidance only to come in far above expectations. In fact, in Q1, Zscaler’s beat had been much wider at thirteen points.

Jay Chaudhry, Zscaler’s CEO, continues to characterize the demand environment as incredibly strong, which has led the company to see expanding deal sizes. Per his prepared remarks on the Q2 earnings call:

Our continued investment in scaling, our engineering and go-to-market machines is yielding the best revenue growth we have had in three years even as we surpassed $1 billion in annualized revenue.

We plan to keep on making substantial investments across the company to continue our rapid pace of innovation and growth. What we deliver with our platform is critical to our customers’ highest priorities. This is reflected in our deal sizes, which are increasing due to our success with large enterprises who are buying more of our expanding platform with a significant growth in the number of new logo and upsell customers for orders with over $1 million in annual value. We now have over 250 customers exceeding $1 million in ARR an increase of 85% year-over-year. Business momentum for a zero plus exchange is strong due to the market need for a modern security architecture in the world of cloud and mobility.”

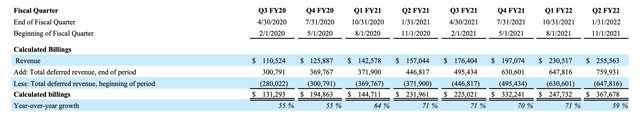

Where the immediate concern is, however, is on billings. As seasoned software investors are aware, billings is a better long-term indicator of a company’s revenue growth trajectory, as it captures deals signed in the quarter that will get recognized as revenue in future quarters.

In Q2, Zscaler’s billings growth clocked in at just 59% y/y – slower than revenue growth, and representing twelve points of deceleration versus 71% y/y growth in Q1. This marks the end of four straight quarters of 70%+ billings growth rates for Zscaler, and tougher y/y comps are starting to play out here; soon, revenue growth will follow. The main question here for investors to digest is if Zscaler will still be able to maintain its premium valuation when growth rates are sliding south.

Zscaler billings trends (Zscaler Q2 earnings release)

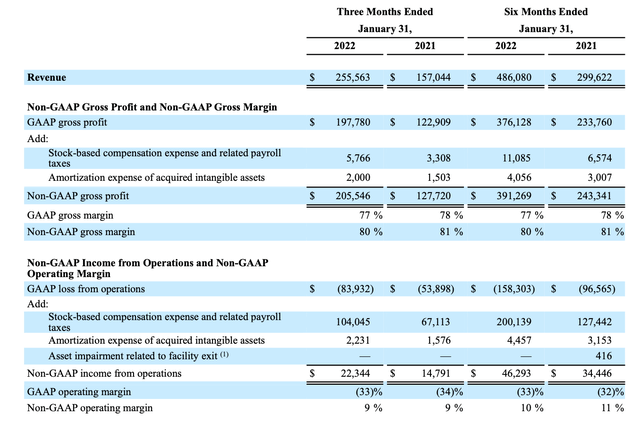

Margin-wise, Zscaler still continued to perform admirably. Pro forma gross margins lost one point to 80% this quarter, but still indexed much higher than most enterprise SaaS peers (where a mid/high 70s margin is typically the benchmark of strength).

Pro forma operating margins, meanwhile, remained flat y/y at 9% in the quarter, giving Zscaler a “Rule of 40” score of 70. This is, of course, quite strong compared with SaaS peers, but do note that Zscaler’s guidance does have the company dropping to a ~7% pro forma operating margin in Q3.

Zscaler margin trends (Zscaler Q2 earnings release)

Key takeaways

With a steep valuation that now towers over many of its beaten-down peers plus the risk of decelerating revenue/billings growth, Zscaler is no longer the best investment to play the coming rebound. Move to the sidelines here.

Be the first to comment