amperespy/iStock via Getty Images

Investment thesis

ZoomInfo (NASDAQ:ZI) is a data business with a solid moat. The company has shown strong growth over the past few years. Unfortunately, its valuation is extremely expensive. I wouldn’t buy or hold the stock at the current price.

I recommend waiting for more information about how ZoomInfo’s growth is performing. This is important after the recent tech pullback. Otherwise, I’d wait for a significant discount to the company’s current valuation.

The business has a strong moat

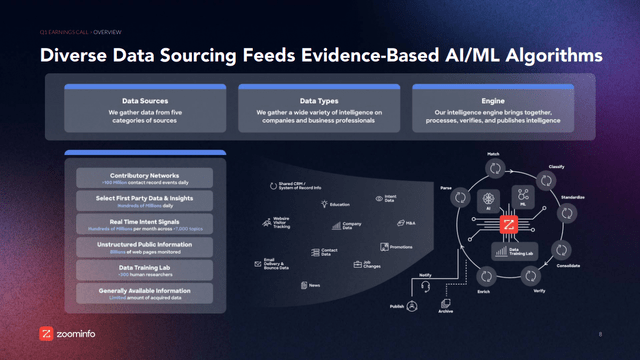

What I like about ZoomInfo’s business is its extensive database of information and contacts. Their data engine gathers, processes, and verifies data from a wide variety of sources. Data scientists work alongside automated processes to make sure the information is reliable. The company’s 10-Q filings highlight their guarantee of 95% data accuracy.

ZoomInfo’s Data Engine (ZoomInfo Q1 2022 Slides)

This data engine is ZoomInfo’s moat. Their high data quality brings in revenue and users. It then allows the company to increase the amount of data it gathers and processes. All this data improves the company’s data collection and verification processes. This further improves their product’s scale and data quality.

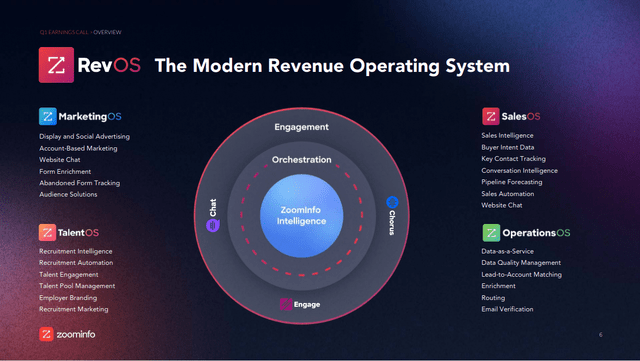

The company can leverage this engine to expand into other product categories. A good example of this is TalentOS, ZoomInfo’s expansion into recruitment software. This segment of the business is growing at 50% quarter over quarter.

ZoomInfo’s Core Products (ZoomInfo Q1 2022 Slides)

The company is exploring other opportunities, such as identity verification software for governments. These other products aren’t directly related to ZoomInfo’s core offering. Instead, they make use of their key competitive advantage to expand into new markets.

The company has compelling growth

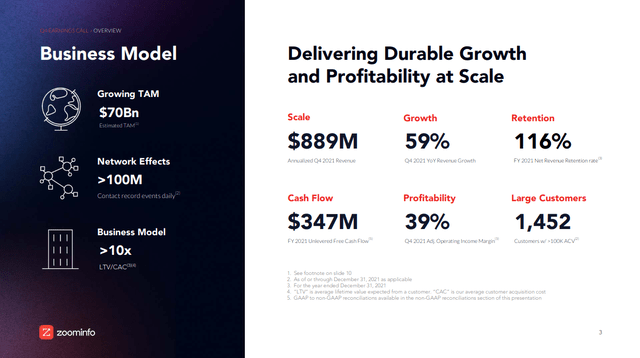

ZoomInfo’s top line growth over the past few years has been impressive. The company increased its revenue by more than 50% from 2020 to 2021. The company has guided for growth of above 40% this year. Even better, the company’s 10-K identifies over 99% of this revenue as subscription revenue. This recurring revenue is more consistent and reliable than usage-based revenue.

ZoomInfo has also increased its revenue growth rate among existing customers. Last year, the company’s net revenue retention rate was 116%. This is up nicely from a 108% and 109% rate in 2018 and 2019. Management said in their Q4 2021 earnings call that they don’t intend to update this number until their fourth quarter results. However, they may provide directional guidance later in the year.

ZoomInfo’s 2021 Business Metrics (ZoomInfo Q4 2021 Slides)

I see some potential headwinds to this growth rate, however. The company indicated in its last 10-K that it has significant exposure to the tech industry. About 44% of the company’s revenue comes from software companies. That’s up five percentage points from 2019. About two thirds of the company’s revenue comes from the software and business service industries. Those industries are currently pulling back on hiring activities. Sales and marketing spending may also come down if we enter a recession. This type of broad decline could limit ZoomInfo’s growth prospects.

Acquisition costs outweigh free cash flow

One of my biggest concerns about ZoomInfo is the number of acquisitions the company has made. The company has spent almost $1 billion acquiring other companies in the past two years. It has almost $5 per share of goodwill and intangibles on its balance sheet. Recently, ZoomInfo announced two more acquisitions for a total of $145 million.

The company discussed this acquisition strategy on its last earnings call. Management is trying to acquire companies and then streamline their sales processes. This drives significant incremental revenue for the company.

I think strategies like this can be valuable. But ZoomInfo bundles a lot of its products. This makes it difficult to identify how much growth is attributable to any specific acquisition. When the company does give commentary on its earnings calls, it seems like a lot of the company’s strong growth is driven by these new products. This adds additional risks for investors. I don’t know how exposed this strategy may be to a shifting economic environment.

The valuation is expensive

While ZoomInfo’s business is interesting, its valuation is very expensive. The company is trading at just under 19 times EV/Sales. The company’s adjusted operating margins look decent. However, that metric removes high stock-based compensation expenses. Excluding a $100 million tax benefit last year, ZoomInfo has not been able to generate a significant GAAP profit.

While the company has shown strong growth, I feel that a lot of future growth is priced in already. Even minor growth headwinds may cause a significant drop in the company’s valuation.

I’d only be willing to pay this much for a company if their 30% to 40% revenue growth rate would continue for at least five years into the future. I don’t feel I have that much visibility into the company’s future operations. The company’s dependence on acquisitions and new products for revenue growth is a risk I don’t feel is priced in. I’d want to buy a company like this at a sizable discount to account for the extra risk.

Final verdict

ZoomInfo is an interesting company with a strong moat. I think growth investors with higher risk tolerances should watch this company.

Unfortunately, the company is trading at an extremely premium valuation. I don’t feel the risk to reward is favorable at the current price. I recommend waiting for a pullback to buy the stock. At the very least, I’d wait for the next quarter’s results. The next report should let us know how recent headwinds have impacted the company.

Be the first to comment