piranka

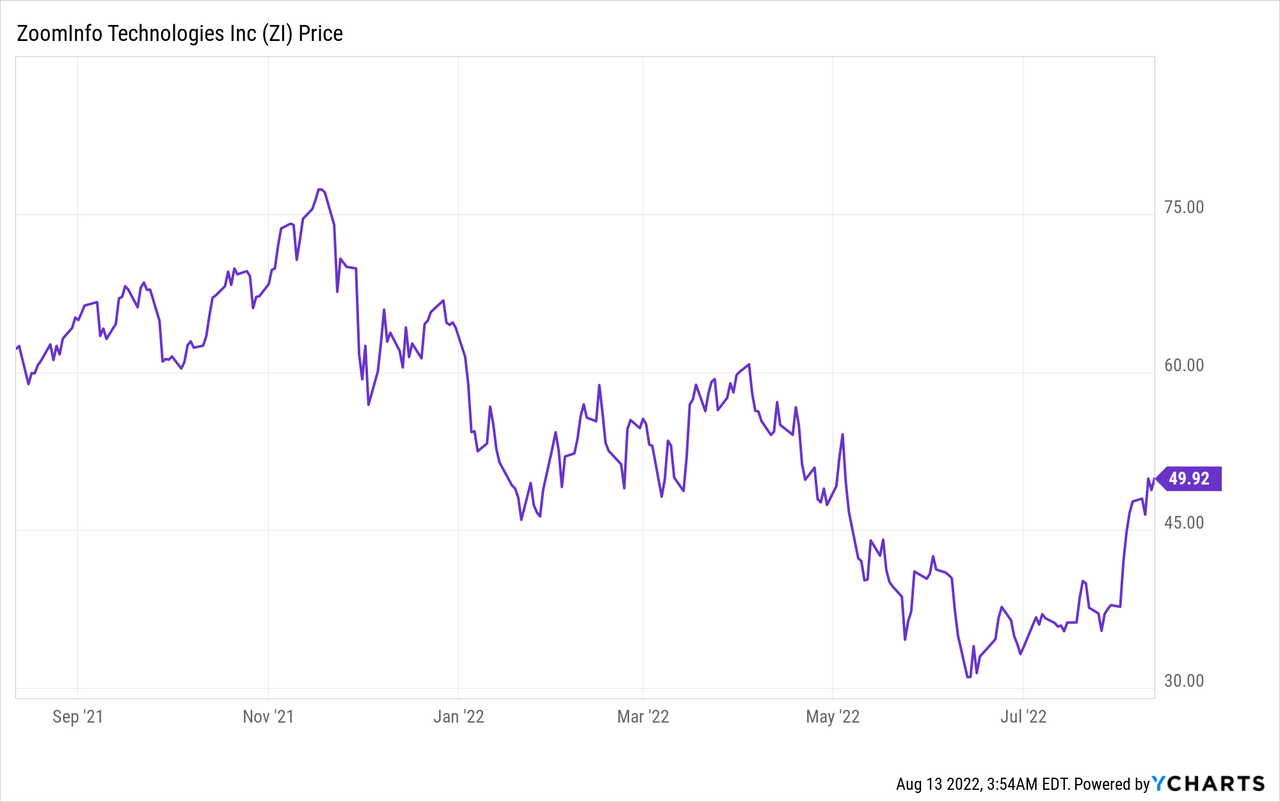

ZoomInfo (NASDAQ:ZI) is a leading Go to Market Intelligence platform which was founded in 2007 as DiscoverOrg before being acquired by competitor Zoom information in 2019. Since its IPO in June 2020 till November 2021 the stock price effectively doubled. However, the rising interest rate and high inflation environment caused the stock to get butchered by ~51% along with the rest of the growth stock market. The good news is since June 2022, the stock price has popped by 51%. The company has announced strong earnings for the second quarter and management even increased its guidance for FY22. With a super high 116% Retention rate, it’s >30,000 customers are finding the platform “sticky” and spending more on its new product features. In addition, A key trait I look for when investing into companies are those which are founder led. In this case one of the original founders Henry Schuck is the CEO, which is great to see. In this post, I’m going to dive into the evolving business model, financials, and valuation for the juicy details, let’s dive in.

Evolving Business Model

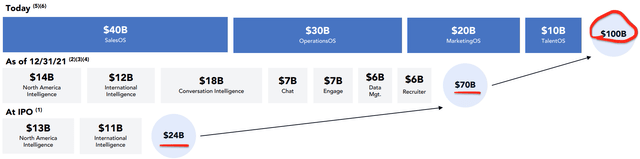

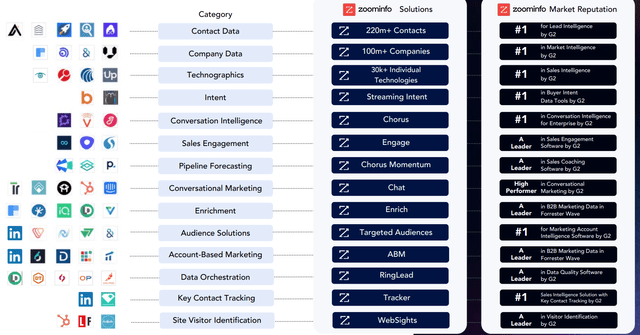

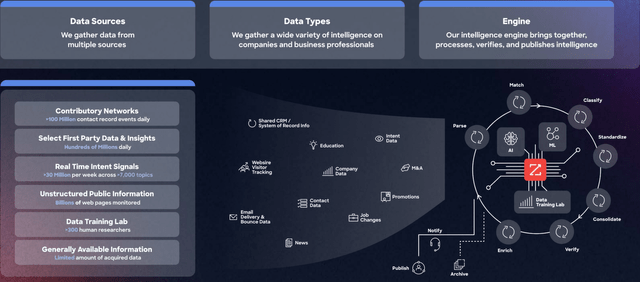

ZoomInfo is a software company which has historically given B2B professionals access to its vast Database of contacts. At its IPO in June 2020, the company had a Total Addressable Market (TAM) of $24 billion. However, since then they have expanded this TAM to $100 Billion.

TAM expansion (ZoomInfo Q2 Report)

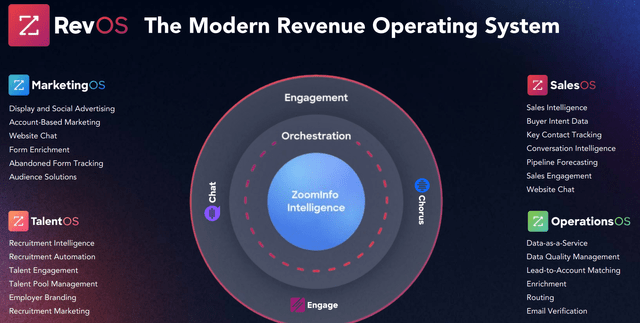

ZoomInfo has expanded its market opportunity by launching a suite of new products which go beyond just a contact database. These include platforms for Sales, Marketing, Operations and even Talent recruitment. The company now offers an alternative to Salesforce, HubSpot, and even Adobe Marketo with its Revenue Operating System (RevOS).

Historically, many B2B teams would have used at least one of the aforementioned platforms (Salesforce, HubSpot, etc.), in addition to a database such as ZoomInfo, RocketReach or LinkedIn Sales Navigator to get contact information. However, ZoomInfo has now brought this all together into one platform, which simplifies management for teams. As you can see from the chart below, this now covers intent data, sales engagement, Account Based Marketing, site visitor identification and more.

The platform even includes a chat bot platform called “Chorus” which can identify high priority leads on the website and then spark a conversation with them. This can also be integrated with Slack Notifications to enable a Sales Rep to respond rapidly. It’s FormComplete feature allows lead capture forms to be automatically enriched with known prospect data and thus minimising the number of fields, which need to be inputted by the prospect. Adobe Marketo was a pioneer with this feature and calls it “progressive profiling“. This may not seem like a big deal, but this really does help with conversions as multiple studies show the more fields in the form the lower the chance of it being filled out.

The whole platform really helps from contact and connection to the final close of a deal.

Recently, the company has also announced a way for customers to integrate Snowflake with Ringlead (owned by ZoomInfo). This enables first and third-party data to be brought together and used as an extra enrichment source. In addition, the fully enriched data can also flow back to Snowflake for storage which is a game changer for Business Intelligence.

Growing Financials

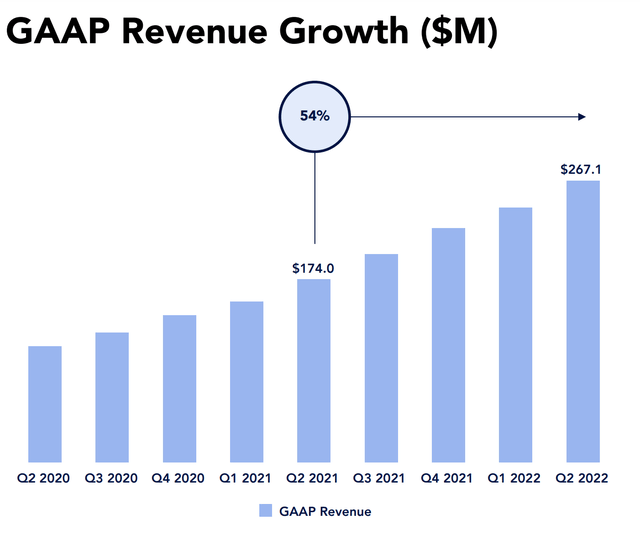

ZoomInfo generated strong financials for the second quarter of 2022. Revenue was $267.1 million, up a rapid 54% year over year. With 42% of this growth being purely organic and excluding recent acquisitions. This revenue beat analyst expectations by $13.25 million, which is a testament to their new “platform” or modular strategy. A “Land and Expand” approach allows ZoomInfo to be a pure contact data provider at first before “expanding” into an account with upsells such as its Sales and Marketing platforms.

Revenue Growth (Q2 Earnings Report)

The tactic of moving “upmarket” is one many leading SaaS companies do as it usually results in higher retention and larger revenue longer term. Out of its 30,000 paying customers ZoomInfo, has over 1,763 customers with over $100k Annual Contract Value (ACV).

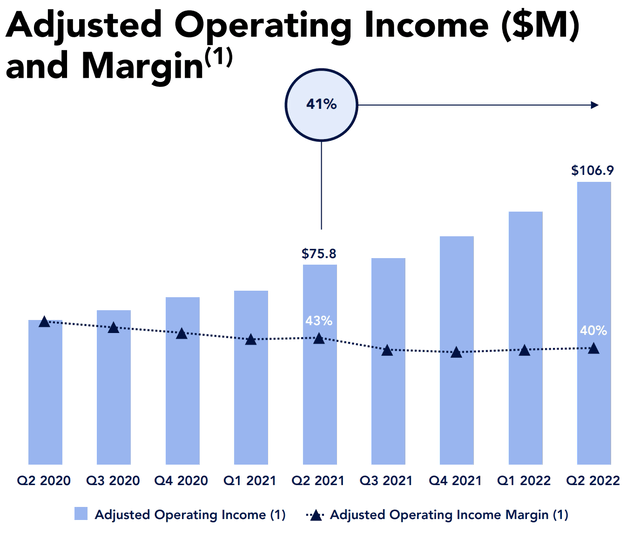

Normalized Earnings Per share was $0.21, which beat analyst consensus expectations by $0.03. Adjusted Operating income popped by 41% year over year to $106.9 million. As a SaaS company it has a high GAAP operating Margin of 15% or 40% on an Adjusted basis.

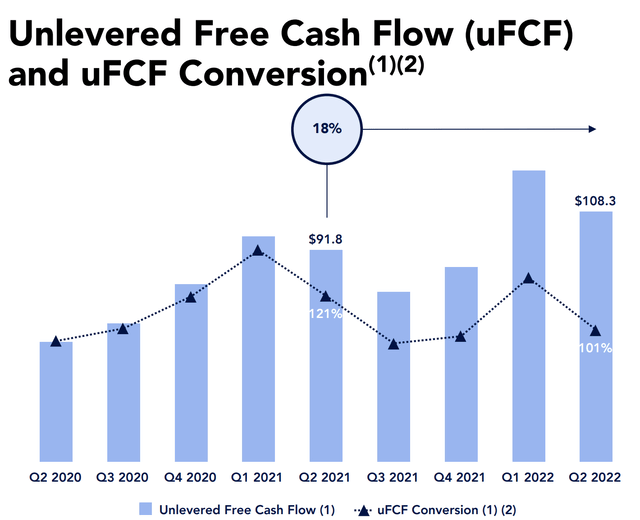

Unlevered Free Cash Flow was $108.3 million in the second quarter, up 18% year over year which was solid despite the dip since the last quarter.

ZoomInfo’s balance sheet is not as strong as I would like it to be. They have $371.4 million in cash, cash equivalents and short-term investments with $1.2 billion in long term debt. This debt level is fairly high for a growth company but should be manageable given the low capex business and positive free cash flow.

Management showed confidence and increased its guidance, which is a positive sign given many other SaaS companies are lowering guidance due to recession fears.

ZoomInfo is expecting $1.08-$1.09 billion in revenue with Adjusted Operating Income between $433 and $437 million for the full year 2022.

Advanced Valuation

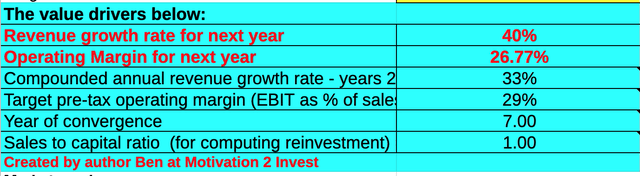

In order to value ZoomInfo I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 40% revenue growth for next year and a conservative 33% for the next 2 to 5 years (not including any acquisitions).

ZoomInfo Stock valuation 1 (created by author Ben at Motivation 2 Invest)

In addition, I have forecasted it’s operating margin to increase slightly over the next 7 years to 29%. As the company benefits from higher operating leverage as it scales.

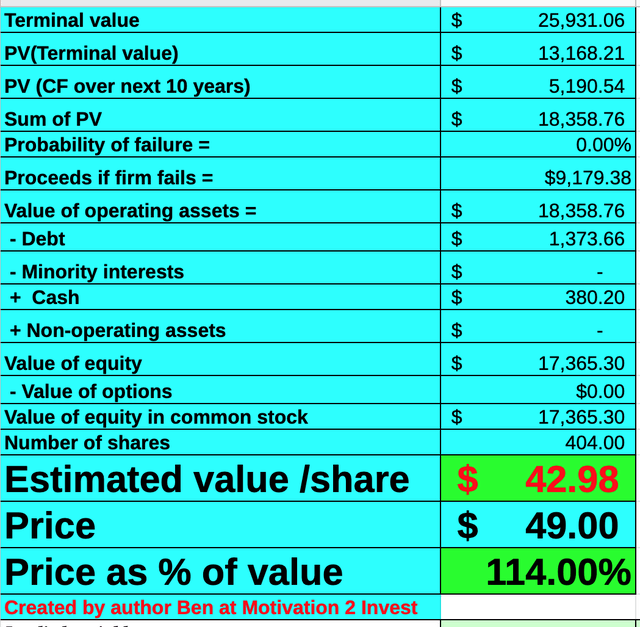

ZoomInfo stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $43/share, the stock is trading at ~$49 at the time of writing and thus is 14% overvalued.

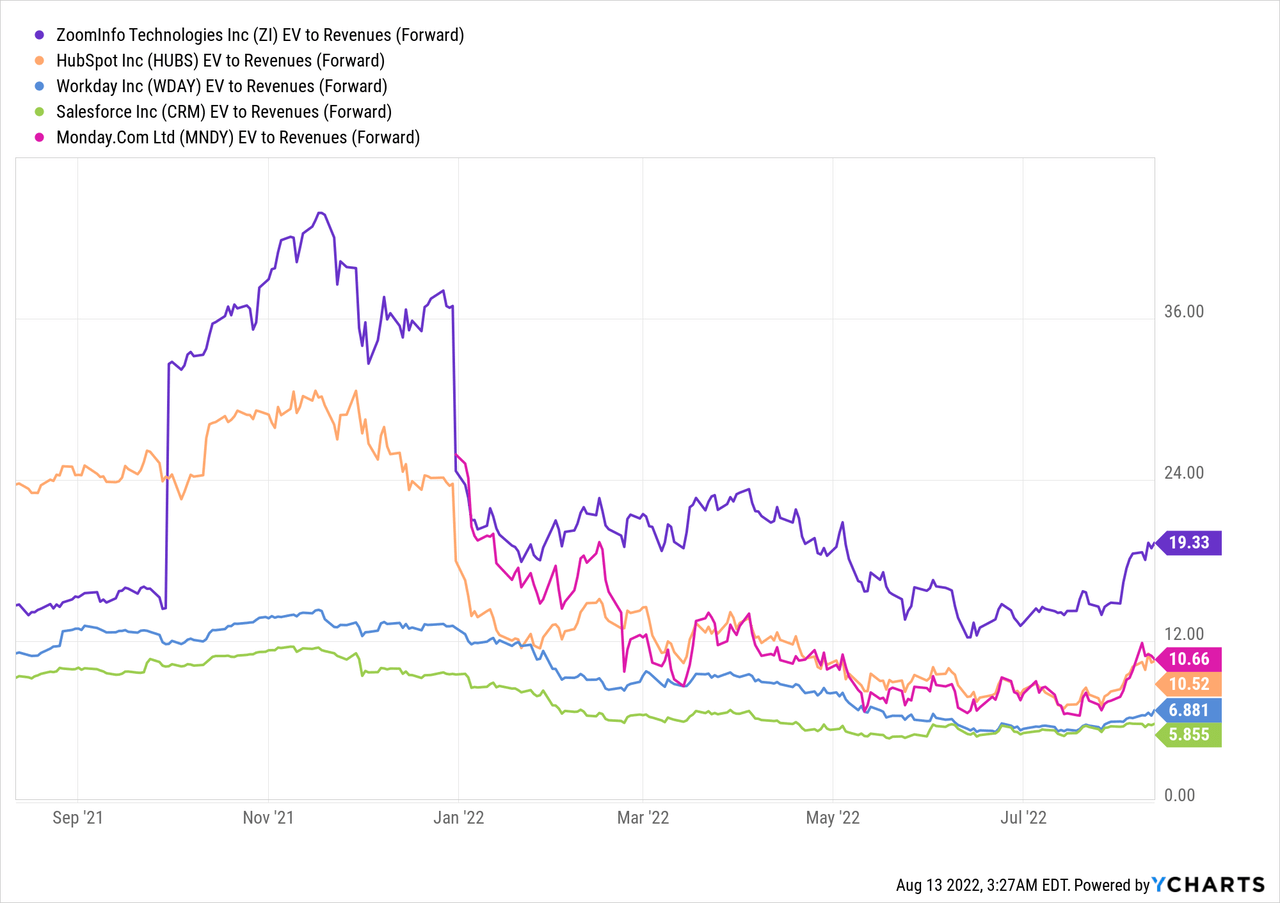

As an extra datapoint ZoomInfo trades at an EV to Revenue (forward) multiple of 19.33 which is cheaper than the levels in 2021 but not the cheapest ever. An EV to Revenue (forward) = 12 looks to be a great buy point. In addition, the stock is more expensive than many other business focused SaaS stocks such as HubSpot (HUBS), which trades at an EV to Revenue = 10.52 and Workday (WDAY) , which trades at an EV to Revenue = 6.8.

Risks

High Valuation

The stock is overvalued at the time of writing, but if they can hit 40% revenue growth next year and 33% over the next 2 to 5 years, then it’s not massively overvalued. However, it should be noted that many more established SaaS companies are trading much cheaper. In addition, the company received a $100 million tax benefit in 2021 which gave it’s financials a significant boost. Then of course there is Stock based compensation which isn’t included in its “Adjusted Results”.

Competition

ZoomInfo has created a fantastic suite of new products across sales, marketing and even recruitment. It’s marketing and usability is best in class and as a new customer I would be very tempted to purchase. However, the issue is many large organisations already use a product such as Salesforce, HubSpot, etc. Therefore, I think getting them to switch to ZoomInfo for their entire tech stack would be a challenge. Thus, this reduces its TAM to those companies which are looking to consolidate their sales and marketing tech stack or are just starting to look for a SaaS solution. The good news is as a leading data provider, I imagine the company has a huge advantage in identifying and finding the best prospects for its product.

Final Thoughts

ZoomInfo is an innovative company ran by a talented founder. In the short time the company has been public they have grown at a rapid pace and executed acquisitions tremendously. The second quarter results followed this trend and management even increased its guidance. However, the company’s high debt, high valuation, high competition, and the fact we are entering a recessionary environment is a risk. Therefore, I think this stock is perfect for ones watch list and after a reasonable pullback, entry could be a good idea.

Be the first to comment