SDI Productions/E+ via Getty Images

Investment Thesis

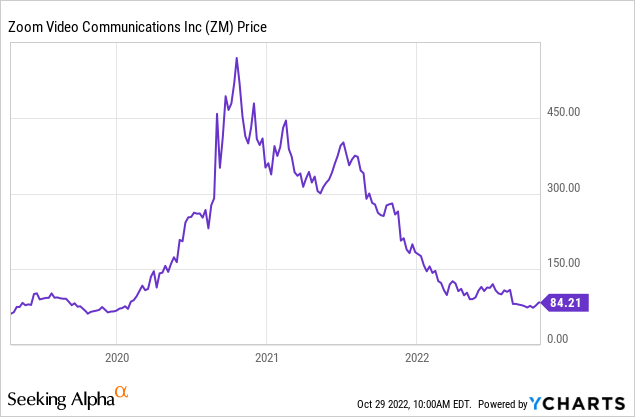

Zoom Video Communications (NASDAQ:ZM) was the go-to app/website during Covid when everybody was required to stay at their house and work remotely. This led to many new customers and therefore much more revenue for the business. Investors loved that high-growth, innovative company and drove the price of its stock to the moon.

But now, after a year, the stock has fallen to all-time lows once again. So the question becomes: Has the story actually changed for Zoom or it is just a matter of time until the company’s shares quintuple again?

Keep reading to find out.

How Does Zoom Make Money?

www.marketingmind.in

Zoom is a cloud-based conferencing tool that allows users to virtually interact with each other through audio, video, and chat. The company makes money in three (3) ways:

1. Subscription Fees

In exchange for access to its portfolio of software products, Zoom charges a variety of subscription fees, which account for the vast bulk of its income. Zoom offers commercial versions such as Pro, Business, and Enterprise in addition to its free Basic plan. Each of these versions caters to a distinct group of customers and, depending on the price paid, enables them to host a variety of participants. In addition, Zoom provides specific packages and solutions for a number of sectors, including the education and healthcare sectors. Also, Zoom boosts the likelihood of selling to a particular consumer type by customizing its service for that market.

2. Hardware Sales

In addition to its software suite, Zoom offers a variety of hardware products. More specifically, Zoom collaborates with other hardware producers and provides its customers with a wide range of phones, tablets, speakers, and other devices. Then, customers pay a monthly subscription fee for each piece of hardware they purchase. After that, Zoom splits those profits with the company that makes the hardware equipment and handles installation and maintenance.

3. Advertising

The advertisements that Zoom plays once a conference starts are another source of income. Only free Basic users who don’t pay for the company’s service see these ads and as a result, Zoom is able to monetize the consumers who do not need or desire to pay for its products. Zoom makes a modest profit each time a user sees an advertisement. This might be a small portion of the company’s revenue at the moment but can easily grow into a sizable amount of revenue with tens of millions of active users.

Competition

nira.com

Zoom Video Communications is not the only communications platform in the world. There are and there were many others even before Zoom became popular 3 years ago. Cisco (CSCO), Google (GOOG) (GOOGL), and Skype are just some of them. So what made Zoom the number one platform for video communications, in other words, how did the company differentiate itself from the competition?

Zoom is special for a couple of reasons:

Simplicity

The platform can be deployed on internal servers or instantaneously enabled on Zoom’s cloud utilizing the Zoom Meeting Connector.

Quality

Of all the video conferencing platforms, Zoom boasts the highest video resolution. With the free version, you receive high-definition resolution, and with paid accounts, you can get up to 1080p.

Security

To safeguard users’ meetings and data, Zoom includes several useful security measures, including:

1) A waiting area where the host can check guests in and provide access.

2) Warnings to participants that a meeting is being recorded so they can choose not to participate if privacy is an issue.

Cost

The list of features in Zoom’s free edition is extensive. The primary reason for someone to pay for an upgraded program is that free meetings can only last for 40 minutes.

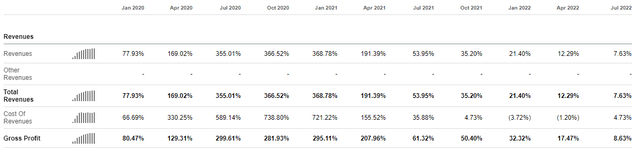

Growth Has Slowed Down But Is Still There

As shown in the company’s income statement, the company used to grow its revenue at 35%-370% YoY until Q3 2021 but this is not the case anymore. The company’s growth rate is constantly declining since then and it has reached a point where it is growing at mid to high single digits.

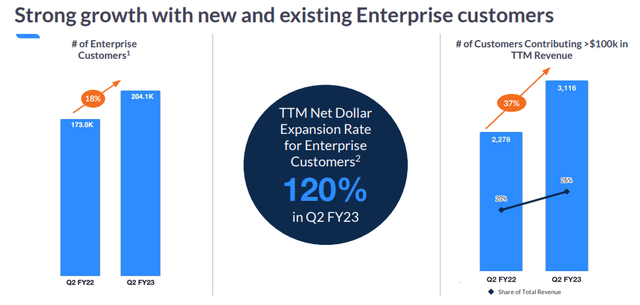

However, the company is still retaining strong double-digit growth with new existing enterprise customers.

Add to that a TTM Net Dollar Expansion Rate (a measurement of the money you generated from repeat clients through upselling, cross-selling, and add-ons) of 120%, and all of a sudden there might be a light at the end of the tunnel for Zoom.

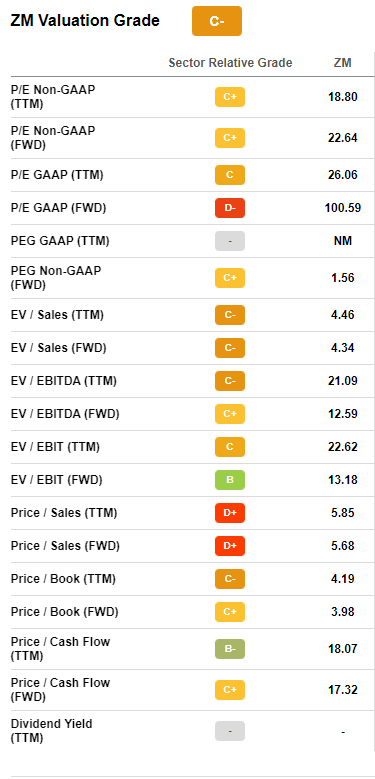

Valuation

SeekingAlpha

Even though Zoom scored a C- in Seeking Alpha’s Valuation model, I do not see any individual metric that shows that the company is irrationally overvalued. Somebody could argue that the P/S ratio is high, but let’s not forget that Zoom is a SaaS company with high margins. Zoom also scored poorly in the P/E ratio; In my opinion, companies that are groundbreaking and are still growing at a decent pace such as Zoom, should not be criticized that much based on the profit that they are making, as they reinvest most of it back into the business in order to grow faster. Having said that, I believe that Zoom has a decent valuation for what it can offer in the future.

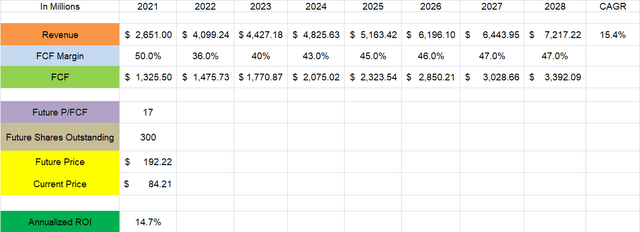

Valuation Forecast

For my valuation forecast, I followed analysts’ estimates for revenue growth and I ended up with a revenue CAGR of 15.4% for the next 6 years. This seems pretty rational to me. According to projections, the size of the worldwide video conferencing market would be over USD 18.56 billion in 2030, growing at a CAGR of 11.71% from 2022 to 2030. Bearing in mind that and also the fact that Zoom is the leader in the sector I feel confident projecting a 15.4% CAGR for the company’s top-line revenue. I then projected that the company will slowly get out of the phase that is heavily reinvesting its profits back into the business, and will manage to achieve a FCF margin of 47%, about the same as it was back in 2021. Finally, I projected a P/FCF of 17 which is less than the sector’s average of 19 and ended up with a future price of $192.22. This implies an annualized ROI of 14.7% which is higher than the average of 10% that the market has yielded over the years.

Risks

As mentioned before, Zoom gained its popularity during the Covid period as everybody was forced to stay at their house and work remotely. But now people don’t have this necessity. The virus is not the hot potato anymore and people have started to go back to their offices. So you have to ask yourself: was Zoom a short-term trend or it is here to stay?

Personally, I believe that Covid changed people’s everyday life forever. Once they all understood how convenient it is to work from home and attend meetings remotely from the comfort of your own house, they didn’t want to go back to the previous “normality”. This is why I believe that companies like Zoom will keep having new customers and therefore grow even further.

However, this is just my personal opinion and I might be completely wrong, so you should factor that risk into your valuation when doing your own analysis.

Conclusion

Summing up, I believe that although we are almost done with the whole Covid story, Zoom has much more to offer to its community and thus much more room to grow. Moreover, according to my assumptions, Zoom will beat the market in the long term offering its investors an ROI of 14.7% for the next years, and this return will get even higher if the stock keeps dipping.

Factoring everything above in my valuation of Zoom, I consider the stock to be a BUY close to this price.

Be the first to comment