William_Potter

Investment Thesis

Zoom (NASDAQ:ZM) heads into its investors’ day next week with the stock down +80% from its highs. On the one hand, Zoom has two key headwinds near term, namely slowing new subscriber figures and FX impact.

On the other hand, Zoom’s investor day will want to turn the narrative toward its growth prospects at the enterprise level.

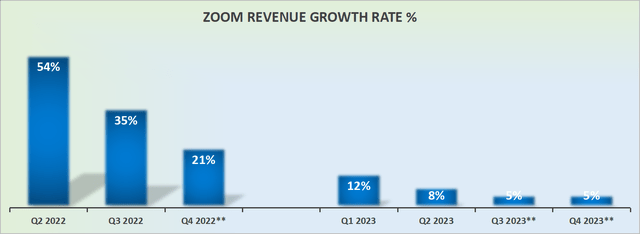

On yet the other hand, there’s no denying that Zoom’s revenue growth rates are starting to mature.

Finally, we should keep in mind that the stock is clearly not expensive if we believe that Zoom’s bottom-line profitability could stabilize in fiscal 2023.

In sum, this is the key question, is 17x non-GAAP operating income a fair multiple for a high-quality, sticky platform? I believe it is.

Zoom Near-Term, What to Think About?

Zoom has moved beyond just video conferencing. Zoom is developing a suite of products to ensure that as more and more companies embrace their digital journeys, Zoom can be the default platform to make sure that all of the communication goes through its platforms.

The key for Zoom will be how to get customers to think about Zoom’s additional offerings, asides from video conferencing. How to get small and medium-sized (SMBs”) customers to embrace Zoom’s productivity and collaboration offerings?

Then, in the background, beyond just Zoom’s ”growth” narrative, how should investors think about Zoom’s customers as they embrace an economic slowdown?

We know from both Microsoft’s (MSFT) and Amazon’s (AMZN) conference calls that SMBs are struggling more than enterprises. We know that the macro factors have become a lot more intense in the past few weeks and are showing no signs of slowing down.

These are some of the macro considerations to keep in mind. Next, let’s dig into the micro.

Revenue Growth Rates Should Stabilize

Here’s what we know. Zoom’s fast-growing days are now in the rearview mirror. This has been obvious for a while now. Anyone that wanted to uptake Zoom’s video conferencing platform is already on the platform.

Indeed, the marginal user is unlikely to move the needle on the overall thesis, either in the bearish or bullish direction.

What is perhaps less thought about is that the comparison next year becomes a lot easier. Again, not so much in terms of revenue growth rates, but arguably more compelling on its bottom line profitability.

Profit Margins Could be Under Pressure

According to Zoom’s guidance for Q4 2023, I believe that it’s fair to accept that Zoom will make approximately $220 to $250 million of non-GAAP operating income in Q4 2023.

That means that its run rate out of Q4 2023 will be just under $1 billion of non-GAAP operating income. However, to make the math straightforward, let’s say $1 billion of operating income.

Immediately it should be noted that this is below its full-year fiscal 2023 guidance of $1.5 billion.

Yes, there’s going to be some seasonality in my estimate, but I believe that’s a reasonable assessment of Zoom’s near-term prospects.

That being said, we should keep in mind that over the next twelve months, Zoom will probably be able to scale back on many of its expenses. After all, the business is clearly not growing anywhere near as fast as it was this time last year.

Hence, we should expect management to carve out costs, and not be so aggressive in investing for growth.

Consequently, I believe that if Zoom cuts back on excess operating costs and expenses, together with some pricing power, we are likely to see Zoom’s non-GAAP operating income finishing fiscal 2023 very much in line with fiscal 2022.

And this leads me to discuss its valuation.

ZM Stock Valuation — 17x Next Year’s Operating Income

The risk and opportunity for Zoom are two sides of the same coin. How to get Zoom’s shareholder base to think about Zoom, not as a growth enterprise, but as a value stock that is valued off of its operating income line?

If Zoom wants to be perceived as a high-growth company, and get that growth multiple, it needs to get shareholders to believe that it can return to mid-teens growth rates and stay there. And this will be tough in the current macro environment.

If that is no longer where the upside is to be found for Zoom, and instead it’s more of a high-quality compounder that’s attractively priced, Zoom needs to ”educate” its investors to pay more attention to its bottom line prospects.

Meanwhile, looking out to fiscal 2023, Zoom is priced at approximately 17x my estimated non-GAAP operating income. This is not 17x forward sales, but actual income.

The Bottom Line

The most pertinent question that investors now have to have to ask themselves is what kind of multiple is reasonable for a high-quality business? We know that Zoom is an incredibly sticky product. We also know that, unlike other SaaS businesses, Zoom has been highly profitable from the start.

We also can see that without any heroics, Zoom’s operating income is likely to turn higher in fiscal 2023, as it moves beyond the tough comparisons with this year. Indeed comparisons should become substantially easier after H1 2023.

In sum, sentiment is now low and mostly bombed out. Indeed, as a point of fact, I suspect that few investors would be ”proud” of owning Zoom in their portfolios as the stock is down so significantly in 2022.

What is more, with the stock down so significantly in 2022, I’m inclined to believe that anyone that wanted to be out of the stock is already out of the stock. That’s an attractive setup for 2023.

Be the first to comment