VioletaStoimenova

Thesis

ZipRecruiter (NYSE:ZIP) is a company that provides a software system that facilitates the streamlining of the recruitment process. This process is a notoriously long and strenuous process for candidates and recruiters. This has seen recruiters and candidates alike adopt ZIP’s system that allows a smoother process. The strength of the economic environment is pivotal for ZIP, as this equates to more job openings and therefore higher usage of the software. However, an impeding economic downturn could depress ZIP’s price further, providing an opportunity for the long term investor.

Company Background

ZipRecruiter, Inc. is in the business of offering digital recruiting services to businesses of all sizes. With reseller plans, integrations with applicant tracking systems, and an email alert system, it greatly improves accessibility for recruiting. With the help of its cutting-edge technology, ZipRecruiter is able to compile the outcomes from over a hundred different job boards in one place. Additionally, ZipRecruiter employs machine learning algorithms to choose which candidates and jobs should be matched. Examples of these signals include the frequency with which a profile is viewed, the frequency with which a candidate is encouraged to submit an application, the length of time a recruiter spends looking over a profile, etc.

Company Presentation

ZipRecruiter’s value proposition as a mediator is contingent on the network effects it generates between the employer and candidate bases it services. These effects serve as the impetus for the company’s choice to expand, in order to capitalize on economies of scale and establish new barriers to entry.

We remain confident in our strategic priorities and focus on the long-term opportunity. With over 4 million workers fill quitting their jobs every month for the past 13 months. It’s clear that job seekers are demanding more from where they work and need the right tools to help them find the right job. Employers in turn need the best technology to surface the right job seekers in the market. ZipRecruiter helps both sides of the marketplace achieve their goals.

Ian Siegel, CEO

As the employment nodes get denser as a consequence of the inclusion of marginal firms, job searchers will benefit from a reduction in the amount of time spent searching for acceptable possibilities. That is because ZipRecruiter actively promotes candidates to employers, jobseekers have a larger chance of finding a position that is a good fit for them, and as a result, they may secure employment more quickly. When marginal employees are integrated into the network, both businesses and jobless individuals benefit. According to data undertaken by ZipRecruiter, the first twenty-four hours after a job ad is posted are the most productive for identifying qualified candidates.

Company Presentation

This means that as the density of the node increases, the rate and quality of opportunities on both sides of the market will grow. In a nutshell, the number of people who join the platform increases according to the number of jobs and local businesses placed on it. The broader the candidate pool for open positions, the greater the number of firms interested in filling such positions. This results in the formation of a positive feedback loop that benefits both employees and businesses. As a result, ZipRecruiter’s data pool grows and improves, which not only makes the platform more effective at meeting the needs of both firms and individuals seeking jobs, but also accelerates the network’s overall development.

We view the likelihood that the bulk of job ads and applications will originate from LinkedIn, the largest employment website, as the greatest threat to this business model.

Macro Environment

The tight labour market and the ripple effects that it creates, such as inflation, are two sides of the same coin. Inflation is not a good indicator of growth for ZIP, but a tight labour market is a good indicator of growth. This is because there needs to be a significant reduction in costs across the board in order to support the stability in the levels of margins of companies within the economy. As a result of this, several businesses have instituted hiring freezes in an effort to fight inflation.

The labor market also remained tight with approximately one unemployed person for every two job openings in Q2 2022. However, in spite of the strength of the quarter as a whole and the shortage of talent for currently open job postings, we began to see employers pulling back on job postings during the final weeks of June.

Ian Siegel, CEO

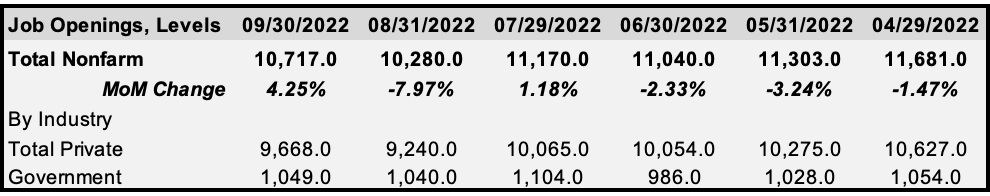

When looking further into the macro economy, one important statistic to keep an eye on is the number of people working in nonfarm employment. According to the following data from Bloomberg, there has been a large decrease in the number of job openings across both the private and public sectors during the second and third quarters of 2022. As the large lag of monetary policy starts playing out in the data (as finally admitted by the FOMC), I believe we will see a continuing slowdown in hiring. This is something that we estimate will continue into 2023.

Bloomberg, Author’s Work

Financial State of the Company

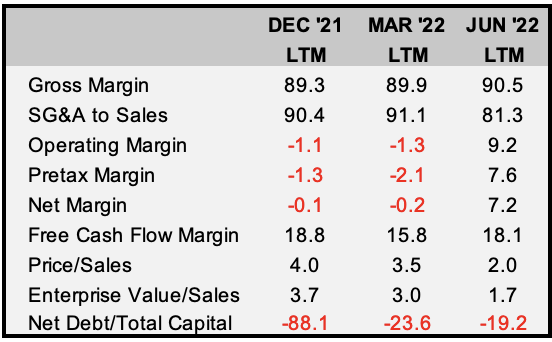

Given the resilient nature of the 2022 labour market and the exuberant shortages made evident by multi decade low unemployment rates, the margins of ZIP have held up exceptionally well. Providing a source of profitability within their bottom line. The disconnect is also attributed to the decrease in the multiple paid, halving in 2022. This discount in the multiple has fallen in tandem with the market, but also exhibits investor worries that 2023 will be partially bad for unemployment. ZIP has significant operating leverage through their balance sheet, allowing them to be well positioned for a potential downturn in the economy.

FactSet, Author’s Work

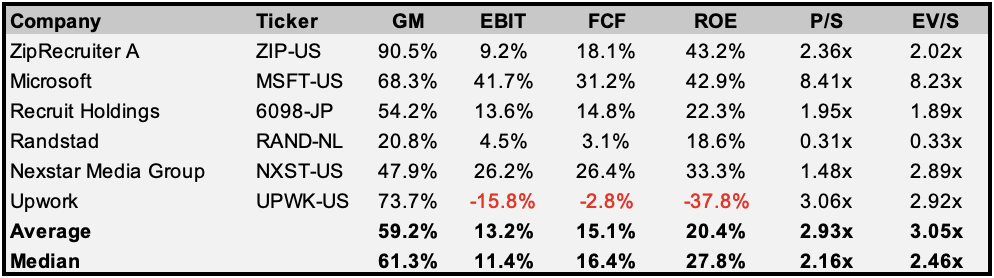

While many of the below companies are recruiters, or have business segments that may compete with ZIP (Microsoft’s LinkedIn), they are a great proxy for a blended group of recruiters who face similar economic trends and the software that pushes these trends.

FactSet, Author’s Work

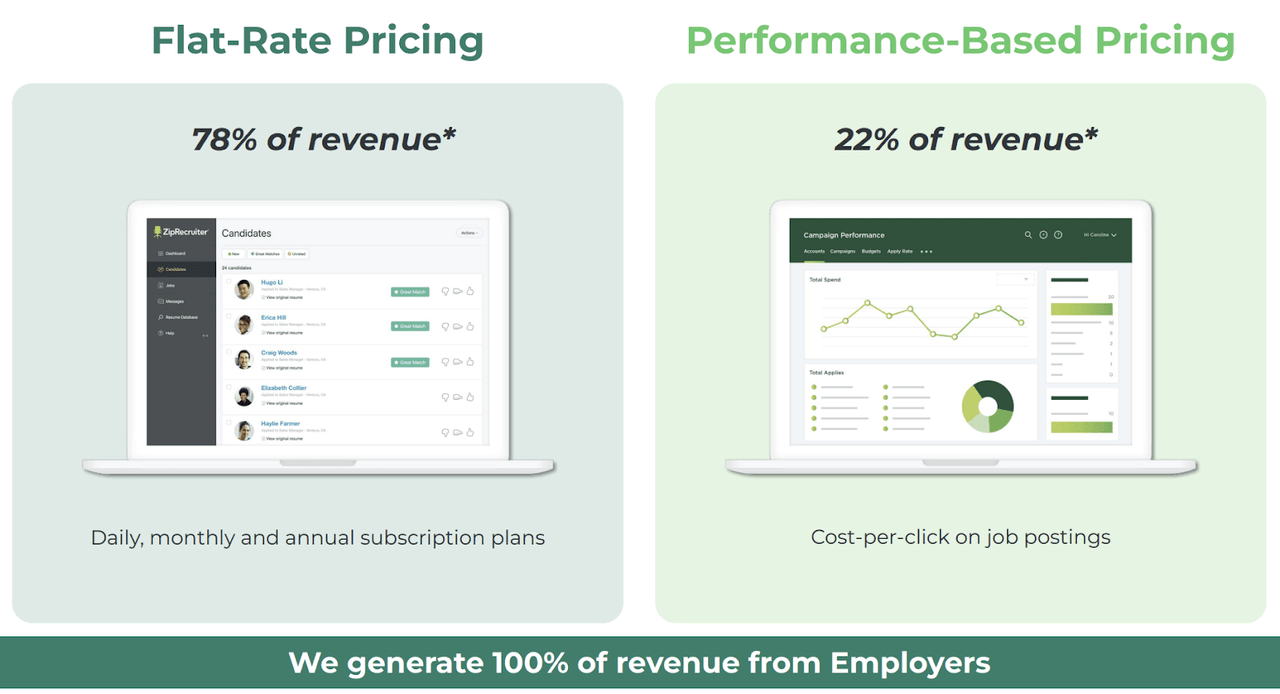

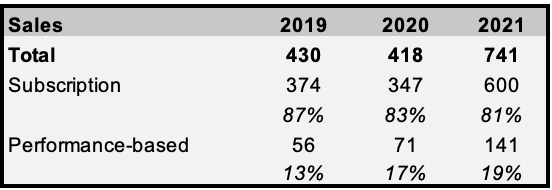

The company boasts two significantly different pricing models. The most popular is the subscription model in which employers are charged monthly or yearly, and the second being a performance based model.

Company Presentation

As made evident below, the growth in the performance based model of software will continue to be the next leg of growth for software companies. This is due to recency bias. Software subscription models were the winners of the last bull run, as companies rarely looked to cut costs given the benign inflation and ease of borrowing. We are currently entering into a different regime, and software companies that are able to adapt will continue to see growth and adoption into the next era of economic policy.

FactSet, Author’s Work

Risks

The key exogenous factors that threaten the validity of the premise and, consequently, ZIP, are a prolonged economic slump or a sharp change in the level of industry competition. Although there are internal management and capital allocation considerations that must be taken into consideration, management has demonstrated their capacity to foresee and prepare for difficult economic circumstances. Additionally, the adoption risks connected to the notion that ZIP might keep taking market share away from titans of the sector like LinkedIn could be troublesome for the thesis.

Final Thoughts

Although I think ZIP has significant long-term development potential, I think it will be challenging for ZIP to navigate the economy in 2023. How the stock does in 2023 may depend in part on if hiring slows down further. However, I do believe ZIP will thrive over the long run in its niche market and might eventually get enough traction to be purchased by Microsoft as a LinkedIn inclusion.

Be the first to comment