Daniel Wright/iStock Editorial via Getty Images

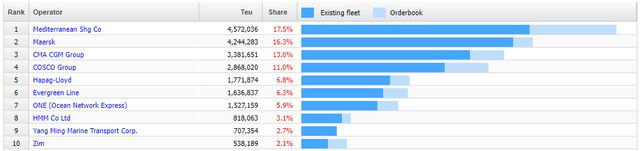

Earlier this year, Israel-based liner company ZIM Integrated Shipping Services (NYSE:ZIM) or “ZIM” attracted strong retail investor interest due to its eye-catchingly high payouts and the fact that the company remains the only large U.S. exchange-listed container liner.

While ZIM barely makes the Top 10 of the world’s largest liner companies, the company has pocketed its fair share of the recent container shipping bonanza.

Since listing on the Big Board in early 2021, ZIM has declared a whopping $32 per share in dividends.

Like all liner companies, ZIM has been enjoying record-high earnings and cash flows for quite some time now, but the party is about to end with investors facing a bad hangover.

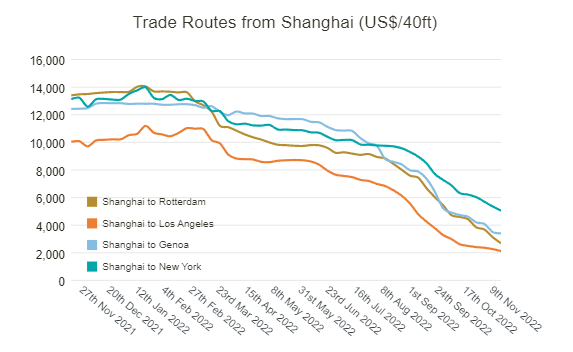

Spot rates have been dropping like a rock in recent months and are widely expected to decrease further going into next year. In fact, some industry analysts now expect a hard landing, with rates temporarily dropping below the longer-term normal.

Rates on the Asia-Europe and transpacific tradelanes remain on course to dip below pre-pandemic levels before the end of the year.

Drewry Supply Chain Advisors

Tightening monetary policy, a shift in consumer spending, elevated U.S. inventories and easing of port congestion are some of the main factors behind the ongoing drop.

With operating costs way above 2019 levels, carriers with elevated spot market exposure could be back into the red by Q1/2023.

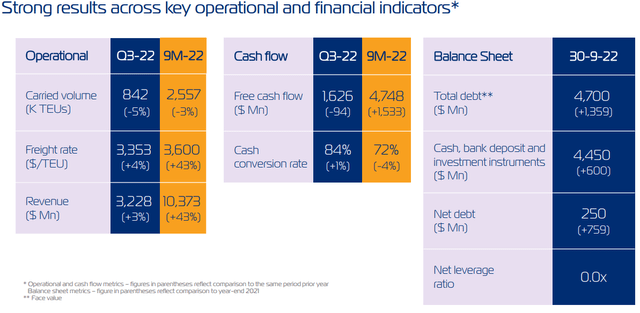

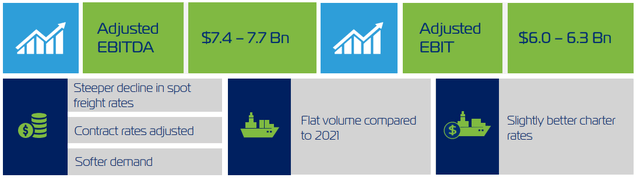

Earlier this week, ZIM reported respectable third quarter results with decent profitability and free cash flow generation, but lowered its full-year outlook substantially:

Driven by macroeconomic and geopolitical uncertainties, the near-term outlook for container shipping has shifted and the normalization in freight rates has begun. Based on our current market expectations, we now forecast 2022 adjusted EBITDA of between $7.4 billion to $7.7 billion and adjusted EBIT of between $6.0 billion to $6.3 billion. (…)

Previously the Company expected to generate Adjusted EBITDA of between $7.8 billion and $8.2 billion and Adjusted EBIT of between $6.3 billion and $6.7 billion.

As a result, profitability will be cut in half on a sequential basis, with the dividend likely around $1.50.

Please note that ZIM distributes dividends on a quarterly basis at a rate of approximately 30% of its net quarterly income, with the total cumulative annual dividend targeted between 30% and 50% of the company’s annual net income.

While ZIM opted for the top of the range last year, the challenging industry outlook makes another catch-up payment highly unlikely, particularly when reading between the lines of Wednesday’s conference call transcript.

That said, the company’s total cash position of $4.44 billion calculates to approximately $37 per share and while ZIM states $250 million of net debt, the vast majority of these obligations are vessel leases.

At the current pace of freight rate declines, ZIM would likely start to lose money by H2/2023 at the latest point. Consequently, investors need to prepare for the dividend ultimately being cancelled next year.

Judging by the comment sections of recent ZIM articles on the platform, many retail investors seem to be unaware of the fact that the company’s dividend policy requires ZIM to generate net income for potential payouts.

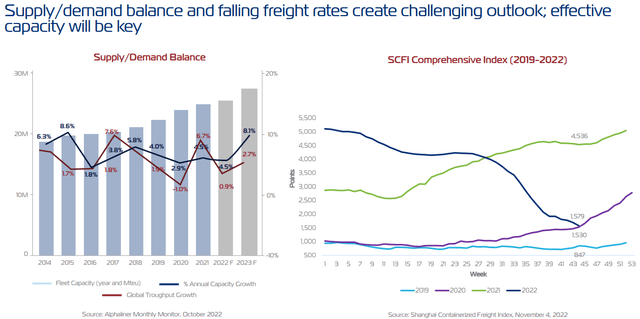

Going into next year, the industry appears to be facing the perfect storm, with muted demand being exacerbated by vastly increased capacity:

Current estimates are for an effective 11.3% net increase in container shipping capacity next year with demand growing at just 1.9%.

Even new environmental regulations are unlikely to mitigate the looming oversupply in the short-term.

Bottom Line:

Tough times ahead for container liners and particularly ZIM investors as the dismal outlook is likely to result in the company leaving the annual payout at 30% of net income, which in turn means no catch-up payment for 2022 next year.

Even worse, with the company likely starting to lose money in the second half of next year at the latest point, investors need to prepare for the dividend to be cancelled entirely.

As the hefty payout has attracted a large number of retail investors to the shares, I would expect news of the dividend being reduced to a tiny fraction of today’s levels or even cancelled altogether to result in additional selling pressure.

With plenty of negative catalysts still ahead, I firmly expect liner companies’ shares to underperform the market regardless of vastly improved balance sheets and plenty of liquidity to weather the gathering storm.

With dividends likely to evaporate next year and the company facing losses sooner rather than later, I still expect ZIM’s shares to fall even further.

At this point, I wouldn’t be surprised to see the shares trading below $20 going into 2023 should rates continue to drop at the current pace.

Be the first to comment