Editor’s note: Seeking Alpha is proud to welcome Halin Park as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

tawatchaiprakobkit

ZIM Integrated Shipping Services (NYSE:NYSE:ZIM) is currently a hot potato in investment communities, but many of the current articles are based on the past performance of the company as they focus on PE ratios and other profitability ratios that are based on COVID-19 earnings that will not be replicated. As ZIM has an unique asset-light business model even compared to other container shipping companies, it is difficult to value ZIM through relative valuation and it is also difficult to conduct traditional valuation through future earnings. However, I believe such difficulties and fears about the future have brought down ZIM’s share price to a point where it is a strong buy even disregarding its dividends. In this article, I will present cases pertaining ZIM up to FY2023. I will also try to present some information that haven’t been focused on, so that readers can learn something new from this article.

Quick company walkthrough

ZIM is an Israeli container shipping company established in 1945. The company has an asset-light model and most of its business is done on a short-term basis. It is exposed to short-term spot rates, but is transforming itself into a company with more long-term contract exposure and is also becoming more asset heavy through its LNG newbuilds. According to its Q3’22 Earnings call, around 50% of ZIM’s volumes are long-term contracts while the other half are spot contracts. So the company is highly exposed to both lease rates and spot rates in main trading routes in the near term.

Near-term prospects

Current spot rates according to the Drewry World Container Index and Freightos Baltic Index have been constantly dropping, but ZIM’s operating income has mostly been positive even in 2017-2019, which can lead us to guess that the company is still wildly profitable at these current rates which are still nearly double of pre-COVID levels.

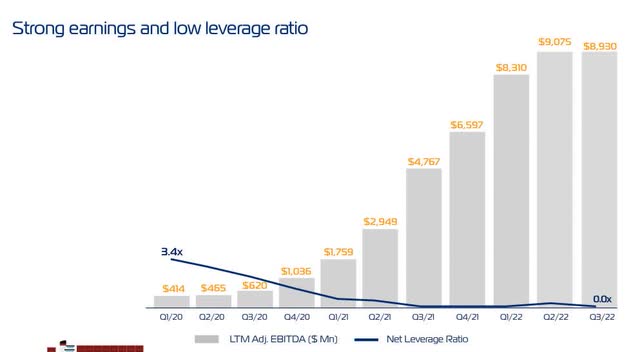

ZIM’s leverage ratio (ZIM’s Q3 Earnings Presentation)

ZIM has also been heavily deleveraging, and is almost debt free if you take out its lease liabilities. So its interest expenses will be less than pre-COVID, which will allow the company to be profitable in the near future. ZIM’s non-operating income has also been on the rise, which is probably from it using its huge cash reserves to earn interest.

So even with the drastic drop in spot rates, the current spot rates are still profitable for ZIM and, combined with the deleveraging efforts, we can expect the company to be profitable in the near term. It is also worth mentioning that ZIM receives a premium over SCFI rates thanks to its efficient business model, according to the Q3’22 earnings call.

Valuation of ZIM’s cash position

Due to ZIM’s asset-light model, a cursory glance over its balance sheet will prevent investors from seeing how much of a fortress balance sheet ZIM has.

If you take a close look at ZIM’s balance sheet, most of the liabilities come from its lease liabilities. According to the Q3’22 balance sheet, ZIM has $99.8 million in short-term debt excluding current portion of long-term debt, and $140.1 million in long-term debt excluding lease liabilities. ZIM also has $3.16 billion in cash and $1.09 billion in receivables. As of the time of this article, ZIM’s market capitalization is around $2.5 billion, which already makes it a net-net stock. ZIM has also earned $92 million on Q3’22 through interest income, which is near the current T-bill rate when you factor in the company’s current cash.

So currently ZIM is being valued less than its net cash position, at a time when its financial position is the strongest it has been in its history. And you also get 4 vessels owned by the company for free at this valuation, which makes ZIM an asymmetrical bet for the value investor even disregarding its dividends.

Bull-Bear cases for ZIM

With that in mind, I’ve set up some likely cases for ZIM.

Before I delve into the possible cases for ZIM, the company’s dividend policy needs to be mentioned for readers to get the full picture. ZIM’s current dividend policy gives 30% of quarterly net income on Q1~Q3, and a “step-up” dividend of up to 30~50% of total annual net income on Q4. When considering cases for ZIM, I’ll use this as a basis point, but keep in mind that the dividend policy may change. I’d like to highlight the following comment by CFO Xavier Destriau (at the Q3 earnings call) when questioned on the continuation of ZIM’s dividend policy:

At this stage, what has been very important to the company is to say what we tend to do and execute on what we said, we’ve been consistent in that approach, I think since the Thursday as being a listed company, and we have adjusted on several occasions of delivering our dividend policy. So today, this quarter, we continue to be true to our words and announced this 30% dividend payout. I think when it comes to what may be the discussion on the decision of the company, in March when we release our full year financial statement.

It’s a little bit too much premature today to opine as to where we will land the consideration that will be taken at the time will be obviously how did we close the year, but also as importantly, what do we think the outlook is ahead of us, and there is lot of unknown data at this point, which again I think make us say that it’s a little bit too early –too premature to opine on what might be the year two payment next year.

If ZIM pays out 50% of total annual net income, you will receive around $10 in dividends pre-tax on Q4, according to management’s adjusted EBITDA forecasts.

Bull case

The bull case will be brought about by various catalysts that may or may not happen, where earnings higher than current analyst expectations are obtained. There is one catalyst that is sure to happen on January 1, 2023 – EEXI regulations.

EEXI regulations that will be enforced on January 1st, 2023 means older ship speeds will fall with more capacity needed. This will most likely have a positive effect on shipping rates from Q1’23 onwards.

Another catalyst that may happen is blank sailings increasing to prop up rates, which have a positive effect on rates despite the big increase in newbuild rate. The current ratio of canceled sailings is 14%, and the ratio of canceled sailings have been consistently on the rise for 7 weeks.

There are other possible geo-political catalysts such as Russia-Ukraine war ending, China reopening, and port congestion increasing due to other macro-economic factors such as the impending rail strike which are expected to have a positive effect on shipping demand.

In such a case, it can be expected that ZIM will at least appreciate to its net cash position in FY2023, which will be $42+ post-dividends, with the price target changing on what catalysts have happened throughout the year.

Base case

The base case would be where current analyst earnings expectations with an average of $4.44 FY2023 hold up, and ZIM retains its current dividend policy. In this case, ZIM will give out around $2.22 pre-tax in dividends FY2023.

As ZIM will have around $40 in net cash per share at end of this year, it will have around $42 in net cash per share at the end of 2023 in the base case. If fears of a shipping Armageddon are quelled, and if ZIM manages to stay profitable in FY2023 despite such fears, it is reasonable to expect its share price to appreciate to its net cash position of $42 post-dividends.

Bear case

The bear case would be caused by a global recession where spot rates fall to or even below pre-COVID rates, with the amount of dividends uncertain.

If rates fall below pre-COVID rates, ZIM will then most likely incur a net loss even with its strong financial position. The company incurring a net loss is more unlikely than the past, as spot rates are expected stabilize over pre-COVID rates in the near term, and as shipping alliances have been increasingly blanking sailings.

If rates remain around pre-COVID rates, ZIM’s net income will most likely be positive as the company’s non-operating income has been rising QoQ while the company has been deleveraging to reduce interest expense at the same time. ZIM’s operating income has been positive from 2017 onwards, which means that its deleveraging efforts, together with it earning interest on its cash, will most likely prevent the company from a net loss even in bearish assumptions.

ZIM is an asymmetrical bet

So all in all, the current market price of $22 as of the time of this article is positing that ZIM will perpetually burn through cash, and accrue a net loss of at least $18 per share in its lifetime. As I’ve mentioned before, ZIM will burn through less cash even in the bear case as it has an almost zero leverage ratio and a large cash reserve which it can earn interest through. So when looked at in the eyes of the owner, for the investor to lose out on ZIM, current spot rates will have to fall significantly below pre-COVID rates perpetually.

Risks unique to ZIM

Even though ZIM looks great on paper, the company has some unique risks which cannot be ignored.

Israel has a special state share in ZIM, which will prevent takeovers and therefore prevent the company from being acquired at its intrinsic value. Also, as Israeli regulations allows ZIM’s fleet to be used in national emergencies, it isn’t likely that the company will ever be up for acquisition. Israel’s special state share also prevents ZIM from moving its headquarters to a country with less taxes, which means investors will be stuck with paying 25% of dividends in taxes.

Also, Israel’s special state share requires ZIM to own 11 ships, which is currently waived. But when ZIM acquires new ships instead of chartering them, it will be subject to the minimum fleet requirements again, and it might be difficult for the company to transition to an asset-light business again.

Finally, the majority of ZIM’s board and its CEO must be from Israel, which may prevent shareholders from changing management. KEN still holds 21% of ZIM, which may prevent the company from utilizing capital freely.

ZIM has been under criticism for not going through buybacks and being continuously undervalued. The company may continue to be undervalued as it is not a feasible target for acquisition, and as it may not be able to utilize capital freely.

Conclusion

Despite the risks mentioned above, ZIM seems to be an attractive hold at least in the near term. If bad macroeconomic headwinds keep prevailing over longer periods, ZIM may start to burn through its fortress cash reserves. But it will require many years of consecutive losses, which makes this an attractive hold from a value investment point of view. I therefore rate ZIM stock a Buy.

Be the first to comment