anyaberkut

A Quick Take On Zeta Global

Zeta Global (NYSE:ZETA) reported its Q3 2022 financial results on November 1, 2022, beating expected revenue and missing EPS estimates.

The company operates a programmatic marketing automation and consumer intelligence platform for advertisers worldwide.

Given the firm’s growth trajectory, steadily increasing forward guidance and discounted valuation, my outlook on ZETA remains a BUY at around $7.90 per share.

Zeta Global Overview

New York, NY-based Zeta was founded to develop advanced online advertising capabilities for companies to generate greater returns from their online marketing efforts.

Management is headed by co-founder, Chairman and CEO David Steinberg, who has been with the firm since and was previously founder and CEO of InPhonic, a wireless phone and communications products company.

The company’s primary offerings include:

-

Opportunity Explorer

-

Identity Graph

-

Intent Graph

-

Agile Intelligence

-

APIs

The firm pursues primarily large-sized clients across all major industry verticals via a direct sales model.

Zeta’s Market & Competition

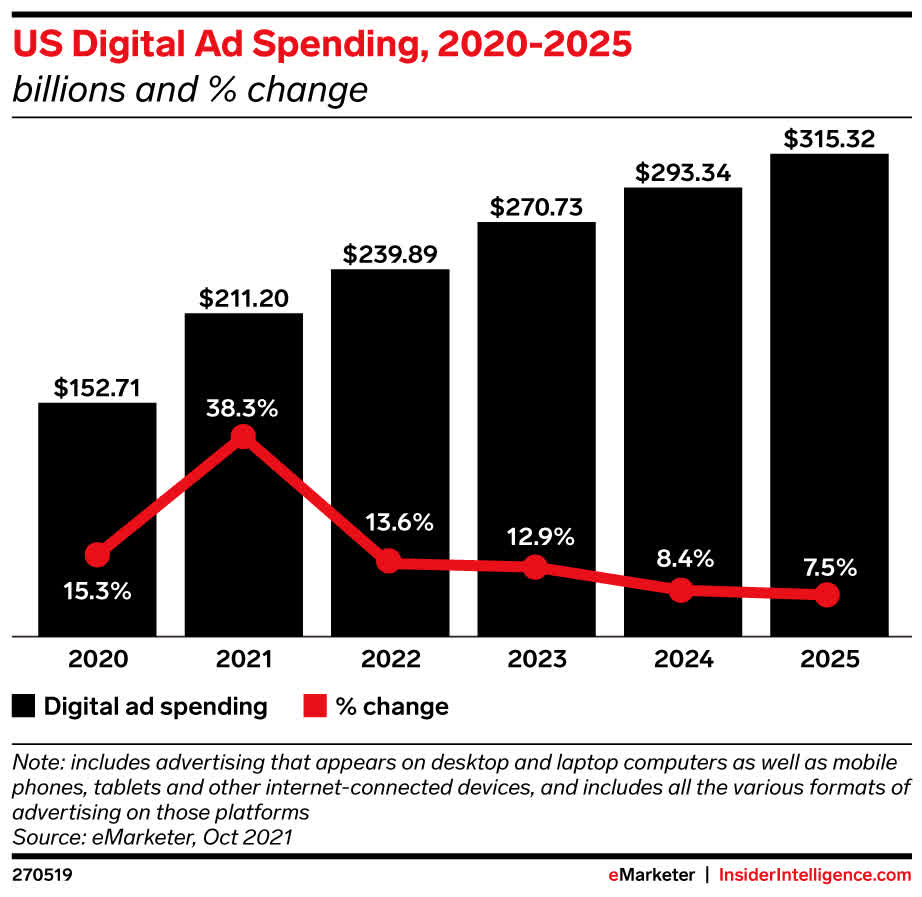

According to a market research note by eMarketer, the market for digital ad spending was an estimated $153 billion in 2020 and is forecast to reach $315 billion by 2025.

In 2020, despite the global pandemic, digital ad spending grew by 12.7%.

The note asserts that 2021 saw significantly increased digital advertising growth after a slower-than-expected 2020, but that future growth rates will decline through 2025.

The chart below shows the report’s forecasted growth trajectory and digital ad spend percentage of total, from 2020 to 2025:

U.S. Digital Ad Spending (eMarketer)

Potential competitors include:

-

Google

-

Adobe

-

Yahoo

-

Meta

-

Oracle

-

Skai

-

Amazon

-

Criteo

Zeta’s Recent Financial Performance

-

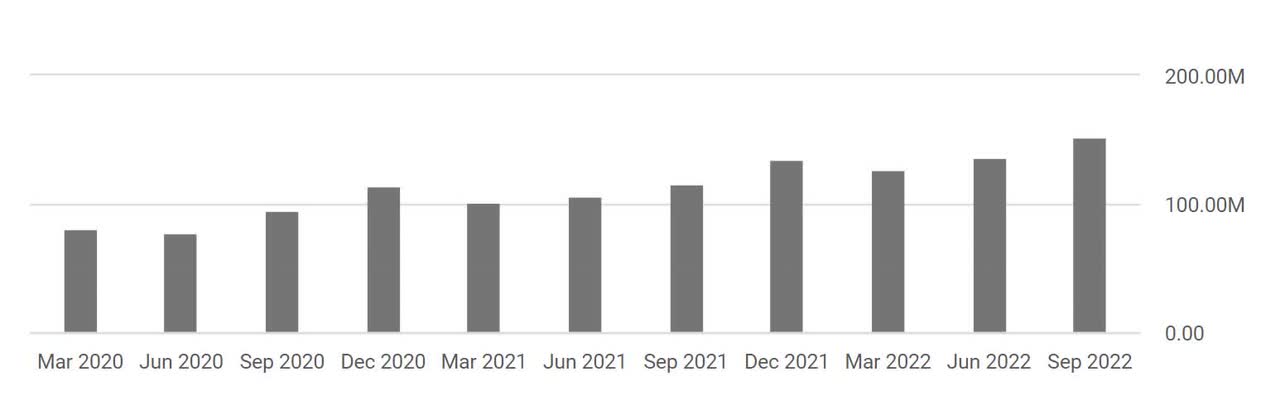

Total revenue by quarter has grown according to the following chart:

Total Revenue History (Seeking Alpha)

-

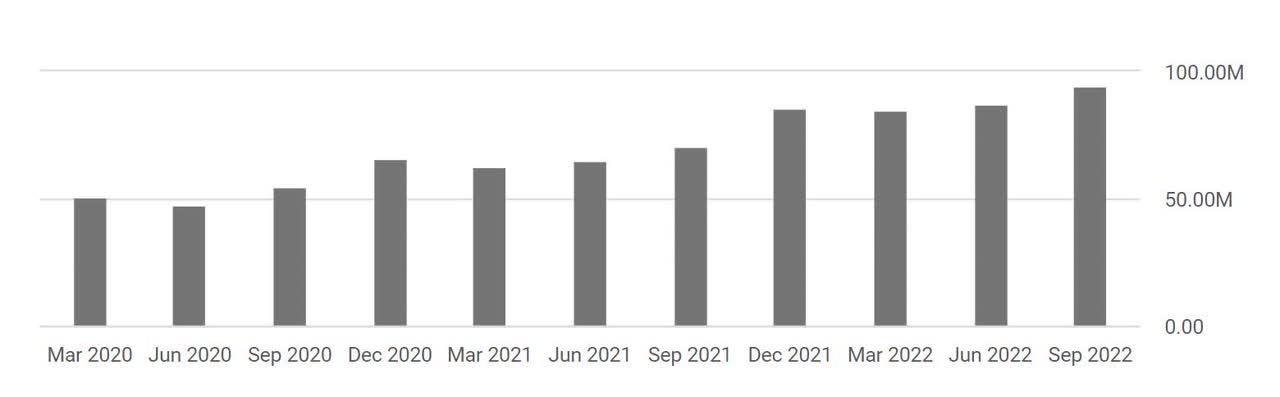

Gross profit by quarter has also risen in a similar trajectory:

Gross Profit History (Seeking Alpha)

-

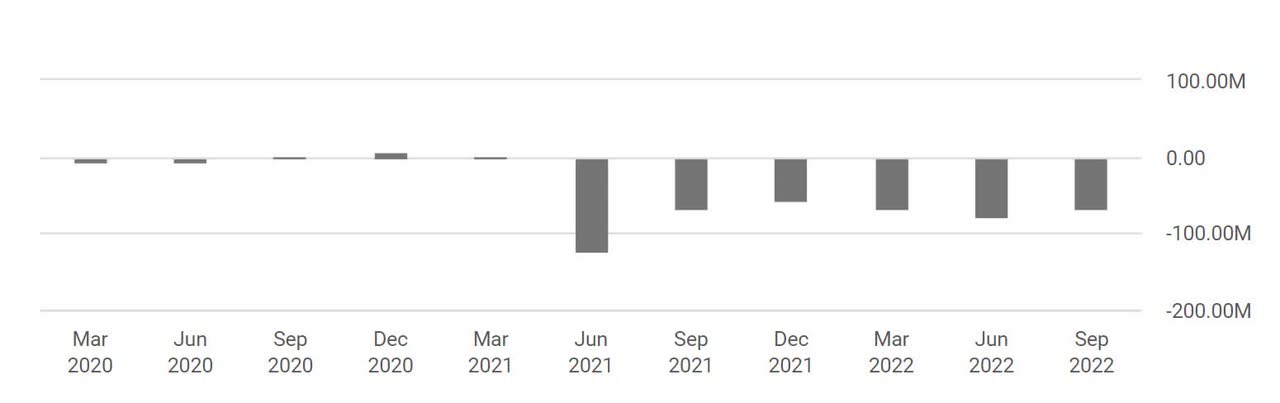

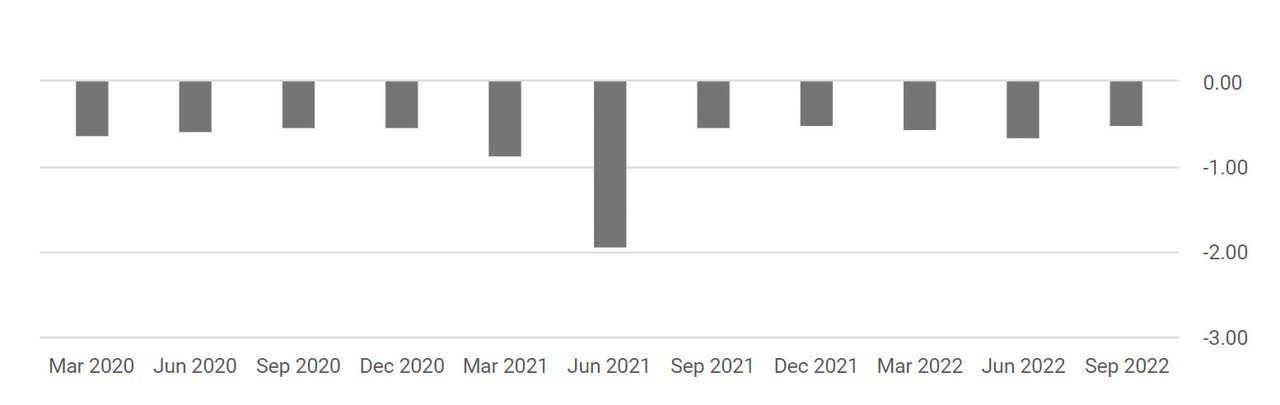

Operating income by quarter has remained significantly negative in recent quarters:

Operating Income History (Seeking Alpha)

-

Earnings per share (Diluted) have also remained negative, as the chart shows below:

Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

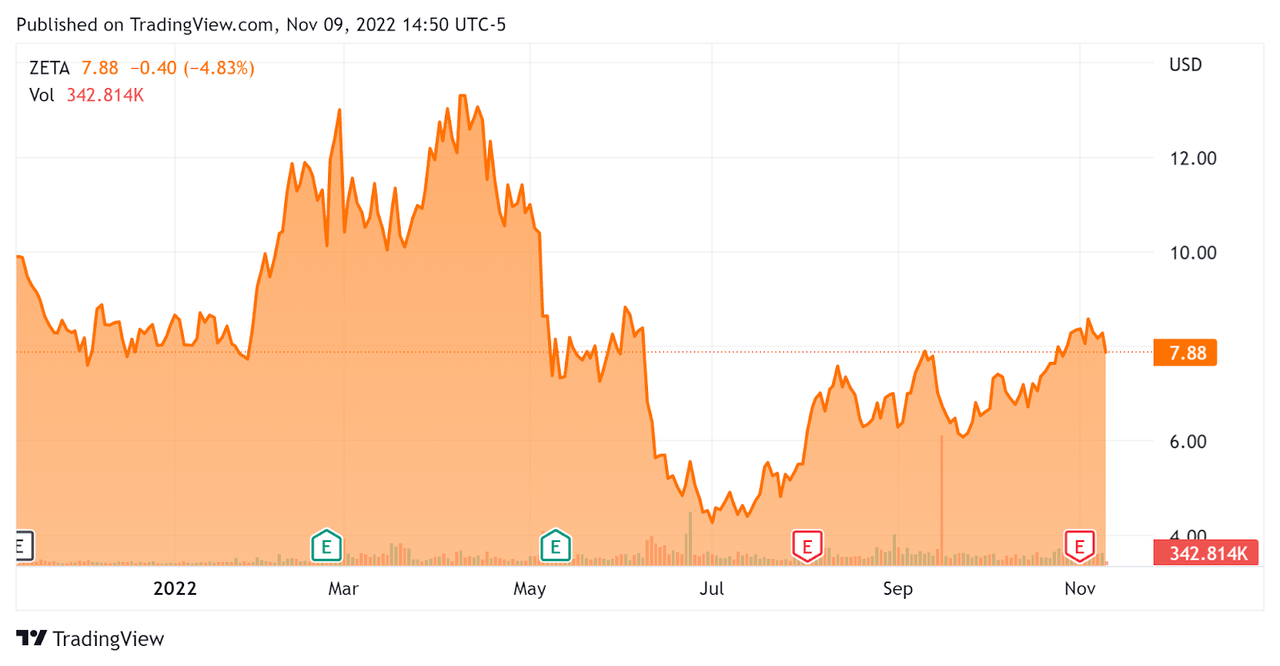

In the past 12 months, ZETA’s stock price has dropped 20.2% vs. the U.S. S&P 500 index’ drop of around 19.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Zeta Global

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.19 |

|

Revenue Growth Rate |

25.7% |

|

Net Income Margin |

-52.4% |

|

GAAP EBITDA % |

-39.4% |

|

Market Capitalization |

$1,690,000,000 |

|

Enterprise Value |

$1,760,000,000 |

|

Operating Cash Flow |

$76,320,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.16 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ZETA’s most recent GAAP Rule of 40 calculation was negative (13.6%) as of Q3 2022, so the firm is in need of significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

25.7% |

|

GAAP EBITDA % |

-39.4% |

|

Total |

-13.6% |

(Source – Seeking Alpha)

Commentary On Zeta Global

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its belief that ‘the market is moving even closer to Zeta’s sweet spot,’ as its platform was designed to improve online marketer efficiency.

During the quarter, the company added 16 new scaled customers, a record for one quarter.

As to its financial results, topline revenue rose 32% year-over-year and adjusted EBITDA was up 40%.

The company’s Rule of 40 results has been disappointing, with the most recent trailing twelve-month figure of negative 13.6%.

Operating losses remain significantly elevated, although reduced sequentially. Earnings per share also remain heavily negative.

For the balance sheet, the company ended the quarter with cash and equivalents of $114.8 million and $183.9 million in long-term debt.

Over the trailing twelve months, free cash flow was $56.5 million, but the company paid out an enormous $301.8 million in stock-based compensation.

Looking ahead, management again increased its full year 2022 guidance to a revenue growth rate of 19% and adjusted EBITDA (ex. stock-based compensation) increasing by 29% over 2021.

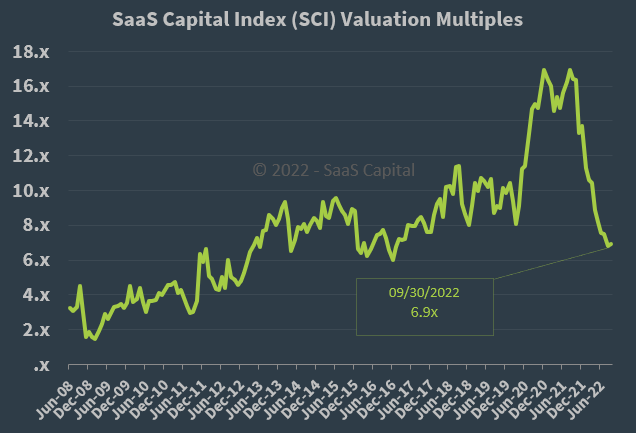

Regarding valuation, the market is valuing ZETA at an EV/Sales multiple of around 3.2x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.9x on September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, ZETA is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

A potential further upside catalyst is the continued pressure on companies to adjust their digital marketing strategies as a result of third-party cookie restrictions from major platforms.

Given the firm’s growth trajectory, steadily increasing forward guidance and discounted valuation, my outlook on ZETA remains a BUY at around $7.90 per share.

Be the first to comment