Patrickistock

Over the year, our internal team has decided to overweight the luxury fashion sector and this was mainly due to 1) brand power to offset the raw material inflationary pressure with higher selling prices, 2) clientele inelasticity, and 3) a strong balance sheet with turnover spread around the globe. During our initiation of coverage, we also emphasized how Ermenegildo Zegna (NYSE:NYSE:ZGN) was a top pick due to:

- A compelling valuation compared to its closest peers (probably due to an IPO discount);

- Higher vertical integration. Indeed, Zegna was born as a textile company;

- The company’s shareholder structure with the Zegna family still being the major shareholders, which means more cost controls and empirical evidence that suggest superior performance in crisis time;

- Strong growth of the Thom Browne brand.

Source: Mare Evidence Lab’s previous publication

Q3 Results

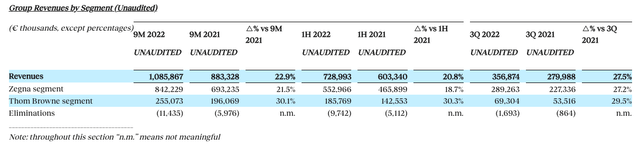

Looking at the latest company’s results, our thesis is playing out very well. Driven by a growth of 27.5% in the third quarter, Zegna’s turnover for the first nine months reached €1.09 billion, up 22.9% over the same period of 2021. Quoting the CEO’s words, the July-September period was “one of our strongest yet thanks to exceptional performance by both Zegna and Thom Browne“. Looking at the three-month results, Zegna delivered €357 million in sales, up by 27.5% on a quarterly basis and accelerating its performance after good Q1 and Q2 accounts.

In detail, the Zegna segment, which includes Zegna brand products, Textile division, and Third-party brands product lines, continued to show robust performance, with quarterly revenues of €289 million (+27.2%) after an acceleration in the period linked to the strength of all product lines. The Thom Browne brand proved to be an important growth engine for the group, with revenues amounting to €69 million in Q3 with an improvement of 29.5% annually.

Ermenegildo Zegna segment sales

Source: Ermenegildo Zegna Q3 press release

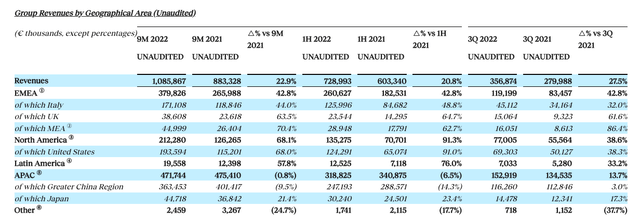

Geographically speaking, all the regions in which the group operates continued to record “significant growth“. With its €116 million in revenue, Greater China returned to growth by 3% in the quarter, reporting a solid rebound in July and August, before the new closures were announced in September (again for a COVID-19 outbreak with a major impact on regions such as Chengdu, Shenzhen and Tianjin). In the APAC region as a whole, turnover amounted to €153 million with an increase of 13.7% due to the positive trend of Thom Browne.

The EMEA area recorded the strongest growth in the quarter and was up by more than 40% compared to the previous year. Positive contributions were also achieved in the Middle East and the UK. Sales in the Americas increased by 38.6% for North America and by 33.2% for Latin America, to €77 million and €7 million respectively. The United States, an area of interest and strategic growth for the group, recorded an increase in revenues of 38.3% to €69 million.

Source: Ermenegildo Zegna Q3 press release

Conclusion and Valuation

Ermenegildo Zegna delivered a good set of numbers and despite the macroeconomic challenges, the company reaffirmed its mid-teens full-year revenue outlook. In the Q3 press release, there was no disclosure on the operating profit margin; however, the company declared that it “continues to anticipate solid improvement in our Adjusted EBIT“. During the CMD presented last May, the EBIT margin was set at 15%. With the positive management guidance and the supportive latest results, we continue to see Zegna at a 20% discount compared to its peers. On a P/E basis in 2023 numbers, the company is still trading at 18x versus a sector average of 23/24x. Today, we also reviewed the latest quarterly results of Moncler (OTCPK:MONRF), the Italian competitor is currently trading at a P/E in 2023 and 2024 which stands at 22.5x and 19.6x. Not to mention the valuation of the French luxury powerhouses such as LVMH (OTCPK:LVMHF) and our strong buy thesis on Kering (OTCPK:PPRUY), but limiting our comps analysis with a focus on the Italian luxury players such as Cucinelli (OTCPK:BCUCF), Prada (OTCPK:PRDSY), and Ferragamo (OTCPK:SFRGF), these companies are at a P/E ratio of 50x, 31x, and 24x respectively. Therefore, we confirm our buy target at $12 per share. The main risks that might affect Zegna’s stock price performance include 1) higher marketing expenses, 2) a new lockdown from COVID-19 outbreaks (especially in the Chinese region), 3) currency development, and 4) non-successful product innovation.

Be the first to comment