Zebra Technologies (ZBRA), with a market cap of $10 billion, is a leader in automatic identification and data capture that includes barcode scanners, specialty labeling, and related software. Zebra is benefiting from trends in cloud computing, enterprise mobility, and automation as it continues to innovate with new products and solutions. The company reported Q4 results back in February with a record year for earnings despite a challenging macroenvironment in 2019 with weaker trends in the Asia-Pacific region. This year, the ongoing coronavirus outbreak represents a new headwind but we think the current selloff in shares of ZBRA can represent a buying opportunity for a high-quality tech stock at a reasonable valuation.

(Source: finviz.com)

ZBRA Q4 and Fiscal 2019 Earnings Recap

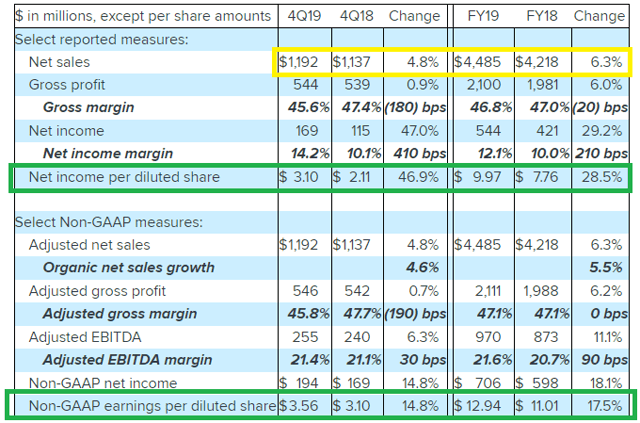

Zebra Technologies reported its fiscal Q4 earnings on February 13 with non-GAAP EPS of $3.56 which missed expectations by $0.09. Similarly, quarterly revenue at $1.19 billion was up by 4.4% year over year but $10 million below the estimates. The company highlighted an overall strong performance in the U.S. and EMEA regions while China was more tepid, continuing trends observed along 2019.

(Source: Company IR)

Financially, this was a solid year for the company. GAAP EPS climbed 28.5% compared to 2018 while the non-GAAP EPS measure reached $12.94, up 17.5% year over year. While EPS reached a record level, gross margin was pressured based on tariff-related expenses leading Zebra to prioritize certain products impacting the product mix. Nevertheless, the adjusted EBITDA margin for the quarter and the full year increased, driving higher net income. Management made the following comments in the conference call summarizing the results:

Our diversified business is enabling us to post solid growth despite an uneven global macro economy. The continued soft environment in China was more than offset by growth in our North America and EMEA regions. We grew all our major verticals led by healthcare, retail and transportation and logistics. We drove double-digit growth in our enterprise mobile computing portfolio which capped another exceptional year. Our customers utilize our mobile computing solutions for new use cases on the Android platform as we benefit from our leadership in the transition from the sun-setting Windows operating system.

One of the highlights of Q4 was Zebra’s acquisition of Cortexica Vision Systems in November. The company specializes in visual analytics through artificial intelligence solutions that include object recognition and machine learning. The deal is an example of Zebra’s commitment to innovation and remaining the market leader in identification.

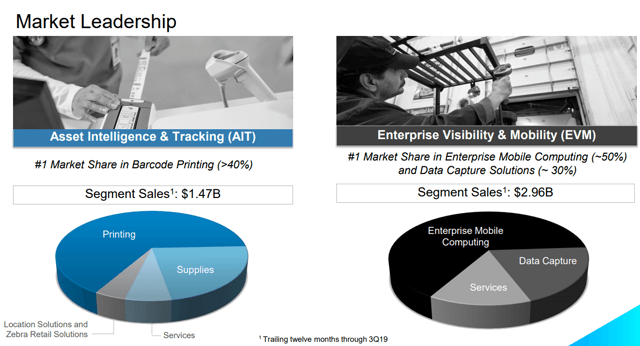

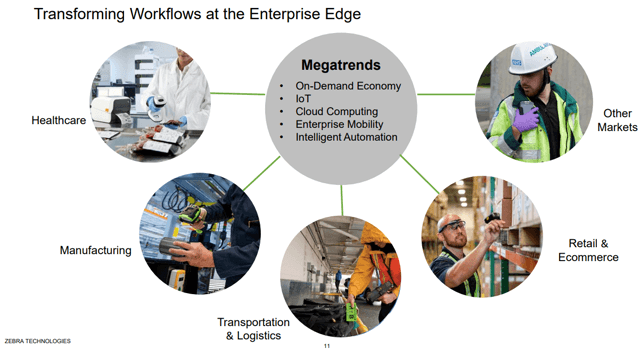

Zebra notes its market leadership position in barcode printing with a market share of over 40%. The separate software integration solutions or Enterprise Visibility & Mobility (EVM) was the largest segment with $3.0 billion in revenue last year, including enterprise mobile computing and data capture each with a 50% and 30% market share. The industries served are diversified across retail and e-commerce, manufacturing, logistics and healthcare, among others. Keep in mind this is more than simply “barcode scanners,” the solutions include specialty and proprietary equipment along with integrated software as a supply-chain management tool.

(Source: Company IR)

Zebra ended the year with $30 million in cash against $1.3 billion in total debt. A current ratio of 0.85x was pressured during the quarter, given its acquisition of Cortexica along with other deals in 2019 totaling $262 million. Separately, Zebra also repaid $312 million in debt and repurchased $47 million in its share buyback program. The important factor is that the company generates strong levels of operating cash flow which reached $685 million in 2019 while reporting a free cash flow level of $624 million. Zebra ended the year with a net debt to adjusted EBITDA multiple of 1.3x, which is expected to improve going forward.

ZBRA 2020 Guidance and Outlook

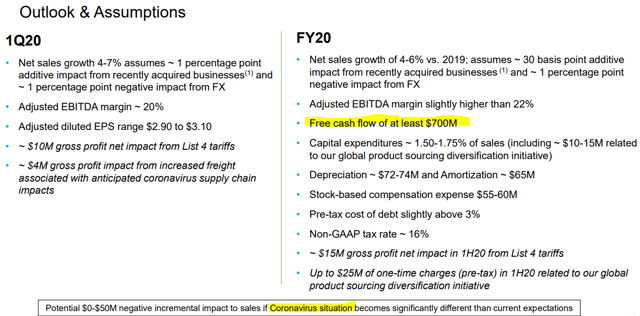

Management issued fiscal Q1 and full-year guidance. For 2020, net sales growth is expected to be in a range between 4% and 6%, with smaller offsetting positive and negative impacts from acquired businesses and FX variations. Adjusted EBITDA margin “slightly higher than 22%” if confirmed represents an improvement from 21.6% in 2019. The free cash flow target of “at least $700 million” compares to $624 million last year.

(Source: Company IR)

Notably, there was also a comment about the potential impact of the ongoing coronavirus outbreak. Management sees a $0-50 million hit to sales if the situation deteriorates from current projections. For context, $50 million represents about 1% of full-year sales. Further comments in the conference call suggested the situation remains fluid with a great deal of uncertainty. Remember that these comments were made back in February when the outbreak was more or less localized in China. By this measure, the situation has already deteriorated in the period since. Management cites a large order backlog and flexible supply chain it feels can mitigate any effects.

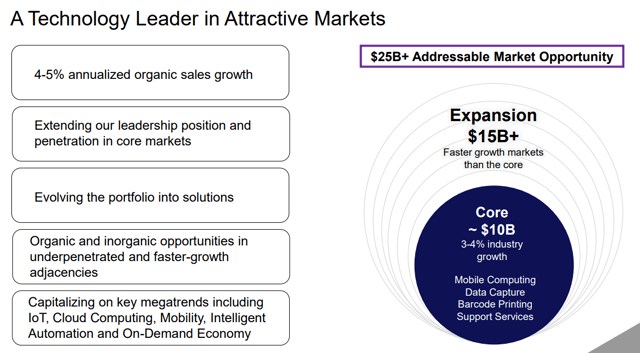

Longer-term, management sees a total addressable market opportunity of $25 billion globally that can be met through its ongoing expansion. An existing core market space of $10 billion is +2x 2019 revenues of $4.5 billion. The trends here include a combination of underlying organic growth between 4-5% per year and an evolving portfolio of solutions to address new uses in mobile computing and data capture.

(Source: Company IR)

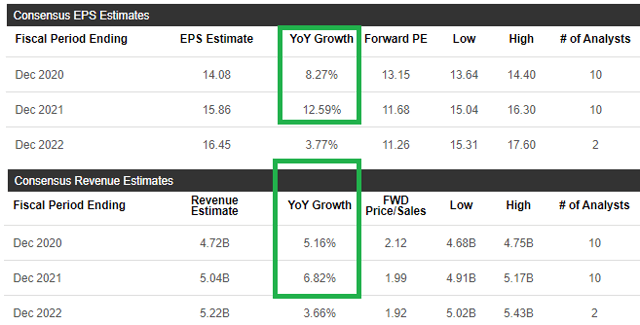

In terms of market consensus expectations, revenue growth this year of 5.16% to $4.72 billion should support a stronger EPS growth at 8.3% to $14.08 per share. In 2021, the market is also positive with an expectation that revenue growth can rebound to a 6.8% year-over-year rate and EPS can reach $15.86.

(Source: Seeking Alpha Premium)

Analysis and Forward-Looking Commentary

We like Zebra Technologies as a market leader and think the business benefits from fundamental tailwinds being the trends like cloud computing, internet-of-things, mobility, and information on demand. Zebra is likely to maintain organic growth opportunities as companies continue to transition towards the digitalization of supply chains and inventory management.

(Source: Company IR)

Zebra is unique as a pure-play on automatic identification at least among the U.S. traded stocks while several other companies also feature competing technologies. Notably, industrial conglomerate Honeywell International Inc. (HON) is recognized as a direct competitor with a line of identification scanners and related products. Separately, Italy-based ‘Datalogic S.p.A ‘ is a market leader in Europe. Globally, the market is fragmented with smaller specialty and niche solution providers. Zebra’s advantage is its partner relationships with the products tending to have a “sticky” ecosystem. Customers already using one line of products will typically stay with Zebra when expanding into other solutions.

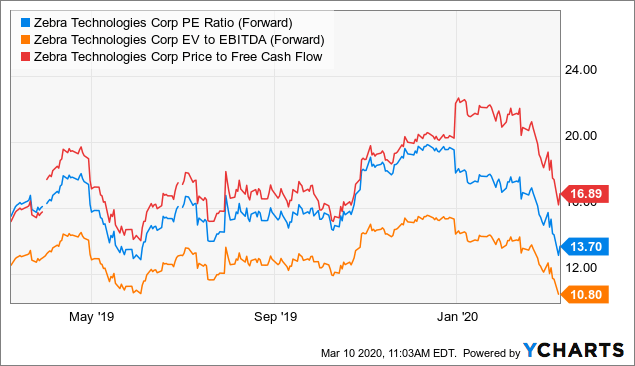

Beyond the current coronavirus outbreak and historical level of market volatility, we are bullish on Zebra as a reasonably valued growth play in tech. Considering 2020 consensus estimates, the stock is trading at 13.7x forward earnings, 10.8x EV to forward EBITDA and 16.9x on 2019 free cash flow. These levels are in the context of the stock already selling off 26% from its 2020 highs at $260 in early January, likely discounting the negative impact of the ongoing disruptions globally.

Data by YCharts

Data by YCharts

While the current consensus is that there will be an eventual containment of the virus, our concern is that the timetable for when economic activity can return to normal is unclear. We expect Zebra, along with the broader stock market, to continue trading with high levels of volatility until more clarity can be developed and a path for recovery established.

That being said, the risk here is that the current situation evolves into a recessionary environment with deeper structural impacts on the global economy that could open up more downside as growth expectations need to be reset. Considering the industries Zebra serves, the company is exposed to cyclical trends in its various markets.

We’re looking at the 2019 low of the stock around $165 as representing a strong buy level which we see as possible should current market conditions continue. Buying shares at a lower price simply improves the risk and reward setup. To the upside, our price target for 2020 at $230 per share represents approximately 20% upside from the current level. Any investor interested in this stock should consider a small allocation and average into a position over days and weeks.

Verdict

Zebra Technologies is a quality company and leader of its market segment, benefiting from several fundamental tailwinds in data mobility and automation. We like the stock as it trades at a reasonable valuation for steady growth and positive free cash flow. Considering the current market environment and uncertainty related to the coronavirus outbreak, we expect continued volatility but see any extended downside as a buying opportunity.

Build a Stronger Portfolio With The Core-Satellite Dossier

Are you interested to learn how this idea can fit within a diversified portfolio?

With the Core-Satellite Dossier, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas.

Get access to all our exclusive features including:

- Model portfolios built around different strategies.

- A tracked watchlist of our top picks.

- A weekly “dossier” with an updated market outlook.

- Access to analysts with a live chat

- Exclusive research covering all asset classes and market segments.

Click here for a two-week free trial and explore our content.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment