Pitchayanan Kongkaew/iStock via Getty Images

A Quick Take On YUKAI Health Group Limited

YUKAI Health Group Limited (YKAI) has filed to raise $20 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides medical equipment management and maintenance services in China.

Given general regulatory uncertainties and a very high IPO price, I’m on Hold for the YUKAI IPO.

YUKAI Overview

Fuzhou, China-based YUKAI was originally founded to sell and distribute medical equipment but has since transitioned to a focus on medical equipment maintenance and management.

Management is headed by Chairman and CEO, Zhenyu Zheng, who has been with the firm since inception and was previously a medical doctor and later an employee at the Fujian Medical Equipment Company.

The company’s primary offerings include:

-

Equipment maintenance, management

-

Supply replacement equipment during downtime

YUKAI has booked fair market value investment of $3 million as of December 31, 2021 from investors including ZhenYu Investment Holdings Limited and other medical investment groups.

YUKAI – Customer Acquisition

The firm seeks customers among hospitals and business partners through either direct bidding or subcontracting.

As of December 31, 2021, the company had 19 customers, of which 13 were hospitals and 6 were business partners.

Sales & Marketing expenses as a percentage of total revenue have risen from a low level as revenues have increased, as the figures below indicate:

|

Sales & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

0.7% |

|

2020 |

0.4% |

(Source – SEC)

The Sales & Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales & Marketing spend, was 24.6x in the most recent reporting period. (Source – SEC)

YUKAI’s Market & Competition

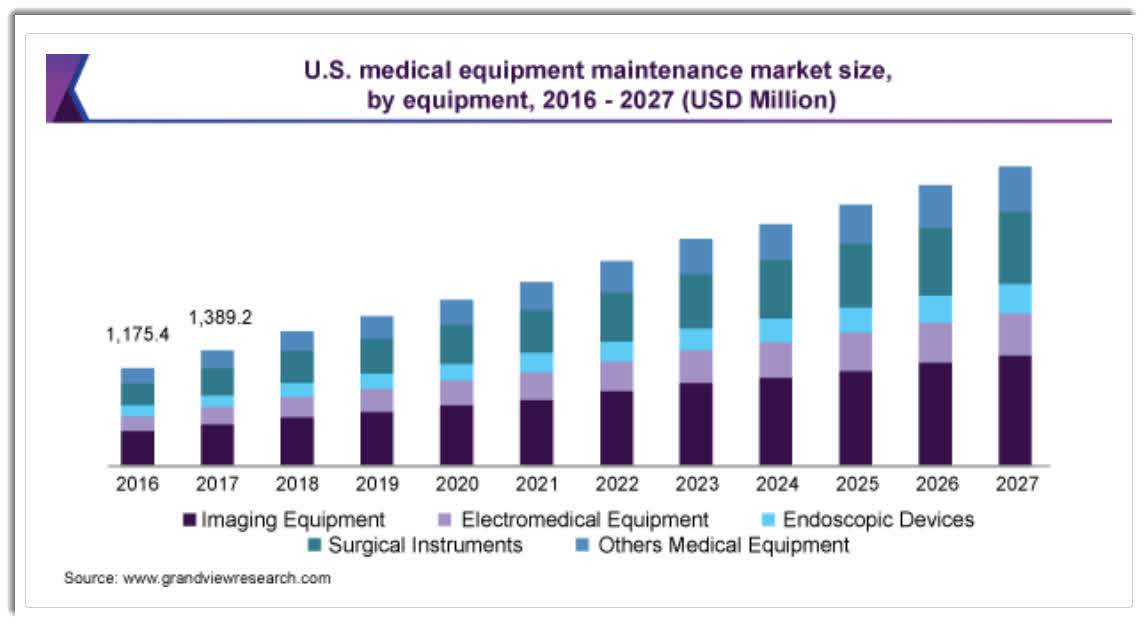

According to a 2020 market research report by Grand View Research, the global market for medical equipment maintenance was an estimated $35.3 billion in 2020 and is forecast to reach $60 billion by 2027.

This represents a forecast CAGR of 7.9% from 2021 to 2027.

The main drivers for this expected growth are a growing demand for medical devices of all types, higher diagnostic rates and an aging global population taking advantage of new innovations.

Also, below is a chart showing the U.S. historical and projected future market trajectory for medical equipment maintenance services:

U.S. Medical Equipment Maintenance Market (Grand View Research)

-

Major competitive or other industry participants include:

-

Shanghai Kedu Healthcare Technology

-

Shanghai Kunya Medical Apparatus Co.

-

Others

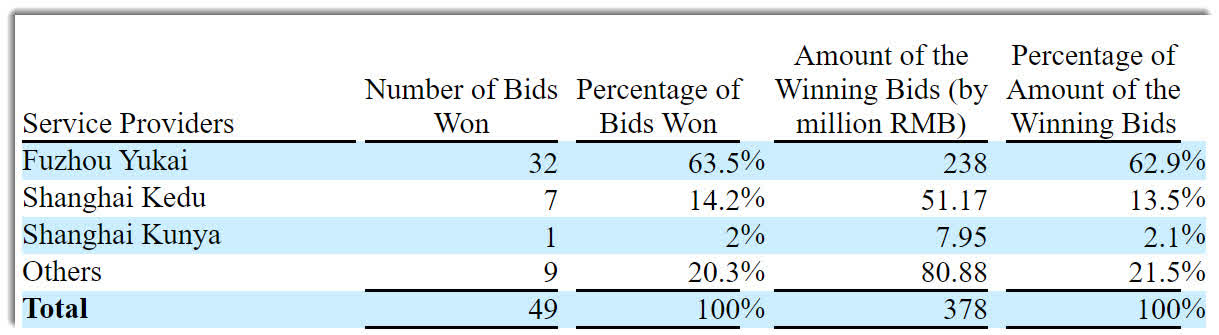

Management said the firm is the largest in the Fujian Province in terms of number of bids won from January 2018 to March 2022, as shown in the table below:

Company Bid Performance (SEC EDGAR)

YUKAI Health Group’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit and gross margin

-

Higher operating profit and operating margin

-

A swing to positive cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 9,650,305 |

19.2% |

|

2020 |

$ 8,094,290 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 2,300,056 |

90.4% |

|

2020 |

$ 1,208,293 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

23.83% |

|

|

2020 |

14.93% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ 1,322,211 |

13.7% |

|

2020 |

$ 265,741 |

3.3% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

2021 |

$ 935,824 |

9.7% |

|

2020 |

$ 7,743 |

0.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ 3,087,585 |

|

|

2020 |

$ (1,069,389) |

|

(Source – SEC)

As of December 31, 2021, YUKAI had $1.2 million in cash and $2.2 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021 was $2.8 million.

YUKAI Health Group Limited’s IPO Details

YUKAI intends to raise $20 million in gross proceeds from an IPO of its ordinary shares, offering 4 million shares at a proposed midpoint price of $5.00 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $60.0 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 25%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

[i] purchasing spare equipment, [ii] further developing our software system, [iii] purchasing properties for our offices and headquarters, and [iv] working capital and other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘currently not a party to any material legal proceedings.’

The sole listed bookrunner of the IPO is Univest Securities.

Valuation Metrics For YUKAI

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Market Capitalization at IPO |

$80,000,000 |

|

Enterprise Value |

$59,781,299 |

|

Price/Sales |

8.29 |

|

EV/Revenue |

6.19 |

|

EV/EBITDA |

45.21 |

|

Earnings Per Share |

$0.06 |

|

Operating Margin |

13.70% |

|

Net Margin |

9.70% |

|

Float To Outstanding Shares Ratio |

25.00% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

$2,760,875 |

|

Free Cash Flow Yield Per Share |

3.45% |

|

Debt/EBITDA Multiple |

0.51 |

|

CapEx Ratio |

9.45 |

|

Revenue Growth Rate |

19.22% |

(Source – SEC)

Commentary About YUKAI’s IPO

YKAI is seeking U.S. public capital market investment to provide funding for its general growth initiatives.

The firm’s financials have produced higher topline revenue, growing gross profit and gross margin, increased operating profit and operating margin and a swing to positive cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021 was $2.8 million.

Sales & Marketing expenses as a percentage of total revenue were tiny; its Sales & Marketing efficiency multiple was an impressive 36.4x in the most recent reporting period.

The firm currently plans to pay no dividends and anticipates it will use any future earnings in the near term to reinvest back into the business.

The market opportunity for providing medical equipment maintenance is large and expected to grow at a moderate rate of growth over the coming years as the healthcare system in China continues to expand and requires greater efficiency to operate at scale.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Univest Securities is the lead underwriter, and the two IPOs led by the firm over the last 12-month period have generated an average return of 215.4% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the uncertain regulatory environment that Chinese firms face from an activist central government.

As for valuation, management is asking IPO investors to pay an EV/Revenue multiple of around 6.2x.

However, compared to U.S. comparable firm Agiliti (AGTI), which is currently valued at an EV/Sales of around 3.7x for even higher revenue growth, the YKAI IPO appears excessively priced.

Given general regulatory uncertainties and a very high IPO price, I’m on Hold for the YUKAI IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment