MARHARYTA MARKO

Co-produced with Treading Softly

I hate seeing wasted potential. It makes me sad to see possibilities that never come to light simply because time, effort, or energy was not used to achieve them.

I recently saw a World War II Willys Jeep in a parade. It was beautifully restored. Someone put a lot of effort into making the engine run well, to get the correct paint scheme and tires, it was a driving work of art.

I’ve also seen the same exact vehicle sitting idle in a farmer’s field, exposed to the elements and rusting away. The potential for an excellent, and enjoyable to drive car lies waiting for someone willing to unlock that potential.

Likely it’ll never come to pass. All that potential wasted. A real shame!

For many of us, our portfolios are operating close to peak performance. However, among the community of investors, we have a number of us who are sitting on wasted potential in our portfolios.

We’re talking about their cash holdings. Losing value to inflation and not earning anything meaningful all while losing that value.

Cash as an emergency savings tool is valuable as cash, and shouldn’t be confused as an “investment” in one’s portfolio.

Cash sitting idly in one’s portfolio is a pyrrhic victory. Sure it seems great that it’s “beating the market” but in all honesty, it’s doing nothing. If you sit on it, it’ll lose to the market in the next recovery. It doesn’t pay dividends, it simply has been losing value over time. You might be “winning,” but even in your winning, you’re losing.

It’s time to put that cash to work. Collect excellent dividends and enjoy the market’s recovery in due time.

Let’s dive in.

Pick #1: ARCC – Yield 8.9%

Ares Capital Corporation (ARCC) is a premium BDC (business development company) that has withstood the test of time. One of the oldest publicly traded BDCs, ARCC is one of the few companies in the sector that was tested under the harsh conditions of the Great Financial Crisis.

BDCs are direct lenders to middle-market companies. These are companies that usually are not publicly traded, but are still quite large. ARCC focuses on the upper-middle market segment with the average borrower having an EBITDA in excess of $170 million/year. These are much larger borrowers than most BDCs invest in, and ARCC can focus on this segment because of its size.

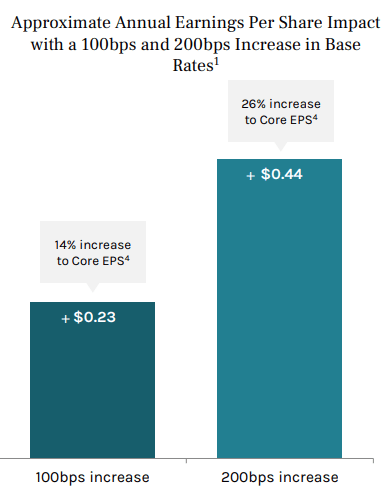

ARCC has the perfect business model for a rising rate environment. The majority of the loans it makes are floating rate, and the majority of debt it borrows is fixed-rate. So, as interest rates rise, ARCC collects more interest, while the interest it pays remains fixed. The combination of higher revenues and lower expenses means a better bottom line. (Source: Quarter Ended March 31, 2022).

Quarter Ended March 31, 2022

A 100 bps increase from March 31st rates adds $0.23 to Core EPS. A 200 bps increase adds $0.44 to Core EPS. Rates are already up 140 bps, meaning that ARCCs earnings are already shooting up right now.

So let me get this straight. ARCC has:

- Increased its regular dividend by 2.4% in Q1.

- Announced a $0.12 supplemental dividend that will be paid in four quarterly installments throughout 2022.

- Grew net asset value to $19.03 in Q1.

- Expects core earnings per share to grow +20% for the rest of the year.

- Will benefit even more if interest rates keep rising, as the market expects they will.

With all these tailwinds, ARCC should be trading at a larger premium to NAV. Instead, ARCC is trading at a slight 2% premium and is cheaper than it was at this time last year.

All I can say is thanks for the dividends as I scoop up more ARCC.

ARCC reports earnings on the morning of July 26th.

Pick #2: RNP – Yield 7.2%

Do you know what I love most about bearish markets? It is that investors tend to sell everything. The good, the bad, the ugly, and the profitable tend to get lumped together as investors run to cash.

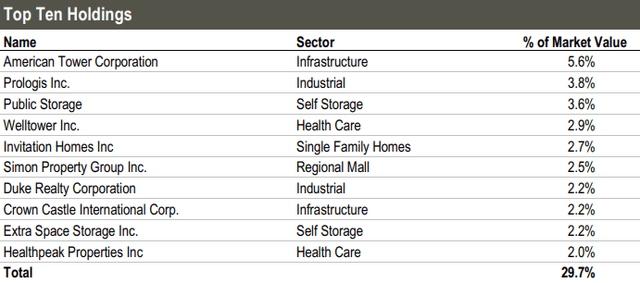

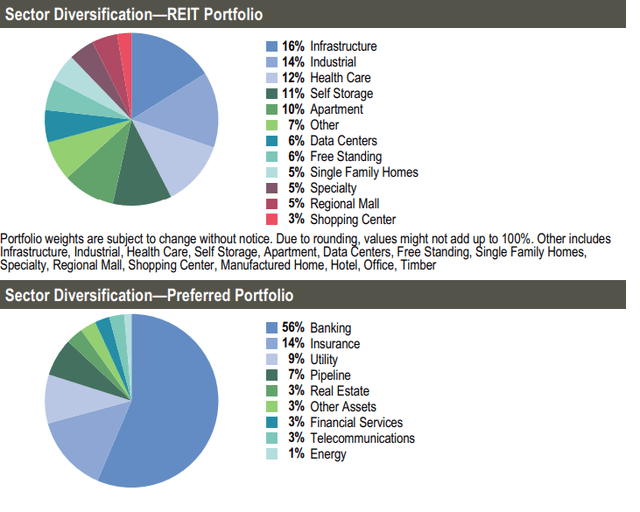

Cohen & Steers REIT & Preferred Income Fund (RNP), is an example of a great investment that the market has cast aside in its hurry to run to cash. RNP is a fund that invests in some of the highest quality real estate investment trusts (“REITs”) around. Their Top 10 is a “who’s who” of blue-chip REITs. (Source: RNP Fact Sheet)

The market has been selling off REITs like they are toxic, likely due to rising interest rates. Yet these companies are in a fantastic earnings environment as rent has been rising with inflation, while they enjoy the tailwinds of having refinanced at historically low-interest rates.

REITs are benefiting from rising rents while having expenses that are relatively fixed. The largest expense for most REITs is interest on their debt. However, over the past two years, REITs have refinanced as much debt as they could at historically low rates. Often refinancing out 10+ years. Few REITs have significant debt maturing before 2024. So they are getting the benefit of rising revenues immediately, but it will be several years before higher interest rates start pushing expenses higher. REIT earnings generally surprised the market in Q1, and going into Q2 we expect the market will be even more “surprised” by the strength of REIT fundamentals.

It has been a long time since inflation has been this hot. Wall Street is used to looking at REITs in a low inflation environment and is failing to understand the real benefits of being a landlord in an inflationary environment.

In addition to a great REIT portfolio, RNP also has a significant allocation to preferred shares

Preferred shares have also faced stiff headwinds as fears of Fed rate hikes have ruled the world. They are significantly oversold, and that portion of the portfolio likely has price upside as well.

With RNP, we get a strong 7.2% yield and plenty of room for capital appreciation in the second half. When the market runs in fear, I’m happy to snap up some quality payers and collect my distributions until the market comes running back.

Shutterstock

Conclusion

Using RNP and ARCC, we can turn a pyrrhic victory into a real one. We can approach the battlefield of life with a growing and steady supply of income while knowing our original capital is hard at work earning more.

Unlike cash, we don’t beat the market, while simultaneously losing.

Retirement shouldn’t be a time to lose by winning. You would be able to enjoy victory without knowing the next battle will be your last.

Instead, have constant reinforcements pouring into your account. This army of dollar bills will enable you to win the war against rising prices and the cost of living climbing. You can enjoy continued financial freedom and financial independence without being burdened by debt and bills you cannot pay.

Live victoriously. Live in the light of financial freedom.

Achieve this through income investing. You can do it. I’m pulling for you.

Be the first to comment