MF3d/E+ via Getty Images

Youdao (NYSE:DAO) is the leading intelligent learning company in China. Youdao is a search engine featured on the web portal of NetEase (NTES), Youdao’s parent company. Since its launch in 2007, Youdao continued to expand its offerings, including Youdao Dictionary, Youdao Cloud Notes, Hui Hui Assistant, and Youdao Tuiguang, etc. Youdao Dictionary has both desktop and mobile version, launched in 2007 and 2009, respectively. Youdao Dictionary is a much-needed product for Chinese users. By the end of July 2012, the dictionary had more than 200 million users globally. Later, its cloud storage offering, Youdao Cloud Notes was launched in 2011 and attracted 15 million users in two years.

Throughout the last decade, Youdao built its strong assets around three business segments: Learning Services (Adult Education, K-12 non-academic, and K-12 academic), Smart Devices, and Online Marketing Services.

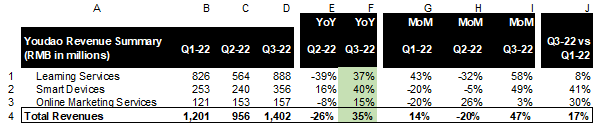

Q3-22 Financial Results and Highlights

Youdao reported a very strong quarter, and here are the summarized financial results and highlights investors should be aware of.

Revenue: RMB1.4 billion, +35% YoY.

Gross Margin: 54.2%, up from 52.6% prior year. The improvement in gross margin is mainly driven by the smart devices segment where new products were launched (Youdao Dictionary Pen X5) with higher gross margin. As a leader in this space, Youdao’s pricing power will continue to increase, leading to margin expansion in the future.

Operating Loss: RMB219 million, -15.6% of revenue; as compared to RMB226 million, -21.7% of revenue in Q3-21.

Share Repurchase Program: The company announced $20MM share repurchase plan (accounting for 4% of its current market cap) in the next 36 months.

Youdao Q3-22 Revenue and EPS beat analyst estimates, signaling growth recovery post the “Double Reduction” policy.

The following figure shows Youdao’s revenue summary since 2021. In Q3-22, revenue grew 35% YoY, as compared to a revenue decline of -26% YoY in Q2-22. This proved Youdao’s capability of quickly reacting to regulatory changes, and evolving and optimizing its business performance.

Youdao’s RMB 1.4 billion revenue in Q3 marked its highest quarter. Investors may have a question whether growth can sustain in the future considering the softening economic environment. My takes are as follows.

First, for Chinese families, spending on education or kids learning remains nearly top priority among all expenditures, and I consider this sector least affected by economy.

Second, with the technology development of Cloud and AI, consumers (esp. Gen Z) will enthusiastically embrace new product offerings from Youdao. I see high potentials in established markets, and enormous potentials in lower-tier cities where many of those are greenfield for Youdao.

Lastly, Youdao’s product portfolio continued to diversify and expand, create massive opportunities for it to cross-sell.

Capital IQ

Smart Devices saw growth momentum (+40% YoY, +49% MoM, and +41% vs Q1-22) and demonstrated Youdao’s widening moat in a high-growth sector.

Youdao Smart Devices revenue was RMB 356 million in Q3-22, 3x of its revenue in Q1-21, and showed significant growth comparing with both prior year and prior quarters.

Youdao’s Q4 performance is likely to be strong as well. In the 2022 Double 11 in China, Youdao Smart Devices sales exceeded RMB 100 million, growing 88% YoY. Youdao Dictionary Pen was the best seller for both TMall and JD.com channels for three years in a row. Its new AI-led Smart Learning Pad X10 had over RMB 3 million on its launch date.

I am positive about Youdao’s capability of continuing its growth momentum for a couple of reasons.

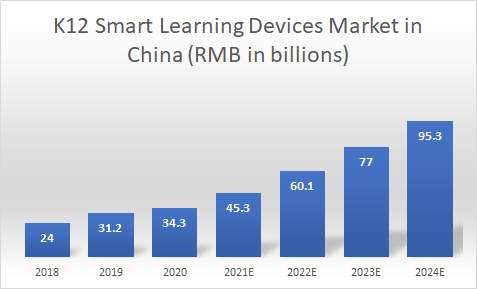

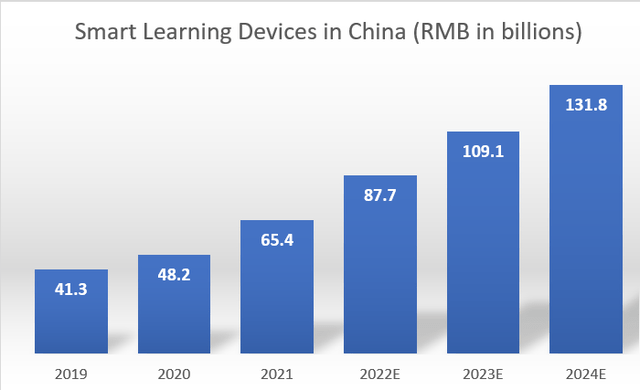

First, the Smart Learning Devices market is rapidly growing. The Smart Learning Devices market in China is expected to grow from RMB 87.7 billion in 2022 to RMB 131.8 billion in 2024 (+23% ’22-’24 CAGR).

For K12 specifically, the market is growing from RMB 60 billion in 2022 to RMB 95 billion in 2024 (+26% ’22-’24 CAGR).

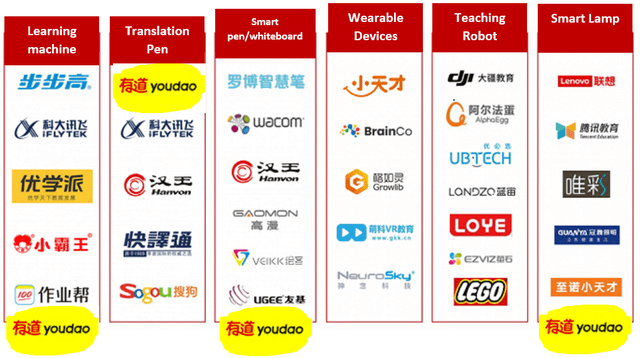

Qianzhan

Second, Youdao is demonstrating its widening moat in this sector. In the earnings release call, Youdao made it clear about its strategy of landing on smart learning devices. Looking at the pace of its new launches, and the categories of products it has rolled out (Youdao Dictionary and Youdao Translator to new products such as Youdao Cloud Pen, AI-led Smart Learning Pad X10, Youdao Listening Player, Youdao Smart Lamp, etc.), I am convinced with Youdao’s capabilities around supply chain, product development, and go-to-market. As a sector leader, Youdao will be able to continue accelerating its pace of iterating and releasing new products with all resources and expertise. As the smart learning devices ecosystem continues to form and develop, Youdao is going to be a main beneficiary while being a distant leader in this space. The following figure shows where Youdao has tapped into.

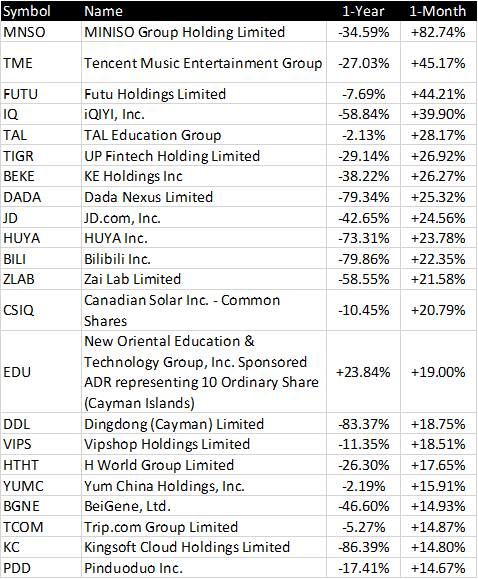

Biden-Xi Talks Boosted U.S.-Listed Chinese Stocks.

When writing about China’s stocks, a common theme has been that “the stock is clearly undervalued on the market, but we are uncertain about the timing of its recovery”. With the recent Biden-Xi talks, many of the U.S.-listed Chinese Stocks have seen a strong boost.

The following figure can give investors some “feel” of the rebound of Chinese stocks.

aastocks.com

Conclusion

If investors are looking for attractive opportunities in Chinese stocks with strong business fundamentals, clear recovery signals, and reasonable multiples, Youdao seems to be one of the targets.

In terms of investment risks, I think the Smart Learning Devices market is becoming crowded, and Youdao has to work hard and execute well to maintain its leading position in this space.

Be the first to comment