Melpomenem/iStock via Getty Images

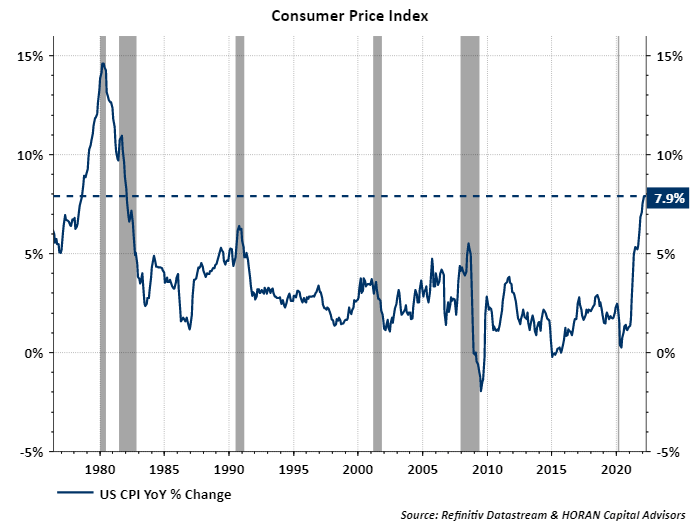

One factor likely having an outsized influence on the Federal Reserve’s interest policy is the current level of inflation. The latest reading on inflation shows it running at an annual rate of 7.9%, a level last experienced in the early 1980s. Many variables can contribute to inflationary pressures, but at the end of the day, prices are driven by supply and demand. In an effort to curb some demand, at the conclusion of the Fed’s March 16 meeting, the Federal Reserve embarked on a path to increase interest rates, the Fed Funds rate specifically, with a .25% or 25 basis point increase.

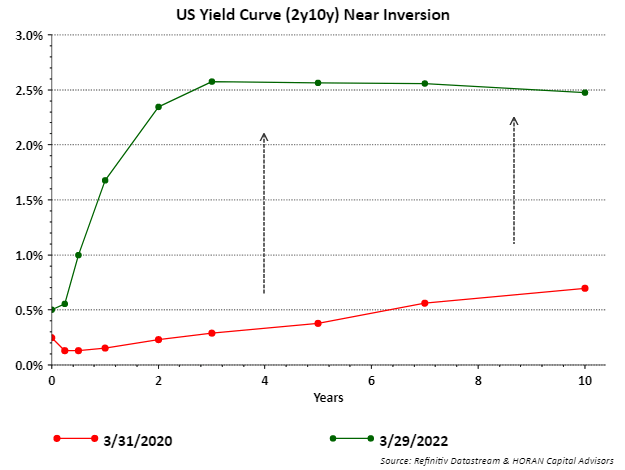

Some market strategists are expecting the Fed to continue to increase the rate at each of the next six Fed meetings. The Fed’s rate decisions have more of an impact on the very short end of the yield curve, the curve displaying U.S. Treasury interest rates relative to their maturities. Market participants generally have more influence on interest rates at the longer maturities. In fact, market rates have already adjusted to a higher interest rate environment as seen in the below chart. The green line on the below chart represents the current yield curve and the 2-year Treasury yield is nearing the same rate or yield as the 10-year Treasury yield. If/when the 2-year Treasury yield exceeds the rate on the 10-year Treasury yield, the yield curve is said to be inverted.

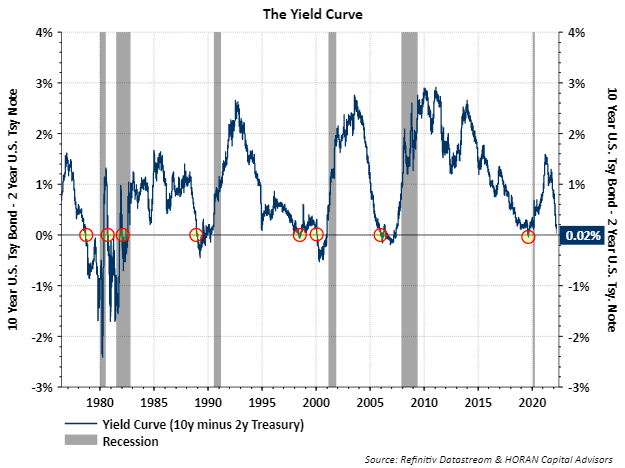

The significance of an inverted yield curve is the fact every U.S. recession in the past 60 years has been preceded by an inverted yield curve. And according to a Federal Reserve Bank of San Francisco paper, “a negative term spread [inverted yield curve] was always followed by an economic slowdown and, except for one time, by a recession. As I write this today (3/29/2022), the yield curve is come precariously close to inverting at just narrow 10y2y spread of 2 basis points.

As I noted in an article I wrote in 2018, there is a silver lining to yield curve inversion, i.e., the onset of a recession occurs an average of 19 months after the inversion and not right away. Additionally, the average return for the S&P 500 Index from the date of the inversion to the recession was 12.7%. The bottom line is an investor does not need to panic; however, one has time to make portfolio allocation adjustments if warranted.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment