Brad Barket

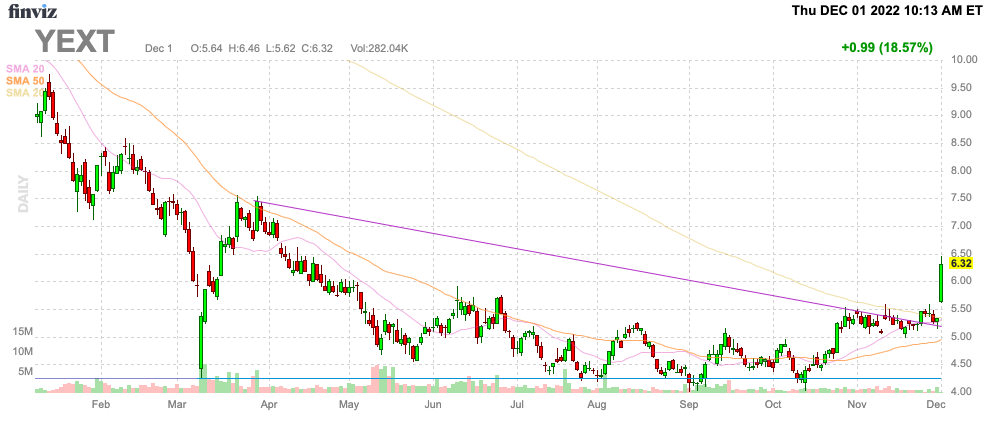

In no huge surprise, Yext (NYSE:YEXT) reported results for the October quarter that weren’t particularly impressive when focused on the top line. The company has replaced management and worked on improving the efficiency of its salesforce over driving revenue growth. My investment thesis is ultra-Bullish on the stock due to the massive valuation discount and the clear double bottom already at $4.

Source: FinViz

Past Execution Problems

For years, Yext has offered a strong value proposition to customers, yet the prior management team was unable to drive sustainable growth. The covid lockdowns initially hurt retail clients using location-based services and the economic rebound was cut short due the pending recession from massive rate hikes.

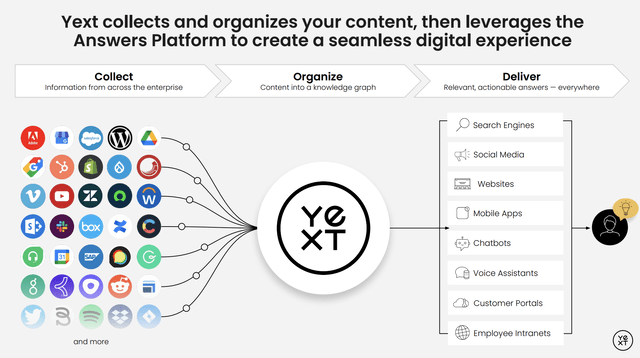

As documented before, the company replaced most of the management team this year due to these execution issues. Yext continues to document how the Answers and AI search products solve problems for customers and increase the productivity of these customers.

The company has always collected digital data from clients and leveraged that information to provide a seamless digital experience for their customers. An increasingly digital world places Yext in the sweet spot of future demand.

Source: Yext Oct. ’22 presentation

The new management team delivered FQ3’23 revenues of $99.3 million for the 6th consecutive quarter with revenues between $98 million and $101 million. The guidance for FQ4 has revenues remaining in this range with a target at $101 million for the high end.

As with other tech companies, Yext faced a strong $12.4 million negative impact from foreign currency exchange rates. The company still saw ARR grow 1% YoY to $390 million. Without the currency impact, the ARR would’ve hit $402 million for 4% growth.

On top of this, Yext is seeing an improved deal pipeline per the CEO on the FQ3’22 earnings call. Even with the improved execution, Yext still only had a retention rate during the quarter in the mid-80% range.

Deep Value

While the new management team hasn’t turned around the business just yet (though the currency issue would alter this view), the company is now on a more solid financial footing. The CEO specially set a plan in motion to make the sales force more efficient before hiring additional sales reps leading to a more impressive financial picture going forward.

Yext reported FQ3’23 net income of $2.5 million versus a loss of $5.5 million last FQ3. The business is on a vastly better financial footing now allowing for the large share buyback this year.

The company has repurchased 12.4 million shares for a total cost of $69.1 million. On top of this, Yext had guided to a FQ4 EPS of $0.02 to $0.03 in another sign of the company producing more consistent profits.

The AI search company not generating revenue growth is disappointing, but the new management team improving sales productivity in this environment is impressive. Yext saw sales and marketing expenses as a percentage of revenues dip from 52% last FQ3 to only 44% in FQ3’23 while ARR grew on a constant currency basis. A small tech company could’ve produced 15% sales growth without producing this level of leverage.

Yext lists 123 million shares outstanding for FQ4 placing the market cap at $780 million after the rally to $6.30. The company has a cash balance of $162 million for an enterprise value of $620 million now.

The company has a revenue run rate in the $400 million run rate placing the EV/S multiple at just 1.5x. When the new management team is able to return the business to growth, Yext has considerable upside potential. The company regularly grew the business in the 15% to 20% annual range pre-covid.

The stock definitely has substantial risk. The internet search market has strong competition and Yext is a relatively small player. If the company was to return to a scenario of large cash burn rates, the cash balance could disappear fast.

Takeaway

The key investor takeaway is that Yext fell too far this year as investors extrapolated too much on slow growth caused by a weak retail market. The stock was too cheap at the lows and remains so even at $6 with the improving profit picture and catalysts for growth ahead.

Be the first to comment