RHJ

Investment Thesis

Yellow Cake (OTCQX:YLLXF) is an investment company that owns physical uranium, stored in North America and Europe. The primary listing is in the UK and there is an OTC listing in the U.S. It is a lower risk investment compared to many mining stocks in the uranium industry, but it still has an attractive upside.

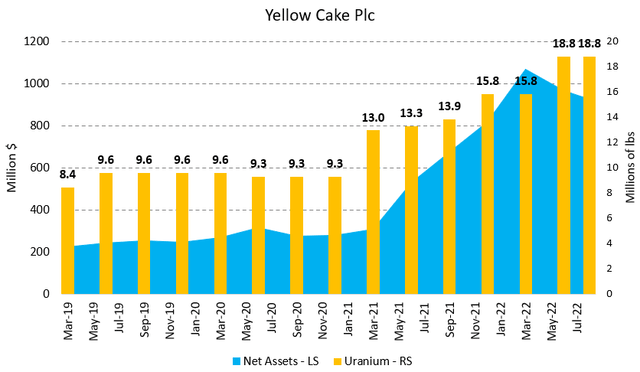

The company has grown its assets over the last few years from an increase in the price of uranium and from raising money in the equity market to buy additional pounds. Total pounds of uranium have doubled compared to a couple years ago, while total assets have tripled.

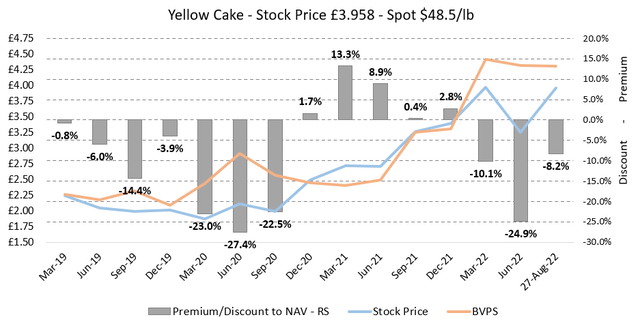

Figure 1 – Source: Yellow Cake Quarterly Updates & TradingView

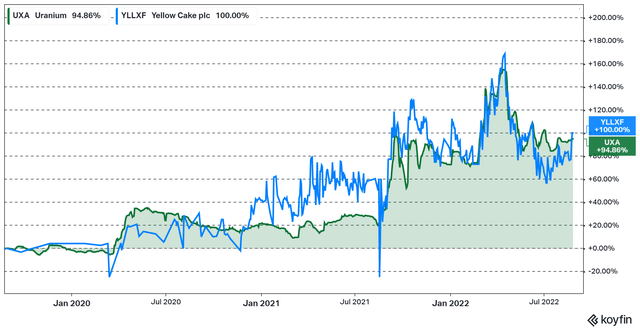

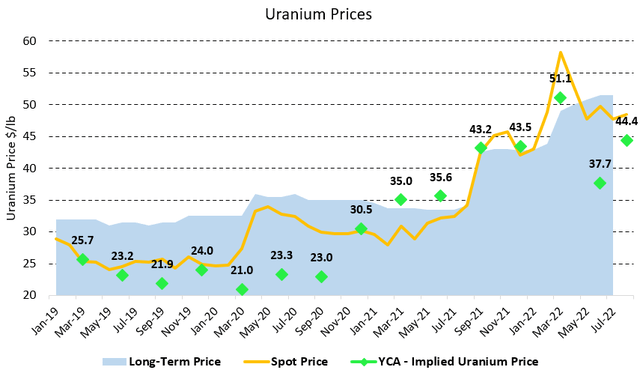

Yellow Cake is a stock I have covered many times in the past. It is similar to the Sprott Physical Uranium Trust (OTCPK:SRUUF) where the long-term performance tracks the price of uranium.

Figure 2 – Source: Koyfin

Yellow Cake does tend to trade with more fluctuations around the price of uranium than the Uranium Trust. The Uranium Trust last traded with a 3.7% discount to NAV, it is marginally larger for Yellow Cake with an 8.2% discount to NAV. While the discount to NAV for Yellow Cake is smaller than at the end of Q2, it is still a decent size discount, which improves the risk-reward for the stock.

Nuclear & Uranium Updates

I listed many of the most important developments in the uranium market over the last year in this recent Cameco (CCJ) article, which I would recommend reading, at least the market development section. Cameco has since then reported its Q2-22 financials and continues to express their bullishness based on contract discussions and the geopolitical focus of avoiding Russia, to the extent that it is possible.

We have lately also heard that the Governor of California is now proposing to extend the use of Diablo Canyon. While the plant only has two nuclear reactors, the symbolic effect is very telling when one of the most renewal focused parts of North America come to the realization that nuclear is needed.

Another recent development is that The Inflation Reduction Act has now passed, whether it will decrease inflation as the name suggests is certainly debatable, but it will provide billions of dollars in support for the nuclear industry over the coming decade.

The biggest update recently was the announcement from Japan that it is now actively planning to restart up to 17 nuclear reactors by next summer to deal with the ongoing energy crisis. The fact that Japan is now also discussing the idea of building new nuclear reactors, adds Japan to the list of countries that have done a complete U-turn on nuclear over the last few years.

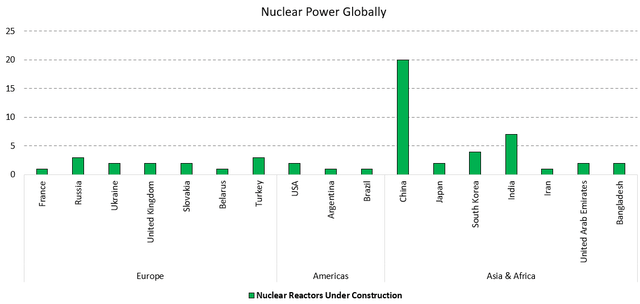

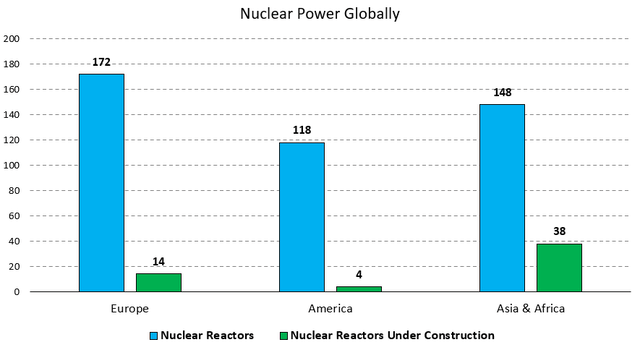

It is hard to be anything but bullish on the nuclear industry and consequently demand for uranium, where reactor lives are being extended in many western countries and we continue to see new reactors being built, especially in Asia.

Figure 3 – Source: Data from Nuclear Performance Report 2022

Figure 4 – Source: Data from Nuclear Performance Report 2022

Valuation & Conclusion

Yellow Cake last closed with a stock price of £3.958, which together with the latest fx rate, and uranium price of $48.5/lb indicates a discount to NAV of 8.2%. Buying Yellow Cake with the current discount is equivalent to buying uranium exposure at $44.4/lb.

Figure 5 – Source: Yellow Cake Quarterly Updates & TradingView

Figure 6 – Source: Yellow Cake Quarterly Updates & TradingView

Apart from the increase in the spot price over the last couple of years, we have also seen the long-term contract price climb higher to $51.5/lb. However, neither the spot price nor the contract price are at levels which would incentivize sufficient supply to balance the market over the long term.

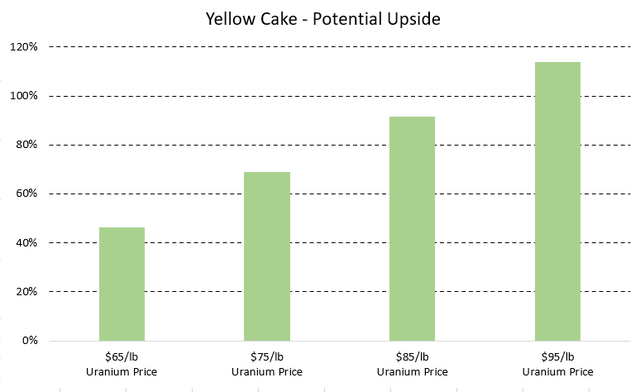

Many have argued a uranium price around $65-$75/lb will be required to get sufficient supply to come online. Given the inflation we have seen over the last couple of years, and we are very likely to continue to see at least in the energy sector, an even higher uranium price is quite likely.

So, with the current implied uranium price of $44.4, the potential upside for Yellow Cake is attractive even without using overly aggressive price assumptions. It is important to remember that this is for an investment with no mining, permitting, and financing risk. The operational risk is also minimal.

Figure 7 – Source: My Estimates

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in cyclical industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio returns have been +81% in 2020, +39% in 2021 and -10% in July of 2022.

Be the first to comment