NicoElNino

Fund investors were net purchasers of short-term assets for the Refinitiv Lipper fund flows week ended July 6, 2022, injecting a net $20.4 billion into money market funds. However, for the same period, fund and ETF investors were net redeemers of equity funds (-$7.9 billion), municipal bond funds (-$313 million), and taxable bond funds (-$111 million).

For the fund flows week, investors continued to gravitate toward defensive plays, with the top attractors of investors’ assets being government-Treasury funds (+$5.2 billion, including ETFs), equity income funds (+$1.5 billion), health/biotechnology funds (+$1.1 billion), and sector-utility funds (+$591 million). And while conventional fund investors were net redeemers of corporate high-yield funds (-$585 million), ETF investors were net purchasers of high yield ETFs (+$1.5 billion).

While both conventional fund (-$4.4 billion) and ETF (-$3.5 billion) investors were net redeemers of equity funds for the fund flows week, the groups took distinctly different paths in the taxable bond universe. On the taxable bond ETF side (+$7.5 billion), investors padded the coffers of government-Treasury ETFs (+$5.3 billion), corporate high yield ETFs (+$1.5 billion), Corporate Debt BBB-Rated Debt ETFs (+$545 million), and flexible funds (+$392 million). However, in contrast, on the conventional funds side (-$7.6 billion) investors were net redeemers of all the macro-groups but managed to inject a net $43 million into Lipper’s General U.S. Treasury Funds classification for the week.

Investors have reversed course on some of the more popular asset classes from 2021, with the average equity and fixed income funds posting market declines of 18.81% and 8.50%, respectively, for the first half of 2022. The NASDAQ Composite and S&P 500 sealed their worst first half of the year since 1970, declining 29.51% and 20.58%, respectively, with data showing waning consumer spending, inflation at its highest point in more than 40 years, and sentiment taking a beating as consumers faced a sharp rise in food and energy costs.

Year to date through the fund flows week ended July 6, 2022, investors were net redeemers of conventional mutual funds and ETFs, withdrawing a preliminary net $299.3 billion. However, the theme outlined above has been in play for some time, with ETFs (+$239.9 billion) handsomely outdrawing their conventional fund (-$539.2 billion) counterparts.

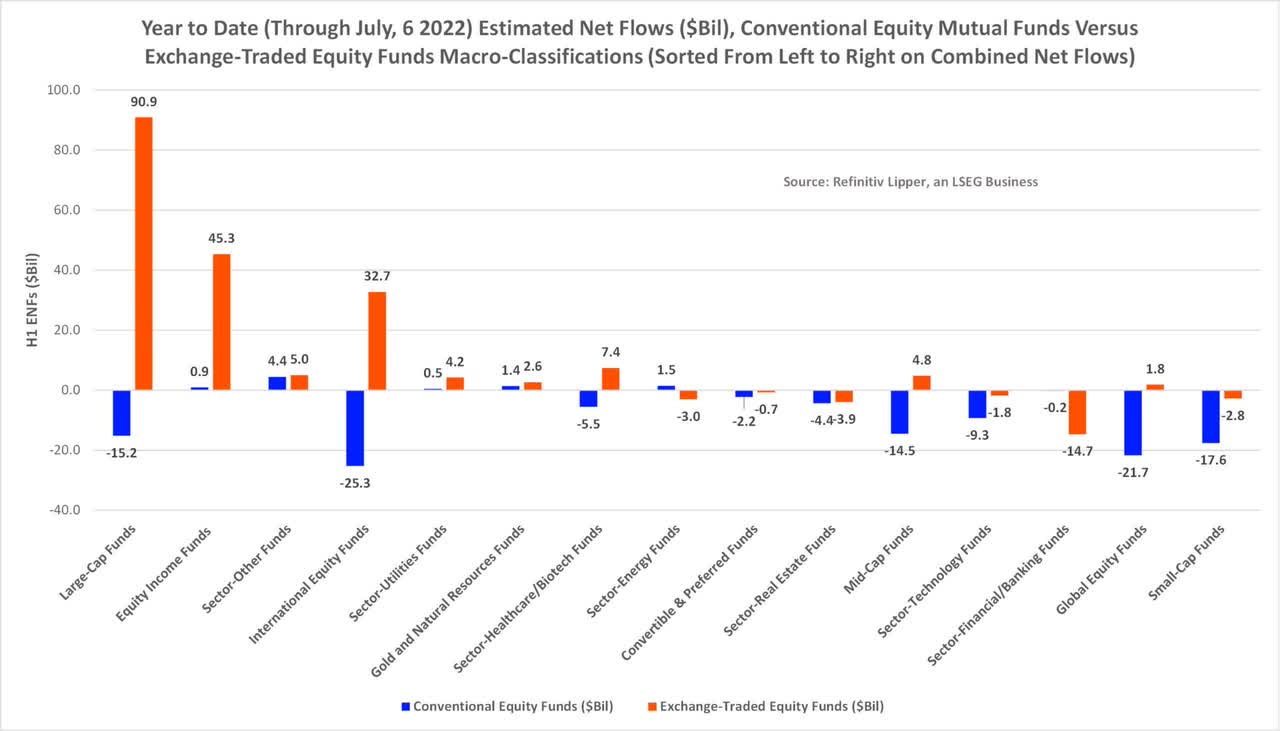

On the conventional equity funds side (-$107.0 billion), investors were net purchasers of the commodities heavy, sector-other macro-group, injecting a net $4.4 billion year to date, followed by sector-energy funds (+$1.5 billion), gold and natural resources funds (+$1.4 billion), equity income funds (+$947 million), and sector-utility funds (+$469 million). However, the international equity funds macro-group (-$25.5 billion) was the pariah of the conventional equity funds group, bettered by global equity funds (-$21.7 billion), small-cap funds (-$17.6 billion), and large-cap funds (-$15.2 billion).

However, the carnage witnessed on the conventional equity funds side was not replicated by ETFs, which attracted a net $168.0 billion year to date. The primary attractors of investor assets were large-cap ETFs (+$90.9 billion), equity income ETFs (+$45.3 billion), international equity funds (+$32.7 billion), and health/biotechnology ETFs (+$7.4 billion). With investors handwringing over slowing global growth and rising interest rates and concerns of a nascent recession, sector-financial/banking ETFs (-$14.7 billion) saw the largest net outflows year to date, bettered by sector-real estate ETFs (-$3.9 billion), sector-energy ETFs (-$3.0 billion), and small-cap ETFs (-$2.8 billion).

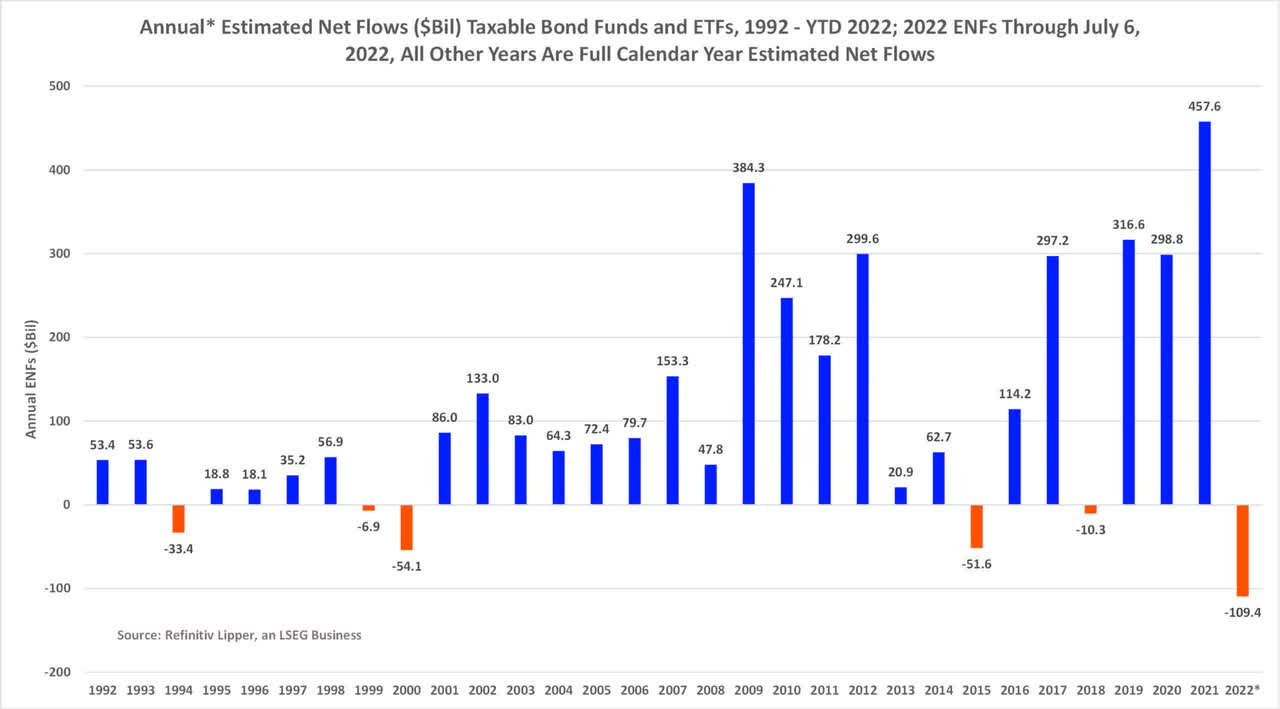

With the Federal Reserve hiking its key lending rate by 75 basis points in June—its largest increase since 1994, and its third rate hike this year, investors have fled many of the taxable fixed income macro-groups—recall the inverse relationship between bond yields and their prices.

Conventional fixed income mutual funds and ETFs handed back some $109.4 billion so far this year—their largest net outflows for any full calendar year ranging back to 1992 when Lipper began tracking weekly flows.

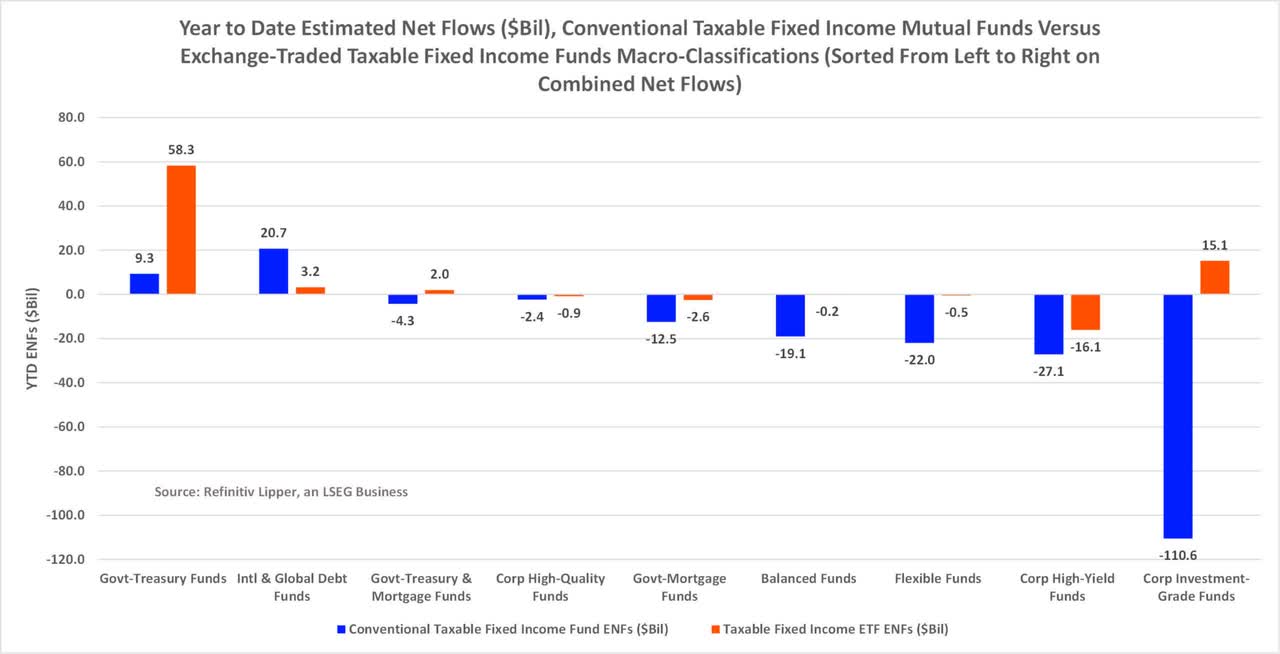

However, the dichotomy mentioned earlier continues—but to a somewhat lesser extent. Conventional taxable fixed income mutual fund investors redeemed a net $167.9 billion so far year to date. The conventional international & global debt fund (+$20.7 billion) and government-Treasury debt fund (+$9.3 billion) macro-groups were the only attractors of investor assets year to date. However, investors’ favorite from 2021 saw the largest net redemptions so far this year, with corporate investment-grade debt funds handing back a whopping $110.6 billion, bettered by corporate high yield funds (-$27.1 billion) and flexible funds (-$22.0 billion).

ETF investors injected a net $58.5 billion into taxable bonds ETFs so far this year, with government-Treasury ETFs (+$58.3 billion) taking in the largest draw, followed by corporate investment-grade debt ETFs (+$15.1 billion), international & global debt ETFs (+$3.2 billion), and government-Treasury & mortgage ETFs (+$2.0 billion), while corporate high-yield ETFs (-$16.1 billion) and government-mortgage ETFs (-$2.6 billion) witnessed the largest net redemptions.

Municipal debt funds and ETFs—collectively suffering 8.24% market decline for the first half of the year—experienced net redemptions as well, handing back a net $77.2 billion, with conventional fund investors redeeming a net $90.5 billion, while their ETF cohorts injected $13.4 billion year to date.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment