peshkov/iStock via Getty Images

(Note: This article originally appeared in the marketplace newsletter on April 27, 2022, and contains current information).

Yangarra Resources (OTCPK:YGRAF) is a Canadian company that reported C$.26 per share of net income while generating C$.46 of cash flow. Those kinds of numbers make this one very cheap investment at the current price of the stock. The company reported those vastly improved numbers when compared to last year even though a third party limited some production in March 2022.

The current robust commodity price market allows the company to run one rig full time while also repaying net debt down to about C$179 million. Increasing production more than 20% in one year combined with repaying roughly one-third of the debt (as a goal) is one very profitable company that has few peers.

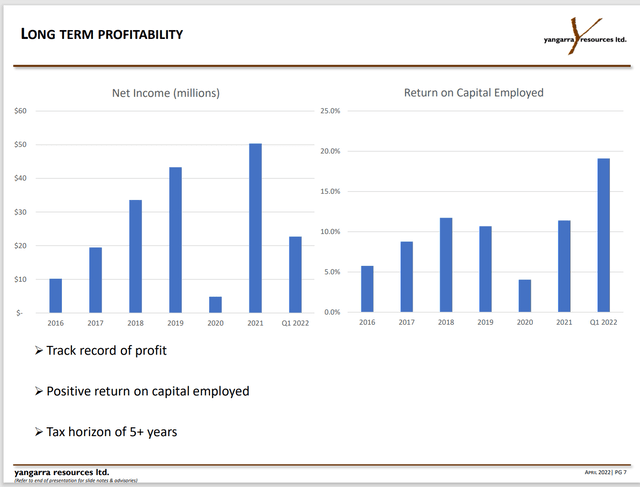

Yangarra Resources Five Year Net Income And ROC History (Yangarra Resources April 2022, Corporate Presentation)

The company impressively posted a profit in fiscal year 2020 when lots of companies lost money and had to impair the asset values. In fact, that five-year history is impressive when compared to the trials of much of the industry in the same time period.

A company with a profit history during challenging times will have leading profitability when times feature robust commodity prices. The company has already made roughly half of the profit reported for the whole previous fiscal year. Commodity prices have only strengthened since then.

Since the first quarter, commodity prices have strengthened considerably. This company has exposure to the natural gas market as well as the liquids and oil market through a decent percentage of natural gas production. These wells are going to be extremely profitable in the current fiscal year. Shareholders should expect favorable guidance revisions as a result in the second quarter report.

The stock price is roughly not quite 3 times annualized first quarter cash flow. That ratio may contract some more unless commodity prices retreat materially from current levels. The company predicts some robust growth in excess of 20% in the current fiscal year and another 2,000 BOE in the next two fiscal years. This company also has the money to pay a dividend once the debt levels are considered satisfactory. This is one of the few companies with a cost structure low enough to allow for both decent growth and dividend payments. Many companies can only grow slowly while paying a dividend once debt issues are taken care of.

(Canadian Dollars Unless Otherwise Specified)

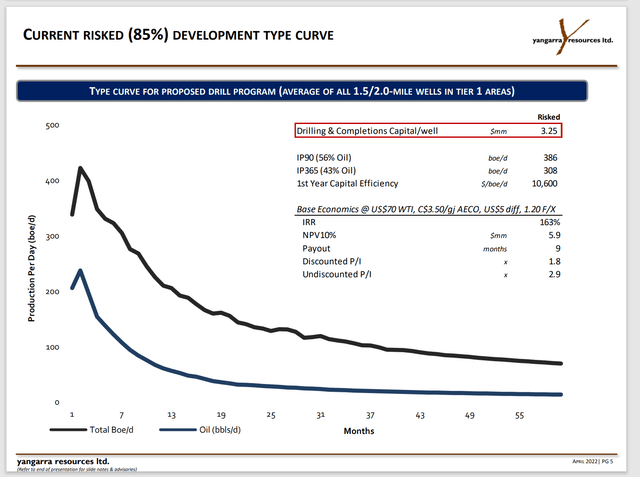

Yangarra Resources Well Performance Data (Yangarra Resources April 2022, Corporate Presentation)

The reason for the company flexibility is the extremely profitable wells. The return on these wells drilled is extraordinary at much lower than current prices. These wells start out producing a higher percentage of oil (which helps the payback period considerably) and then produce a less profitable mix as the wells age.

The fast payback means that management can (if it chooses) drill two wells in the same year using the same capital. That money spent actually gets far more cash flow than one well because of the fast payback. It is what allows for relatively fast production growth while repaying debt first and then later a dividend.

The company also has a location advantage because it drills an interval that few others currently develop. Land is relatively cheap in Canada. So, this company acquires more acreage at a considerably lower cost than is the case in the United States.

Even though acreage cost is not typically part of a well breakeven presentation to shareholders, that lower location cost heavily influences company profitability. A lower location cost is one less thing that needs to be paid back with a lot of money.

Management

Both the management and the board of directors have experience in building and selling companies. That will lower the “small company risk” materially (though it won’t eliminate that risk). It also means the chances of this company eventually being sold are likely higher than is the case “on average”.

Some signs of management experience would be the beginning of drilling in a relatively new zone back in 2015 when the industry was suffering from a major commodity price decline. This company went on to demonstrate the profitability of the new zone as shown above.

At a time when many managements will pay nearly full price or a small discount to drill in very profitable plays, it takes unusual management to find a new very profitable place to produce oil. Shareholders reap the benefit of above average profitability as a result.

The likely result of this is the obvious growth in the current play for as long as that is possible. But this management is more likely than most to find another low-cost way to grow should that become a priority in the future. The current acreage is likely to keep management busy for a very long time.

Furthermore, much of Canada consists of stacked intervals that contain oil. There is an excellent chance that other intervals on this same acreage will become viable or competitive with the current interval as technology continues to improve. There is also a good chance that secondary recovery techniques would lead to a longer production life than is currently projected.

With a management like this, a company has a bright future ahead. Good managements tend to surprise on the upside. This appears to be one of the better, more experienced, managements in the industry.

Small companies in this industry tend to be a risky area loaded with fraud, cost overruns, and general ineptness. That is why it is so important to find experienced management that has built and sold companies before. There will be a public record of the past treatment of investors and shareholders that even lenders use before deciding to lend money to new ventures.

The Future

Yangarra management has indicated a desire to bring the debt down. At some point management may even decide to pay the debt off completely. This year it appears possible to reduce outstanding debt by at least one-third of the current balance. At that point it will be up to management and their lenders to decide what a desirable debt balance is to minimize financial risk in the future.

This was a company that had been acquiring leases and testing different well techniques. The decision to change to a producing company was made just before the coronavirus challenges hit. This company, fortunately, had just enough production to justify some reasonable debt ratios given the economic challenges ahead. But the debt market now demands better ratios in the future. Fortunately, there was enough production to sharply drop the debt ratios when commodity prices rose.

This is one company that is likely to have the debt issues resolved within a year or two. After that it will be a choice by management as to whether to return more money to shareholders or to grow production quickly. Usually, a management that builds and sells companies will chose to favor production growth. That means that this company is unlikely to be an income option for investors (probably not ever). But the well profitability points to substantial appreciation potential.

Personally, I usually will hold the stock until management sells the company. I would only sell it myself if the stock became wildly overpriced with several years of growth priced into the stock price. Right now, the opposite is true. So the stock can be considered for purchase for those that want a cheap entry into the industry. This management has treated investors well in the past. So that is likely to happen again in the future.

Be the first to comment