We Are

Elevator Pitch

I rate Yalla Group Limited’s (NYSE:YALA) shares as a Hold.

I touched on the moderation in YALA’s “MAU (Monthly Active Users) growth for its core social networking app” in Q4 2020 and the “stiff competition” that the company faces in my April 9, 2021 initiation article. I retain a Hold rating for YALA with my latest article, as I consider both the company’s near-term growth prospects, and its diversification efforts that should bear fruit the long run.

Slower Growth Drove Valuation De-rating

In 2022 year-to-date, Yalla Group’s share price has dropped by -54%, while the S&P 500 is only down by -19% in the same time frame. YALA’s consensus forward next twelve months’ Enterprise Value-to-Revenue multiple has compressed from 1.92 times as of January 3, 2022 to as low as 0.22 times at the end of the October 28, 2022 trading day as per S&P Capital IQ data. During this same period, Yalla Group’s consensus forward next twelve months’ normalized P/E multiple also de-rated from 8.9 times to 4.3 times.

It is easy to understand the reasons for Yalla Group’s poor stock price performance and valuation de-rating, if one reviews YALA’s recent financial results. As per financial data sourced from S&P Capital IQ, YALA’s revenue growth has slowed substantially from +154.5% YoY in the first half of 2021 to +10.5% YoY for the first half of this year. Yalla Group’s operating profit margin also contracted by -270 basis points from 29.1% for 1H 2021 to 26.4% in 1H 2022.

It is also noteworthy that YALA expects the company to achieve a top line of $72.5 million in Q3 2022 based on the mid-point of its management guidance highlighted in its Q2 2022 earnings press release. This implies that company management sees Yalla Group delivering a modest YoY revenue growth of +1.7% for the third quarter. In other words, YALA is unlikely to see a significant acceleration of its revenue growth in the near term, which explains why Yalla Group’s shares haven’t performed well since the start of the year.

Spotlight On Revenue Diversification

At the company’s most recent Q2 2022 earnings briefing on August 9, 2022, Yalla Group emphasized that it will pursue a “ROI (Return On Investment) based sales and marketing strategy.” I think this suggests that YALA will be very careful in deciding how to allocate capital between its flagship products and new products to drive future growth.

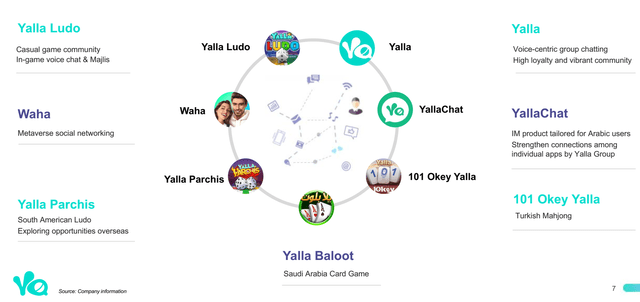

Yalla Group’s Product Portfolio

YALA’s Q2 2022 Earnings Presentation

As highlighted in the chart presented above, Yalla Group has a number of products in its portfolio. In its second quarter results media release, YALA referred to “Yalla” and “Yalla Ludo” as its “flagship mobile applications.” Yalla Group also mentioned in its fiscal 2021 20-F filing that “Yalla and Yalla Ludo, still contribute to the majority of our revenues.”

It is reasonable to assume that Yalla Group’s top line growth has moderated in the first half of the current year because its flagship products are now already at the mature phase of the product lifecycle. Therefore, it is critical for YALA to seek out new growth drivers and diversify its revenue base in the medium to long term. That said, it won’t be easy for YALA to find new products that are able to contribute a similar amount of revenue comparable to that of its flagship products in a very short period of time.

YALA revealed at its second quarter results call that it recently “invested in two gaming studios” as part of the company’s efforts in “exploring the mid-core and hard-core game distribution business.” Considering that YALA already has a presence in the casual games segment with Yalla Ludo, it does make sense for the company to venture into the “mid-core and hard-core” gaming segments.

Nevertheless, there will be “short-term pain” for Yalla Group in the near term, before the company has a chance to enjoy the “long-term gain” associated with the potential success of its revenue diversification. YALA highlighted at its Q2 2022 earnings call that its non-GAAP adjusted net profit margin might decrease from 37.6% in Q2 2022 to somewhere between 30% and 35% in the short term. The expected margin compression for Yalla Group in the near term is attributable to investments related to new products.

Share Buybacks

YALA initiated a $150 million share buyback program in May 2021, which expires on May 21, 2023. As disclosed in its Q2 2022 results press release, Yalla Group has already allocated $25.4 million of its excess capital to share repurchases between May 2021 and June 2022. This is equivalent to 16% of Yalla Group’s $150 million share repurchase authorization, and 5% of its current market capitalization.

As of June 30, 2022, Yalla Group had $124.6 million remaining from its current share buyback authorization and a cash balance of $384.9 million. This implies that YALA has the flexibility and financial capacity to engage in value-accretive share repurchases going forward.

Bottom Line

I continue to assign a Hold rating to Yalla Group’s stock. Diversification will take time, so YALA’s top line growth should remain sluggish in the short term. However, further downside for YALA’s shares might be limited by the fact that the company is in a position to support its stock price with share repurchases.

Be the first to comment