Adrian Vidal/iStock via Getty Images

The Global X Covered Call ETFs remain some of the most debated and popular income investments. I recently wrote an article on the Global X Nasdaq 100 Covered Call ETF (QYLD) as this happens to be their most popular covered call strategy, but sometimes the most popular isn’t the right investment choice for an individual. The Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) is similar to QYLD, but its focused index is the S&P, not the Nasdaq 100. XYLD has been growing in popularity as its assets under management have grown 488% since 5/31/21, increasing from $272.11 million to $1.6 billion. Investors continue to allocate capital toward these strategies as their large distribution yields are appealing.

There is also another debate, capital appreciation vs. Income investing. There is an argument that investing in income investments is a waste of time because too much future appreciation is left on the table. The most common point I hear is that investing in an S&P index fund is a better approach as you can just sell a share or two when income is needed. There is certainly logic to this method of thinking as the markets over time have always appreciated, but why can’t you have it both ways? I think the point that bears often miss is that many income investors are also invested in traditional index funds and have several other types of investments. I have never been of the mindset to condense investments as I believe in diversification. Many corporate 401k plans do not offer covered call ETFs as an investment option, and many investors have the majority of their retirement accounts allocated to index funds, target-date funds, or a mixture replicating a 60/40 portfolio. Many individuals will be forced to sell off shares from investments due to the required minimum distributions in their retirement years. Income investors look toward investments such as XYLD to build streams of income to offset their cost of living in the future. XYLD is now yielding 11.91% as its share price is $42.29 making it an interesting income investment to build your future income stream.

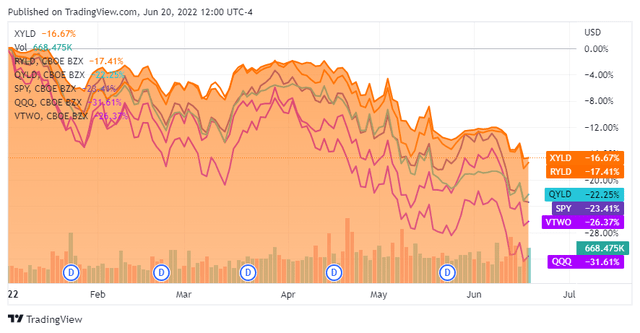

XYLD is holding up better than its counterparts, QYLD and RYLD, and their respective indexes

Even though Global X added a 4th covered call fund, there just isn’t enough data on it for me to add it in this analysis. XYLD is holding up better than its counterparts QYLD, and the Global X Russell 2000 Covered Call ETF (RYLD) amidst the markets entering bear market territory. Many investors would rather sacrifice some upside potential or income generation for capital preservation. The S&P 500 closed -3.41% on the week, pushing it further into a bear market as it’s now down -23.39% in 2022. The Nasdaq closed in the green on Friday but still closed the week down -2.01%, which added to its total year decline, pushing it lower by -31.80% YTD. The Russell 2000 also declined -2.85% for the week and is down -26.70% YTD. From their respective indexes, the S&P 500 has declined the least in 2022, while the Nasdaq has fallen the furthest.

In 2022, XYLD has protected investor capital better than its counterparts of the major index funds for their respective indexes. For this comparison, I will use the following index funds:

When looking at XYLD, QYLD, RYLD, SPY, QQQ, and VTWO in 2022, these funds have declined from -16.67% to -31.61%. XYLD has declined the least, followed by RYLD, then QYLD. All 3 covered call funds have outperformed their respective indexes YTD. What is also very interesting from this comparison is that all 3 covered call funds (XYLD, RYLD, QYLD) have outperformed all three of the index funds (SPY, QQQ, VTWO) as well.

Very few investments have appreciated in 2022, and even the bellwethers such as Apple (AAPL) have declined. The most common bear argument that I have seen was that during bear markets, covered call strategies would decline further than their respective indexes as they will produce large levels of volatility. The S&P 500, Nasdaq, and Russell 2000 indexes are officially in bear markets, and 2022 has seen nothing but downward declines. This bear thesis has been proved incorrect time and time again on the way down and still doesn’t hold up. XYLD has outperformed SPY, QQQ, and VTWO in 2022, and in addition to preserving capital, it generated double-digit yields.

The concept around how XYLD is able to generate large annual distributions which are paid monthly

First, what is a covered call? Per Investopedia:

A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. To execute this, an investor holding a long position in an asset then writes (sells) call options on that same asset to generate an income stream. The investor’s long position in the asset is the “cover” because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a “buy-write” transaction.

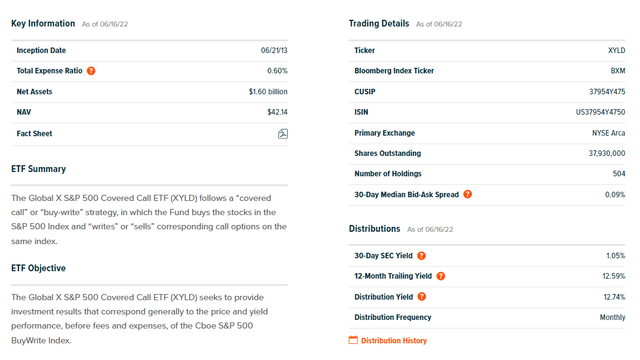

XYLD invests at least 80% of its total assets in the securities of the S&P 500 and writes call options on the S&P 500 index. Each time the fund writes a covered call option, the fund receives a payment of money from the investor who buys the option from the fund. The premium paid by the buyer of the option provides income in addition to the security’s dividends or other distributions. XYLD uses an at-the-money call option strategy, and the options are written systematically on the monthly writing option date of the S&P 500. This is an efficient way for investors to gain exposure to income generated from the options market without worrying about doing something incorrectly or spending time learning what to do. XLYD does all of the work as it writes call options on the S&P 500 index saving investors time and the broker fees of doing this independently. For all of this work, XYLD only charges 0.60% in management fees.

Unlike other investments, XYLD can generate monthly income due to its covered-call strategy, writing call options on the S&P 500 index. One major upside to XYLD is that the fund is not dependent on dividend harvesting from its underlying positions. If companies reduce or cut dividends, XYLD’s income is minimally impacted. XYLD’s distributable income is generated from writing monthly covered calls and collecting any dividends that may be paid from its underlying securities. The covered-call strategy has become increasingly popular for income investors because large premiums can be generated on a continuous basis through writing calls.

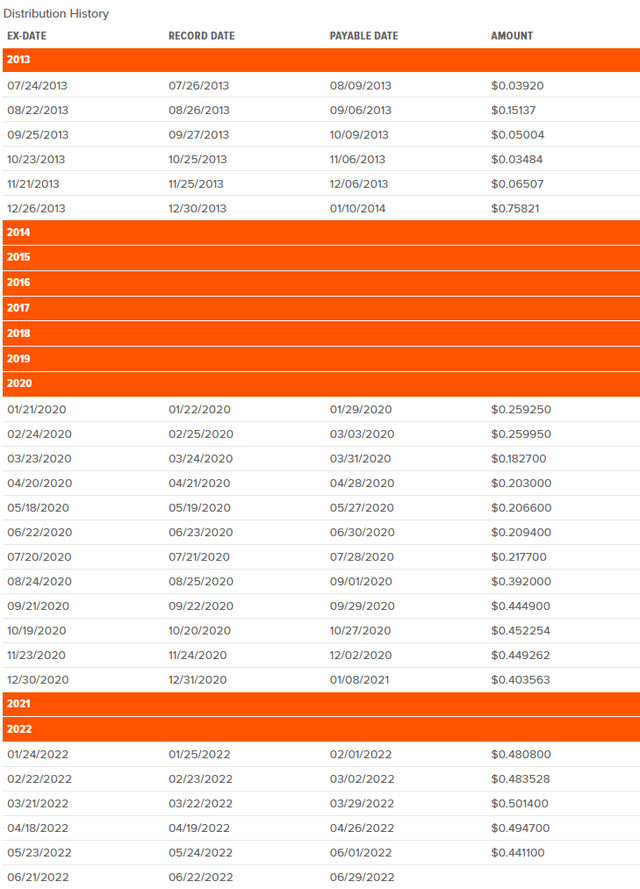

XYLD has been generating monthly income since its inception without skipping a month.

According to Seeking Alpha, going back to June 2013, it looks like XYLD closed at $40.45 on its first day. Since July of 2013, XYLD has paid 107 consecutive monthly distributions. While XYLD’s monthly distribution income fluctuates due to option premiums, its track record speaks volumes as to the validity of its income strategy. During 2020 XYLD generated $3.68 of distributed income per share while many companies and funds reduced or in some cases, eliminated their dividends. On 1/3/20, XYLD traded at $51.04, placing its forward yield on investment at 7.21%.

Many income investors look at income investments as owning a business. When you own a business, you don’t have a value placed on your business every second of every day as you do when investing in the market. Your concern is turning a profit and generating take-home income. Income investors tend to look at income investments the same way they would as owning a business. The value of the asset will increase and decrease over time which becomes an acceptable risk as long as the flow of income isn’t disrupted.

Hypothetically, if you had purchased 100 shares of XYLD on its first day of trading, your allocated capital would have been $4,005. Since July of 2013, XYLD has paid 107 monthly distributions, which have amounted to $2,594 of income. Over this period, you would have received 64.77% of your initial investment back in the form of distributions while still owning the underlying asset of 100 shares. From a capital appreciation standpoint, 2022 has been horrible, but since its inception, you would have recognized $224 of capital appreciation (5.59%). XYLD has been an investment where in just over 9 years, you would have been paid 64.77% of the original investment while generating a 5.59% return on capital. These numbers would drastically change if the monthly distributions were reinvested instead of taken as income. Your capital appreciation would drastically increase in lockstep with the stream of income that XYLD produces.

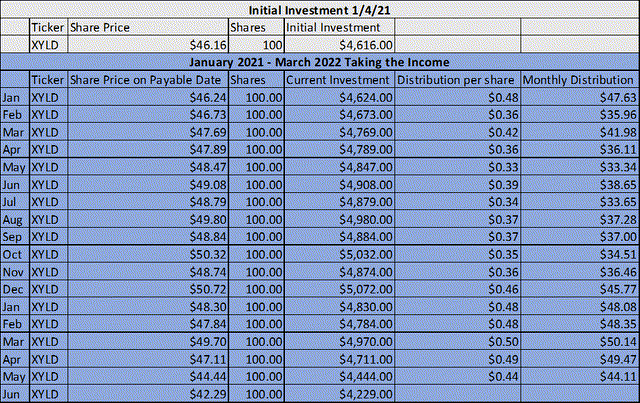

Covered Call ETFs weren’t popular when they started trading, so I want to show how XYLD would have faired if you had purchased 100 shares at the beginning of 2021. XYLD traded for $46.16 on 1/4/21. An initial investment of 100 shares would have cost $4,616. Since then, 17 monthly distributions have been paid as each share has generated $6.99 in income. Your initial investment would have declined by -$387 (-8.38%), but you would have generated $698.50 in income along the way. Your initial investment of $4,616 would have a forward distributable income yield of 15.13%. Overall, you would be up $311.50 (6.75%) on your overall investment. You would have collected $698.50 in income, you would still have your 100 shares valued at $4,229, and they would still be producing monthly distributions.

Steven Fiorillo, Seeking Alpha, Global X

Conclusion

I think now is a great time to consider XYLD as an addition to an income portfolio. XYLD has proven to be an excellent source of income since its inception, as its paid 107 consecutive monthly distributions. On a percentage basis, XYLD has declined less than its counterparts, less than its respective index (S&P 500), and less than its counterparts respective indexes (Nasdaq, Russell 2000). XYLD is trading at $42.29, placing its distribution rate of $5.03 at an 11.91% yield. Covered call strategies have disproved the common investment argument against them as they have proven to be less volatile than their respective indexes. XYLD should be on the top of the list if you’re looking for double-digit monthly distributions.

Be the first to comment