mihailomilovanovic

The SPDR S&P Retail ETF (NYSEARCA:XRT) gives investors broad exposure to the U.S. retail sector. Historically, the XRT ETF has generated strong long-term returns, as it has not paid to bet against the U.S. consumer.

However, a recent weak retail sales report suggests consumer spending may be faltering. Historically, weak consumer spending is associated with periods of major economic weakness. This confirms my view that a recession may be in the cards for 2023. I would be hesitant to hold the XRT ETF heading into a recession.

Fund Overview

The SPDR S&P Retail ETF provides broad exposure to the retail sector. The fund tracks the S&P Retail Select Industry Index (“Index”), an index designed to track the retail segment of the U.S. equity markets. It includes the following GICS sub-industries: Apparel Retail, Automotive Retail, Computer & Electronic Retail, Department Stores, Drug Retail, Food Retailers, General Merchandise Stores, Hypermarkets & Super centers, Internet & Direct Marketing Retail, and Specialty Stores.

The index is a modified equal-weighted index, which avoids concentration in large capitalization stocks. The fund allows investors to make tactical bets on U.S. retailers.

The XRT ETF has $280 million in assets and charges a 0.35% expense ratio. It has a trailing 12-month distribution yield of 2.6%, paid quarterly.

Portfolio Holdings

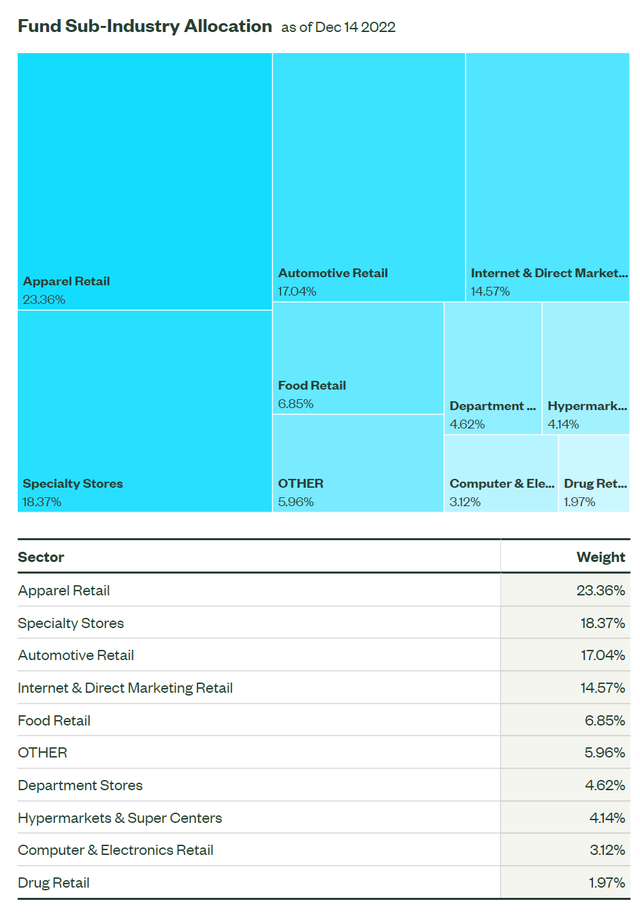

Figure 1 shows the XRT ETF’s sub-industry allocations. The fund’s biggest weights are apparel retail (23%), specialty stores (18%), and automotive retail (17%).

Amazon.com, Inc. (AMZN), the largest retailer in the world by market cap, only has a 0.8% weighting in the XRT ETF versus an 18.6% weight in the Consumer Discretionary Select Sector SPDR Fund ETF (XLY), which is modeled after the consumer discretionary sector weighted by market cap.

Figure 1 – XRT sub-industry allocation (ssga.com)

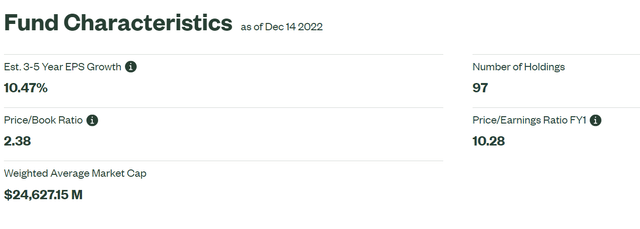

Overall, the XRT portfolio holds 97 positions with an average Fwd P/E of 10.3x (Figure 2).

Figure 2 – XRT fund characteristic (ssga.com)

Returns

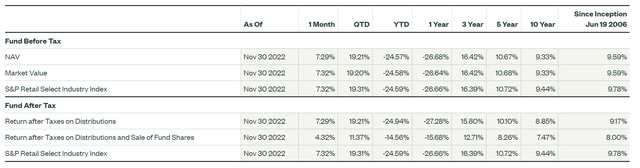

Despite a poor 2022 with YTD returns of -24.6% to November 30, 2022, the XRT ETF has generated strong long-term returns of 16.4%/10.7%/9.3% on a 3/5/10Yr timeframe (Figure 3).

Figure 3 – XRT returns (ssga.com)

Are Consumers Tapped Out?

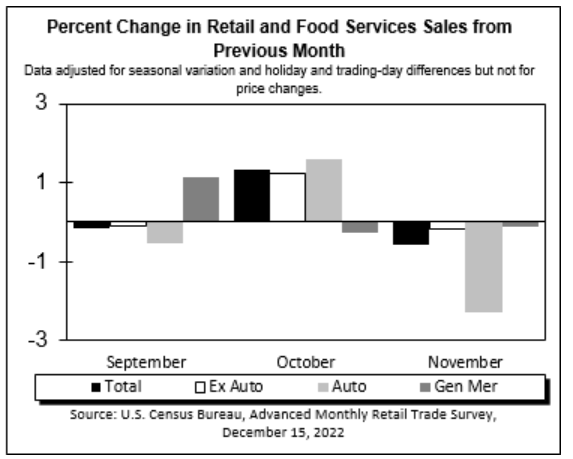

A recent advanced retail sales report from the U.S. Census Bureau suggests consumer spending may be slowing. For the month of November, advanced estimates of U.S. retail sales were $689.4 billion, down 0.6% MoM. This reading missed Wall Street consensus estimates, which called for a 0.1% MoM decline.

More importantly, the ex-Auto retail sales figure actually declined 0.2% MoM vs. consensus estimates, which had called for a 0.2% MoM gain (Figure 4).

Figure 4 – U.S. retail sales ex-Auto MoM% (U.S. Census Bureau)

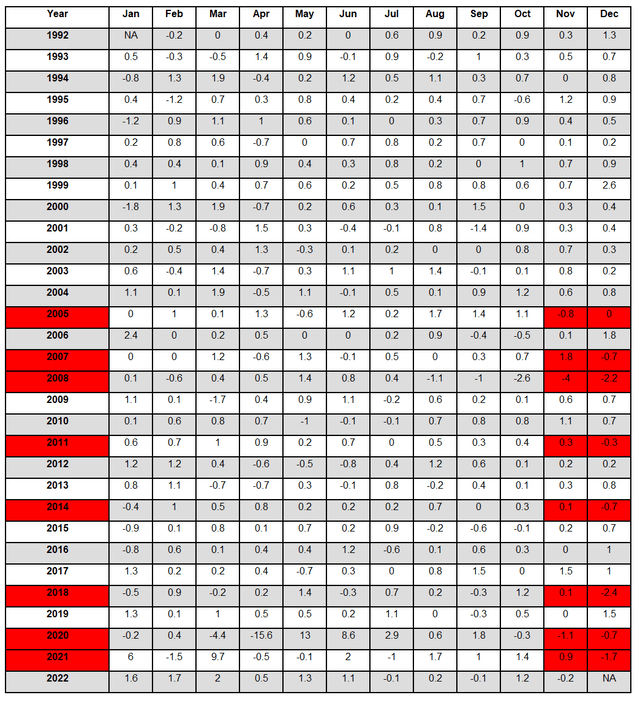

Historically, MoM retail sales ex-Auto tend to increase in the final months of the year, as American consumers prepare for the important year-end holiday season. Over 30 years from 1992 to 2021, the MoM retail sales ex-Auto growth rates in November and December were only negative 8 times (Figure 5).

Figure 5 – U.S. ex-Auto retail sales MoM% are rarely negative in November/December (Author created with data from U.S. Census Bureau)

When retail sales falter during the important holiday season, it is usually a sign of a weak economy. 2005 saw an abrupt economic slowdown towards the end of the year while 2007 and 2008 was the Great Financial Crisis. In 2011, U.S. consumers experienced depressed sentiment due to a U.S. credit downgrade and the first European debt crisis. 2014 was a repeat Eurozone crisis. 2018 was an economic slowdown from Fed tightening and President Trump’s trade war. Finally, 2020 and 2021 retail sales were impacted by the initial COVID restrictions and the Omicron variant.

Weak Consumer Spending Confirm Recessionary Fears

In recent weeks, I have written extensively about the rising risk of a global recession in 2023. For example, in a recent article on the PIMCO Dynamic Income Fund (PDI), I highlighted that market expectations for the Fed to start cutting interest rates in the second half of 2023 are consistent with fears for an impending recession.

Already, we are seeing PMI surveys consistent with a contracting economy. Economic forecasters such as the Conference Board are estimating a high probability of a recession in the next twelve months. This latest report on U.S. retail sales confirms my thesis that the U.S. economy is on the precipice of a recession.

Credit Card Metrics Begin To Falter As Well

In addition to slowing consumer spending, investors also got some pretty negative credit card metrics on December 15, 2022. Discover Financial (DFS) reported November credit card delinquency rates of 2.36%, an increase from 2.23% in October and 1.60% YoY. Net charge-off rate also rose to 2.46%, from 2.10% in October and 1.53% YoY.

Similarly, Capital One (COF) reported November delinquencies of 3.32%, an increase from 3.17% in October and 2.13% YoY. Charge-offs were 3.14% vs. 2.93% in October and 1.66% YoY.

Interestingly, American Express (AXP), which caters to wealthier customers, saw U.S. credit card delinquencies hold steady at 0.9%, flat MoM, and a small increase from 0.7% YoY.

As consumers cut back on spending and become delinquent on their credit card balances, I expect retail-focused equities represented by the XRT ETF to suffer in the coming months.

Technical Picture Weak

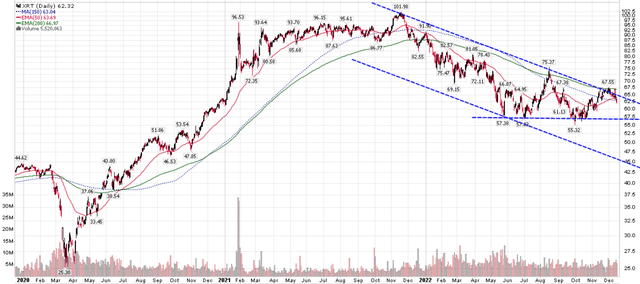

Technically, the XRT ETF recently rallied to a year-long downtrend before reversing. The immediate downside is a re-test of the 2022 lows near $57. A breakdown could target the lower end of the downtrend around $45 (Figure 6).

Figure 6 – XRT reversing at downtrend (Author created with price chart from StockCharts.com)

Risk To My Call

The risk to my call is the old adage, “don’t bet against the U.S. consumer”. The weak November retail sales could be an anomaly, and retail stocks could stage a rally if the global economic environment improves in the coming months.

Conclusion

The XRT ETF gives investors broad exposure to the U.S. retail sector. Historically, the XRT ETF has generated strong long-term returns, as it has not paid to bet against the U.S. consumer. However, a recent weak retail sales report combined with faltering credit card metrics suggest the U.S. consumer may be tapped out.

Weak retail sales figures in the critical holiday period tend to be associated with major economic weakness. This confirms my view that the U.S. economy is headed for a recession in 2023. I would be hesitant to hold the XRT ETF given economic headwinds.

Be the first to comment