gesrey

It would have been naïve to think that the current inflationary headwinds would not affect XPO Logistics (NYSE:XPO), but its highly unfair to see the stock price hammered down by 40% from the high it made in August 2021. The split as a result of RXO spin-off, also provides a very good opportunity to choose between a truck loading transportation company and a well-established tech-oriented truckload broker or adjust the allocation based on a delineated outlook on the potential of each business. The current price for both the businesses looks highly attractive as a long-term play based on the discounted cashflows and relative multiples basis.

The combined business reported an increase of 3% in its revenues, which is actually negative in real terms, however the adjusted EBITDA grew by 25% on year-on-year basis to $352 million, excluding intermodal and gain from real estate sales. The corporate costs for the third quarter (excluding one-time expenses), declined by a whopping 37% from same period last year. Once the product pricing as GRI reflects the inflationary adjustments at the start of next year, this cost rationalization would improve the margins substantially.

Strong Cashflow and Fiscal Position

The Levered Free Cashflow on LTM basis for the combined business was at reasonable levels (US$443.8m) implying a multiple of only 8.31x or ~12% in free cashflow yield. This is not bad for a cyclical business, especially during a period when the recession bottom-out or Fed pivot is still awaited. It provides a unique opportunity to build the position, which has solid return generating potential with the improvement in profitability once the optimism returns.

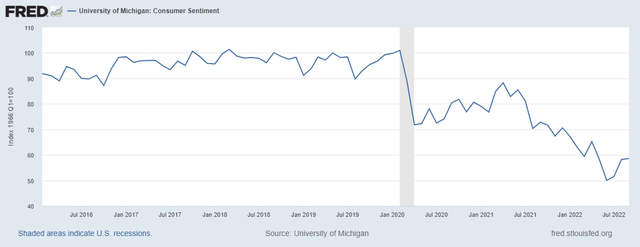

The company, anticipating the interest rate to rise, has been deleveraging proactively throughout the year with the leverage ratio declining to 1.7x in Q3-2022 against 2.7x at year-end 2021. It positioned the business well enough to brace for the impact and go back to the debt market once the macro headwinds subside, particularly on any demand slowdown. The holiday season could have been expected to precipitate a tailwind but it is prudent to keep the optimism in check with rising inventories and consumer sentiment down at 58.6 in Sep-2022 from 72.8 in Sep-2021.

FRED – ST. LOUIS FED FRED – ST. LOUIS FED

XPO, the LTL Business Performance

On stand-alone basis, the Less-Than-Truckload business reported adjusted EBITDA of US$757 million for 9M-FY22 which, excluding real estate gains, an increase of 9% on year-on-year basis with the revenue and adjusted EBITDA being third quarter records. The adjusted operating ratio stood at 83% which is a 160 bps improvement on year-on-year basis. The revenues (excluding fuel surcharge) increased by a decent 4.9% from last year and the management expects at least $1 billion of adjusted EBITDA for the full year, which is phenomenal when compared to the adjusted market cap of US$3,680m (at the pre-market traded price of approx. US$32/share on November 1, 2022). The trailing twelve-month PEG GAAP is at 0.04 which is a reasonably strong indicator of good price performance over the coming years.

Capacity Expansion

The company has also been investing in capacity expansion which could prove to be a drag if there is a sharp deterioration in economic conditions. On the flip side, it could add some buffer on the potential decline in revenues while preserving the room on the upside.

The new terminal in New Jersey to manage volume flowing through the Northeast Corridor, replaced the smaller terminal and added 24 new doors to the network, bringing the expansion to 369 doors against the targeted 900 net new doors open by year end 2023. Having added a second trailer production line in the first quarter, the company will be adding another line in the fourth quarter. The linehaul trailer fleet will be up by more than 10% by year end 2022 and the trailer production is planned to be increased by another 50% next year. It is hard to see a more optimistic and aggressive management in the current macro environment but the operating rate and strong fiscal position support the business case.

RXO – A Tech-Oriented Brokerage Solution for Truckloading

The spun-off brokerage business offers a unique asset-lite opportunity to access the independent carrier network of 1.5 million trucks. According the Q3 investor presentation, the company recorded a massive 31% increase in the gross profit dollars with reasonable gross profit margin of 19% (+500 bps) in the North American truck brokerage. The mobile app for the brokerage platform has been downloaded over 850,000 times which signals a decent market interest. It provides the critical mass that is hallmark of a strong recurring revenue over the years to come.

Conclusion

In conclusion, the lower price multiples and the potential growth as a result of capacity expansion should generate better returns. The free cashflow might come under some pressure with all the capex plans and any weakness in the price should be taken advantage of to build further positions.

Be the first to comment