Nastassia Samal/iStock via Getty Images

Investing is getting harder, not easier. Today the S&P 500 (SPY) and many leading dividend stocks are at or near record highs today, and very few index funds or individual stocks currently offer income even close to the elevated levels of inflation we are seeing.

Changing market conditions often require different investment strategies and with most of the major benchmarks are at or near record highs, finding value is as hard as ever.

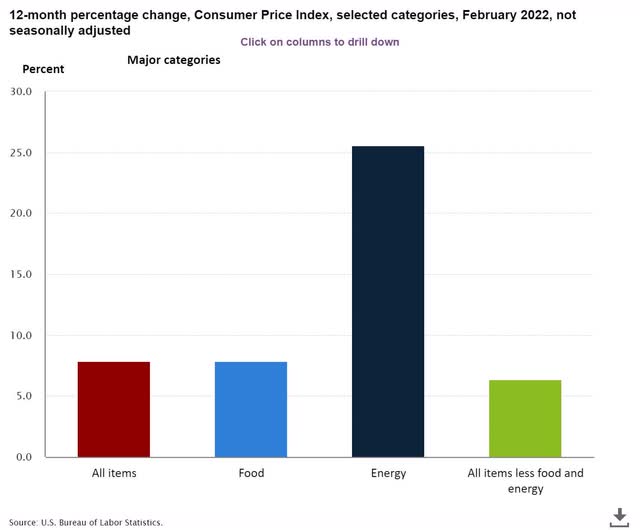

Today inflation is the biggest challenge that most dividend and income investors face, with the consumer price index consistently showing prices rising across the board at a rate consistently above 5%.

In this kind of investing environment most dividend and income investors will need to look at untraditional or alternative investments to continue to get inflation adjusted income and total returns.

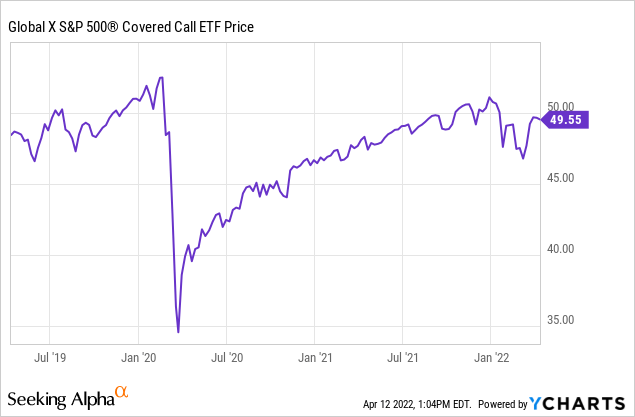

One income-based investment fund that has consistently offered double digit returns every year over the last 8 years is the Global X S&P 500 Covered Call Exchange Traded Fund (XLYD). This covered call fund has offered investors total returns of 30% over the last 3 years, and the fund has a 5-year average dividend growth rate of 29%. The fund currently yields just under 10%, and this ETF returned 9%, or $4.45, in dividends over the last year. This indexed fund invests at least 80% of the fund in stocks that are in the S&P 500.

A Stock Chart (Seeking Alpha)

Inflation rates have consistently been over 5% for over a year now, and recent data suggests that inflation rates as measured by the consumer price index are likely to remain very high for some time. The consumer pricing data released today shows year-over-year inflation of 6.5%, the highest levels seen in 40 years. This recently released information showed Energy inflation came in at 11%, and food inflation came in at 8.8%.

Finding dividends and income in this kind of inflationary environment is challenging, and investors are looking for inflation adjusted income and total returns are going to need to look at alternative and nontraditional investments, such as the Global X S&P 500 Covered Call Exchange Traded Fund (RYLD).

This fund’s core holdings, which are of course indexed to the S&P 500, are 26% technology, 14% health care, 13% financials, 12% consumer cyclicals, 9% communication, 8% industrials, 6% consumer defensives, 4% energy, 3% real estate, 3% utilities, and 2% basic materials.

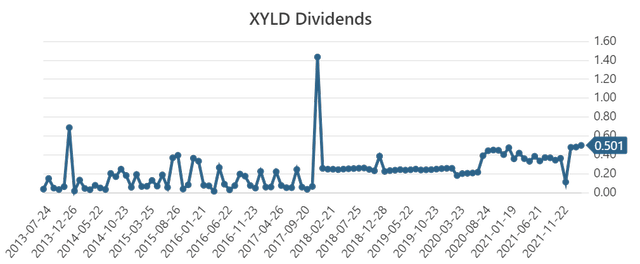

This exchange traded fund has an expense ratio of .6%, which is very good for a fund as active as this one is. The total assets under management of this fund are $1.21 billion and dividends are paid monthly. These distributions will obviously vary as the income from the covered calls fluctuates. Monthly distributions can change primarily based on volatility levels in the market impact the premiums the call options sold against the equities held. Still, the annual dividends and income this fund offers have been consistent and impressive since the fund’s inception 8 years ago.

Dividend Information (stockanalysis.com)

Even though the monthly distributions this fund offers have at times fluctuated significantly over the last 8 years, these payouts have still been consistently above the rate of inflation. This fund has yielded between 4% in 2013, to just under 10% last year. The average annual payout over the last 8 years is 7%, and annual distributions have been 6% or higher in 6 of the last 8 years. The fund has existed for 8 years.

Covered call funds such as this fund obviously tend to perform best during periods of elevated volatility, because that is when the premiums in the options that are sold against equities held are the highest. We are currently seeing elevated levels of volatility across major markets for many reasons. Today inflation is at a 40-year high, geopolitical tensions are raging in Eurasia, and Covid remains an issue with a recent outbreak in China. There have also been signs of a slowdown as well, with the residential and nonresidential construction markets in North America showing anemic recent growth. There is no reason to believe that current uncertainty and fear we are seeing across markets worldwide is going away anytime soon.

No investment comes without risk and the two biggest risks of investing in a covered call fund such as this are limiting your upside profit and also seeing your monthly and annual payouts vary significantly. The biggest risk of selling covered calls is that the investor is selling off part of the upside in the investments they are making, so upside gain is capped well downside risk is theoretically unlimited. Even though the Global X S&P 500 Covered Call Exchange Traded Fund has consistently offered strong income and total returns over the last 8 years, annual payouts have varied from as little as 4%, to as much as 9%.

The key to a covered call strategy being successful is you need enough volatility in the market get a nice premium on the calls being sold, but an income or dividend investor also doesn’t want so much volatility that capital preservation becomes an issue. This fund achieves both goals by offering solid returns without excessive volatility. While inflation rates and geopolitical tensions may rise or fall, volatility is likely here to stay. The Global X S&P 500 Covered Call Exchange Traded Fund is a well-diversified large cap fund that uses an options based strategy that is ideally suited to provide income and dividend investors with stabile and impressive payouts for some time.

Be the first to comment