Mohamed Sayed/iStock via Getty Images

Intro

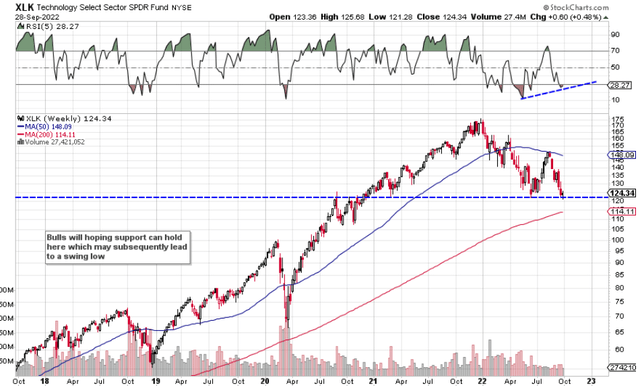

It will be interesting to see if Technology Select Sector SPDR Fund (NYSEARCA:XLK) can remain above its June lows of approximately $123 a share in upcoming sessions. The fund’s trend is certainly downward, confirmed by the rejection of the 50-week moving average (Or 200-day moving average) at roughly $146 a share in August of this year. Bullish divergences are beginning to appear, however, in the RSI momentum indicator, which points to a hard bottom in XLK in the not-too-distant future.

XLK Technical Chart (StockCharts.com)

Price Extreme

Given that the ETF is now trading at a price extreme compared to historic levels, there is plenty to be attracted by in XLK at present. For example, despite the 11%+ decline in the fund over the past three days, assets under management have actually increased by more than 7% in this timeframe. This means buyers are coming to the table in expectation of a rebound. Furthermore, the fund’s ultra-low expense ratio of 0.11% is well below the 0.45% fee when we average out ETFs’ expense ratios in general. Suffice it to say, if one was utilizing an options strategy in XLK, one could buy something like a debit call spread when we get a swing low in the technicals in earnest.

Buying call spreads though are better employed in environments of low implied volatility. XLK’s implied volatility due to the recent decline has spiked above 30% which is well above average for this fund. Therefore, how can we construct a bullish trade using the fund’s high implied volatility to potentially make a healthy gain? Enter the broken wing butterfly.

Broken Wing Butterfly

Although one may deem the broken wing butterfly a complex options strategy, it is an excellent strategy for the trader whose objective is to record a high number of winning option trades. In fact, the broken wing butterfly (when constructed correctly), has a probability of profit of over 80% and is even higher than this when the position is adjusted correctly. Let’s get to the breakdown of our broken wing butterfly in XLK which we put on just over a week ago.

Initially, we sold the October ($132/$133/$135) Broken Wing Call Butterfly for a $0.15 credit per butterfly. This means, the purchase of the $132 call strike, the sale of two $133 call strikes, and the purchase of the $135 strike results in a $0.15 credit per butterfly. The broken wing (Higher $135 call strike instead of $134) enables us to collect a credit which essentially eliminates any risk to the downside. Essentially, if XLK were to keep plummeting from its present level, that $0.15 would be for the trader to keep as all options would essentially end up being worthless at expiration.

Whether trading or investing in the financial markets, if one can consistently place themselves in positions where one has limited downside risk but yet strong upside potential, the potential for a successful career in this industry increases significantly. Our XLK broken wing butterfly has a maximum profit potential of $115 (long call spread width + credit received) and a maximum risk of $85 (Short spread width minus long spread width – credit received). We win as long as XLK remains above $134.15 by expiration.

Potential Adjustment

However, given the downswing shares of XLK experienced over the past week or so, we can make an adjustment that essentially will eliminate all risk from this position going forward. By rolling up the $135 call to the $134 strike for $0.05 (which turns the position into a regular butterfly), we now have a risk-free position. Our overall credit now is $0.10, our maximum profit is $210 (Width of the butterfly + credit received), and our max loss is $0. Essentially, we cannot lose our $0.10 credit, but we really want XLK now to rally and finish somewhere between the $132 & $134 strike, with the $133 strike being optimal. Although the probability of XLK resting at that $133 strike at expiration is low, the key here is to put on similar traders as often as possible to ensure that over time, the numbers can work out in your favor.

Conclusion

The Technology Select Sector SPDR Fund has had a very challenging six weeks, but a bottom may be close at hand. Bullish divergences are beginning to appear in the technicals and asset flow has been bullish in recent weeks. Concerning our broken wing call butterfly, we now want shares to rally up past $130 a share over the next 3 weeks. We look forward to continued coverage.

Be the first to comment