Pgiam/E+ via Getty Images

Investment thesis

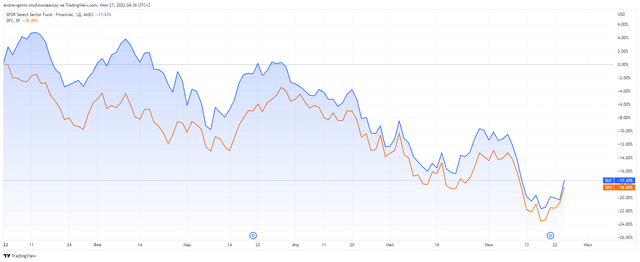

In the beginning of 2022, the banking sector enjoyed fairly high popularity among global investors – the relevant sectoral indices significantly outperformed the broad market indices in leading countries. This was largely due to expectations that the increase of rates outlined in the main regions would have a positive impact on the interest rate business of banks. However, optimism faded quickly, as the acceleration of inflation in the world, which provoked expectations of a sharp tightening of the monetary policy of the main central banks, as well as the war in Ukraine and severe lockdowns in China, led to a significant deterioration in economic forecasts. And the banking sector, whose business is sensitive to the situation in the economy, showed an outstripping decline and, like the broad market, went into negative territory since the beginning of the year.

Investors realized that the banking sector is not a safe-haven investment during the rising interest rates cycle. Panic ensued, causing a massive sell-off of bank stocks. However, the uncertainty about the short-term prospects of U.S. banks provides an excellent opportunity for long-term investors as the long-term outlook remains unaffected.

XLF (NYSEARCA:XLF) has 40% of its portfolio invested in American banks. I think that the recent fall provides a good opportunity to invest in a strong and relatively stable sector.

Disappointing Q1 results

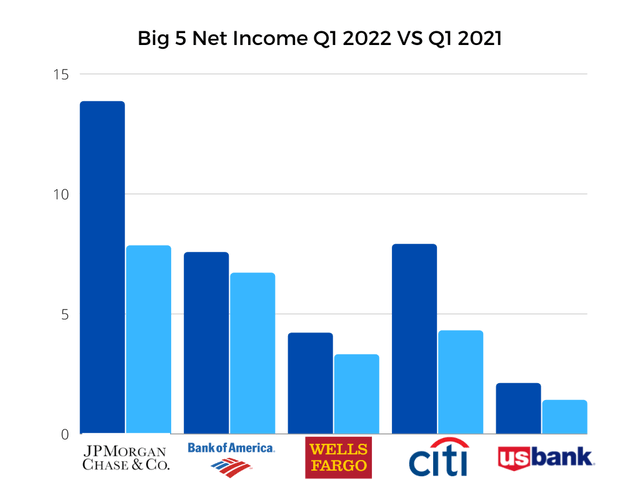

The banking sector in the U.S. was one of the main beneficiaries of the economic recovery in 2021 after the previous crisis year and showed a significant increase in profits. However, this year promises to be far from being so successful for the sector, as evidenced by the rather weak results of the first quarter.

The total net profit of 5 leading U.S. banks fell by 34% YoY to $23.54 billion. Citi (NYSE:C) and JPMorgan Chase (NYSE:JPM) saw a net profit drop of more than 40%. Total net revenue fell to $102.5 billion. The decline in quarterly profit in annual terms was recorded for the first time in six quarters.

Banks’ revenues were significantly pressured by a sharp drop in income from investment banking services, which suffered due to the weakening of M&A activity in the world, as well as due to a significant decrease in the number and volume of IPOs and bond issues due to the deterioration in the global financial markets. At the same time, all leading U.S. banks managed to demonstrate an increase in net interest income, which was due to the growth of corporate and retail lending with a relatively stable net interest margin.

The main factor behind such a strong decline in profits though was a sharp increase in provision for credit losses. This was due to worsening forecasts for the American and global economies, as well as expectations of significant losses on operations in the Russian Federation, as a result of which banks had to create additional reserves. JPMorgan’s provision for credit losses, for example, was $1.46 billion as the bank saw “higher probabilities of downside risk in the economy”.

Stress testing

On Friday, The U.S. Federal Reserve released a statement, which stated that all 34 of the largest U.S. banks have passed the stress test. This means that they will have enough capital to continue operations in the event of serious economic problems.

Modeling that assumed a $612 billion loss or a 2.7% to 9.7% decline in the Tier 1 Common Capital Ratio showed that if such an event occurs, the margin of safety for financial institutions will exceed the minimum requirements.

The hypothetical scenario included a global recession with significant stress in the commercial real estate and corporate debt markets. Unemployment rose to a peak of 10%, GDP declined by 5-7%, commercial real estate prices fell by almost 40% and stocks by 55%.

The stress test showed that although banks are facing short-term problems right now, they are still in a good shape and are ready for any economic problems.

Outlook

The short-term outlook for the U.S. banking sector is currently clouded by significant uncertainty. Bank executives note that the current financial situation of consumers and companies, as well as consumer spending in the United States, remain at a good level. However, in the future, they see significant geopolitical and economic challenges associated with high inflation, problems in supply chains and the war in Ukraine.

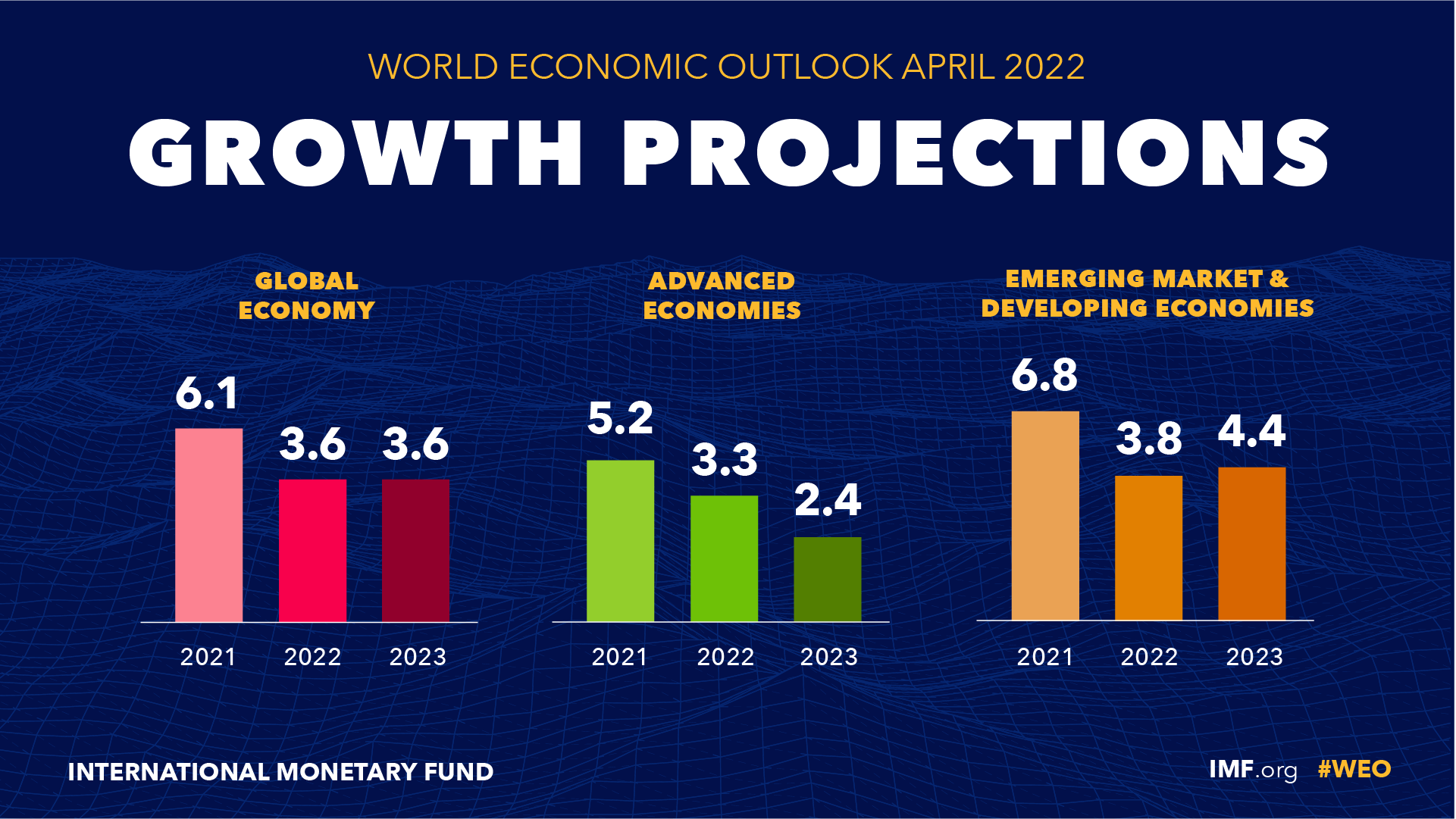

However, I maintain a positive long-term view on the sector. Despite rising risks, the current projections in the baseline scenario do not assume a recession in the global economy in the coming years. In particular, according to the IMF estimate, global GDP will grow by 3.6% in 2022 and 2023, with positive dynamics expected in all developed countries of the world. In this environment, banks will continue to feel relatively good, although their 2022 results will not be very strong.

IMF.org

Banks also reported that the lending activity of the U.S. population is gradually returning to normal amid the lifting of coronavirus restrictions and the completion of anti-covid support programs, under which citizens of the country received significant funds. Banks recorded a significant increase in spending on credit cards for purchases in stores, travelling and entertainment. Although the economic environment is tough, consumers are not willing to limit their spending, which is a green flag for the banking sector.

Impact on XLF

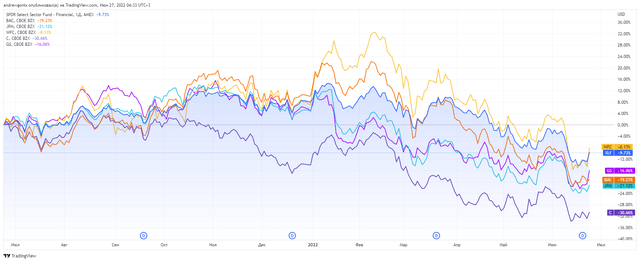

Banking sector stocks account for more than 40% of XLF’s portfolio and were the biggest losers.

| Ticker (bank stocks) | YoY return |

| JPM | -23,07% |

| BAC | -20,87% |

| WFC | -9,78% |

| C | -32,89% |

| PNC | -13,92% |

| TFC | -11,03% |

| USB | -16,46% |

| MTB | 12,71% |

| FRC | -20,67% |

| SIVB | -25,94% |

| FITB | -8,73% |

| CFG | -20,47% |

| RF | -4,08% |

| HBAN | -12,03% |

| KEY | -14,85% |

| SBNY | -23,56% |

| CMA | 5,69% |

However, the underperforming banking sector should not be the reason for reducing positions in the fund. In fact, it might be a good time to use the panic and buy more shares of the biggest best-in-class financial ETF.

| Metric | XLF | VFH (closest peer) |

| AUM | $30.39 B | $9.46 B |

| Expense Ratio | 0.1% | 0.1% |

| Number of holdings | 66 | 374 |

| Average daily volume | $2.42 B | $88.19 M |

Conclusion

Although big banks are among the biggest losers this year, I believe that they are still very strong and work in a favorable economic environment. Thus, I think that an investor should not be afraid of the banking sector, but keep an eye out, as the long-term prospects remain excellent.

As a long-term investor, I believe XLF is a Buy.

Be the first to comment