peshkov

Thesis

We urged investors in our previous update on The Energy Select Sector SPDR ETF (NYSEARCA:XLE) not to add aggressively even as it rallied from its July lows to form its August highs. We cautioned that the strength in XLE had not been supported by the increasingly tenuous price action seen in WTI crude (CL1:COM). Therefore, the risk of a sharp pullback in natural gas futures (NG1:COM) that we believe drove the summer rally in XLE could worsen the downshift in XLE if WTI prices continued to weaken.

Accordingly, Henry Hub natural gas futures have pulled back markedly from their August highs and rushing to re-test their July lows. We cautioned and even maintained our conviction that such surges were unsustainable, and investors need to be very cautious, no matter what they discern from the media. Price action is forward-looking; therefore, it could offer significant insights into what the market is thinking ahead, instead of trying to assess which Wall Street strategists are correct in their bullish/bearish assessment.

Our analysis indicates that WTI’s weakness is likely to continue further, as it couldn’t retake its critical support level, despite what the media says about tightness in demand/supply dynamics. The market has been trying to price in a recession since June, as it’s forward-looking.

We believe the critical question facing investors now is to parse the potential demand destruction from a recessionary scenario that could impact the price action dynamics of the XLE.

However, we urge investors not to simply buy into the thesis of your favorite Wall Street strategist that supports your conviction. We understand the story of structural energy shortages, record earnings, low valuations of energy stocks, high cash flow profitability, debt reduction, and record dividend yields. These stocks would not have collapsed markedly from their June highs if it was so simple.

So, instead of trying to discern which parameter is the most important, we urge investors to pay attention to price action as we believe it provides the most objective analysis (there’s no such thing as 100% objectivity in any study) for investors to understand and assess.

WTI Crude Weakness Could Likely Continue

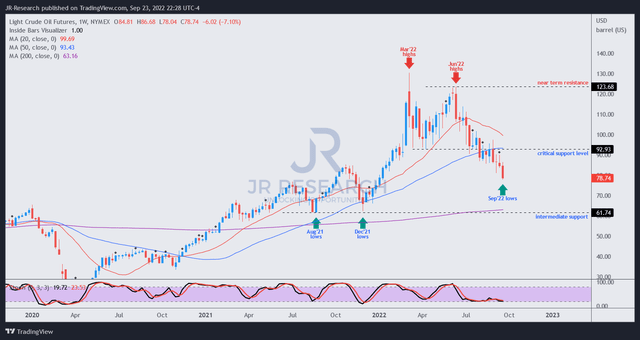

WTI crude price chart (weekly) (TradingView)

We highlighted in our previous update that there was a bear trap (indicating the market rejected further selling downside decisively) in August. Therefore, it should portend a short-term rally (at least), helping WTI crude to retake its critical support level, as seen above.

Investors should consider it essential for WTI crude to regain control of its critical support level, which it has been unable to do since early August. Therefore, the failure of a short-term rally from its bear trap indicates the market’s directional bias of moving further downward, which is a critical red flag.

Moreover, the price action leading to breaking its critical support level is not emblematic of a capitulation move (rapid downward and steep decline to force weak hands to give up their shares). Instead, it was classic distribution, indicating that astute sellers were drawing in dip buyers progressively, creating the “false impression” of a “not-to-be-missed” dip-buying opportunity.

There were two instances of a climax top, as seen in March and June 2022, which suggested the market forced the top while drawing in investors unwittingly. The reverse of such price action would indicate capitulation but was curiously missing in its pullback from June highs. Therefore, we postulate the market has been distributing since June in anticipation of a recession.

We deduce that WTI crude would find significant challenges in regaining its bullish bias from here. Recall it has already lost its initiative from its bear trap. Also, price action is not indicative of capitulation. Furthermore, it appears to have lost its 50-week moving average (blue line) decisively. Breaking below that level will likely lead to even more pain, as it suggests that the market’s momentum has decisively shifted to the downside, with sellers in significant control.

We Emphasized Natural Gas Price Action Was Unsustainable

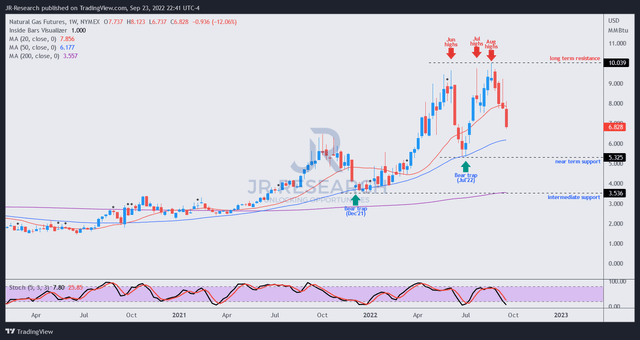

Natural gas futures price action (weekly) (TradingView)

In our past articles, we have emphasized several times that the price action in Henry Hub natural gas futures was unsustainable. The series of bull trap price action (indicating the market rejected further buying upside decisively), as seen above from June to August, is as straightforward as it could get for us.

Therefore, sellers have astutely leveraged Putin’s actions and rhetoric exacerbating Europe’s energy crisis to draw in overly-optimistic buyers and force the series of topping actions in NG1 before digesting their gains with glee.

Therefore, with natural gas and WTI crude getting pummeled recently from their highs, it justifies the weakness in XLE.

Is The XLE ETF A Buy, Sell, Or Hold?

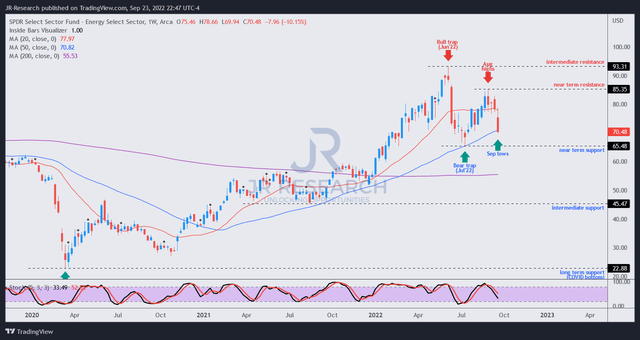

XLE price chart (weekly) (TradingView)

XLE has fallen markedly from its August highs, a red flag. Note that its August highs have created a lower high price structure, below June’s highs. Therefore, it’s a critical sign of buying momentum failure that could suggest that the massive rally in XLE could be over.

Notwithstanding, the next hurdle that XLE needs to clear is the potential re-test of its July lows. The sell-off has forced XLE closer and is emblematic of a capitulation move to force weak hands to give up rapidly. However, it remains to be seen whether the re-test would be successful or could fail like WTI crude, as discussed previously.

Given XLE’s likely price top in August, we urge investors not to buy this dip yet and to wait patiently for the re-test to assess the buying support at July lows. If July lows break decisively, given the run-up seen in XLE, we believe its medium-term rally would likely be over, and adding the dips could lead to even more pain.

As such, we reiterate our Hold rating on XLE ETF for now.

Be the first to comment