imaginima

Published on the Value Lab 11/9/22

The Materials Select Sector SPDR Fund (NYSEARCA:XLB) is a relatively small ETF with less than 30 holdings that has a pretty heavy skew towards a couple of industrial gas companies, as well as some other commodities. The exposures on balance look alright from the point of view of maintaining a resilient position despite macro threats, but the issue with XLB is that resilience is priced in with its selection. The income is weak and the fees are not low, so we don’t see any reason to get exposed to an ETF where investors can make pretty sterile and cheaper bets on specific commodities by choosing narrower ETFs or better yet individual companies. Overall, XLB gets a pass from us.

XLB Breakdown

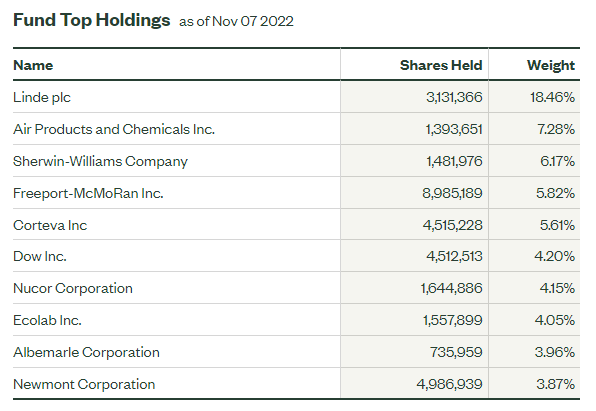

The top holdings are the following:

Top Holdings (ssga.com)

The skew is pretty heavy towards the top 5 companies, which account for more than 40% of the total ETF’s allocations.

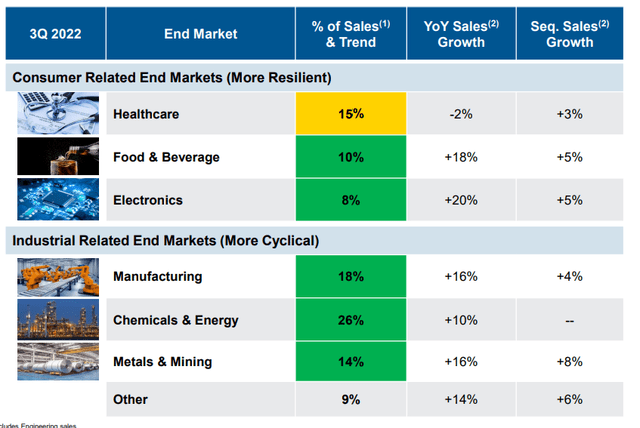

Linde (LIN) and Air Products and Chemicals (APD) are together around 25% of the ETF’s allocations and their exposures are primarily to industrial gases such as oxygen, nitrogen, some of the noble gases but also to process gases such as CO2, helium, hydrogen, acetylene and some other specialty gases. The atmospheric gases can often have less cyclical markets and are derived from air separation processes that employ cryogenics and other tools. The resilience of these volumes come from healthcare but also other industries like good and beverage. Metals and mining, chemicals and energy and manufacturing are other industries that compose the end-markets but these are more cyclical, and feature more the process gases. The split in terms of revenue for each of these end-markets is represented by the larger of the two holdings, Linde, and shown here. Note that healthcare at the moment is a low-growth area, so growth is still coming from more cyclical exposures which means harsher reversions coming. Moreover, the need for upping running inventories may reverse as pressure comes off major logistic bottlenecks, making reversions even stronger.

Some of the manufacturing exposure is to things like windows, which use noble gases, and other applications in housing. Further housing exposures come from Sherwin-Williams (SHW) which manufactures and distributes paints. Nucor (NUE) which is a steel company similarly is exposed to trends in construction. While Nucor is more exposed to heavy construction, which is more cyclical and levered to credit conditions, Sherwin is exposed to smaller scale construction. Our view on construction is that development economics are of course worsening markedly due to the dual-effect of both lower housing prices and more expensive credit conditions. These markets are leveraged and are therefore quite unsurprisingly suffering. Nonetheless, there are secular trends that remain, and we detail them in full in our coverage of the lumber players. Sherwin is likely to be more resilient, and is continuing to show growth in Q3. It also has the even more resilient DIY markets to thank in terms of continued demand despite higher rates.

Other exposures are to copper in Freeport (FCX), which has retreated substantially in price together with the cycle and the glut we are arriving at in the electronics industry especially, but still benefits from secular tailwinds even though they won’t save FCX from the current down cycle in commodities. And besides the slew of basic intermediate chemicals that dominate the rest of the portfolio, all products that are benefiting from the insufficient chemical plant capacity we’re getting with disruption from Russian sanctions that have taken petrochem and other capacity off the Western market, there is Corteva that are benefiting from the importance being placed on food security and crop productivity, but also suffering meaningfully in margin from higher gas prices. They are also exposed short on the US dollar.

Bottom Line

There are some solid exposures especially among the top stocks, but there is no total defense from cyclicality. In fact, there is still a broad exposure to cyclicality in the portfolio, more than there is to more resilient, specialty products. Yet the ETF trades at a 16.6x PE. That’s in line with the broader US market, which is mostly tech exposed and is less cyclical. This doesn’t make much sense to us. Things could go wrong from here despite the US managing to insulate itself from macro pressure thanks to the weaponisation of the dollar for supporting their current account, and playing their game against Russia almost entirely at Europe and not their own expense. Many of these stocks, while mostly US focused, have wallet share in other countries whose currencies are in relative decline and in relative macro decline, and are exposed to the downcycle materialising globally, even if the US is so far insulated. We do not believe that they deserve a higher valuation than the broader market at all, even if they could sport a premium valuation relative to other, broader materials exposures.

Then on the matter of income, the yield is 1.55%, and the fees 0.48%. There is almost nothing left for income where other commodities plays can get your double digit yields as markets fear the cycle. We think XLB is anti-economical at these prices.

Be the first to comment