dan_prat

The iShares S&P/TSX Composite High Dividend Index ETF (XEI:CA) is a Canadian income ETF that invests primarily in large cap Canadian financials and energy corporations. They are quite levered to crack spreads in the oil industry and give investors some Canadian dollar exposure to avoid the USD now that peaking inflation may signal a period of decline in the dollar. Overall, they seem a decent winter bet, although there’s no screaming value or income proposition here.

XEI Breakdown

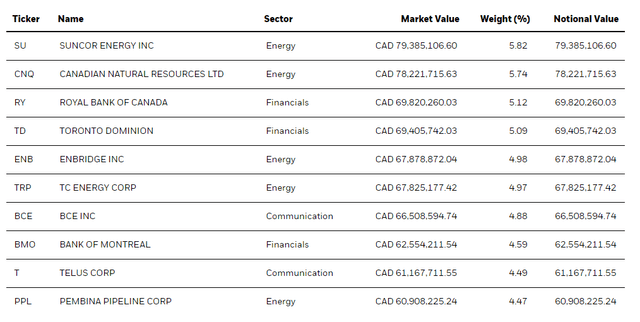

The top holdings in the ETF are the following and give a good snapshot of the sectoral exposures within:

Top Holdings (blackrock.com)

The ETF isn’t very small, within are 75 holdings, and the pretty even weightings go towards a lot of oil sands exposures in Canada. Oil sands are a non-conventional way of getting crude from tarry sands in fields in Canada that then have to be refined into crude products. It’s a very dirty industry, pollutes more than the rest of oil, but it is benefiting from higher crack spreads from crude products, in particular diesel which has been strengthened by the energy situation and winter’s approach. Inventories for crude products are in general very low, and capacity has shrunk since the start of COVID-19. There is quite a lot going towards pretty high utilisation rates, where many of these oil sands companies are comfortably above 90% in both their upstream and downstream businesses, and it signals tight conditions for refinery capacity and difficulties in procuring crude.

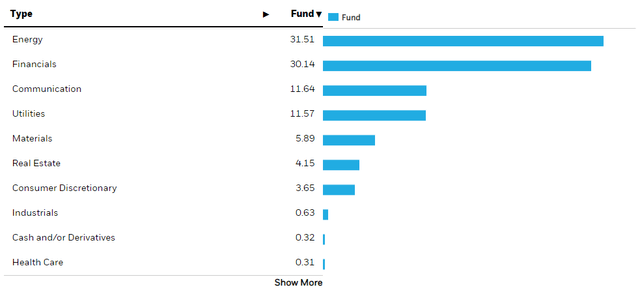

Sectors (blackrock.com)

Energy exposures also include some pipeline companies and terminal businesses, and the energy exposure drives the plurality of the allocations here at 31.5%. Note that a lot of this exposure is dollar denominated.

The other major exposure is to financials, that includes a lot of the usual suspects in the range of Canadian big banks. Full service banks have been suffering a bit due to issues in the capital markets and pressures on the wealth management businesses. Otherwise business and personal banking have been benefiting from the rate cycle. We think that while markets are excited about the prospect of peaking rates, there is more work for the Fed to do within their mandate. Rising consumer inflation expectations for year ahead are quite high and the Fed will want to quash that before stopping their rate hiking to be sure that there’s no wage-price spiral risk.

Bottom Line

The expense ratio is pretty low at 0.22%, and the yield is attractive at 4.28% with the underlying companies generally being pretty good dividend payers, and support to cracks in the winter lending itself to the majority of that payout in the medium term. The PE is 12.86x, which reflects well the mix between cyclical exposures in oil that trade in the mid-single digits and higher PE issues like telco, utilities and financials which trade at higher rates. Also, outside of the financial and energy exposures which have a lot of US wallet share or are operating in dollar denominated markets, there is a fair bit of exposure to the Canadian dollar which could be opportune as people speculate away from the dollar into more beaten down currencies. The CAD has seen a resurgence on the prospect that rate hikes may be coming to an end. Overall, it is a reasonable ETF to play oil sands companies and then solid Canadian financials, but overall there is nothing particularly compelling about this ETF.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment