imaginima/E+ via Getty Images

I’m currently exploring equities with price exposure to the energy market – especially thermal coal and natural gas. Both baseload power sources have seen dramatic price increases since the invasion of Ukraine, and yet the market still seems to discount the possibility of sustained pricing near current levels. I found a cheap, limited downside equity in Unit Corporation (OTCPK:UNTC) but have continued searching for something with more torque to the upside. The name that caught my eye is W&T Offshore (NYSE:WTI), partially due to their unique approach to hedging.

Overview

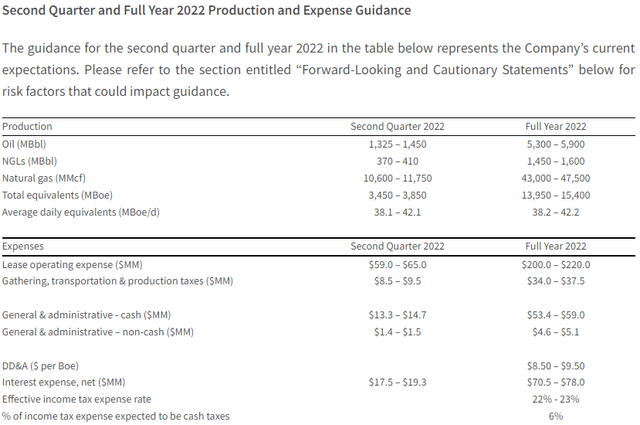

To frame the WTI story, consider their FY22 production guidance and hedges:

WTI Guidance (WTI Q1-22 Press release)

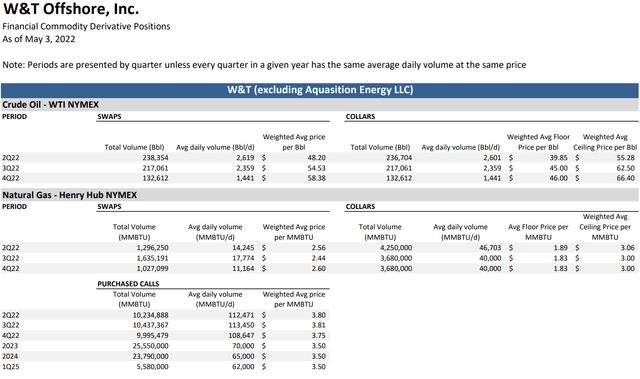

WTI Hedges (WTI Investor Presentation)

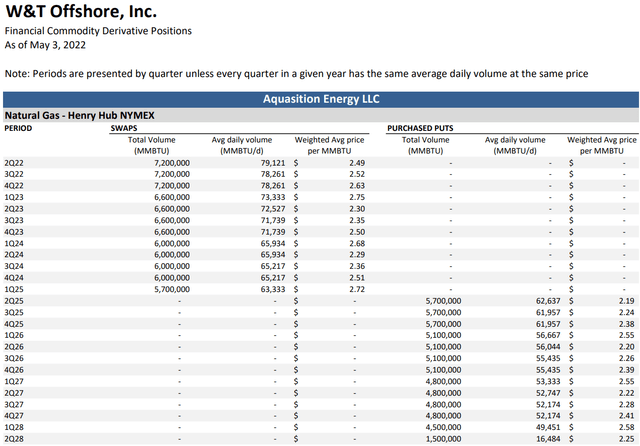

WTI Hedges (WTI Investor Presentation)

WTI was required to hedge a substantial portion of their natural gas production in cooperation with their current lending agreements; however, to maintain exposure to market pricing they bought a slug of natural gas calls for dates through 2025 for about $20m. Just the current quarter’s portion alone is now worth >$40m at current spot pricing. In their own words:

For the remainder of 2022, W&T is 28% hedged for oil and is fully hedged for natural gas. The Company also has purchased call options on natural gas with a weighted-average strike price of $3.78 per MMBTU covering approximately 88% of its anticipated natural gas production for the balance of 2022; these call options help offset the Company’s other natural gas hedges and allow W&T to capture a substantial amount of natural gas price increases.

WTI did not benefit from these calls repricing in the first quarter as significantly as they will in the second quarter (see spot Natural Gas Pricing Chart below) and futures pricing:

Spot Natural Gas Pricing (Seeking Alpha)

WTI’s production guidance also reflects that Q1 will be their lowest production of the year, partially due to recent acquisitions.

Let’s take a quick look at WTI’s guidance for Q2 at midpoints of the above guidance:

Q2-22

-

1,388k barrels of oil, of which 238k sold forward at $48.20 and 236k sold at $55.28. We can assume the balance is sold at $110.

-

390k barrels of NGLs, unhedged. Assume $50 realization.

-

11,175 MMCF natural gas, 1,296 sold at $2.56, 4,250 at $3.06, 7,200 at $2.49 (fully hedged, ~1,500 MMCF not produced against hedges). Calls realized at $8 and I netted out the unproduced gas for $8m.

|

Revenue (M) |

|

|

Oil |

$125.1 |

|

NGL |

$19.5 |

|

Gas |

$34.3 |

|

Sold Calls |

$35.0 |

|

Total Revenue |

$213.9 |

|

OpEx |

$71.0 |

|

DD&A |

$32.8 |

|

G&A |

$15.5 |

|

Interest |

$18.4 |

|

Taxes |

$15.0 |

|

Net Income |

$61.2 |

|

Normalized EPS |

$0.43 |

(Source – Company Guidance, Spot Pricing)

Given the street estimates Q2 revenue of $240m and $0.47 EPS, this doesn’t seem set up for a major earnings beat – unless WTI delivers on the higher end of guidance like they did in Q1. There will also be significant puts and takes marking their hedge book to market, so GAAP vs. estimates above may look different.

Valuation

Based on the guidance above, WTI should trade around 4x PE if one annualized Q2-22. They also have about $500m of net debt and nearly half a billion of asset retirement obligations that will eventually need to be addressed, implying a ~$2B enterprise value. The company made $220m of FY21 adjusted EBITDA and $91m FCF, suggesting they trade at 10x and 20x multiples in a more normalized environment, but also ignoring their growing production. Annualized Q1-22 EBITDA and FCF were $359m and $188m, generating less demanding 6x and 11x multiples for what should be their lowest production & realization quarter of the year.

Note – I am not adjusting the EV for the millions of in-the-money natural gas calls.

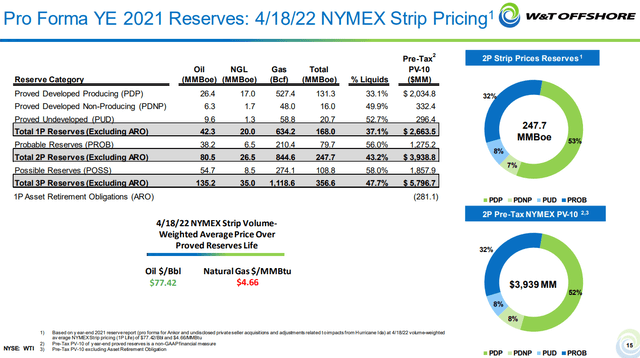

Reserves

WTI Reserves (WTI Investor Presentation)

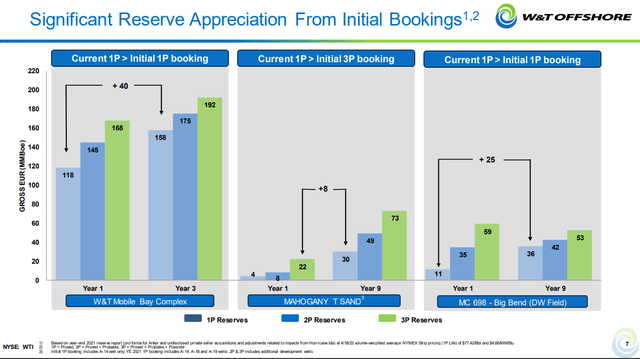

Supporting the valuation above, at weighted average strip pricing of oil at $77.42 and gas at $4.66, WTI still has proven reserves well in excess of their current EV at a 10% discount rate. Management materials explain how they have historically been able to produce above SEC guidelines for reserve levels due to the nature of sandstone formations in the Gulf:

WTI Reserve Growth (WTI Investor Presentation)

Management

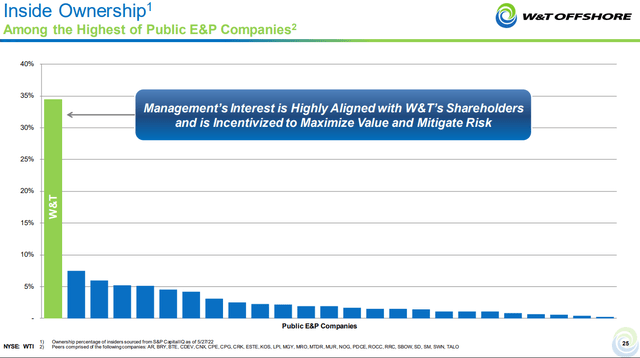

One of the unique features of WTI is their concentration of ownership, as the Founder, Chairman, and CEO Tracy Krohn holds 48m shares (~34%) and exercises significant control over the company through this stake. This kind of insider ownership is not something you often see in energy, which has allowed WTI to pursue growth initiatives at a time when most public E&Ps are focused on capital returns, reflecting their belief of what will best grow shareholder value.

Insider Ownership (WTI Investor Presentation)

Interestingly, from the time of the energy crash in 2008 through 2014, WTI paid over $350m of dividends, demonstrating their ability to care for shareholders through a cycle.

Bonus Upside

One prior article has comments highlighting some unique possible upside on WTI. The well WTI is slated to begin drilling in Q4 22, “Holy Grail” is a re-drill of Callon Energy’s 2008 efforts that were shelved by the energy crash. Expectations were for 22,500 Boe per day from two wells in the field, which will likely end up looking optimistic, but still demonstrates there could be significant growth from bringing this well online. This, along with recent acquisitions and rolling off hedges, demonstrates WTI is a rare energy growth story and a very attractive way to play expectations of sustained higher energy prices.

WTI has also developed JVs with deep-pocketed investors, including current efforts with HarbourVest (OTCPK:HVPQF) and Baker Hughes (BKR), and a recently announced agreement with Korea National Oil. These arrangements allow WTI to access capital without significant financial exposure, with opportunities to increase their returns via execution.

Because WTI has 30m, 25m, and 23m natural gas calls for the remainder of 2022, 2023, and 2024, if natural gas pricing were to reach $16, these calls would equal the entire $1B market cap of the company, given their ~$3.50 strike. This excludes the profitability of the company’s current operations with the gas hedges in place, partially unhedged oil and NGL production, and future acquisition growth.

It’s usually best to avoid taking a strong stance on where commodity prices are heading, but there are cases floating around suggesting $20+ gas is more likely than a return to $3 in the near term as US shale production fails to grow as expected. If this prediction comes true, WTI should be one of the best performing stocks in the market.

Risks

-

WTI is focused on growth via acquisition and new exploration, so poor execution on either front could result in value destruction.

-

WTI has a $100m ATM in place to be used if needed as part of an acquisition or refinancing (possible 10% dilution at $8 share price). This risk would be more acute if not for the substantial insider ownership.

-

No capital return program is currently being executed, in contrast to most public E&Ps.

-

WTI strongly hinted on their latest earnings call that they are nearing a refinancing on their 9.75% notes due in 2023. I expect the outcome of a refinancing to be strongly positive, but the execution risk remains until it is completed.

Conclusion

The W&T Offshore story is fairly simple – grow the business, grow production, maintain exposure to upside in energy prices. WTI’s hedges provide some downside protection if prices collapse, but buying WTI is primarily a bet on continued energy strength.

Be the first to comment