JHVEPhoto/iStock Editorial via Getty Images

Introduction

As I discussed in my prior article on Canadian construction and engineering firm Aecon (OTCPK:AEGXF) (ARE:CA), I believe that infrastructure remains a key industry to rely on for investing. Some companies are cyclical and bull cycles can be leveraged for strong returns, while others are stable cash flow earners that investors can slowly accumulate shares. Then, there are companies like Canada’s WSP Global (OTCPK:WSPOF) (TSX:WSP:CA) which drive strong growth through frequent acquisitions. In fact, WSP Global’s growth profile is unlike any other company in the construction and engineering industry.

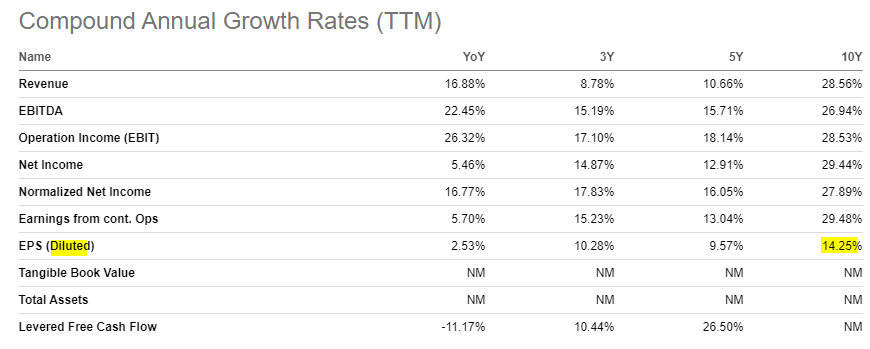

Seeking Alpha

As you can see, the frequent acquisitions have allowed both revenues and earnings to rise at a rapid clip, but growth is lumpy and unpredictable over time. We can also see that dilution is eating away at shareholder returns by a significant margin, but the goal is to perform buybacks upon maturation of the company. However, the issue is determining the company’s value during the coming transition period between high inorganic growth and slow earnings-led growth. This article will attempt to assess the viability of an investment into this interesting company at current levels.

Benefits of Diversification and Scale

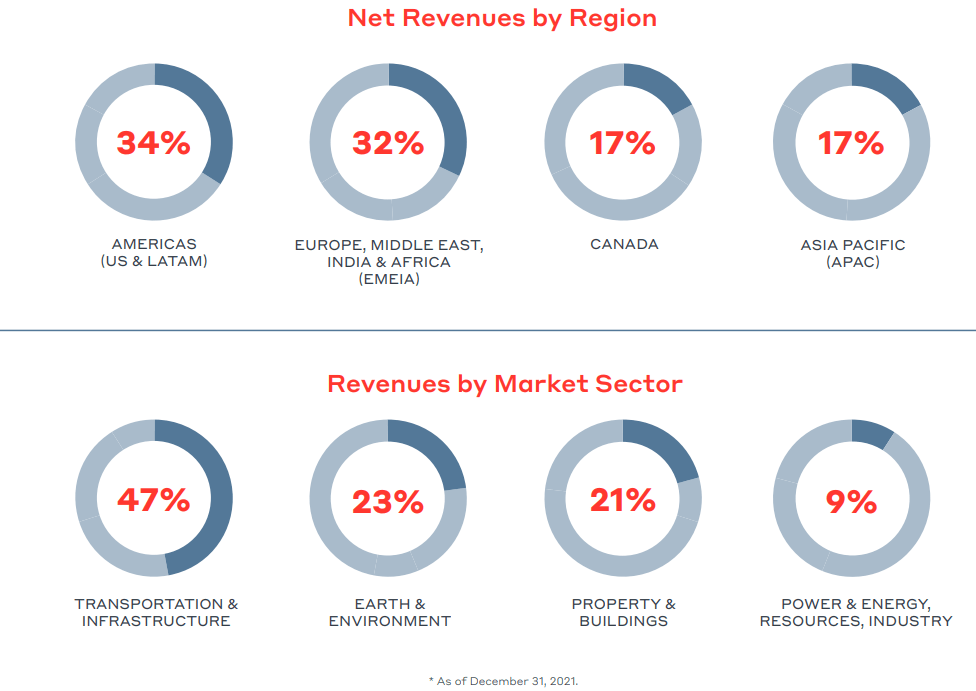

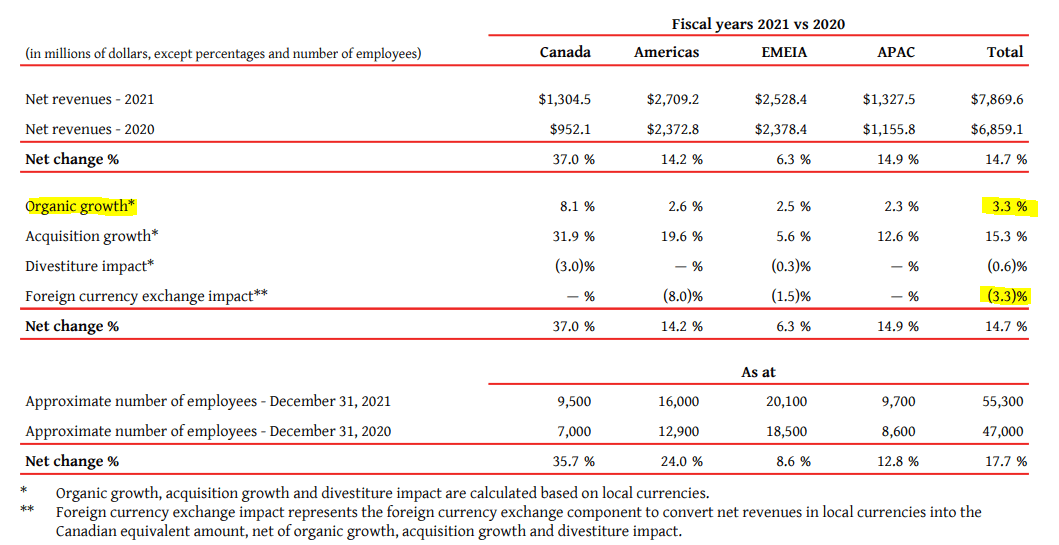

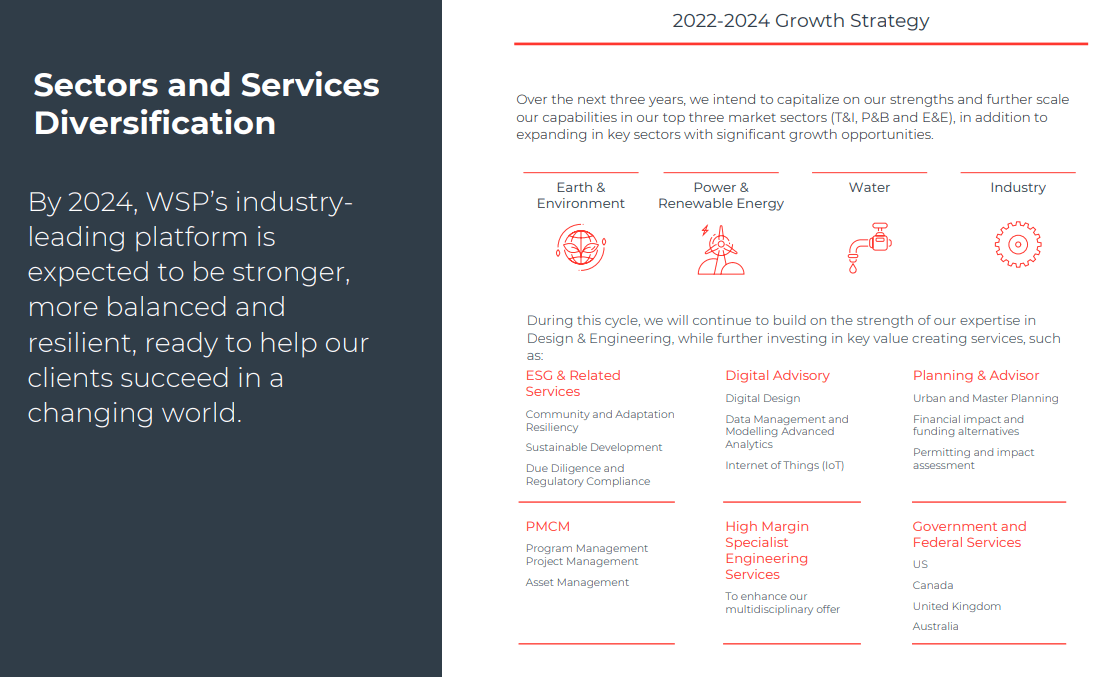

In order to provide longevity, and in WSP’s case, earnings growth, a healthy revenue base is essential. Thanks to the dozens of acquisitions over the past 10 years, WSP has diversified their operations to include nearly the entire world, suggesting that economic headwinds will be lessened. Projects also are diversified, but transportation and other civil projects remain at nearly half of all revenues.

A recent acquisition of John Wood Group’s (OTCPK:WDGJY) environmental services division will favorably increase the diversity of revenues moving forward, along with adding further global scale. We can also see that the wide geographical presence helps to negate the effect of currency exchange rates, but 2022 is far more volatile and the exact impact remains unclear. I expect that there will not be a huge issue due to the relatively strong CAD compared to Asian and European currencies.

WSP 2021 Annual Report WSP 2021 Annual Report

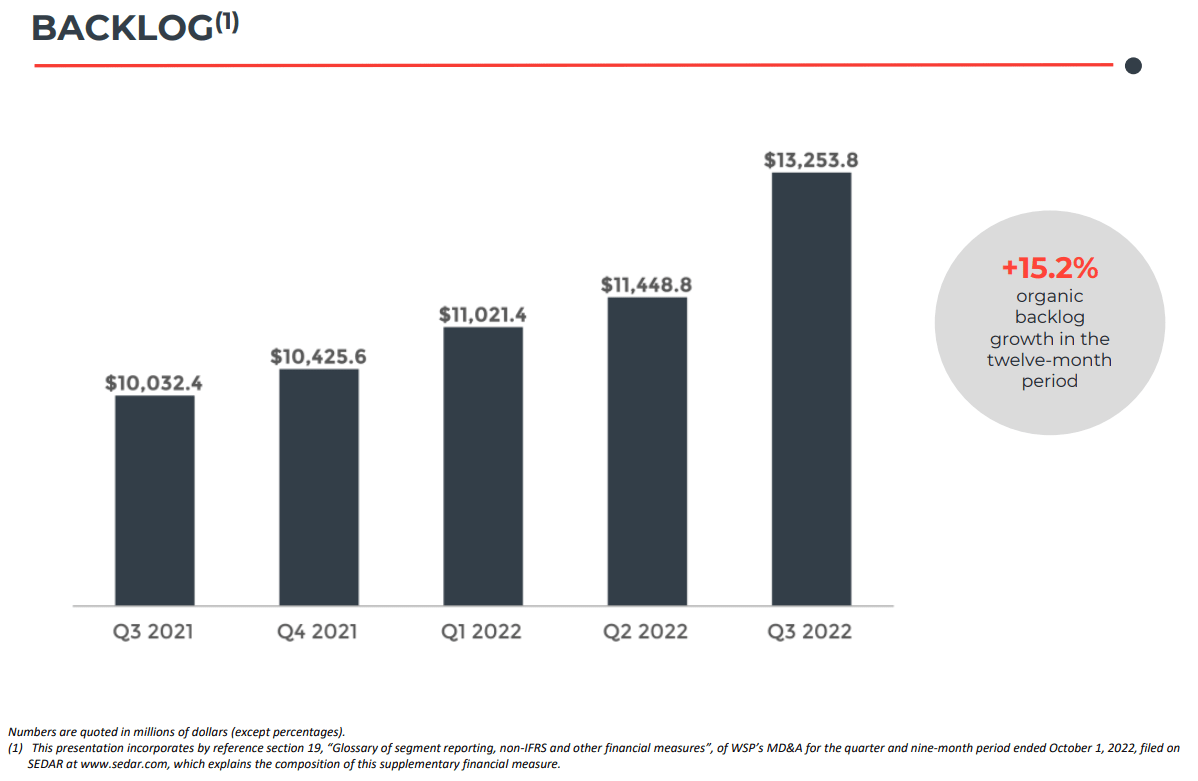

With additional Canadian and global infrastructure tailwinds I have frequently discussed in my articles, WSP has established an incredible backlog of over $13 billion CAD (data in CAD from here out). With the milestone of 8 billion in human population, governmental spending on infrastructure to support economies, and the general decrepit nature of existing infrastructure globally, I believe that WSP has plenty of growth opportunities in the short to intermediate term. However, without acquisitions, revenue growth will fall to around 10% per year or less and investors must keep this in mind.

WSP 22Q3 Presentation

Historical Data

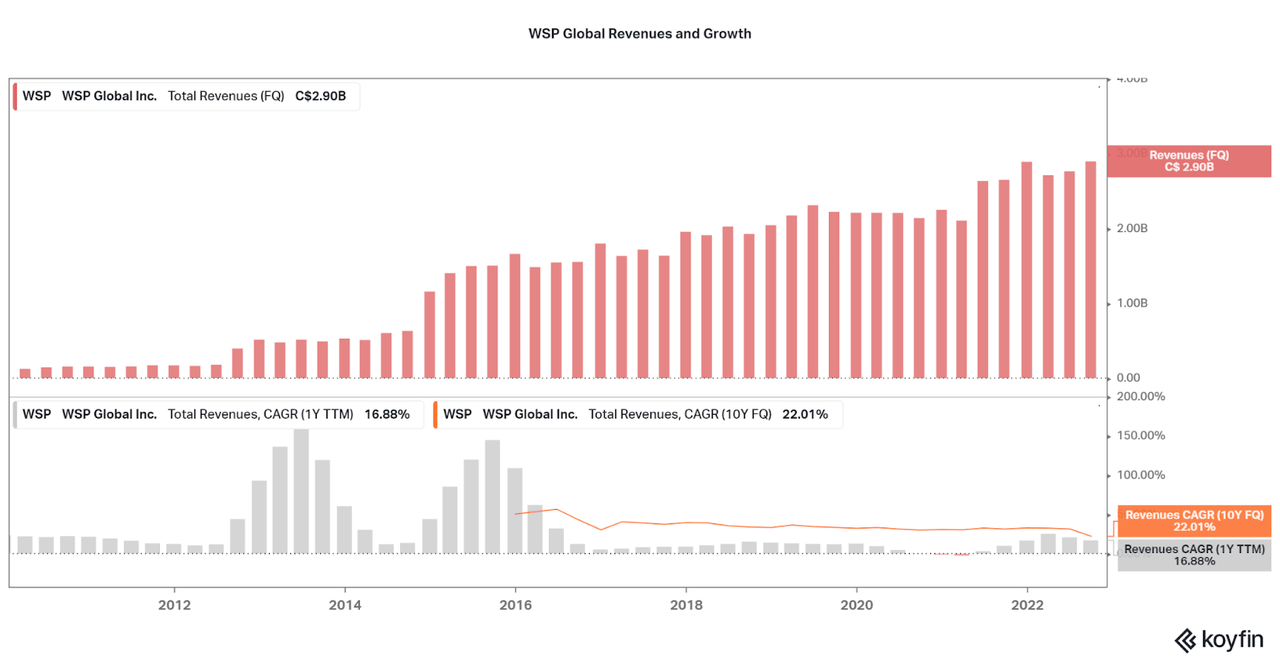

Based on the historical revenue data, we can see the rapid pace of growth that has been spurred on by acquisitions. However, the majority of revenue growth came from two large acquisitions in the first half of the 2010s. Growth has slowed down significantly since then, but a recent buying spree in 2021 and 2022 is revitalizing growth of late. However, the true growth rate is evident during periods of no acquisitions, all of which suggest less than 10% organic growth.

Koyfin

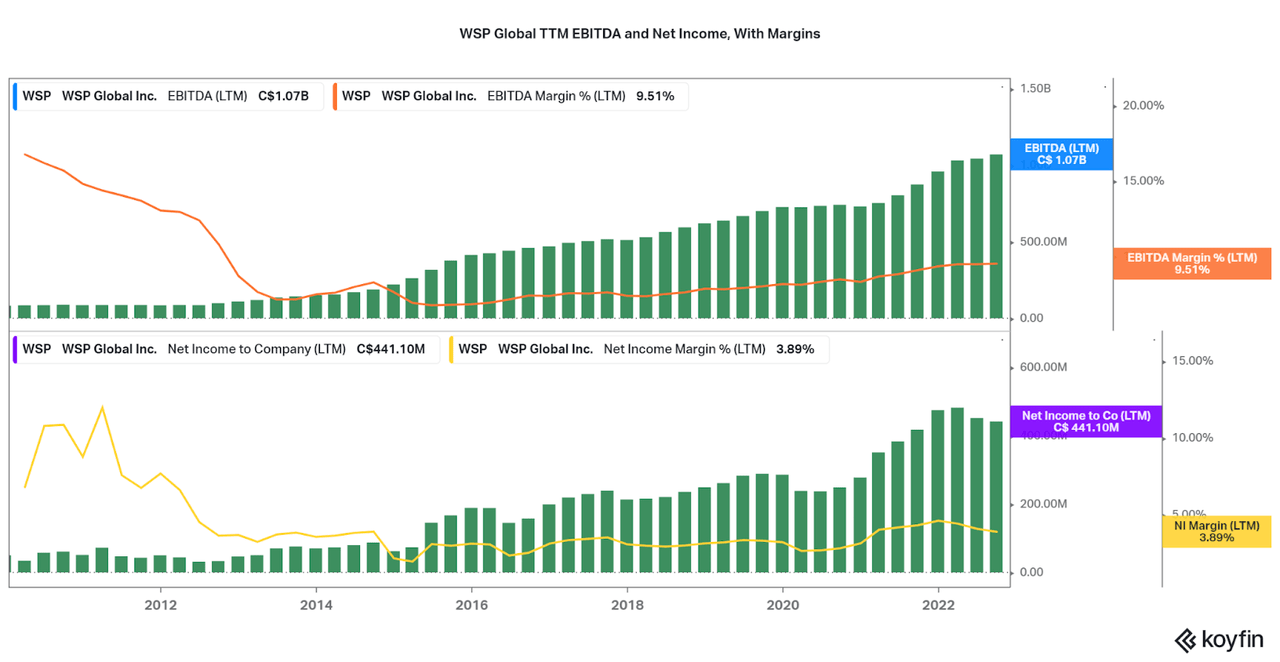

However, we can also see that despite the mess of finding synergies between the various new subsidiaries, WSP has been able to drive increases in profitability over time, a great signal for those looking to hold until a more profitable, but low growth state is the norm. Current margins are already quite competitive in the market and high-quality peers such as Stantec (STN) or Tetra Tech (TTEK) offer insights into what WSP could become with higher margin levels (the more profitable, the slower the growth). For now, investors should be happy with the progress, and the data supports a long-term hold thesis despite the possible slowdown in growth.

Koyfin

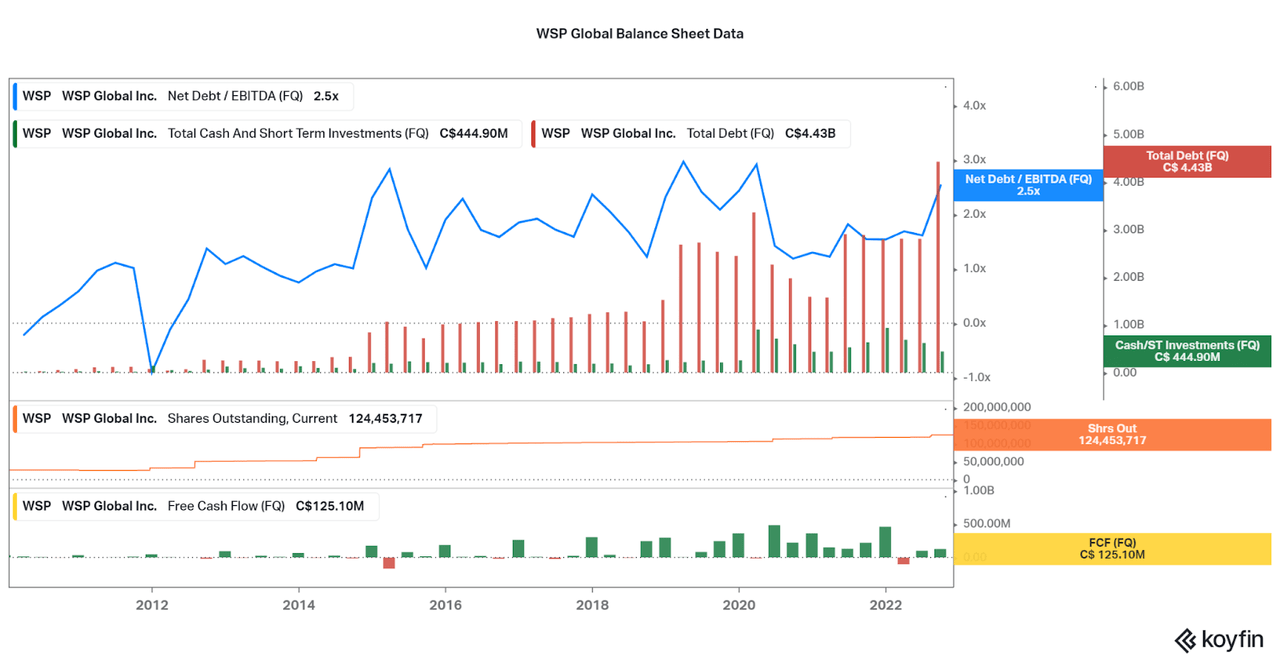

Despite the earnings progress, WSP does have some balance sheet issues that are weak points for the long-term thesis. First, net leverage remains high at 2.5x EBITDA due to the leveraged acquisitions. Thankfully, the leverage levels are remaining below 3.0x, but investors should be careful of rising debt levels. Additionally, dilution remains an issue with acquisitions coming with the issuance of some shares. While the issuance rate is slowing of late, the effect of buybacks would be a tremendous benefit for investors. That is up to the rate of growth and profitability to determine over the coming years.

Koyfin

Valuation and Outlook

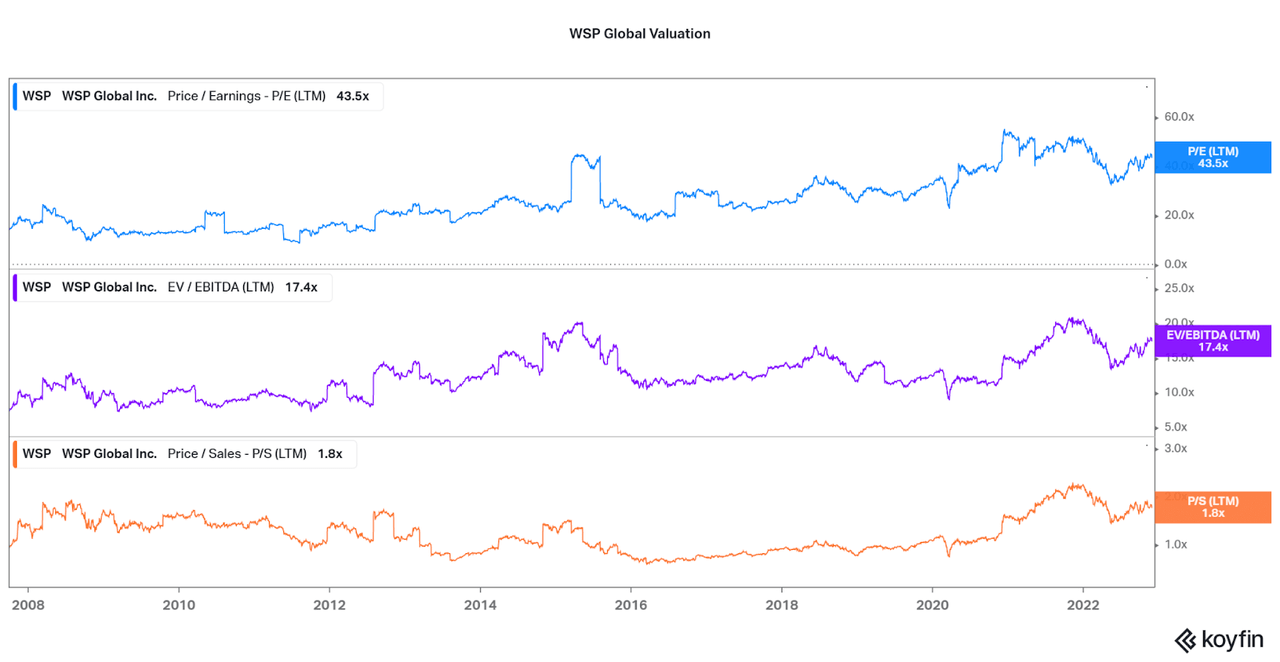

Despite the slowdown in growth and rising leverage, WSP is trading down about 13% from all-time highs seen at the beginning of the year. Investors certainly expect significant forward momentum to be maintained despite economic conditions as well. The strength in this bear market may be taken as a positive indicator for long-term success, but I worry if any growth weakness appears, investors would be quick to sell the name off.

Even the valuation in 2018-19 was far lower than current levels, and I do not view the company as equally stronger now. However, valuation does take into consideration forward performance and opportunity, along with the wisdom of the crowds, and I would hesitate to suggest the share price will fall a meaningful amount.

Koyfin

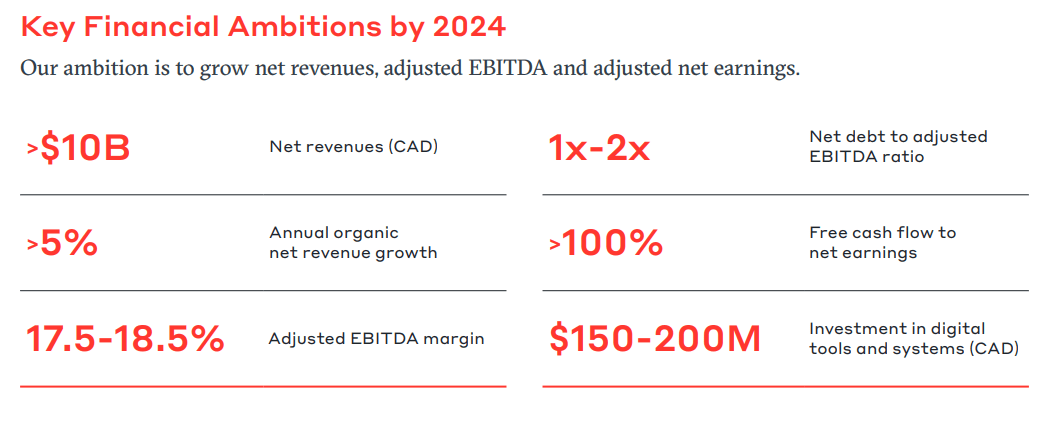

In fact, there is some outlook provided by management in their 2021 annual report to support the thesis that the shares are unlikely to fall further from current levels. As shown in the image below, net revenues will reach over $10 billion over the current levels around $8 billion. This lower rate of growth of around 5% per year is slow, but at the same time WSP expects to keep adjusted EBITDA margins at the same level (adjusted EBITDA in Q3 was 18.6%). I suppose that this may suggest that earnings may rise at a faster rate, especially if there are improvements to GAAP EBITDA margins.

Lastly, the company expects to keep adjusted EBITDA between 1-2x, so additional debt will not be issued. However, keep an eye on GAAP metrics in case adjustments become unreflective of actual performance. Despite the ambitions already being met in 2021, I do expect that like in the past, these expectations will be beat.

Now, the issue is whether the current valuation allows for a margin of safety, and for that I would hesitate to say yes. Therefore, WSP is more targeted for a long-term bet, rather than a short-term play on the industry. I look forward to see how their changing focus on higher margin consulting and research fares, and this is another long-term catalyst for current investors to rely on.

WSP 2021 Annual Report WSP IR Introduction Presentation

Conclusion

Although I do believe that the current valuation is fair, bordering on overvalued, I also do not expect significant downside as to-date performance remains strong. I remain on the fence, but would consider slowly establishing a position as a recurring investment, rather than chancing a lump-sum bet.

I also wish that the period of acquisition-driven growth would continue as the current market holds lower valuations than years prior, and this would be another way to support the outlook and maintain the current valuation. However, I believe that peers such as Aecon offer a better intermediate-term investment thanks to cyclicality, and profitable entities such as Stantec and Tetra Tech offer better accumulation value at the moment. As things develop, I will be sure to update.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment