D Dipasupil/Getty Images Entertainment

Investment thesis

We do not rate WPP (NYSE:WPP) as a quality cyclical as we believe it has limited scope to generate high free cash flow in the future. We believe customers will reduce advertising budgets in the face of macro challenges, and the company itself will see margins under pressure from direct cost increases. The last two financial years of strong free cash flow generation appear unrepeatable. We rate the shares a sell and look for a better entry point.

Quick primer

WPP plc is the world’s largest advertising agency business with approximately 25% global market share, followed by Omnicom Group (OMC) and Publicis (OTCQX:PUBGY). Established in 1971 and headquartered in the UK, it employs over 100,000 people, has 325 of the Fortune Global 500 as customers, and operates in 111 countries. CEO is Mark Read who was appointed 4 years ago, replacing founder Martin Sorrell who stepped down following personal misconduct allegations.

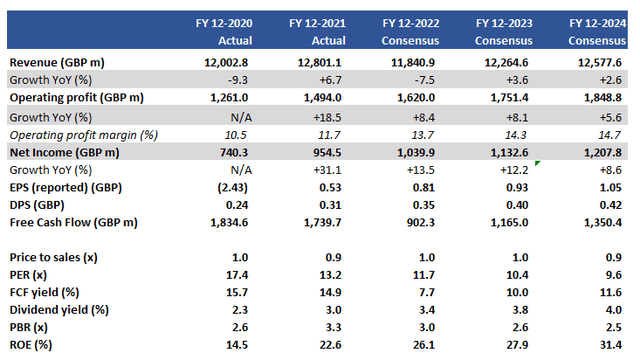

Key financials

Key financials (Refinitiv, Company)

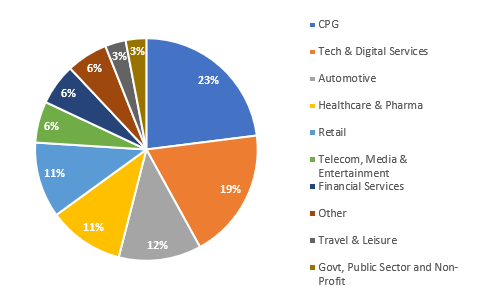

Sales split by client sector (FY12/2021)

Sales split by client sector (FY12/2021) (Company)

Our objectives

The company signed off FY12/2021 results as a ‘marquee year‘ with management stating that the business was well-positioned in high-growth markets. We note consensus forecasts are not bullish in the near term with future free cash flow estimates significantly lower than the record levels achieved during the pandemic. In this piece we want to assess the following:

- the outlook for sales growth in FY12/2022 and beyond given the macro picture.

- understand why free cash flow generation is expected to weaken.

We will take each one in turn.

Limited growth prospects

Advertising agencies are cyclical and generally not viewed as secular growth businesses. Topline trajectories usually reflect global GDP growth, and hence investors tend to view these shares as shareholder return plays.

With many economic think tanks lowering global growth forecasts, the backdrop is a challenging trading environment. The International Monetary Fund reduced global growth to 4.4% from 4.9% YoY in January 2022. More recently on 21 March 2022 Fitch Ratings lowered global GDP growth to 3.5% from 4.2%, citing inflation intensifying and Russia’s invasion of Ukraine.

Whilst hurdles YoY in FY12/2022 were not expected to be very high, consensus forecasts are expecting sales to decline YoY bringing volumes below FY12/2020 levels. We can observe the following reasons. Firstly, although there is no detailed breakdown, Central and Eastern Europe made up a sizable 12.3% of total FY12/2021 sales for WPP – this will be under pressure in the near and longer-term with the Russian market faced with economic sanctions and the exodus of businesses such as Apple (AAPL) and Fast Retailing (OTCPK:FRCOF). Secondly, inflationary cost pressures present a double-edged sword as clients cut back on advertising budgets, and direct costs increase in the form of staffing costs, utilities, and taxes (such as National Insurance hikes in the UK – the social security equivalent in the US) pressuring margins.

This backdrop together with less accommodating fiscal policies leads us to believe that advertising dollars will be used more sparingly – especially for WPP’s core market segments such as CPG (consumer packaged goods), Automotive, and Retail. Sectors where demand may remain stable are Tech & Digital Services and Healthcare & Pharma. Overall, we agree with consensus that the outlook for sales growth is muted. Next, we look at prospects for free cash flow generation.

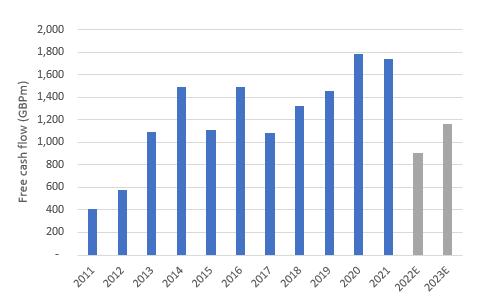

Outlook for free cash flow generation limited

WPP had managed to generate record levels of annual free cash flow during the pandemic. It would be an encouraging sign if this trend was sustainable.

Annual free cash flow generation

WPP plc Annual free cash flow generation (Company, Refinitiv)

On closer inspection, we see that the key drivers appear to be one-off factors. In FY12/2020 the company impaired GBP2,823 million/USD 2,016 million in goodwill – if this non-cash item was omitted, free cash flow would nearly halve. In FY12/2021 the company recorded a large accounts payable balance of GBP15,252 million/USD10,894 million (growing 49% YoY); this was a major contributor to positive working capital which boosted free cash flow. Essentially, both factors do not appear repeatable.

We look at how capital allocation may be impacted by generating less free cash flow.

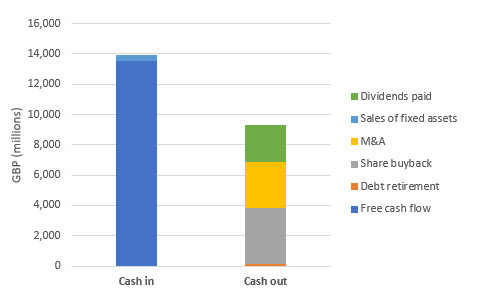

Capital allocation

Historically, WPP has been allocating its free cash flow primarily to shareholder returns followed by M&A activity.

Capital allocation over the last 10 years

Capital allocation over the last 10 years (Company)

Questions will be raised over the company’s capacity to generate shareholder returns as the outlook for free cash flow generation declines. The balance sheet is currently well-capitalized with a net debt to equity ratio of 0.8x, but considering there is no real tangible book value in the business, the company’s ability to generate cash is the key factor to assess. Whilst dividends are expected to grow going forward, we believe conducting sizable annual share repurchases will become much more difficult to execute.

Valuations

On consensus forecasts the shares are trading on PER FY12/2022 11.7x, a free cash flow yield of 7.7%, and a dividend yield of 3.4%. On a standalone basis, we see these as relatively attractive valuations.

We note that consensus forecasts have been raising its sales forecasts for the last 12 months, which we find to be too optimistic. The share price has nearly reached pre-pandemic levels, but given the macro environment, we do not see much scope for upside in the medium term. With consensus forecasts appearing too bullish, we believe the shares are unattractive.

Risks

Upside risk comes from a relatively short conflict between Russia and Ukraine, with a peaceful resolution being close at hand and global economic activity normalizing.

There is also the view that localized conflicts tend not to impact global equity markets significantly, which may highlight that our macro view is too negative.

Downside risk comes from advertising budgets taking a major cut by large CPG and Retail players, as an inflationary environment compounded with fiscal tightening results in falling consumption.

The company toning expectations down for its FY12/2022 earnings as well as its capacity for sustained share buybacks would be negative for the shares. Management is currently planning a GBP800 million/USD571 million share buyback, which would be more or less flat spending YoY – together with dividends to pay, total shareholder returns may not be entirely self-financed.

Conclusion

WPP is a leading services company but we believe it has limited scope to generate high free cash flow in the future. We believe customers will reduce advertising budgets in the face of macro pressures, and the company itself will see margins pressured under direct cost increases. The last two financial years of strong free cash flow generation appear unrepeatable. We rate the shares a sell, looking for a better entry point.

Be the first to comment