Richard Bord/Getty Images Entertainment

U.K.-based advertising holding group WPP plc (NYSE:WPP) has so far not shown much negative impact from advertising slowdowns reported by other companies. I expect that to change in due course, but continue to be upbeat about the firm’s long-term prospects.

I last covered the name in July with my bullish note WPP: Price Decline Offers Value. Since then, the shares have fallen 11%.

Performance remains solid for now

As recent U.S. tech share markdowns have shown, advertising is clearly starting to show some impact from customers tightening their belts.

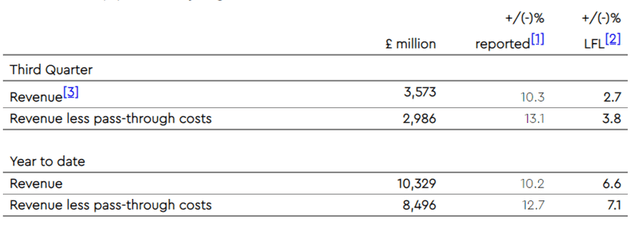

Last week, WPP released its third quarter results. They showed that, for now at least, revenue has been more than holding up.

company quarterly results announcement

Source: company quarterly results announcement (footnotes omitted)

The announcement said,

We enter the last quarter of the year with confidence, based on the leading competitive position of our businesses, our client momentum and the knowledge that the actions we have taken to strengthen WPP leave us well placed to support our clients in navigating the economic uncertainties ahead.

In fact, the company’s bullishness is shown by the fact that it raised its full-year revenue guidance. However, at the same time, the company adjusted its forecast headline operating margin improvement target to 30-50 basis points, compared to around 50 basis points previously. While that may sound relatively minor, I see it as a sign that while inflation may be helping the company to build revenue by increasing billing rates, for example, it is also adding costs that could slow margin improvement.

Western continental Europe already saw revenue contraction in the third quarter on a like-for-like basis (of 2.1%). If that slowdown also shows itself in other markets, such as North America (which reported 4.7% like-for-like growth in the last quarter), the current bullishness could turn out to be short-lived. Even if 2022 comes in line with expectations, 2023 may turn out to be more challenging. The North American figure is already down sharply from the second quarter figure of 12.7%.

The company – which reports in pounds – has also benefitted in its reporting from recent sterling weakness. Revenue growth of 10.3% year-on-year in the third quarter turns into only 1.4% when exchange rate impacts are excluded.

I still think WPP deserves credit for a solid performance in an increasingly challenging market. But I also see grounds for concern that the business could weaken in 2023, with a combination of low revenue growth or revenue contraction and cost inflation.

WPP retains long term strength

But while the short- to medium-term outlook may seem relatively unexciting, I think the long-term investment case for WPP remains attractive.

It has a leading collection of advertising agencies, which can continue to form the basis of long-term financial success. The company has also been expanding its digital footprint in recent years to reflect (arguably belatedly, but better late than never) the leading role that digital media now has in the advertising market.

Unpacking an exact number for this is difficult, but in its interim results, the company said that, “Faster growth areas of experience, commerce and technology around 39% of revenue less pass-through costs in Global Integrated Agencies ex-GroupM in H1.”

The risk of lower advertising spend by clients is real, even if it has not yet manifested itself clearly at WPP. But I see the advertising market as cyclical and reckon WPP remains well-positioned not only to survive a downturn but to benefit some years down the line when the ad market starts to show strong growth again. At that point, though, WPP shares may not be available at today’s price.

Valuation remains attractive

Despite the fall in valuation, I continue to see WPP as a buy.

WPP completed £692m of share buybacks in the first nine months of this year and expects a full-year buyback total of £800m. That would be just under 10% of today’s market capitalization of £8.2bn. As I regard the current share price as attractive, I see this buyback program as attractive from a valuation perspective.

Based on last year’s post-tax earnings, the current price-to-earnings ratio is just over 11. I regard that as attractive for a business of this quality and continue to rate it as a buy. Meanwhile, the shares offer an attractive 4.1% dividend yield. The interim dividend grew 20% from last year and I expect at least the same at the full-year level, which would suggest a prospective yield at today’s share price of 4.9%.

I also recognize, though, that the WPP share price might get even cheaper from here. At some point I expect the company may guide for negative impact from an advertising recession, perhaps in 2023. If that news leads to a further markdown in the WPP share price, it could become even more attractively valued from a long-term perspective than it is now.

Be the first to comment